Six months ago, the US was still reporting 226K new cases of COVID a day, a rate that would peak in the first half of January at over 300k. Daily deaths also peaked in those first two weeks of the new year at over 4000. The economy was still struggling to recover, most restaurants surviving on takeout traffic, and no one was even talking about going back to the office. The S&P 500 was nearly 600 points lower and the 10-year Treasury was yielding less than 1%. The 2-year note was about half its current level. Gold was still near $2000 and crude oil was trading for less than $50/barrel. We have come a long way in a short time.

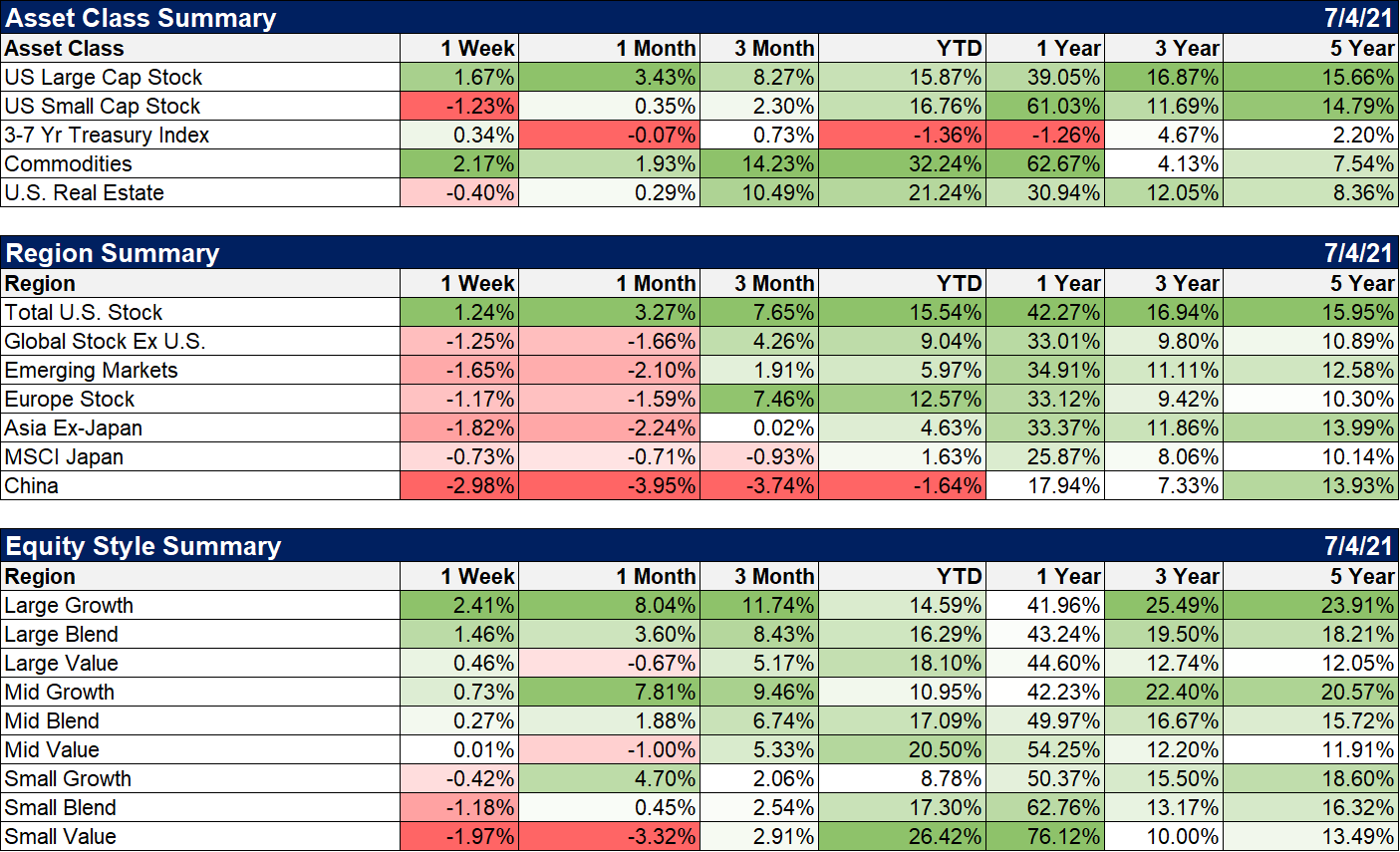

As we mark the halfway point of the year with the traditional 4th fireworks, hot dogs, and apple pie, the economy is in full recovery mode and asset prices are soaring. The latest new case count before the long weekend was less than 10,000 and deaths were less than 100. Those totals may be skewed low because a lot of states are not reporting these numbers daily anymore but that in itself is a positive sign that the US may finally be approaching that magic herd immunity level. Restaurants in most places are fully open for business, mask mandates have fallen by the wayside, and companies are trying to figure out how to get employees back in the office if only on a part-time basis. Stocks are up mid-teen percentages, depending on what broad average you’re looking at, and the NASDAQ (shutdown index) is actually lagging the S&P 500. More specifically, technology stocks are middle of the pack, way behind other more mundane sectors like energy, real estate, and financials. Crude oil is up nearly 55% and the broader GSCI commodity index is well ahead of stocks, up by nearly a third and back to where it was at the beginning of 2020. Gold is down on the year as recovery offers better opportunities than the inert, barbarous relic.

