When the ECB’s leadership presented their first QE to the assembled media on March 5, 2015, there was a lot of the usual corporate-speak. It sure wasn’t fedspeak, the purposefully obfuscating wordsmithing of the kind made infamous by Alan Greenspan. No, on this occasion, to the contrary, Mario Draghi, the ECB’s President, wanted to be perfectly clear in what he was saying.

Sort of:

The substantial additional easing of our monetary policy stance supports and reinforces the emergence of more favourable developments for the euro area economy. In an environment of improving business and consumer sentiment, the transmission of our measures to the real economy will strengthen, contributing to a further improvement in the outlook for economic growth and a reduction in economic slack. Thereby, our measures will contribute to a sustained return of inflation towards a level below, but close to, 2% over the medium term and underpin the firm anchoring of medium to long-term inflation expectations.

His message was clear in the sense that the average layperson could easily understand what he was saying. No one needs to explain the meaning of “substantial additional easing” or “improving business and consumer sentiment.” Nor was there much to misunderstand about the rest of it.

The issue or issues, there are several, arise instead about specifically how what the ECB would go on to do might become “substantial easing” or, more to the point, “transmission of our measures to the real economy.”

On the one hand, the technical transaction details are very easy, too: the central bank buys up a bunch of financial assets. Beyond that, it only gets questionable. Everything else from here is a misunderstood tangle of unexplored relationships and results; and because of this, monetary policy officials have used these complications to their advantage.

Don’t bother yourself thinking too much about this, just trust us.

The ECB (or the Fed, whichever puppet show producer) purchases financial assets offsetting them by issuing bank reserves. If this is the sum total of your observations, then it might indeed look like money has been printed; the central bank’s balance sheet goes up often way up quite quickly.

The more appropriate, meaningful perspective from the point of view of the commercial banking system instead observes something very different: an asset swap yielding at best undetermined outcomes.

We all should be asking, and should have been asking from Day 1, in the wake of Japan’s previous dubious pioneering of same, just how it goes from here. Central bank swaps assets for commercial banks; OK, now what?

Mario Draghi back in March 2015 already left you a clue: sentiment. He believed then, that too many continue to believe now, an incurious yet placated public not interested in thinking too hard about QE’s details will yield improved sentiment. Happier consumers consumer more than would have otherwise, likewise more enthusiastic businesses hire and invest in more workers and projects at greater speeds.

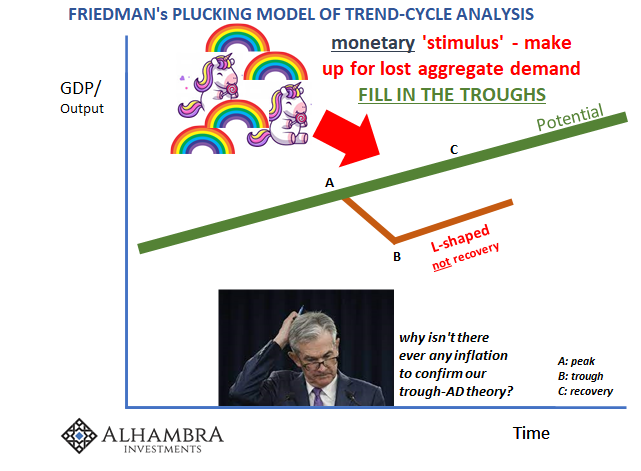

Betting it all on sentiment, though, that’s a very risky proposition. Presuming rainbows and unicorns might not get it done in the real economy, there would have to be something financially tangible to all this bond/asset buying, isn’t there?

What’s left is basically two “channels” in the “real” sense. The first is, unfortunately, the interest rate channel. I write “unfortunately” because going all the way back to Japan’s first QE more than twenty years ago the immense volume of scholarship written up about the idea conclusively illustrates that it doesn’t accomplish much if anything in reducing yields or rates.

You don’t actually need the academics; just look at any bond chart.

