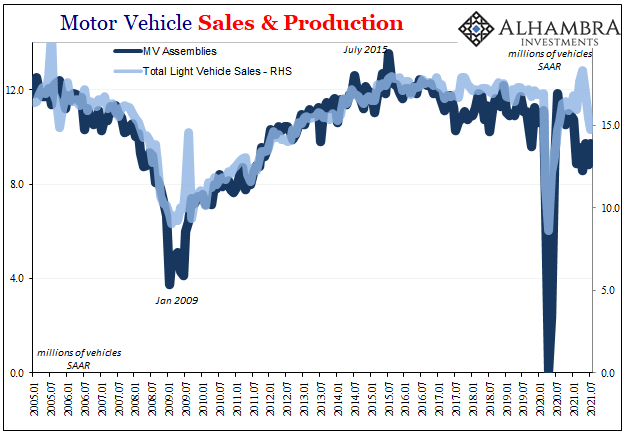

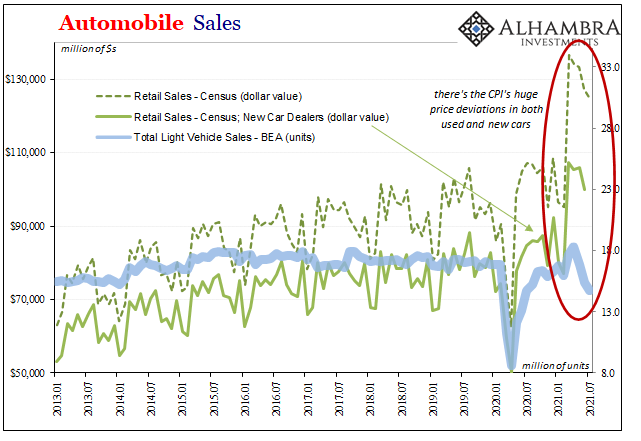

A tale of two retail industries. In the one, the well-known chip problem holding back what is already a monstrously robust (if artificial) sales environment. Automobile dealer lots are nearing empty and carmakers are unable (perhaps unwilling, too?) to produce near sufficient volumes to keep up let alone restock.

This view of the situation, though, has clouded perspectives particularly as they might relate to inflation potential. It appears now commonly believed that this auto inventory problem is universal; that, overall, goods are in very short supply all over the domestic economy.

Not so. While the entire retail sector grapples with supply and supply chain issues, outside the automotive segment the rest of it has been far more successful mitigating bottlenecks. In fact, by both anecdote and data, retail inventory ex autos is at record levels.

One such anecdote, and a big one, Walmart reported earlier today that its own stock of inventory was up 20% compared to last year. Though the comparison to 2020 was favorable – particularly the run-down inventory levels of toilet paper which had been hoarded by the public – management has said for two straight quarters its current inventory position has been “lapping last year’s COVID related effects.”

The company’s CFO, Brett Biggs, almost bragged about these figures as a measure of successful crisis management. And it absolutely is – in the one respect of the giant being able to navigate the challenges of 2021. Clogged port facilities, lack of available chassis, railroad carload snafus, fickle drivers sitting home for lack of companies offering a market-clearing wage, etc., these all have led retail (and wholesale) companies to make substantial changes to long-established practices (like JIT).

One such, and a potentially dangerous one, has moved forward as much inventory as possible.

The biggest way we’ve handled supply chain delays is adjusted ordering and front-loading…orders of many items,” Costco CFO Richard Galanti said last month. “And we think we’ve got that pretty well under control.”

Many appear to have preferred to order way in advance thereby allowing for measurably longer lead times rather than risk not getting the goods in time for consumer demand. And that’s true – so long as consumer demand holds up. If it doesn’t, if the economy suddenly goes soft (for, say, artificial factors fading away), then suddenly these wise new practices leave their practitioners holding the sizable bag.

As one academic (professor of logistics) put it:

If those sales would drop, they would be drowning in inventory.

