I had intended to lay off the T-bills today, just to write about something else, anything else, but, as often occurs, circumstances intervened. We’ve been subjecting you to seemingly unrelenting focus on Treasury bills’ various follies this year. The reason is quite simple, and trading early in the morning today a very good example both of “what” and “why.”

FRBNY last week called it a “scramble for collateral.” Its telltale signs show up in the bill market (though not strictly bills) very early in the morning, though the Liberty Street Blog writing about it borrowing heavily from an OFR (Treasury’s Office of Financial Research) report which required confidential repo information gleaned from DTCC and others just to come up with that expression.

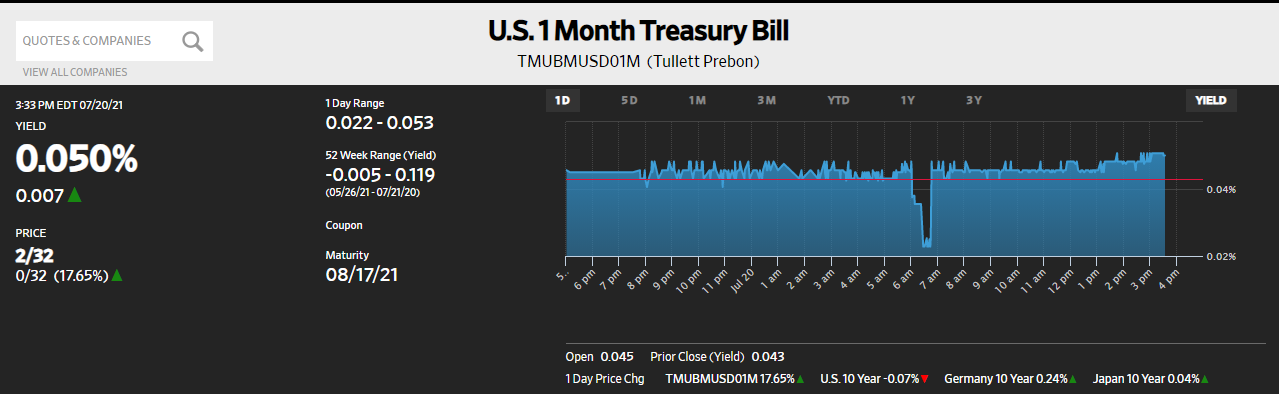

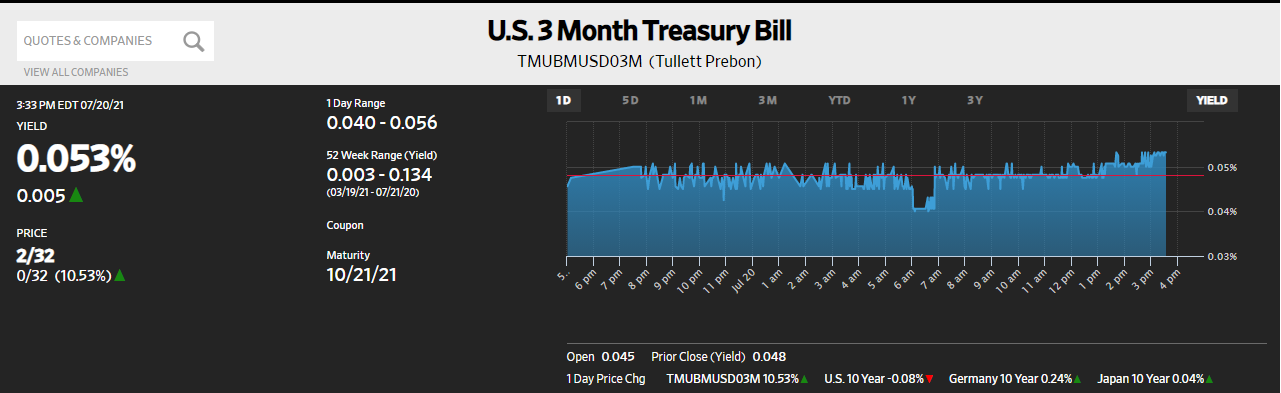

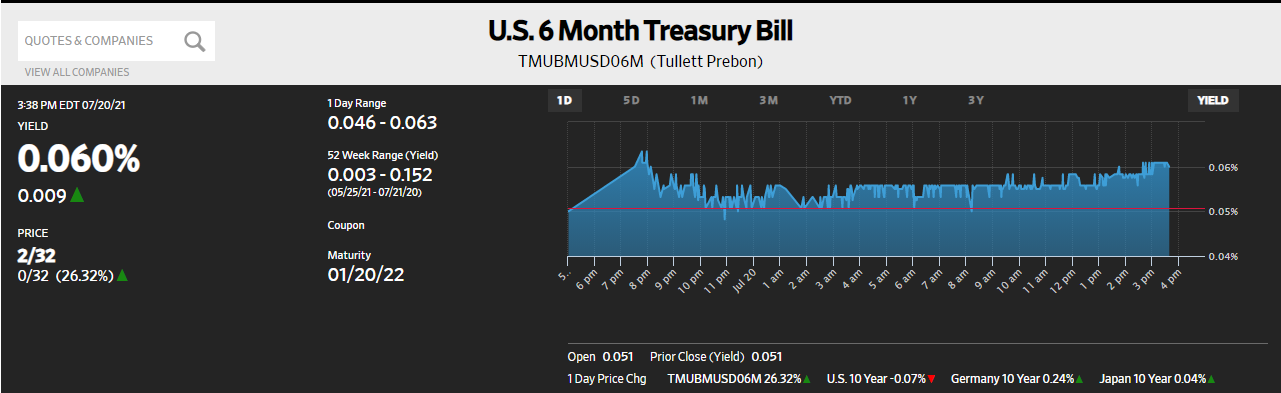

There’s no need for confidential transaction data, just look at the market:

Not quite a buying panic, nor the more pervasive yield “holes” like those sucking global liquidity down to nothing last March. Still, this scramble for early morning collateral was pronounced and interestingly most prominent in the shortest end instruments; huge at the 4-week maturity, less so for 3-month bills, and only a small spot at the 6-month tenor.

Now, the Fed’s New York branch in its blogpost said any recent scramble for collateral like this one can only itself have been a product of, consistent with the consensus view of the RRP, too much money. What else are they going to blame?