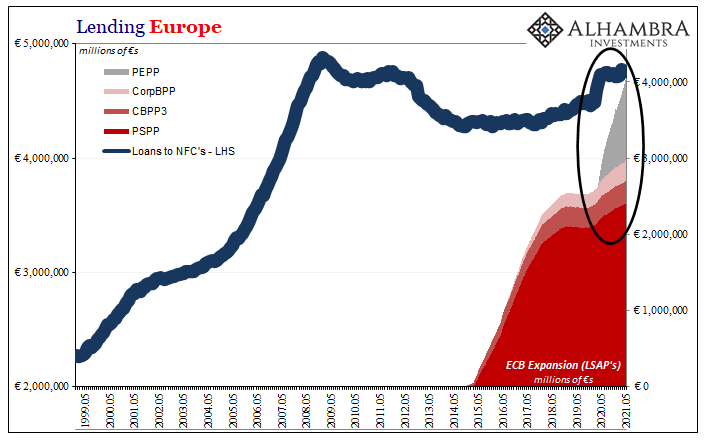

If no rainbows/unicorns and without any influence through the interest rate channel, there’s only what’s called “portfolio effects” left. About a year after the ECB started up its QE, in April 2016 I wrote that you could already see, nope, not happening here, either:

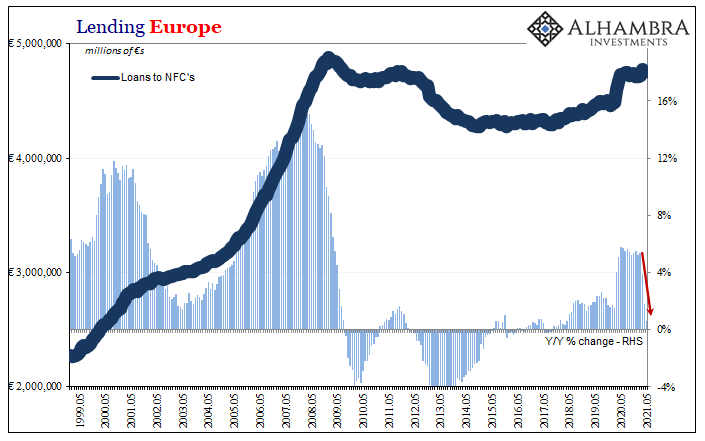

The idea is “portfolio effects” coupled with lower interest rates that are supposed to filter down to smaller and medium enterprises (SME’s). By buying corporate bonds, the ECB expects that financial agents will have no choice but to add risky positions including loans to SME’s that it believes could just use more debt. One immediately stands in awe of the total convolution of the scheme, setting aside any rejection of additional borrowing and credit as the solution here, as if distorting now the corporate sector to join the ridiculously skewed financial sector has anything more than the slightest chance of actually drawing out the intended results.

SME’s are small and medium-sized businesses, the lifeblood of legit economic growth of the modestly inflationary variety. It’s almost weird how central bankers, and not just those in Europe, completely understand how the post-2008 environment has left it with this specific deficiency in each part of the global economy. Big Business has all the credit and money it needs thanks to the bond market, able to float an endless stream of junk.

So, by buying up corporate bonds, too, as part of any wide-ranging LSAP (large-scale asset purchase) the central bank theory of portfolio effects forcing banks to adjust their portfolios beyond Big Business sounds, well, sound. SME’s have been starved for any trickle of credit especially loans, following the LSAP asset swap banks have no alternative but to lend to them. Right?

It never works because central bankers are blind to the reasons for this bank/market skew in favor of the largest companies. And it’s not just Big Business; it’s more so an asset class preference: bonds vs. loans. In an unchanged background environment of illiquidity and uncertainty or monetary constraint, it’s no contest even when the central bank intends to tip the scales in favor of SME lending.

To put all this in terms of 2021’s Big Debate, inflation transitory or not, there simply will not be inflation if credit growth ends up so narrowly distributed. Inflation, real inflation, sustained acceleration of consumer prices, this requires widespread, more uniform redistribution by the financial sector to all parts of the economy; especially to SME’s and especially in the form of broad lending.

