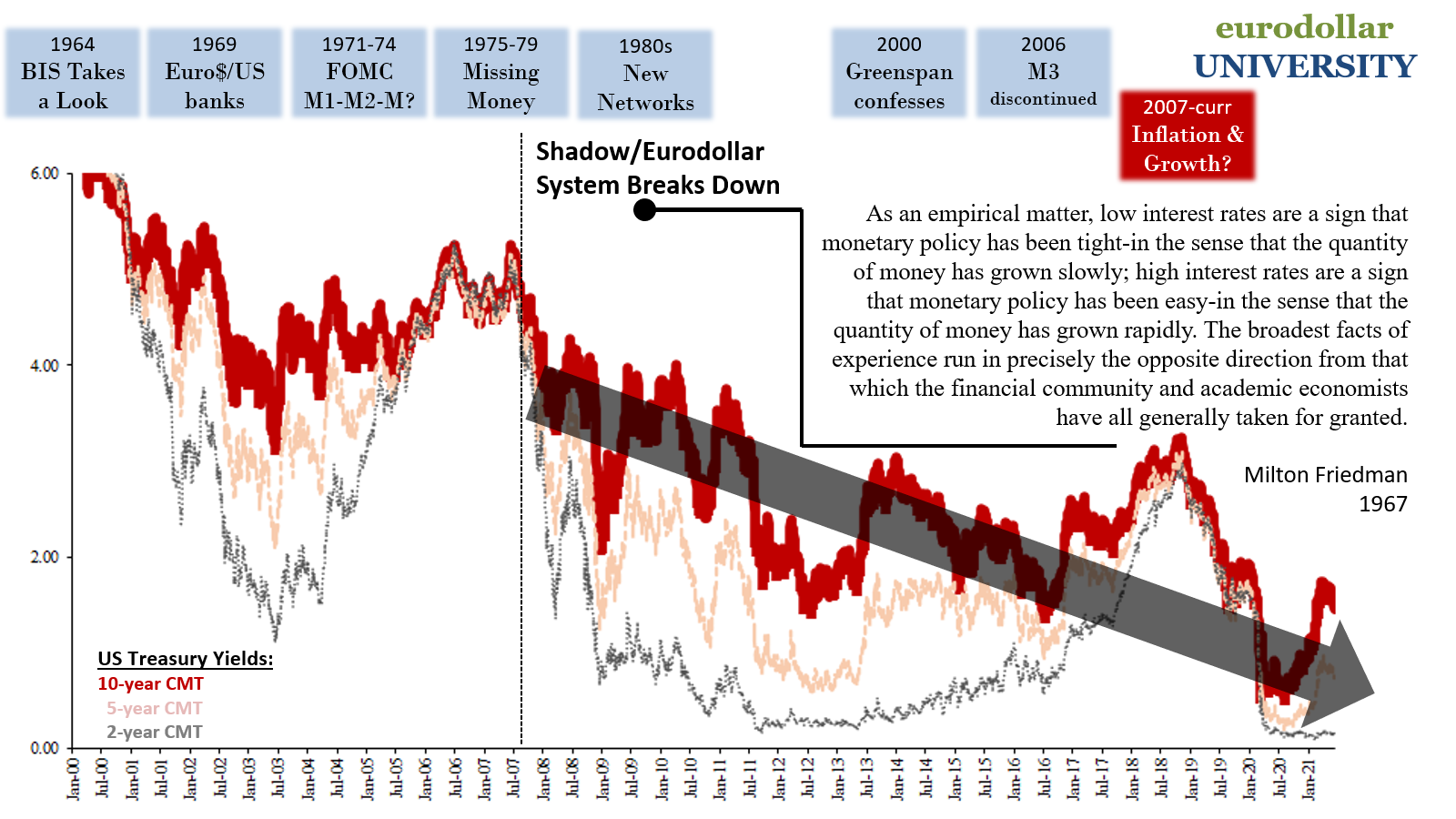

In one sense, we have a template to follow, two potentially, but in another there may not be one this time. I’m talking about reflation and how it plays out specifically in bond yields because these have been among the most reliable indicators. Economists and central bankers unaware of this wealth of information right in front of them, right here for everyone to see, confused simply because their outdated, anachronistic worldview doesn’t allow for rational interpretation.

Though very different from what you’re taught in the textbook, the textbook having it all backward, in this instance it truly is easy: rising yields = good, meaning less deflationary pressure and potential; falling yields = bad, meaning more deflationary pressure and potential.