More recently, repo market participants have highlighted an early morning “scramble for collateral” due to an overabundance of cash. This imbalance has several drivers, including less interest in cash borrowing (and thus providing collateral) by levered accounts, the continued increase in cash availability amid money-market fund inflows and rising aggregate reserve balances, and Treasury bill paydowns. This has resulted in an increase in more early morning and negative-rate trading as dealers are willing to incur negative cash lending rates to obtain collateral. [emphasis added]

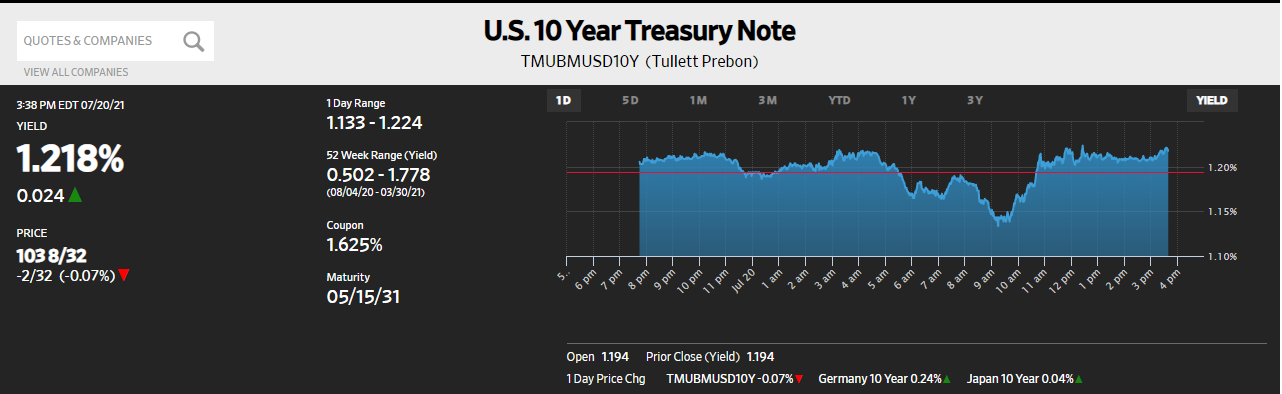

Here we are on an early Tuesday morning with one very obvious collateral scramble staring right back at us (again, no need for nonpublic confidential information, just eyelids and minds not entirely closed by the ideology behind Don’t Fight The Fed). At the time this most recent one began – right at 6am EDT on the dot – there had already been more than an hour of buying in LT UST’s following up yesterday’s already distressing big move. And that move, obviously, wasn’t of the sort you’d equate with “an overabundance of cash.”

With an ongoing downdraft in global yields, especially as it has picked up pace, this is a deliberate market signal for un-abundance and this other’s much higher probability deflationary longer run consequences. More bad things, in other words.