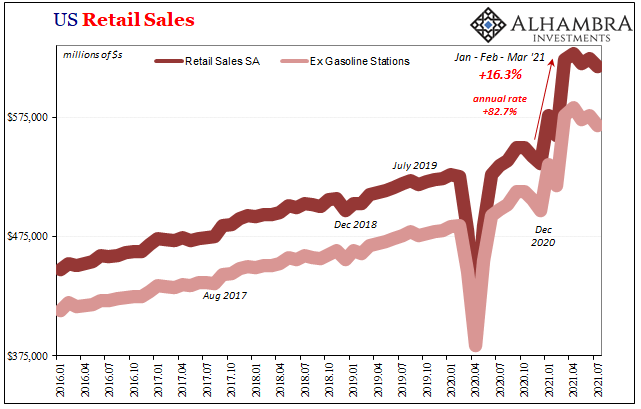

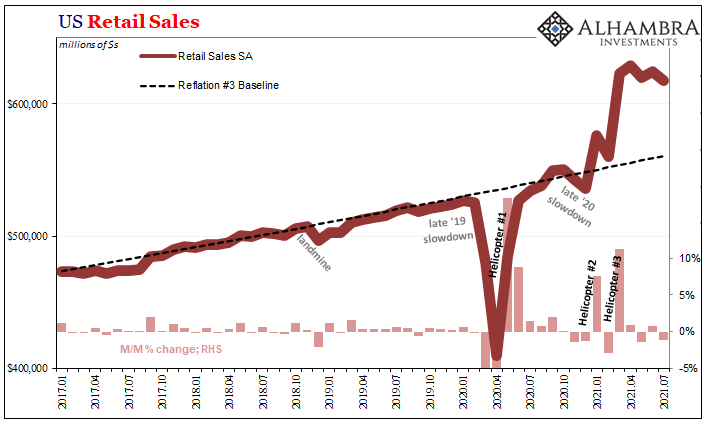

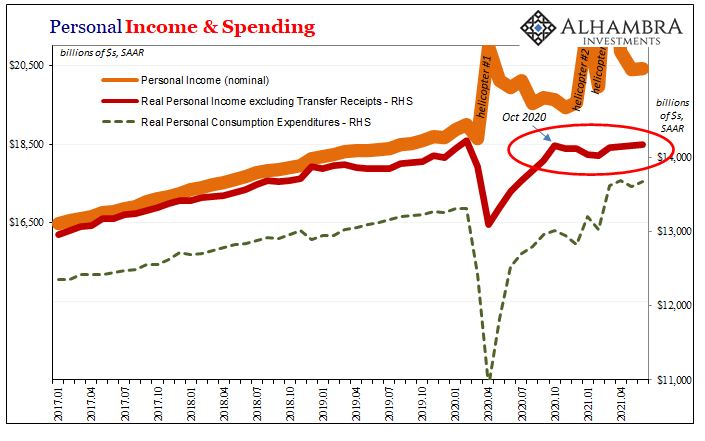

Retail sales, according to the Census Bureau’s latest figures for July 2021, remain quite elevated but are trending somewhat lower at the same time. The downward track over the past several months, sales peaking back in April after the last big Uncle Sam cash drop, is unsurprising given what’s been behind it.

The key question now isn’t even about whether this sugar high wears off, but by how much and how long does it take? The reduction in sales should continue, unevenly as always, over the coming months. What everyone wants to know is how far down does it get before renormalizing to small “e” economics (of the private income view).

Retailers with huge inventories are betting ahead that it won’t be so far to the bottom; that they can nimbly manage these rather historic imbalances which include a bunch of retailers, especially in food, outright hoarding product because they’ve bought into the inflationary rhetoric all over again (just like many including Walmart had in 2011; it’s actually a common mistake even though you’d think retail businesses would know something about inflation potential).

Walmart US division chief (CEO) said, “We're seeing cost increases starting to come through at a pretty rapid rate" before adding that inflation is "going to be serious."

— Jeffrey P. Snider (@JeffSnider_AIP) August 16, 2021

Walmart's US CEO. Case closed. Inflation done deal.

Nope. This was March 2011.https://t.co/fMC9LSZKfF

And yet, production.

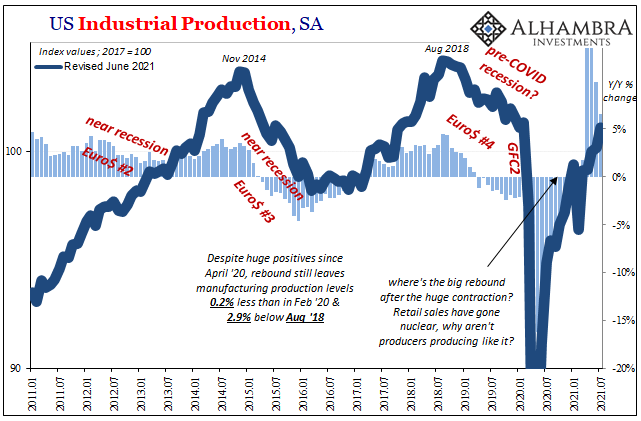

We’ve been saying this since the depths of the recession and now up to July 2021 it remains no different. Producers aren’t seeing volumes (despite prices) at anywhere close to the picture from retail or consumer sales. Why not?

