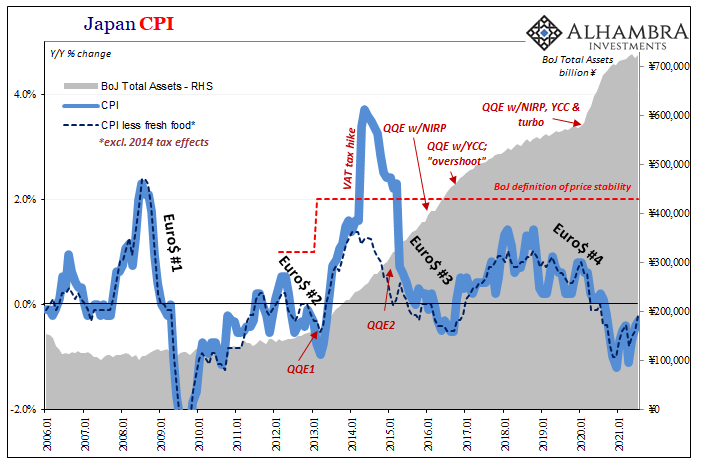

Being able to compare European inflation rates with their American counterparts helps expose what’s driving the latter and it’s not inflationary currency. Comparing both of those inflation regimes with the Japanese simply exposes the Bank of Japan and QE. This was perfectly obvious before the Base 2020 CPI estimates came about.

Central banks, we’re always told, possess the printing press of legend and lore. The stories surrounding this currency-cranking machine are always of the cautionary variety by purpose: be very careful lest any printer let too much paper escape and unleash inflationary totality. Not for nothing, this story is always related in German for equally obvious Weimar reasons.

Not just possess, the 21st century central banker is no longer the one who merely threatens to unleash its power. Confronted by big monetary and economic problems, one after another (this seems to be important), the world’s collective money printers have gone literally insane with electric activity.

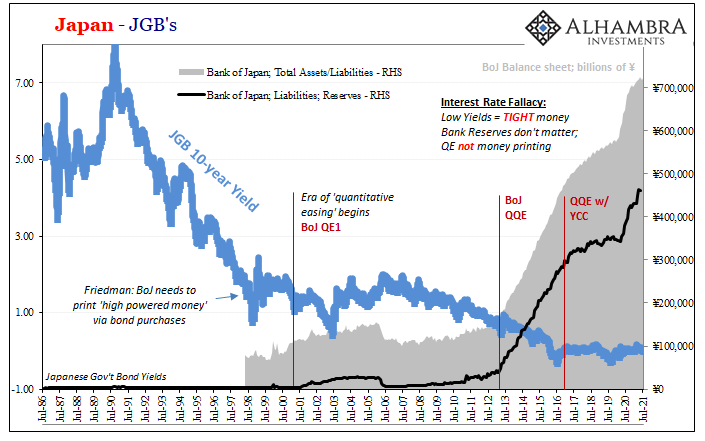

None more so than the Japanese. Already stuffed to the rafters with bank reserves, supposedly the digital “paper” currency product of this era’s technical output, going back to last February (up to May 2021, the latest average figures posted) the Bank of Japan added another ¥116 trillion to so-called base money which had already reached ¥344 trillion before this latest senselessness began.

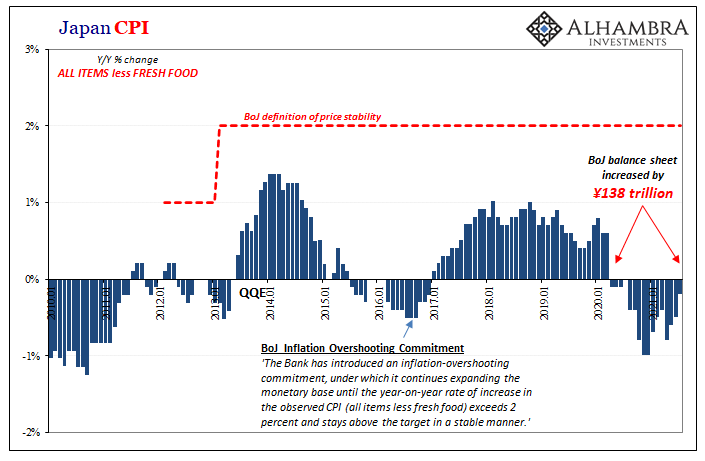

In raw terms of BoJ’s balance sheet, the totality of this latest QE LSAP, the increase from February 2020 to July 2021 was also ridiculous: rising from the prior absurd ¥585 trillion to coming in on three-quarters of a quadrillion (¥723 trillion). The ¥138 trillion increase in total assets purchased simply means that the vast majority of those purchases were let straight through the other side of the BoJ balance sheet into bank reserves (only a few dozen trillion being absorbed by other factors).

That works out to an increase in bank reserves of just over 34% in one year and one quarter. Adding another third to, again, what’s called base money having already achieved overflowing levels of same, this could only result in an equally insane amount of consumer price inflation. And you need not speak a word of German.