Central bank bond buying, or QE, doesn’t really come into it except on occasions in the early reflationary periods when the bond market gave QE a chance to prove itself. It just never did (zero chance for success; can’t fix a real money problem with rainbows and unicorns). Interest rates rose reflecting the simple reality – even as the Fed was buying up billions per week of the same bonds – that up is good (for the economy and the people in it) and down is bad.

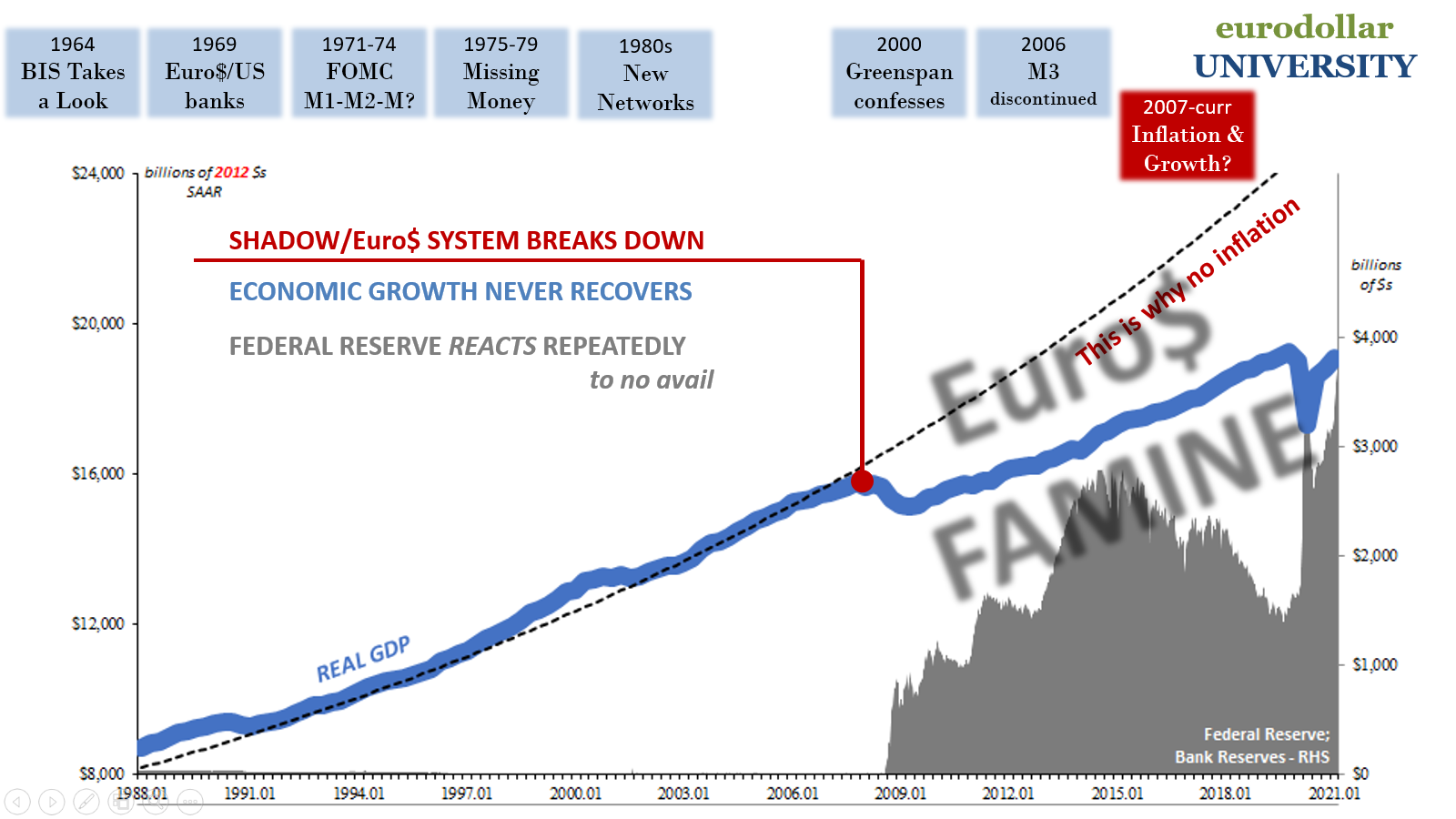

The up part never lasts and that’s the thing. The deflationary potential never goes away, the structural malfunction of the eurodollar system makes this impossible; deflation potential merely switches, over time, between periods when it becomes really bad (Euro$ #n) and then those when it is less so (Reflation #n).

