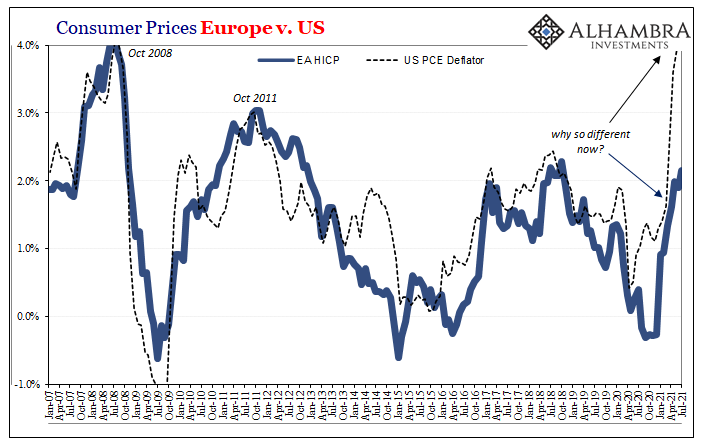

Europe’s statistical agency Eurostat reported today that its preliminary inflation estimates released earlier for the month of July 2021 had come out correct. Those first guesses had put the year-over-year change in the overall HICP at 2.2%, and its core rate one of the lowest at 0.7%. With more completed survey data and more time to recheck the statistics, confirming these estimates for last month also substantiates their gross difference with inflation survey results over here in the US.

As we’ve pointed out now for several months during this American inflation hysteria, it is the US set of figures which is an extreme outlier. Furthermore, that there is such a huge discrepancy is itself significant simply because, global factors, US and European rates have been more closely correlated than not for a very long time.

Given the full range of July data on both sides of the Atlantic Ocean, what can each tell us about this sudden separation? What’s the real inflation deal?