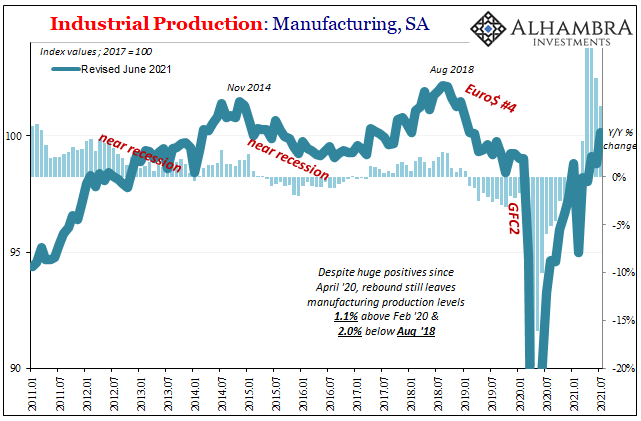

Supply, chips, COVID, etc., a myriad of excuses which can’t fully account for, for example, overall Industrial Production in the US, according to the Federal Reserve’s latest estimates, released today, which is only now reaching January 2020 levels. More to the purpose, overall IP remains significantly below the last peak which actually dates back to the summer of 2018, hardly indicating a serious turnaround equal to both sales and now possible inventory.

This despite these anecdotal confessions from some corporate C-suites of intentionally overstocking product. We can only conclude that while some like Walmart and Costco certainly have been doing this – after all, the Big Guys have the financial wherewithal to eat up the massive amounts of cash it takes to buy then hold product you won’t sell for a lot longer than typical – while at the same time perhaps much if not most of the rest of the economy remains unconvinced and more cautious.

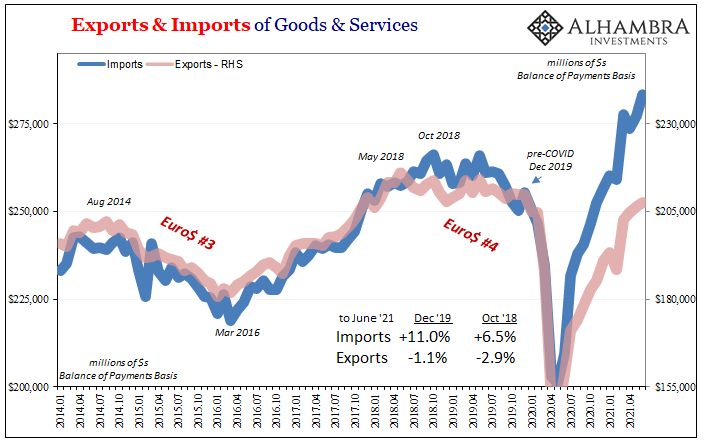

It is absolutely like that around most if not the vast majority of the rest of the world – partially accounting for US industrial lethargy. Domestically, sales are up through the roof even if cooling off a touch; globally, they aren’t even close to reaching pre-COVID levels which, again, were already significantly less than 2018 peak levels.

Two tales of a single industry inside two very different sets of economic circumstances. The automotive sector can’t get nearly enough to keep up with sales, while the rest of the domestic system, or its biggest individual pieces, may be having too much success at the same attempt. This further marking a huge divide between the one single part of the global economy that is actually frenzied in this way, the domestic goods business, a clear outlier among a much more subdued global entirety.

And in the auto business we can see the much the basis for the current “inflation” hysteria, taken outside of autos by first straight-line extrapolation across-the-board (the narrative belief that auto price imbalances are meaningful representations of what must lie ahead for every other industry).

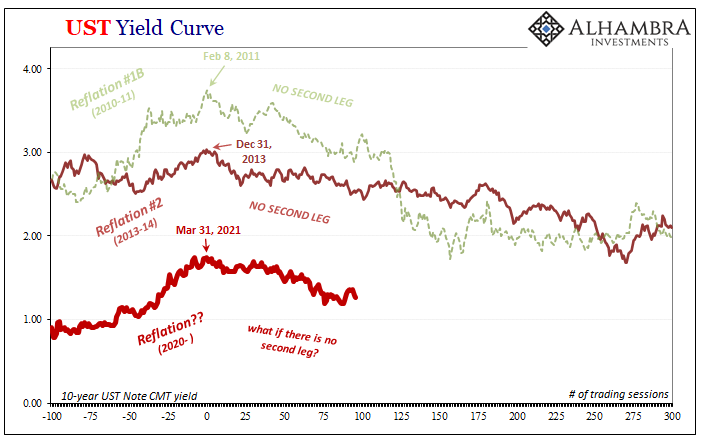

The bond market since mid-March, and really late February (Fedwire), has been awash in widening deflationary not inflationary potential. Here we can see just why that has been even in this one aspect of the world’s system which has reached closest to “robust”, even red hot. Unless it lasts so much longer, what happens to general and specific prices if eventually overstocked retailers figure out they have been, in fact, grossly overstocked?

Thus, for inflation to happen the entire rest of the world has to become a lot more like US retail sales rather than for US retail sales to slow down like the rest of the world. Even as US retail sales already have slowed down.

On that, it isn’t that the bond market is awash in deflationary potential, more accurately low and falling yields simply reflect the same already evident in the real economy (especially outside the US) including domestic goods and all the more varied ways supply constraints have taken their toll. Though we don’t yet know what the future toll might eventually be, the bond markets’ is a pretty reasonable guess.

Stay In Touch