Inflation is monetary, meaning that “real” inflation – a broad-based and sustained accelerating trend in consumer prices – is a part of the not-real financial realm. If reckless authorities print too much money, then the solution, for anyone rationally seeking protection, is to rotate out of the financial and into the real.

The logic is unassailable: too much money, high inflation, real commodities the place to go shelter. That’s never been the issue, not even as far back as the first QE and Obama’s monstrous ARRA. Instead, the fault always undermines the thought process from its front; no inflation because no money had ever been printed. Yes, this fact absolutely includes not just the Fed’s bank reserves but everything else which might end up on – or as a consequence of – its balance sheet.

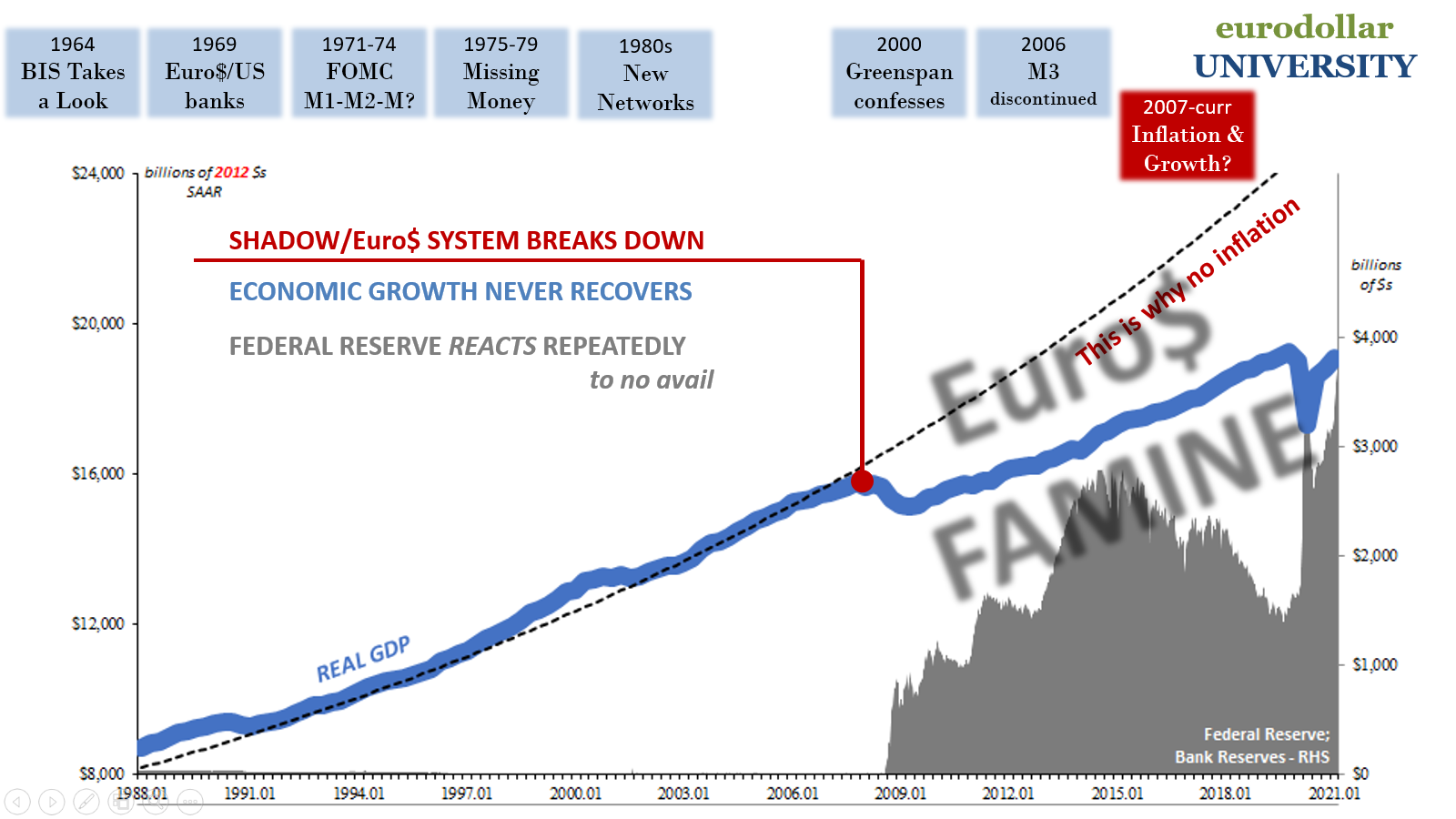

What, then, money? It’s not what you can see which ultimately matters, money matters and the money that matters, rather it’s what you don’t. Shadow money. I have enormous sympathy for, and patience with, the public’s view on all this wrongly colored by unbacked mainstream assumptions that still ply some mythical Greenspan put as if it was ever real: everyone can see the Fed’s balance sheet balloon upward, leading to excessively excess bank reserves, but what you don’t see is what must’ve cause the Fed to act in the first place.

