It’s been a little too on-the-nose. Claiming only a minimum level of dramatic license here, what we have continuing toward an uneasy future is a case of life imitating art (which imitated real life). We’ve all heard of Shakespeare’s famed soothsayer cautioning the arrogant Roman Emperor Caesar to watch his back on March 15. How about the 18th?

Beware the Ides of March…

Comforted by his own ascension thereby complacent as to the content of the message laid generously in front of him, famed Julius would transform into an early case study of recency bias. Who would Caesar ever fear, conquering much of the known world with such combination of on-demand brute strength and strategic cunning?

Friends, Romans, Countrymen, Lend Me your Ears.

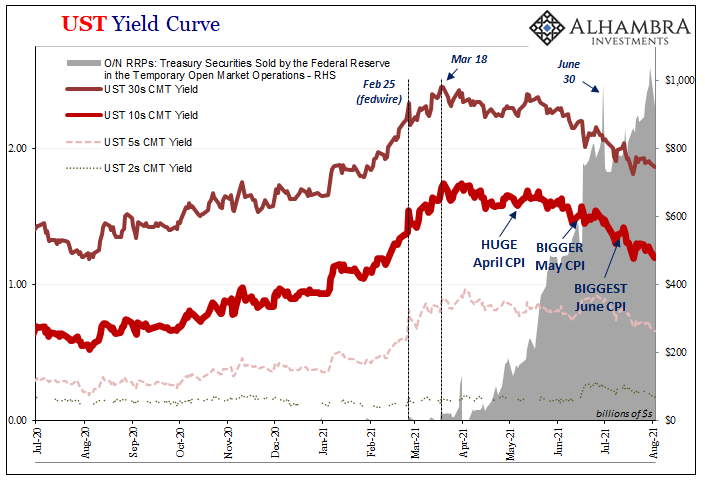

We’ve been talking almost nonstop about very nearly the ides of March 2021 since around that very date. On March 18, everything that’s become interesting to the point of seriousness seems to have shown itself beginning right then (and one more I’ve neglected to display for you these long four and a half months; more on that later). You can’t mistake the dramatic aftermath of mid-March:

Nah, that’s just too much money, said Caesar, the imperial mint coining about the massive influx bringing only the most favorable tides to the empire’s fate. Money market funds stuffed with bank reserves parking them with the central bank’s “soak up” window (reverse repo). Nothing to fear from a known (according to Investopedia) technical matter, right?

Not content to explain the one, maybe “too much money” could account for LT yields, too, with the banking system flush with deposits and seeking some kind of place for them.

But if these were the product of all good things, why wouldn’t banks lend instead? Ssssshhhhhhhhh,

This is news?

— Jeffrey P. Snider (@JeffSnider_AIP) July 29, 2021

It's like 2018 never happened. Then again, if you were Jerome Powell (or Bloomberg) you'd probably want to forget, too.https://t.co/dEl4rT0coE pic.twitter.com/96JHX7DAmV

In fact, it has become a cottage media industry attempting to place what outwardly seems contradictory behavior in the most non-threatening way. At best, Treasury notes and bonds like the RRP; at worst, Bloomberg’s writers reassure themselves before opining forcefully into the public’s ear how maybe it’s all a big mystery. Perhaps just corona stuff.