If bank reserves are indeed base money.

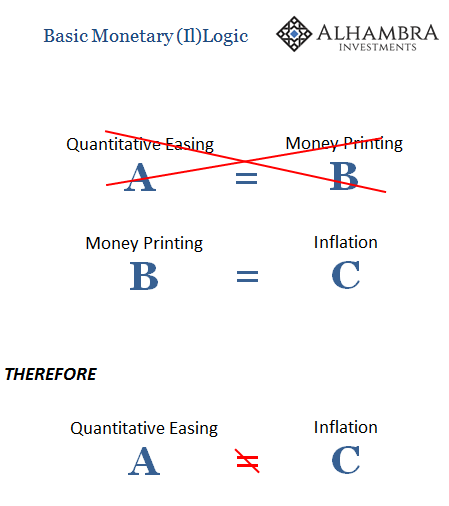

But they absolutely are not:

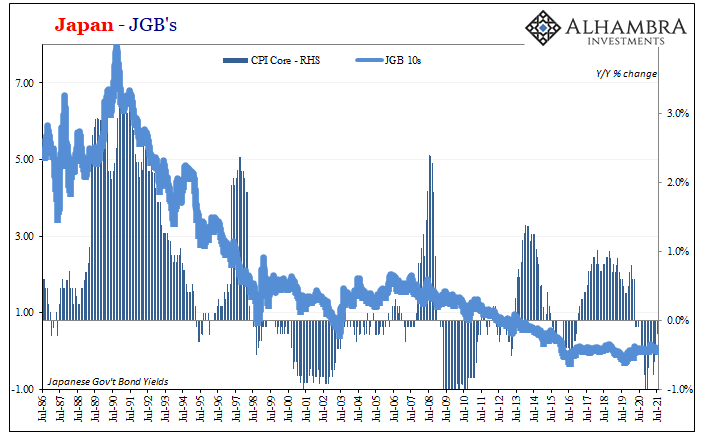

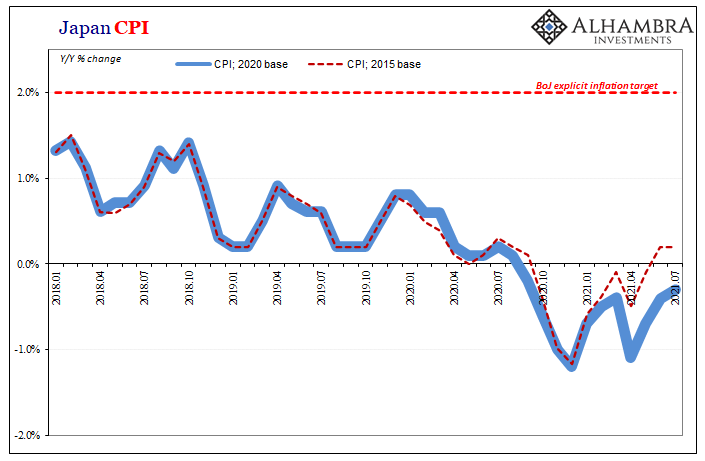

The QQE2020 iteration was already failing by CPI standards from five (now six) years ago. The Base 2015 version of Japan’s average consumer bucket had indicated only the same distinct lack of consumer price inflation despite this overwash of purported currency. According to this now-older set of figures, Japan had gone outright deflation (as it continues to do no matter which numbering or set of letters attached to QE) beginning last October and ending this May.

Statistics Bureau Japan today says, nope, the Japanese economy has yet to escape outright deflation which actually began one month sooner, starting last September. The new benchmark Base 2020 consumer price bucket has substantially revised recent price activity and changes in a way that only further exposes this most central central bank scam:

People are right to suspect these consumer price indices insofar as these are nowhere near as exact or accurate as sometimes made out to be. No one can average out consumer price experience for everyone to four decimal places; what even is an average consumer?

But in Japan’s case, like so many others, including the US CPI, we needn’t obtain unassailable levels of precision. The data is unambiguous despite the fuzziness in methodology and statistic construction.

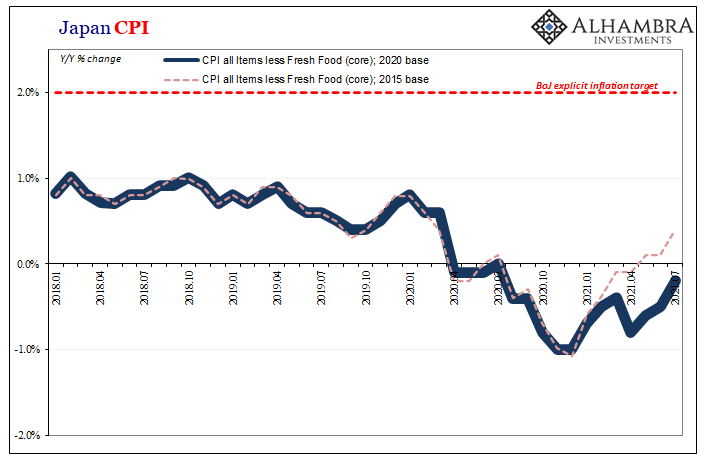

Not just energy or food in each bucket, either, but also core prices recently revised substantially, too; and that matters a bit more because, recall all the way back in September 2016, BoJ said that it was going to leave no monetary stone unturned until this core inflation rate reached, surpassed, and then stayed well above 2% annual rates for a prolonged period of time (overshooting policy).

