Germany’s flash July 2021 inflation estimate came in hot yesterday, boosted mostly by comparisons to July 2020’s VAT-free situation. That country’s CPI is a robust sounding 3.8% year-over-year this month, though only 3.1% in its flash HICP terms.

Despite Deutschland’s oversized contribution and influence, Eurostat reports today how for Europe as a whole there was a whole lot of little inflation in July. Base effects and surging commodities, and yet the headline (which includes energy and food) ticked up only to 2.2% year-over-year from 2.0% in June.

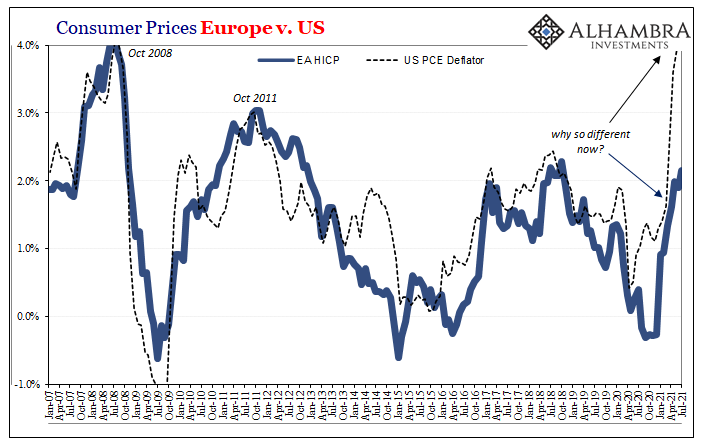

This is nothing whatsoever like what US consumer price indices are suggesting even though, up until very recently, those on both sides of the Atlantic had been highly correlated for more years than fit on my chart.

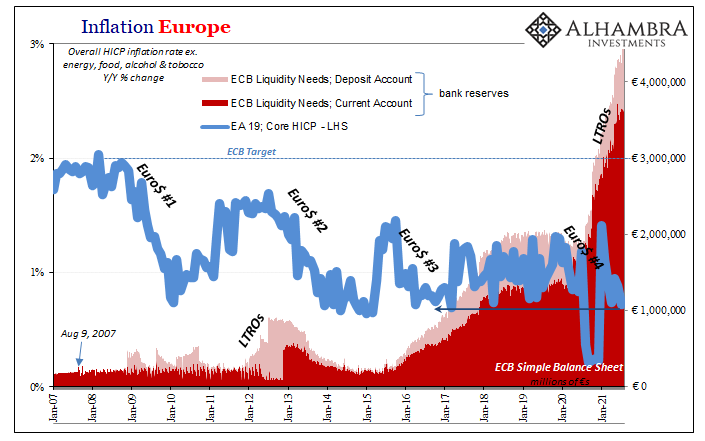

Unsurprisingly given this, the core HICP index for all of Europe increased all of 0.7% year-over-year. Over here in the US, its core CPI has of late managed to rise 0.7% and more in a single month several times. Not just different, suspiciously so.

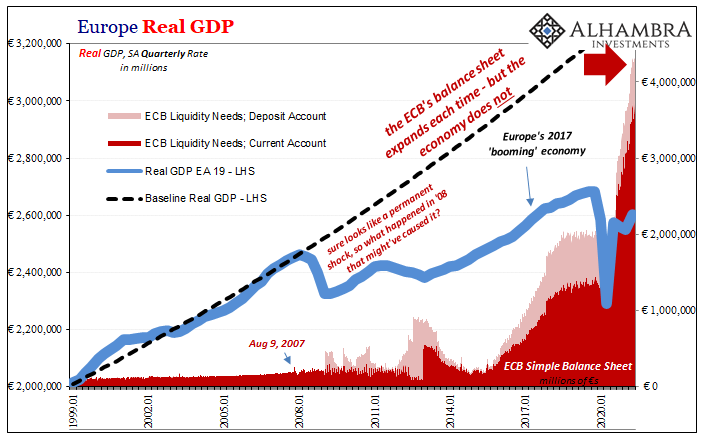

This distinct lack of inflation isn’t difficult to trace. Eurostat also gives us their first preliminary figures for GDP during the second quarter of 2021. Concerns about lack of acceleration in the US have only been compounded in European countries. Sure, they are still way behind on reopening and whatnot, but that only obscures the fact there has been little economic progress going on for three quarters to now (Q2).

Outside of Q3 last year, overall Europe is still today at a standstill; no inflation mystery at all.