It’s the latter not the former which sets the economic, financial, and monetary worlds in motion. Deflation. Yet, we’re constantly told bank reserves are money and the Fed (or ECB) possesses some money printer and has been using it only too much. Dollar’s imminent crash and all that.

But if this stuff we don’t see really does stay in the shadows, how can we possibly know what’s really going on money-wise? Well, the first clue is actually the Fed’s balance sheet; as just stated, when it goes up that’s actually your first deflationary warning.

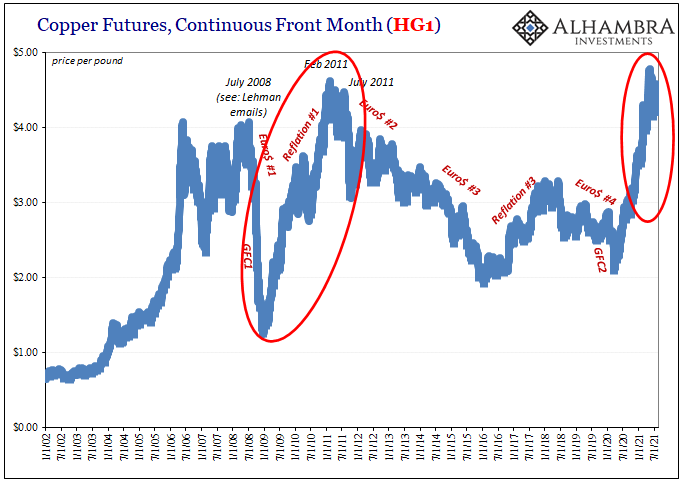

Other than that, absolutely, commodities can offer us a meaningful window through which to peer closer in on the shadows. That’s how markets work, even if everyone operating in them doesn’t see the whole picture or completely understand the full nature of that system. If more and more within the commodities markets seek this real protection from inflationary currency, then it stands to reason what they are all fleeing from in the shadows is that very thing.