Therefore, all there ever can be is reflation, never recovery (and the inflation which would confirm it; this really isn’t about consumer prices, or at least not solely about them).

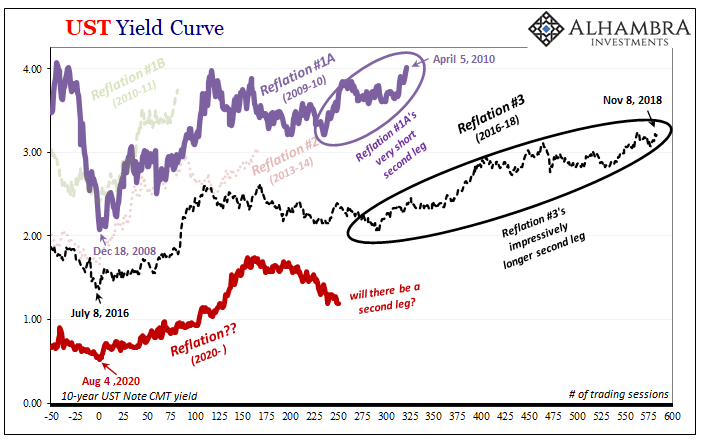

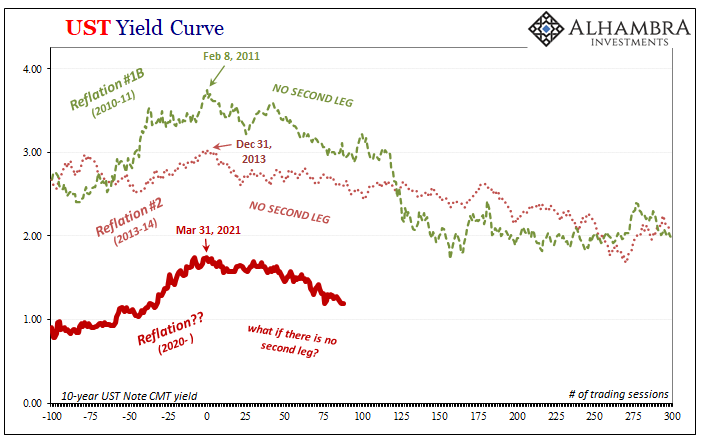

The reflation “templates” we have, and there are five examples (splitting Reflation #1 into two parts), are further divided between those with second legs and the others without. As you can see below, in the former class of reflationary periods there is the initial or big BOND ROUT!!!! followed by a multi-month pause before it then resumes (the second leg) for some length of time.

And of the two which have them, only one was to any serious length (time).

If we match the others (below) up against the current period (which, even by now in August 2021 I’m still not convinced counts as its own reflation, partial one in between Euro$ #4 and, if it continues like this, an in-process Euro$ #4b), peak to peak, it sort of fits right in – especially when compared to the early part of Euro$ #2 (February to June 2011).

This doesn’t mean a similar type crisis as July-August 2011 is right around the corner, merely that – and this is my whole point – it wouldn’t be unusual at all if the best days of reflation are already behind us (and that more serious deflationary potential could be just ahead, even if that doesn’t become a full-blown “thing”).