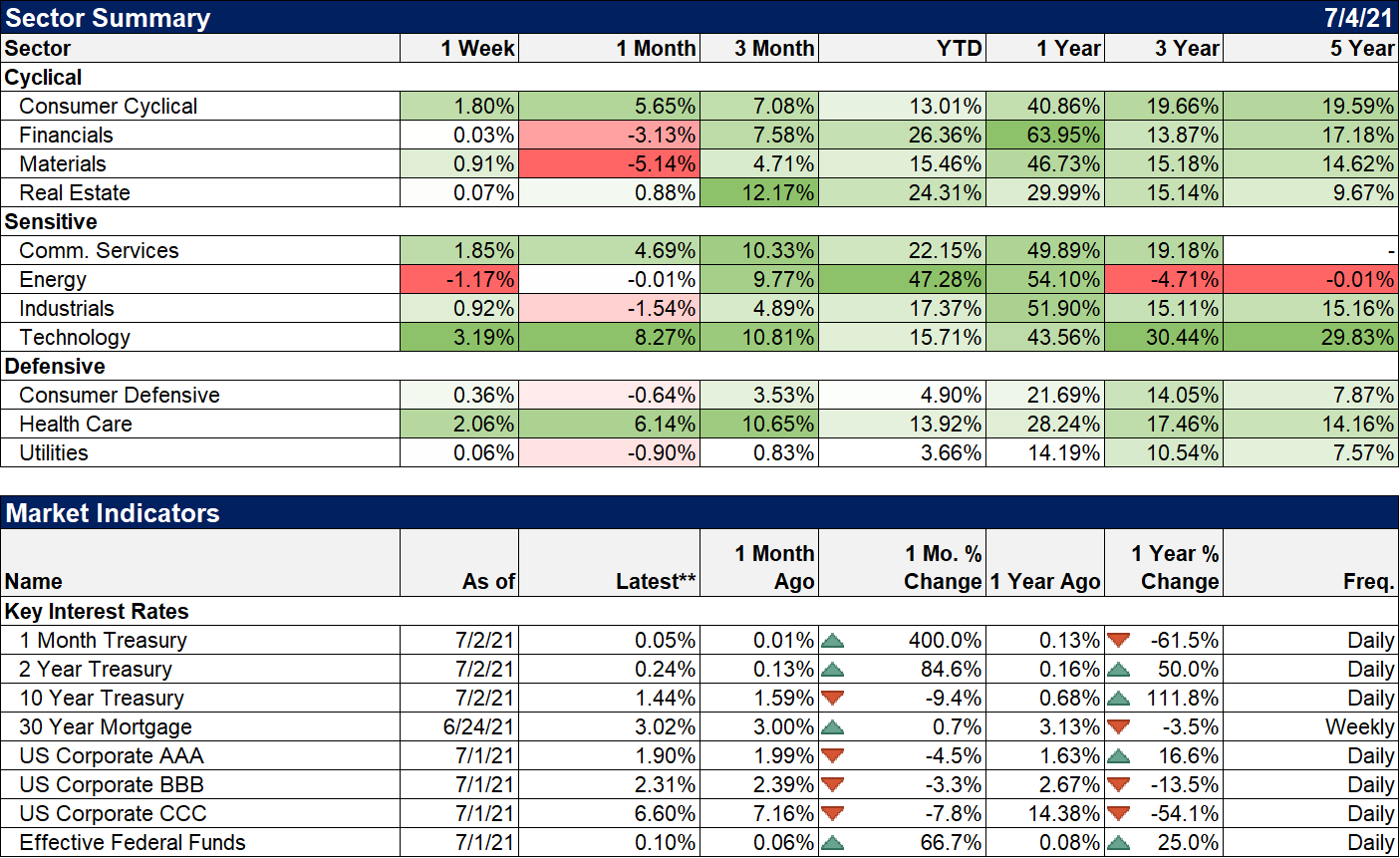

Interest rates, viewed from the beginning of the year, have moved as one would expect in an economy recovering at an above-trend pace. The 10-year note yield is up 56% since January 1 and the 2-year note yield is up 84%. The spread between the 10-year and the 2-year has risen 40 basis points, a 50% change from the end of last year. Inflation expectations are up too but only about 30 basis points since the end of 2020. Real rates are higher too but by an even more modest 20 basis points.

As we enter the second half of the year though, it is hard to ignore some contradictions in the markets and the economy. Economic growth in the first half of the year is going to print a big number, a fact of which everyone with an internet connection or a pulse is already aware. And yet, that 10-year Treasury note yield, while up since the beginning of the year, is also roughly 30 basis points off the high for this recovery set at the end of the first quarter. The entire second quarter was a gentle but steady rally in bonds, with the long end up nearly 7% in Q2. The yield curve also flattened in the second quarter as the rise in short rates was only recent, coming almost entirely after the recent Fed meeting. And while commodities were up in the quarter, that was driven primarily by energy, a consequence of reduced US production and a curiously disciplined OPEC+. The real surprise – for some – in the energy space was natural gas up nearly 40% in Q2; reduced shale drilling has a bigger impact on gas production than crude. Meanwhile platinum was down nearly 10% in the quarter, copper moderated its gains and the ag space appears to have peaked.

The boom narrative is led by the record number of job openings and an elevated quits rate, a show of bravado predicted by exactly no one. The jobs market is healing but we are also still nearly 7 million jobs short of where we were prior to the first COVID lockdowns of last year. Despite that, if Q2 GDP growth is anywhere near the Atlanta GDP Now estimate of 7.8%, it will exceed the pre-COVID peak by over 1%, a burst of productivity growth that, again, no one predicted. And amid talk of labor shortages, wages are up only 3.5% year-over-year, which actually makes a lot of sense in the context of the previous sentence. Companies have been accused of not offering the market-clearing wage but maybe they just don’t need those workers and so aren’t willing to bid up for them.