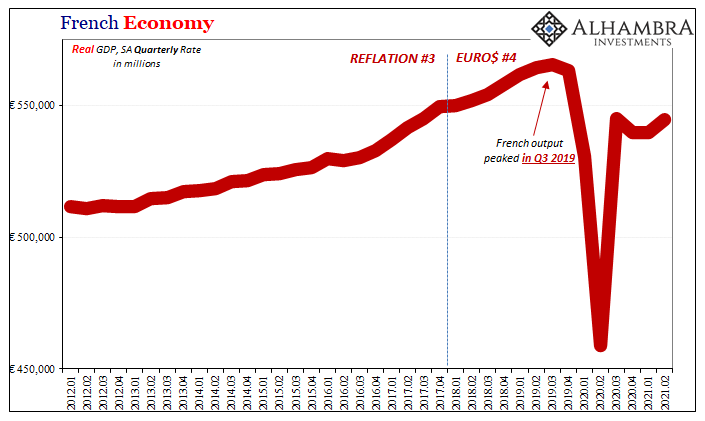

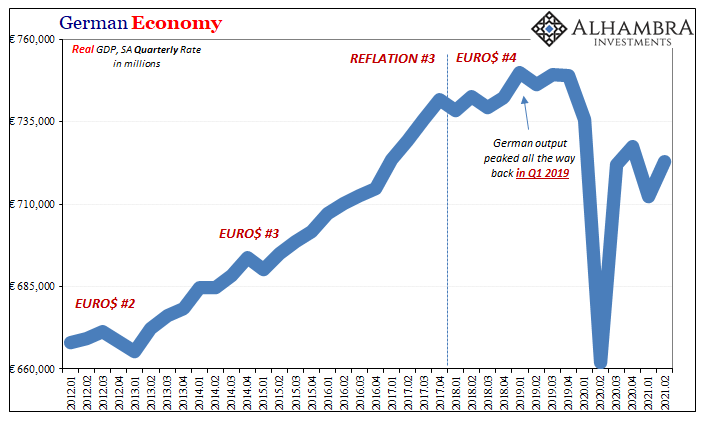

Results by country vary as they typically do; the French economy seems better positioned, insulated if only because the German system is more susceptible to the global ups and downs. Struggling Germany on the basis of COVID but also, perhaps more so, that other global factor (see: bund yields).

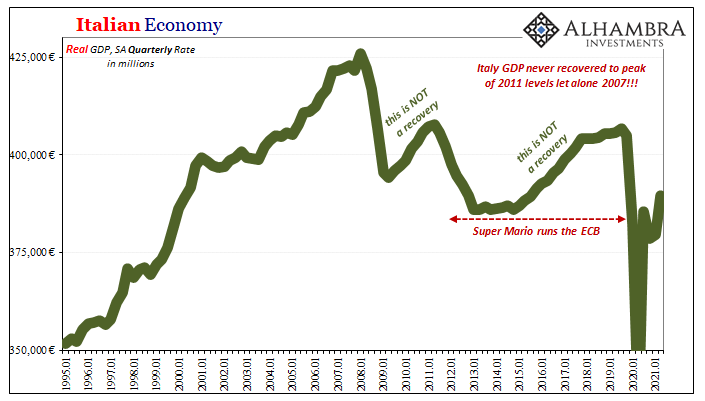

Italy, well, managed a better Q2 than either of those, but that means very little to Italians who have never once at any point recovered from 2008’s contraction in absolute terms. A truly sad, criminal situation that sadly isn’t unique for the last more than a decade.

It may seem, therefore, like a split decision bringing this back to inflation terms. The US vs. Europe, equal (thereabouts) in size thus a toss of the coin which one determines where everything goes from here?

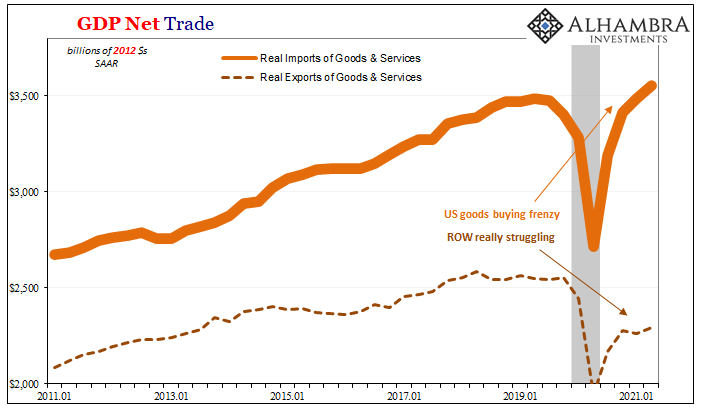

No, it would only appear that way in this one-on-one setting; the miserable truth is that the rest of the world, many parts of it, are actually looking up at Europe. The near entirety of the global economy is in truly poor shape, a fact that is – for Americans – obscured by their own CPI’s and each’s narrowly-driven results drawn from the narrowness of the goods sector.

As I keep writing, and bonds continue pricing, the US situation in consumer prices is an extreme outlier. Both in terms of its own internal pricing structure as well as, very importantly, compared to the worldwide economy whole. The latter is what ends up making all the difference.

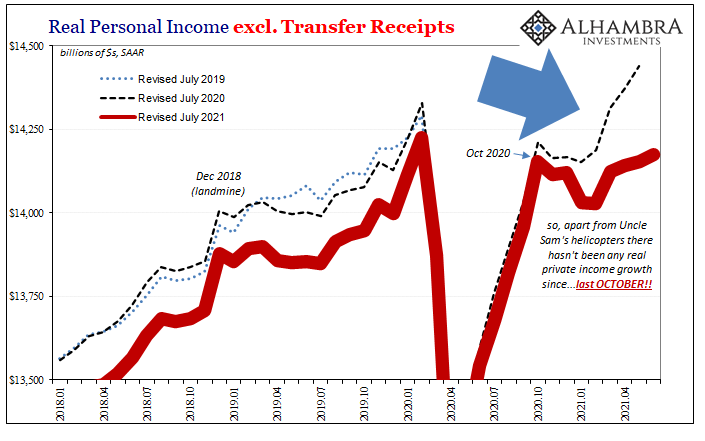

And all that was before today’s income data revisions to American private economy factors which really emphasize (and it’s impossible to overstate this) how outside of Uncle Sam’s fading check writing there may not be, or have been, as much difference in the US economy after all.

Stay In Touch