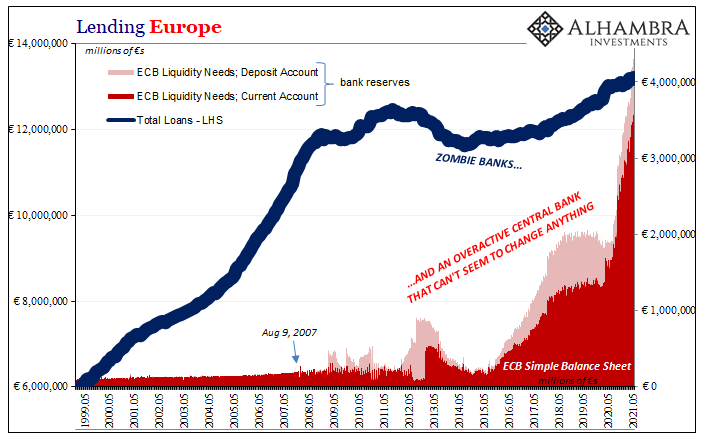

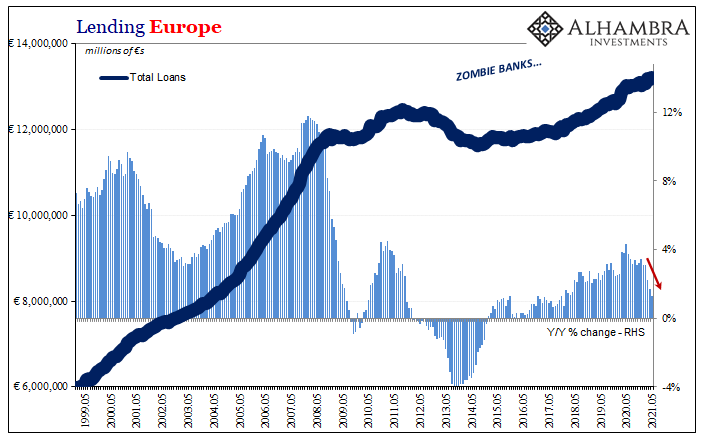

The way QE is talked about in Europe is like it is anywhere else on the planet. You’d be forgiven for thinking it has been highly successful in every channel including portfolio effects. We’ve already looked at US lending before and, no, not even close.

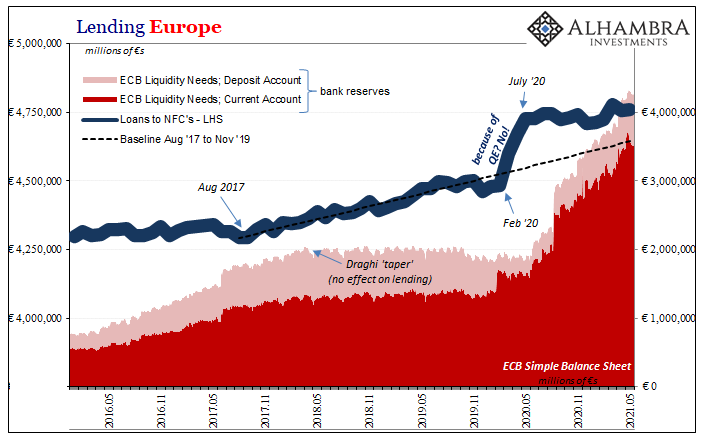

Believe it or not, Europe’s situation is worse. Far worse. Mario Draghi never wanted you to, nor does his successor Christine Lagarde, each preferring you just take their word, but see for yourself:

Not only has lending stagnated, it has been the lowest performing in loans to NFC’s (non-financial corporations, which also includes big as well as small and medium firms). Portfolio effects are nonexistent.