Stock investors are certainly on the boom bandwagon too, with the major averages trading at nose bleed valuations and a new speculative story capturing the market’s imagination seemingly every day. SPACs are considered tame these days when they once occupied a spot just above penny stocks – which also seem respectable these days. The cryptocurrency markets launch a new scandal on a weekly basis. Defi appears to mean that your money will be decentralized from your wallet with founders suddenly missing, defi-ing anyone to do anything about it. And the SEC doesn’t seem to have a clue even where to start. Meanwhile in junk bond land, spreads to Treasuries are the lowest since last decade when the ability to fog a mirror was a stringent loan covenant.

Obviously, liquidity is abundant. There is cash available for just about any venture with an outline of a business plan and private equity has bought nearly everything over the last year that wasn’t nailed down. They even bought lots of things that were nailed down as Blackstone and others jumped back into buying single-family homes. That may or may not have been a factor in house prices being up nearly 15% over the last year, but even that apparently isn’t enough to get sellers off the sidelines; inventories are still near all-time lows.

The banking system is so stuffed with deposits they are turning them away. And if you believed the banks when they were last seen lamenting the end of the SLR suspension as if it were the end of modern banking as we’ve known and loved it, well, breathe easy because the Fed is letting them all buy back boatloads of stock to reward them for all those loans they aren’t making. Meanwhile, the Fed just keeps QE on autopilot, seemingly oblivious to the circular firing squad known as the Reverse Repo Facility. QE has the Fed buying Treasuries on the open market and selling them back to the market – and paying 5 basis points for the privilege – via reverse repo. I think we may have reached peak central bank absurdity. If the market really needs those Treasuries – and it sure seems they do – why not just stop buying the damn things? Apparently, the Fed believes giving away 5 basis points to money market fund sponsors – they certainly aren’t passing that 5 basis points on to shareholders – is all that is keeping us from banking system meltdown. Or something like that.