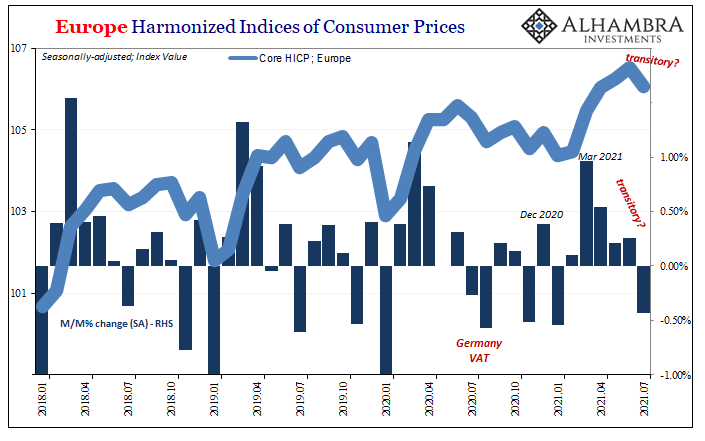

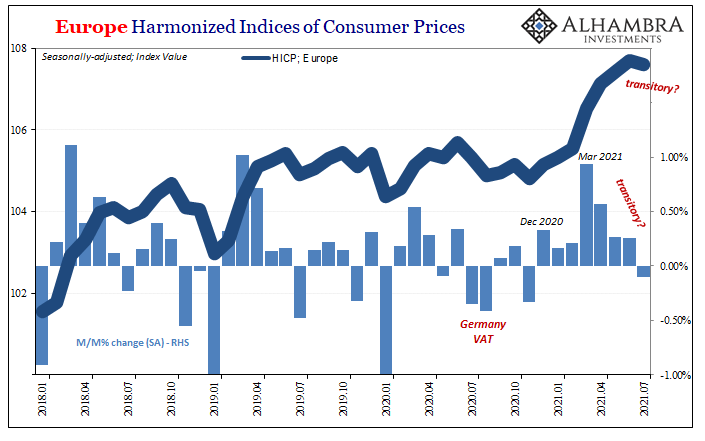

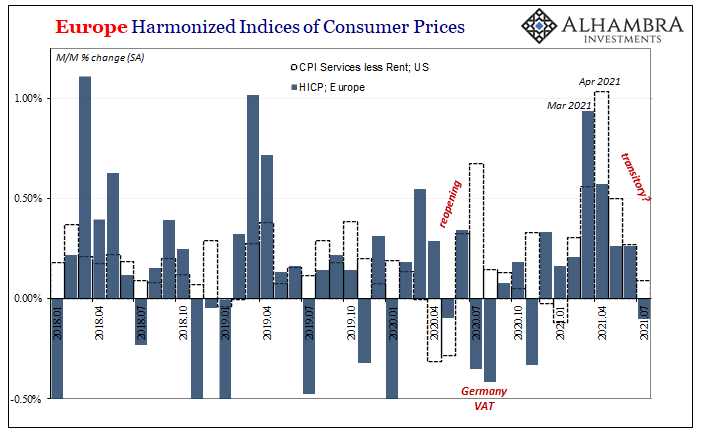

Start with Europe. The monthly pattern which emerges from recent months is already very familiar. The HICP as well as its core version both exhibit the same reflation on/reflation off which we’ve also pointed out in some of the US CPI samples (see: below). Along with bond yields (BOND ROUT!!!!), there was a noted jump for inflation both here and there during the early months of the year.

Global yields first (though, interestingly, not for Germany’s market), following the late February/mid-March inflection in most bonds, European inflation rates have been falling since peaking in March. For July, the monthly change both the headline HICP and the core were negative, or outright short run deflationary (which isn’t uncommon over there).

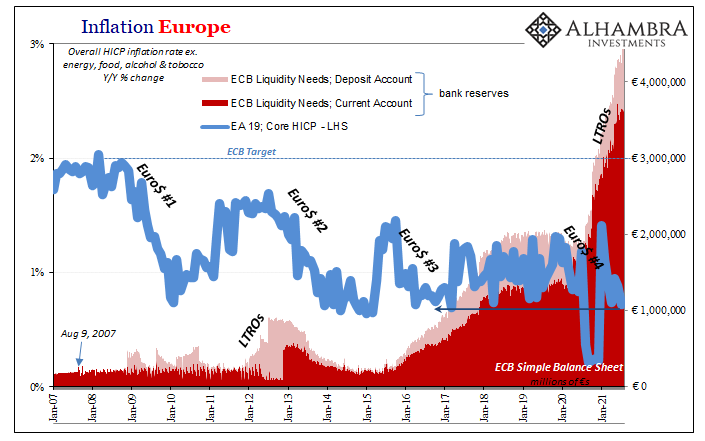

Now the differences: notice already that even the recent monthly spikes in Europe aren’t really out of character for the past few years of what’s been an unusually (and frustrating, for the ECB if not Europe’s peoples) low inflationary environment.

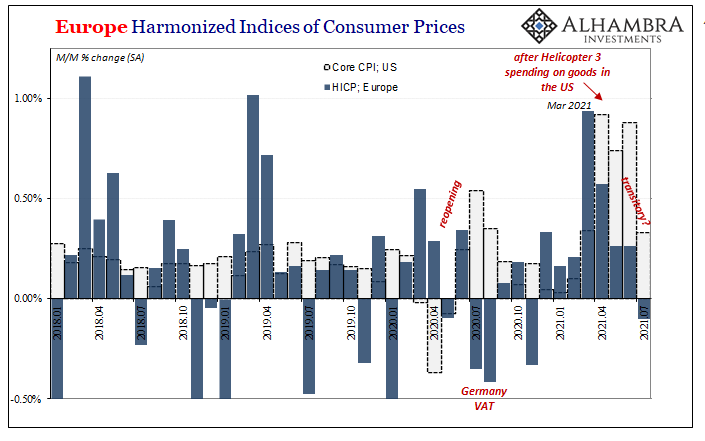

By sharp contrast, the monthly changes in the US CPI (and PCE Deflator) over the past few months have been among the highest since the eighties. In other words, for Europe the reflationary rush earlier in 2021 was not much more than getting back toward normal – normal being lackluster – whereas the relatively far greater leaps in monthly US numbers have been truly extraordinary.

Not only that, in those US indices which contain a high proportion of exposure to goods prices – especially autos – those extraordinary monthly price increases have been sustained for these few months longer than what we see in Europe or of what we find in American consumer price buckets (like CPI Services less Rent) which aren’t so heavily influenced by those narrow segments.