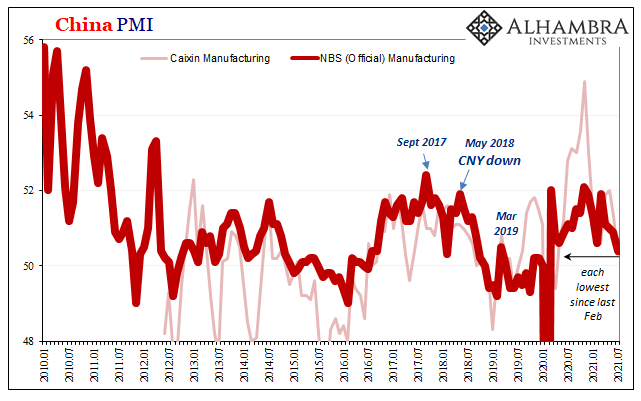

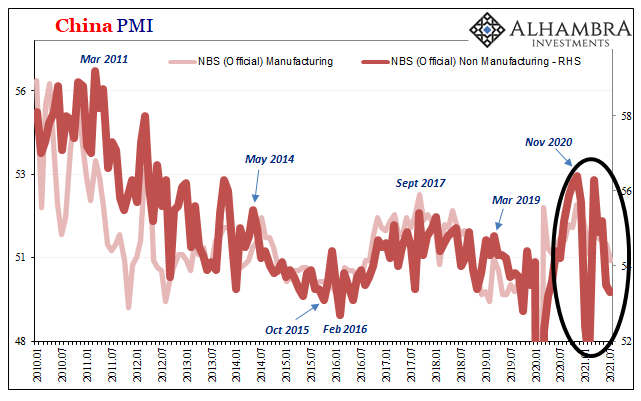

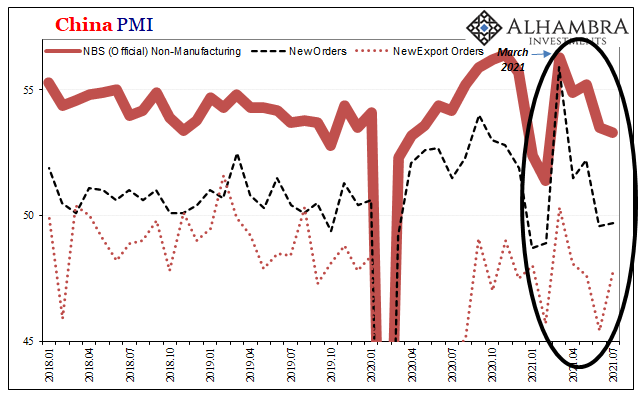

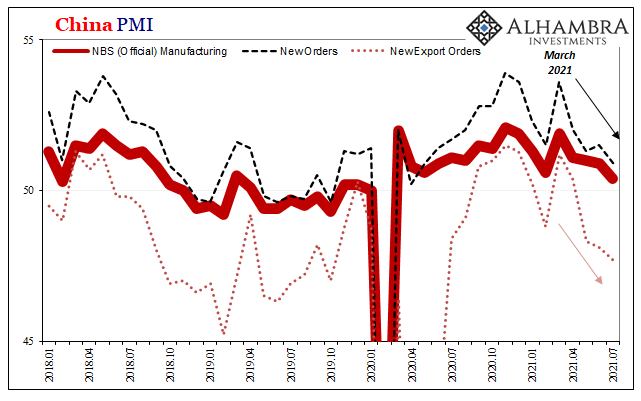

Over the weekend, China’s National Bureau of Statistics (NBS) published some alarms of its own. Taken in the most straightforward manner, these Purchasing Manager Indices (PMI) speak forthrightly of a global slowdown, material economic weakness continuously in that direction.

Nope; can’t be, says the mainstream. Anything else, sure, but not a poor economy. No, no:

This was the weakest pace of increase in factory activity since a contraction in February 2020, amid the Delta variant of COVID-19 outbreak in the eastern city of Nanjing, higher material cost, and extreme weather.

The numbers by themselves don’t paint much of the picture: China’s official manufacturing PMI dropped to 50.4 in July 2021 – barely more than the magic number – from 50.9 in June. The New Orders component was just 50.9, while the diffusion for New Export Orders sank to 47.7.

Perhaps more concerning, if you aren’t buying bad weather as an excuse, the non-manufacturing PMI failed to rally from one of its lowest on record the previous month (53.5). Instead, the NBS projects 53.3 for the critical month of July, which is about the same as October 2015 when China’s economy was circling the drain instead of accelerating as had been predicted.