I don’t know what will happen in the second half of the year. I know we’ve already had a great year in the first six months but that tells us nothing about what is in store. The big trends point to a continued economic recovery, assuming the Delta variant doesn’t take us down for another round. There are some contradictions out there but some of them are less contradictory than they first appear. Our economic output has fully recovered while leaving 7 million former workers still in the former category. That is capitalism in a nutshell and it is, lest everyone forget, deflationary. That may be one reason interest rates have stalled, although negative real rates are a pretty big hint that everything isn’t hunky-dory in the growth department. In any case, if one broadens their view beyond the most recent quarter, it is obvious that rates are still in an uptrend albeit a fairly shallow one. Most commodities have pulled back but that’s after a big run higher so profit-taking is probably the best explanation.

At Alhambra, our strategic allocation delivered strong returns over the last year and first half of 2021. In other words, a lot of our return over the last year was beta, a function of running a multi-asset portfolio with a healthy allocation to real assets (commodities and real estate). And our beta this year has been better than most because our strategic allocations to those asset classes is higher than most. But for the second half of the year, I’d be surprised if beta works that well for anyone. Markets are very stretched from a momentum standpoint and are due for a rest. The second half of this year will be a time to concentrate on the tactical – which sectors, what stocks, which commodities? It is possible, I suppose, for earnings to grow fast enough to justify current stock market valuations but it seems unlikely. If so, it may be that tactical becomes the new black while the indexers, for a while at least, look terribly out of fashion.

————————————————————————————————————————————————————————————————————————————————————————————————————————