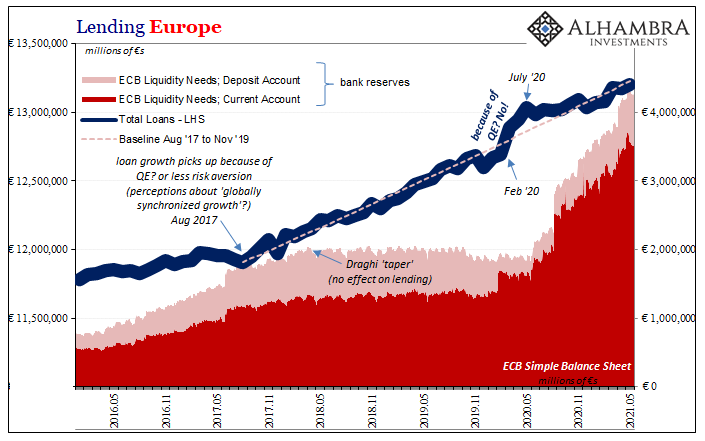

That conclusion applies equally to all of the ECB’s QE’s from the very first one to the latest which remains ongoing. It is only a quirk due to March 2020’s GFC2 which might leave a slightly favorable impression of this PEPP (as well as the regular T-LTRO’s accompanying it).

In Europe, as America and everywhere else around the world, companies – mostly large ones – panicked by a very real monetary crisis drew down on revolving credit lines. Thus, banks reported an immediate rise in lending beginning in March 2020 and lasting until July.

But that wasn’t because of QE, it was because of the inability of central banks to effectively alleviate this immense and global monetary shortage. In terms of Europe’s lending data, loans to NFC’s spiked by €261.6 billion during those five months, accounting for all and more of the $150.1 billion in increase in total lending (loans to other financial institutions, not MFI’s, declined sharply to partially offset the rise in those to NFC’s).

In other words, QE didn’t produce any lending this time around, either. Since July 2020, total loan growth has dropped precipitously because new lending to NFC’s has dried up entirely.

Within a few more months, last year’s liquidity loan-panic spike will be erased and it will then become unmistakably obvious that total lending activity has “somehow” underperformed at best, vegetated or declined at worst.

They have, and will continue, to use their buzzwords and the media will help them by writing up these failures as if unquestionably successful on nothing more than the word of the central bankers behind them. Yet, all it takes is a little, a tiny bit of interest to see what’s truly behind the monetary curtain.

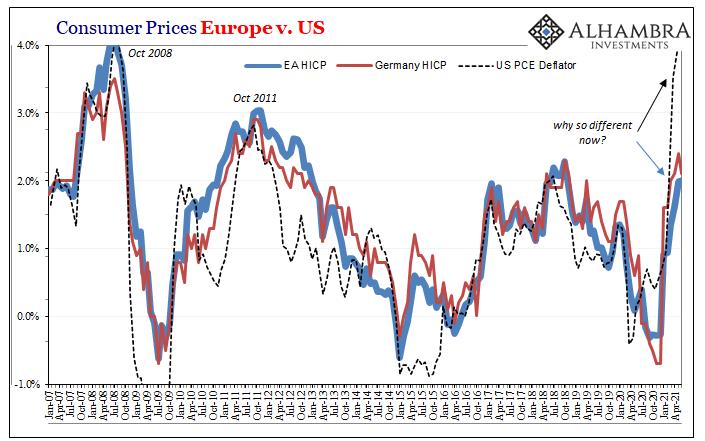

There’s no inflation anywhere here in Europe’s credit numbers, and so even now there’s not much in the various HICP’s. The American banking system’s lending figures aren’t that much better, and certainly not categorically different. QE doesn’t work. Never has.

The recent disconnect, then, nothing more than Uncle Sam as the exclusive, transitory difference between US consumer price indicators and their European counterparts. After his effects fade, each big piece of the global economy is left back in the same condition if not worse than pre-COVID (see: bond yields).

No matter what central bankers say, what gobbledygook they toss out there, or what’s written up in the media, there’s isn’t any money so there won’t be any credit meaning inflation’s something else entirely, too.

Unlike them, I’m not asking you to just take my word for it. Rather, all I’m doing is advising you to stop listening to these people and more than anything just look for yourself.

Stay In Touch