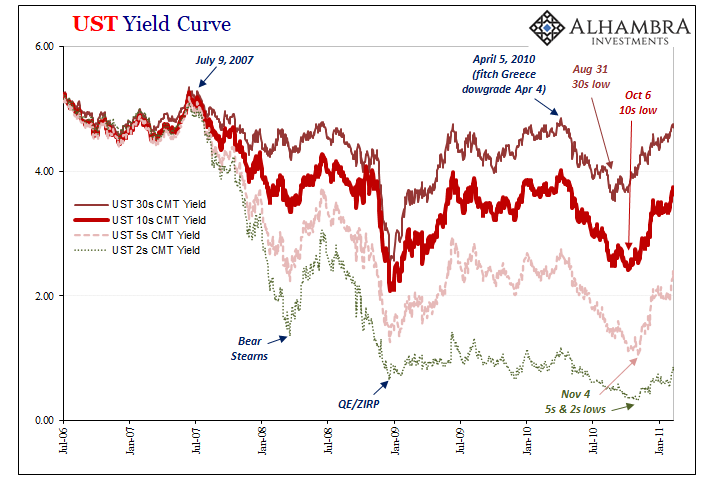

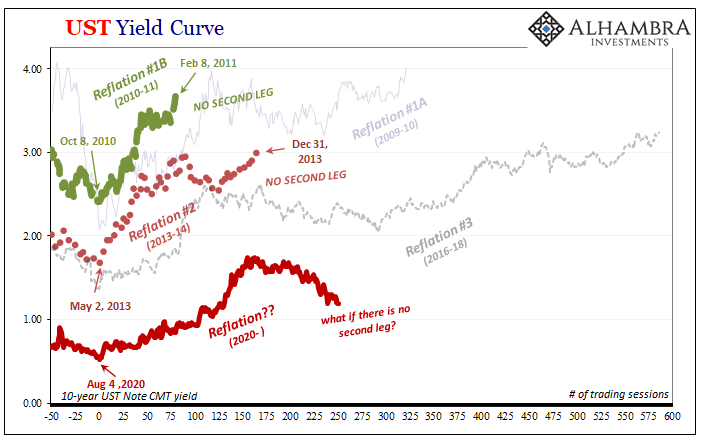

In the other two with second legs, the first of those (Reflation #1a) turned out to be incredibly short; interrupted, interestingly, by a disturbing and disturbingly unnoticed grave collateral shortage (it wasn’t really about Greece).

This leaves only the last reflation, Reflation #3, which had demonstrated any significant potential to reignite itself and continue yields upward for a prolonged period. Does the current monetary and economic climate share (any, let alone enough) common traits with globally synchronized growth?

Or more like mono-leg Reflation #2, perhaps the repo-driven max at Reflation #1b?

Conversely, can the economy (globally) find its footing once more, can someone provide a collateral boost (multiplier), before enough deflation triggers are triggered therefore beyond the point of being salvageable?

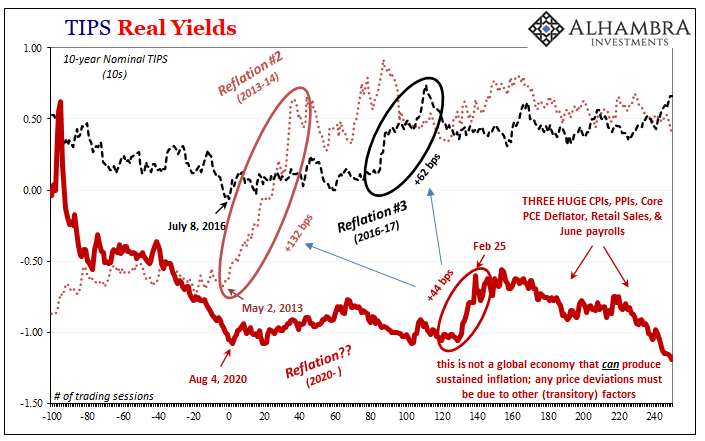

These are why we are obsessively seeking more confirmation of either a continuation toward deflation becoming more than future potential (as a growing Euro$ #4b, or #5) in a list of possible key factors; something like JGB 10s turning negative again (which they very nearly did just today) or a future “collateral day” and related twisting in money or yield curves.

The catch, potentially, is that 2021 in many, many ways is unlike any of those other reflationary periods – and I don’t just mean how little and feeble the current one’s reflationary results. There is much about today that is unprecedented making it potentially more complicated than comfortably relying on these reflation templates alone.

It may turn out that this really isn’t any different than those before, certainly how it seems right now, but there are factors in this regard which are worth paying attention to; from Uncle Sam (not “infrastructure”) to this global supply/demand imbalance, how much corroborated by markets (not stocks) unrelated to UST’s (something like gold, for example).

As it stands today, global bond markets appear quite comfortable running the typical reflation playbook, to early August 2021 of the single leg variety. The more it keeps going along that template, the more it continues with more really ugly than not (see: below), the greater the likelihood of, and shorter wait for, the inevitable Euro$ #5.

Even if 2021 does shift to a second leg reflation, or if 2021 is impacted by any extraordinary other things, in the end it still doesn’t change the longer run outlook which is Euro$ #5.

Only the timing. So long as the monetary system is as it currently is (next Monday the 14th anniversary) deflation potential always remains.

Stay In Touch