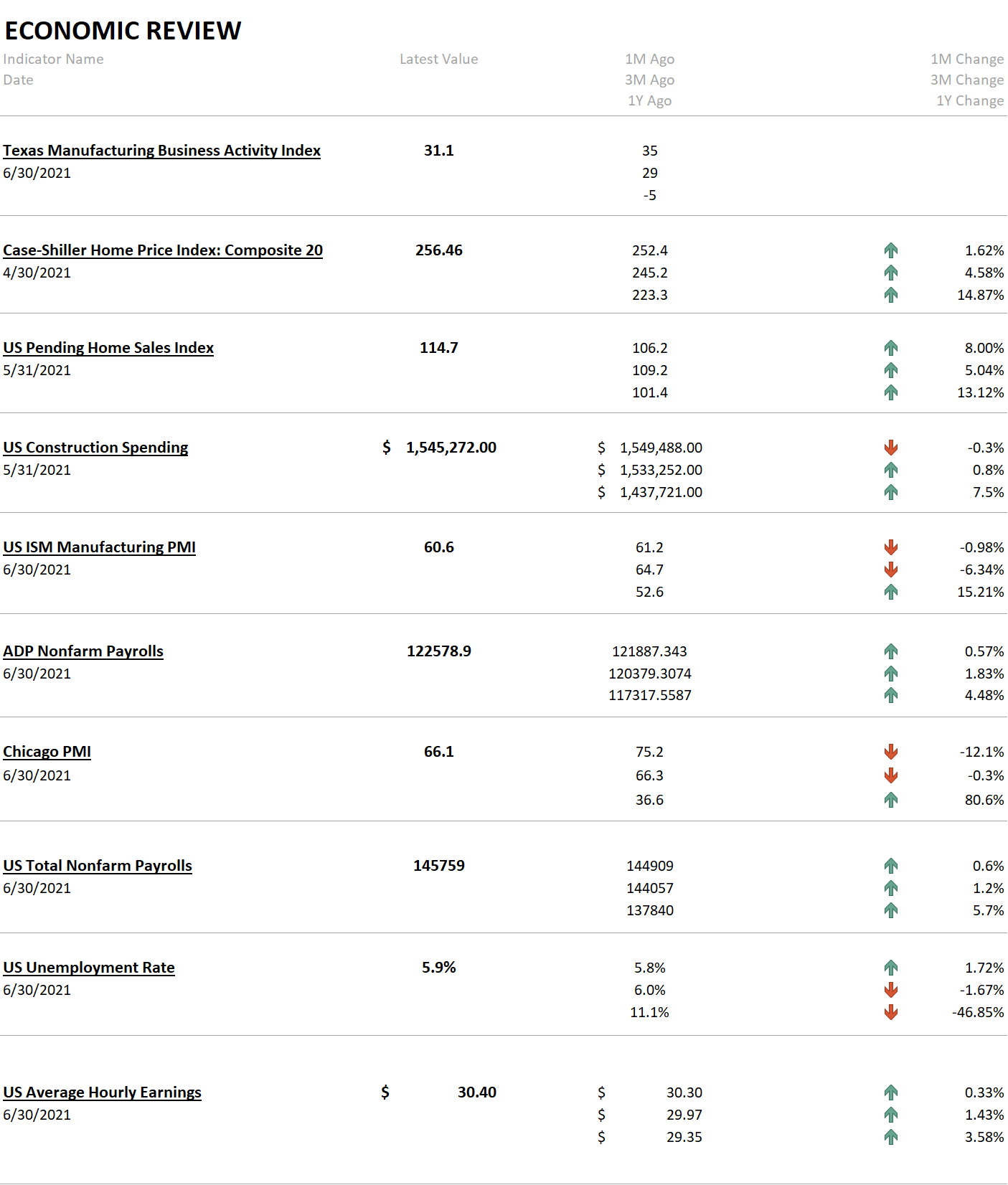

The economic data last week was generally positive although some of the data points were lower than last month. The Dallas Fed, ISM manufacturing, and Chicago PMI were all down from last month but also still at very high levels. Construction spending was down a bit but just a fraction below the all-time high set in January. Pending home sales ticked higher despite an almost 15% year-over-year rise in home prices. Someday supply will catch up with demand in housing but that day isn’t today.

The big report was obviously the employment report which was more mixed than the headlines might indicate. There was a big spread between the household and establishment surveys but these things are volatile so we’ll see what happens over the next few months. Maybe the most interesting part of the report was Job Leavers which jumped by 164K, seeming to confirm what we’ve seen from the JOLTS report.