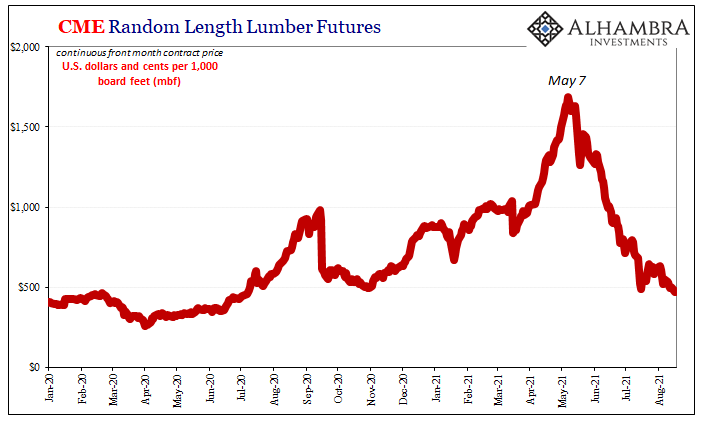

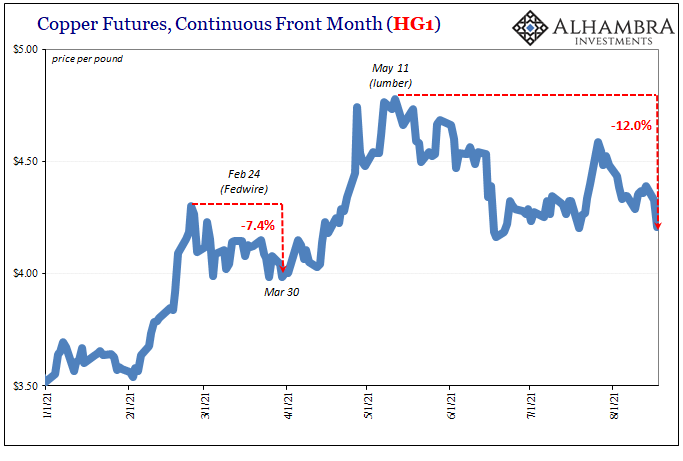

Thus, over the past year and a half, the inflationary money-printer-go-brrrr did seem to catch fire of especially two leading commodities – copper and lumber.

“Clearly, commodities have been on a tear,” says Peter van der Welle, strategist at asset management firm Robeco. The rally’s pace is surprising, but “we expected rising inflation expectations and a subsequent boost in demand for assets with inflation-hedging capabilities, like commodities.”

Expectations for further global growth and a greater need to compensate for inflation risk—along with excess liquidity, historically low real interest rates, fiscal stimulus, and a weaker trade-weighted U.S. dollar—have underpinned the commodities rally year to date, van der Welle says.

Going back to when the rally in both began last summer, these two more than others had been touted as growing proof of the shadow system for once accepting Jay Powell’s version of monetary events; his flood. Here it was out of the shadows and heading into orbit, with both copper and lumber sailing upward with just alarming speed especially when Uncle Sam’s helicopters added so much more to the orgy.

What else could have possibly explained this fiery situation other than “a greater need to compensate for inflation risk – along with excess liquidity…?”

Well, small “e” economics. Simple supply, for one:

With earlier copper hoarding expected to unwind over the months and year ahead, even the most demand-optimistic of these commodity watchers is expecting a modest pullback in the price during 2021. And these are mainstream Economist projections. Not to mention what’s actually going on in China, and it’s not massive “accommodation” by any stretch.

Supply constraints rather than Jay Powell’s name are all over Dr. Copper’s prescription pad.

You don’t hear much about copper and lumber prices this summer even though for awhile there during the late spring the latter was as much a financial speculator’s Rockstar as AMC or dogecoin had been. Lumber futures had attracted such unusual attention because of what we were told was pushing it onto the front pages.

— Bobby (@DJBobbyPinMusic) April 29, 2021

Wow, neighbours just casually flaunting their wealth in the hallway. pic.twitter.com/mhr3JPLpQA

— Bong Capital (@BongCapital) April 19, 2021

Even those who took a more rational view of these circumstances (including how cut lumber prices had so radically diverged from raw timber prices which haven’t really budged at any point) were still inflationary in their outlook, convinced that while supply bottlenecks at saw mills had created the excessive price spike, there must’ve been some inflation signal in there even if somewhat less than at its full mania.

Prices have since fallen to the $800 range — still nearly double their pre-pandemic rates — in what could potentially be the new level for the near term. [emphasis added]

The above was late June. Below from early May, a more rational take nearest the top amounting to the same longer view takeaway:

Dean said he doesn’t expect to get back to pre-Covid-19 lumber pricing, but he does think the situation will moderate. “People are only paying these high prices because they have to, and eventually those people who have to buy lumber will buy enough and we’ll be able to breathe and prices will reset. To me, the question is, where will we reset?” he said. [emphasis added]

Lumber, in particular, was absolutely ripe for its epic fall but even those expecting supply factors to play out like they have were pretty sure relatively high prices were going to be baked in it for the long haul. It couldn’t have been all supply, could it?

Yes, for lumber absolutely supply. The possibility, and good one, therefore not just lumber.

In the futures market, the once inflationary-sure signal has retraced all the way down back under $500 as if it was all some bad dream. For its part, copper remains elevated, but supply problems there are even less elastic and responsive to conditions. It might take a bit more time, but even if it does it’s not like copper reached some epic high like lumber had (copper where it is now proved no more inflationary when last at this price in 2010-11).

Both these were once not very long ago (early May) proclaimed definitive evidence as to inflationary money printing. They never really were, but, and here’s the thing, ironically, they might be now. Transitory because no money was printed, just bank reserves and the temporary reach of the federal government’s immodest check writing, the latter leading to temporary price deviations. Not inflation.

Stay In Touch