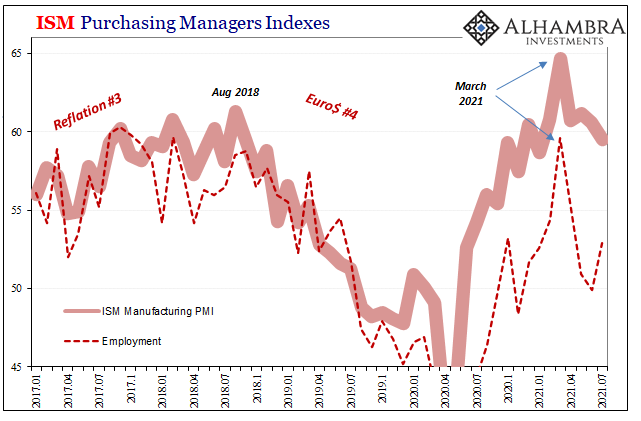

This morning’s ISM merely added to the same global picture. While the headline estimate remains elevated at a seemingly robust 59.5 for July, it’s the direction (and timing) with which at least the US manufacturing economy appears to be taking. Barely a few months ago the index was sky high (64.7) and seemingly on its way to the moon with nothing on Earth able to realistic threaten its dominance.

You’ll notice how in each of these charts, though they may be “soft” data taken to measure sentiment, they keep coming back to the same point of time. It’s far enough back in time that it can’t be delta corona, it’s not one or the other, Chinese weakness due to Chinese factors, or US slowing due to US factors, rather what’s pretty evident is the synchronized condition apart or outside the mysteries or benign excuses.

What point? Which time? March!

As I keep pointing out, and will continue for the foreseeable future, bond yields (very much unlike stocks) are created from trading inside and next to the real monetary system and all the intricate ways it influences and takes stock of the real economy – in real time. Here we have across the entire bond market (much more than just UST yields or RRP use) useful signals, a soothsayer’s soothsaying of monetary and economic circumstances which only seem like the impenetrably flowery language of Middle English poetry to the public purposefully distracted from their pure worth.

In other words, they only seem like they need to be translated because the mainstream is very far from native to its language. Like Julius Caesar, that convention – from media to Economists to central bankers – deems such forecasting as the unserious work of pagan ritual when, irony of ironies, the real science is in the trenches of the bond market whereas Economics and its media cult tries to divine economic strength from a comical concoction of reading tea leaves into astrological faith (econometric models).

At this point, they're aren't even trying. At least they're inadvertently being honest about not being honest. Just invented some "test" that no one would ever consider.

— Jeffrey P. Snider (@JeffSnider_AIP) July 22, 2021

This just isn't analysis, it's pure inflation propaganda.

ICYMI, UST yields are substantially lower today. pic.twitter.com/Rf3bmXBsKw

Media: How can we further prove we have no idea what's going on?

— Jeffrey P. Snider (@JeffSnider_AIP) July 19, 2021

'Stumped' Wall St: Uh, we're the ones buying all these bonds. https://t.co/V6715eiqf3 pic.twitter.com/OuxBeiAsIG

We’ve been warned since the Ides of March that economic weakness is real and getting “more” real by the month. Not in one place or another, but in enough places (practically everywhere, including the big economies) that we better start paying serious attention (if not actually doing something about it, but, again, central bankers). Unheeded, the weakness was written off as everything it never was nor could have been.

Not by all accounts, but by a whole lot we see much more than random coincidence. The global economy took a bad misstep around March, one that was immediately picked up on in bonds, and rather than regaining its footing to march onward it has only stumbled more and more.

Caesar ended up dying on the steps of the Senate because he superciliously believed in his own hype. Translated into 2021’s terms, to get to INFLATION HYSTERIA!!!! this required imagining first an unbreakable strong recovery. Such “strength” and its foregone inflation was instead unscientifically conjured to sell a Ptolemaic narrative rather than being a product of honest, rational analysis; and then when challenged – almost immediately (see: Feb 25) – the response was to keep whistling past the graveyard.

Life and art.

Stay In Touch