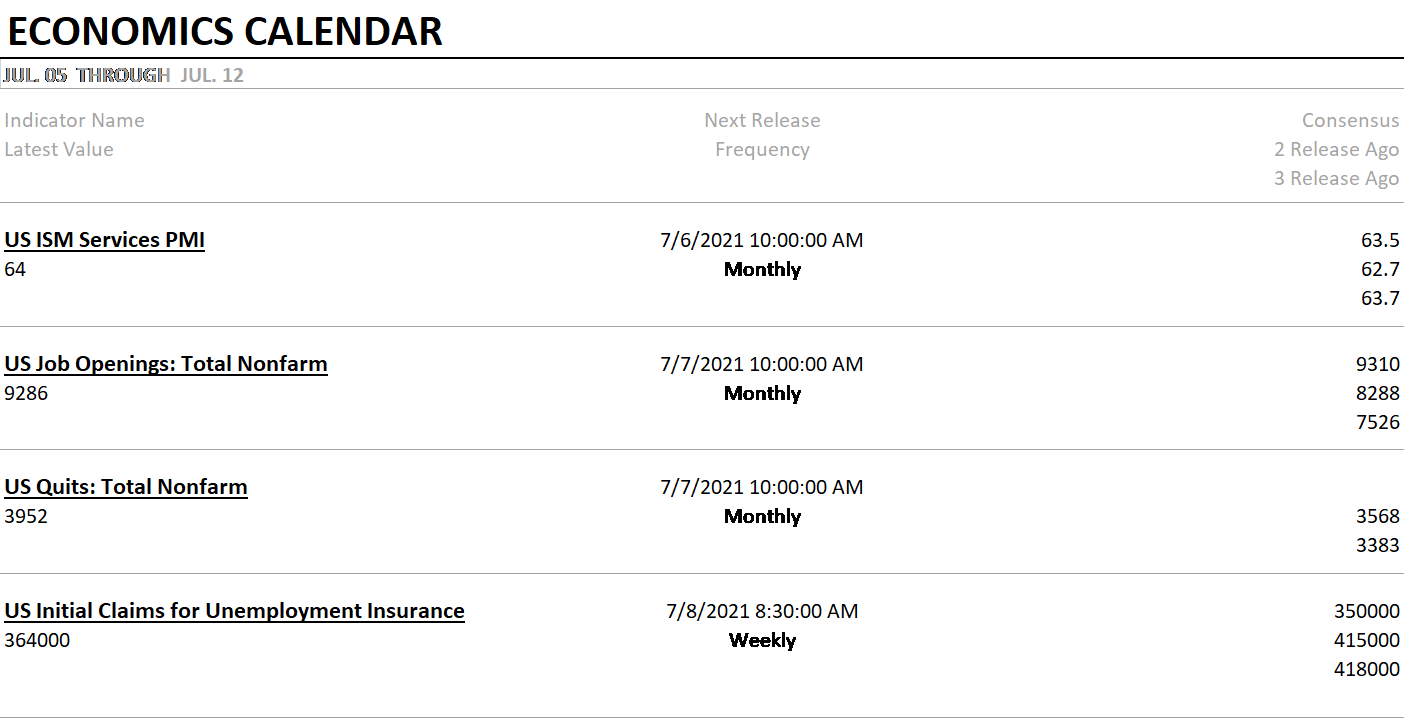

It is a very light calendar for this holiday-shortened week but we will get another look at the JOLTS.

Growth had a good week and won over value for the quarter as well. The gap between the two YTD is narrowing but value still has a clear lead. Commodities had another good week with crude oil following the lack of an OPEC+ agreement. Real estate cooled a bit and foreign markets had a tough week with China leading the way to the downside as the Chinese leadership fought back against US limits on state-owned companies by pounding on the ones not owned by the government. Small-cap also lagged on the week, an indication that (maybe) there are some fears about the Delta variant of COVID seeping into markets.

You also see the fear of another virus wave in the sector report where tech (shutdown stocks) led the way. Healthcare also had a good week and we suspect it will have more.

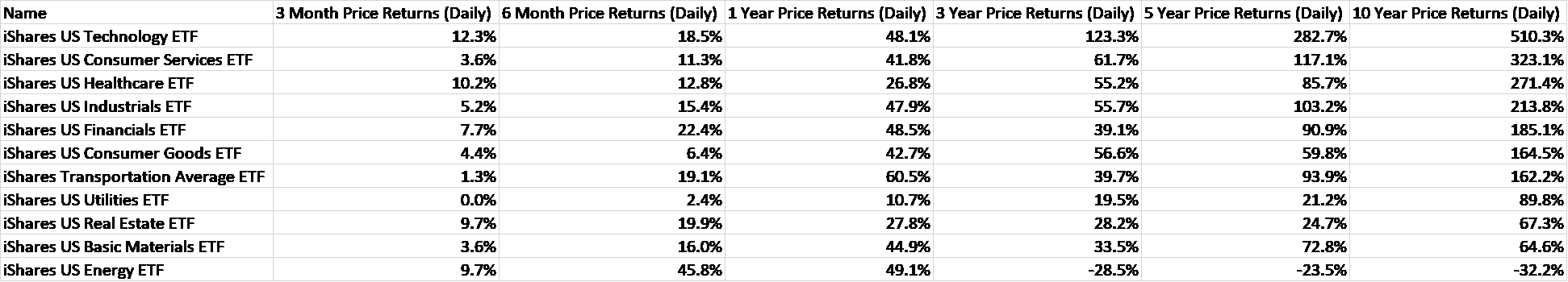

There are often contradictions in markets and the economic data. That is normal and healthy and expected. But there are also often explanations for the anomalies even if we don’t know what they are yet. Are interest rates pointing to a softening of the recovery? Maybe, but the bulk of the evidence says no. Are stocks overvalued? Probably, but that doesn’t mean all stocks and sectors are overvalued; nobody said this was going to be easy. Eventually, the speculative nature of this market will produce a reaction, a bear market. In the past when that has happened, there were always parts of the market that avoided the fallout (or mostly). In the 2000-2002 bear market, avoiding tech was sufficient to limit your losses and outperform. In 2008 the same was true of financials (although outperforming in that bear market was a lot harder than the previous one). And when the averages finally give way in this market – and they will eventually and probably from a level we can’t imagine right now – there will be pockets that outperform. My guess is that if you avoid technology and consumer discretionary you’ll probably come out better than most. If you are looking for new investments you probably want to concentrate on the sectors with lousy 5 and 10-year returns:

Joe Calhoun

Stay In Touch