Clear temporary “inflation” in all of Europe as well as non-goods US:

The other major difference accounting for 2021’s geographical dichotomy is Germany’s VAT “holiday.” Effective July 1, 2020, and lasting until December 31, the German government dropped the tax rate for the vast majority of the goods purchased by consumers in that country from 19% to 16% (the standard rate), while for others (reduced rate) the levy was adjusted downward from 7% to 5%.

This then caused a ripple effect in European consumer prices reflecting how, in terms of the end user, prices were broadly lower in the second half of last year within Europe’s largest economy.

During those same months, especially July and August, this in America had been the first big transitory bump to US inflation rates. Thus, last summer consumer prices did one thing here, at least on an average basis, while moving in the other direction over there.

These factors together account for most of US and European “inflation” experience and the difference in them over the past year. Aside from Germany’s VAT, there had been much in common – acceleration if not to the same ultimate degree – with each side from around January until March and April when European estimates began to slow while American rates tied to goods continued at unusually high rates.

All this adds more evidence to the conclusion US “inflation” during these months has been caused mainly by one particular idiosyncratic factor (spoiler: not the Fed nor its bank reserves) impacting a smaller consumer price segment shared with neither US services nor European prices overall.

Hardly a mystery, this key difference therefore Uncle Sam’s checkbook.

Given how background inflation conditions in the US as well as in Europe, real inflation of the monetary variety, is governed by shared global factors, accounting for the previously close and lengthy correlation between each’s consumer price measures, we have more thoroughly isolated and identified this singular discrepancy.

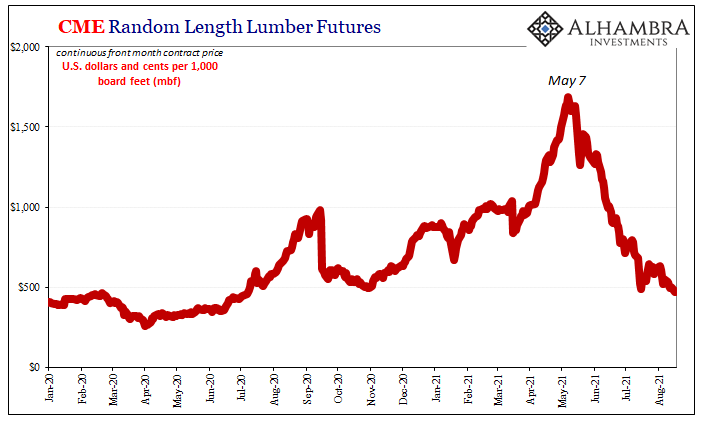

Since it seems pretty clear that the US federal government helicopters are largely behind goods prices and therefore inflation numbers domestically, giving these true outlier status, combined with the growing anti-reflation, more deflationary tendencies in US prices outside of goods, then the prices of goods as well as services pretty much everywhere else on the planet, the net takeaway is that the US consumer is undergoing a (painful) temporary price deviation caused by its own government’s “rescue” attempts.

The argument in favor of it takes place on a moral basis rather than small “e” economics; it is neither “stimulus” nor is it inflationary. Deviations and disruptions, sure, but these are temporary.

Once they recede, as they already have begun to, being picked up in these other inflation estimates not directly tied to US goods prices, the overwhelming balance of probabilities suggests the full set of US CPI’s and the like will become more like Europe HICP rather than the other way around. Global factors demand convergence either way; either the world is actually flooded with money and a robust, full-blown fiery recovery, or…it is not.

Anything short of the former will leave the world economy in the same pitiful state as pre-COVID, well short (over time) of central bank inflation targets let alone something like the Great Inflation.

Even after these several continuous months of 70s-style inflation rates in America, the verdict still appears to be, quite conclusively, not full-blown fiery recovery. After all, it took this unhealthy, gargantuan government intervention just to get a few months of not-awful in economic circumstances (while misbalancing then temporarily spiking consumer goods prices in the process).

And that’s even before the full weight of more recent, ongoing anti-reflation/renewed potential deflation – should it continue this way across the whole global system – truly kicks in.

A huge thank you to Europe for sponsoring an inadvertently helpful inflation control group. Take away Uncle Sam, no big “inflation.” True for the Europeans up to now, and increasingly the case for the United States going forward.

Stay In Touch