The previous day’s bad things (deflation) in highly bid UST’s (and others, like Germany’s bunds) had stabilized overnight until around 4:40am EDT (Asia!) and then the negatives began piling up quickly all over again. A little over an hour later, bam, scramble for collateral.

Overabundance of cash? Even Jay Powell has visited the shortage of T-bills.

Here’s instead how I described last year’s much more destructive versions of this exact thing as they were unfolding (again, no need to use impossible-to-get nonpublic information), this from March 18, 2020 right in the thick of it:

Over the past several dreadful weeks of liquidations the pattern has largely repeated. During the early morning hours, before regular trading opens, yesterday’s repo transactions are unwound. Under normal and even less-than-ideal conditions these are just rolled over.

Not any more. Collateral calls mean in some cases using gold as a last resort (which gets dumped immediately) and in others the buying of pristine collateral at any price. Gold is slammed while T-bill prices skyrocket, their yields plummet. For those unlucky enough to have neither option in front of them, fire sales of assets including stocks and other risk credits.

OK, so where was that last piece in the causal chain? Why no fire sales or liquidations after today’s very clear, pretty serious collateral rumble?

If you look across many markets, including UST’s, on the contrary things are up after today’s trading in the (very modestly) reflationary sense. Even bill yields are a bit higher, the 4-week in regular trading much closer to the 5 bps of the RRP and the 13-week well above it (and, as noted previously, use in the RRP declined today from yesterday, keeping to that correlation).

What I wrote last year still applies here: “under normal and even less-than-ideal conditions these are just rolled over.” We know via warnings and the behavior in the bond market we’re operating in less-than-ideal conditions, especially scarcity in bills. Though today’s action wasn’t easily rolled over, it was apparently difficult, it still got rolled over.

This right here is the reason why we are on the hunt for more escalating warnings, out looking for the big ones; many of those which have not yet happened.

The dollar, for example, is moving up but taking its time doing so, not quite in the fashion of the acute shortage. Only a single RRR out of China thus far. Japan’s 10-year government bond has only flirted with zero, and reached it during Asian trading this morning, though not yet negative. And despite Monday’s pretty dramatic dive in UST yields, I wouldn’t qualify it yet as a “collateral day” (I need to come up with a new term for this).

In short, if we had already observed those warnings then we’d have expected before today that the deflationary pressures including collateral had already crossed a threshold, of sorts, from mildly irritating where repo and general funding was difficult to roll over into outright more dangerous where rolling over becomes near impossible. The global dollar system not yet having passed through into that stage, not yet having triggered those other key alarms, this indicates that this system still has sufficient elasticity and space to absorb imbalances.

Not normal, of course, and getting iffier as these negatives pile up, but not yet to the point beyond the edge of manageable. It’s not that bad – yet.

Because of this, today’s scramble for collateral didn’t manifest as anything more than maybe the endpoint of the last few days of more serious deflationary angst. The global system grew seriously short of collateral (and not just because of supply problems, almost certainly shortening “collateral chains” of re-use and such), causing major problems, but enough positions overall came to be squared, leverage and funding imbalances expunged sufficiently and deliberately, leaving this weak but not dysfunctionally-weak system to roll enough over in order to find itself and achieve a settled state before triggering the more destructive impulses.

In fact, having done so, by the time the US markets opened (give or take) for regular trading there had been enough scrambling and squaring that reflation very shortly took over (and you don’t need some mythical “plunge protection team” to explain this kind of thing).

However much this is true in the very short run, for today, there almost certainly will be more lingering negative consequences. The dollar shortage periods which continue (Euro$ #n’s), before they get to their most acute phases, this is how they go, as “small” things go wrong in seemingly unrelated and short run fashion but pile up in conscious effort as the system adjusts to the fact that these problems happen and continue to happen (whether or not the Liberty Street blog writers or Jay Powell notice them, or, when they do, understand their real nature and implications).

Today the system was fluid and elastic just enough to limit the deflationary consequences of one of the more obvious collateral spasms of recent weeks. That system is, though, tilting more and more in the wrong direction, meaning that in the grand scheme today fits only-too-well in its tilt.

If we end up observing these other key warning signs, once those indicate more glaring systemic weaknesses sufficiently past some unknowable threshold, then a single day of collateral scarcity will no longer get squared in a single morning’s messy effort.

For now, we do seem to be just on the outside that kind of state. By how far or by how much is anyone’s guess, though way too close for comfort (therefore, relationship between bills, RRP, and LT Treasury yields).

Stay In Touch