Are these central bankers even capable of embarrassment, let alone something more scientific like recognizing and acknowledging how thoroughly proven QE has been?

Proven in only the respect that this smoke and mirrors is nothing whatsoever to do with printing presses, currency of any kind, or inflation.

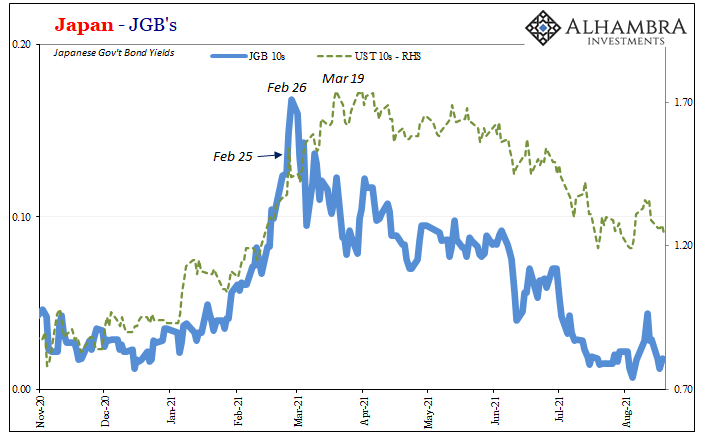

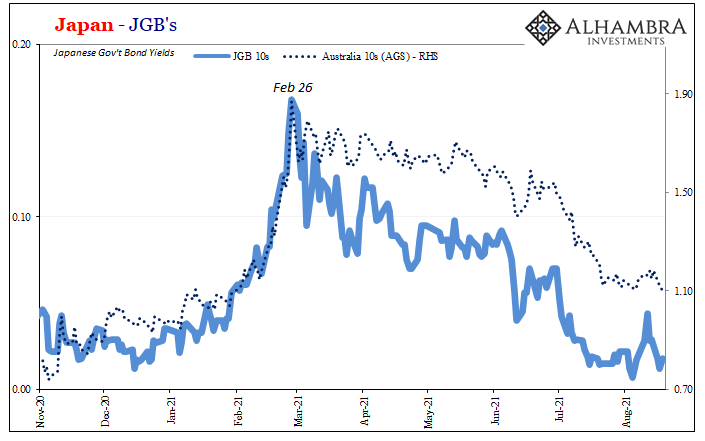

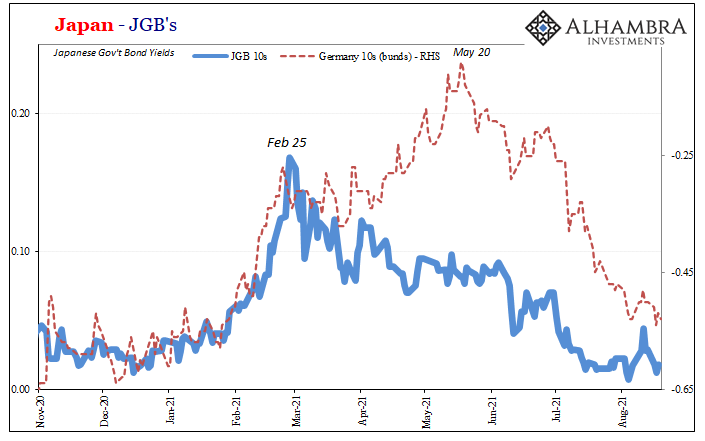

There is a spectrum to global inflation conditions – yes, global inflation. The real money out here is eurodollar translated, and it has little use for bank reserves of any denomination including US$ (sorry, Jay). Banks are what make money, not central banks. Without the former, it doesn’t really matter what the latter does.

US inflation experience over the past few months has been temporarily supported (or dealing pain) from Uncle Sam, while in Europe without helicopters to that degree much less. Far less still in Japan from no support whatsoever, the fruits of both QE and money-financed fiscal expansion having been done the longest.

But the main problem is the public; and by that, I don’t blame the average person at all since every one of us has been outright lied to for more than 20 years. Each and every time one of these methodically disproven QE’s is rolled out – and it doesn’t matter where – the media uncritically writes the same thing as what had been written of the very first QE two decades ago:

“The BOJ’s move injects a large amount of money into the Japanese economy — known as quantitative easing.”

Not a single thing in that sentence is true, right down to the well-established proof this stupid thing is neither quantitative nor easing. Yet, the passage is reprinted in every single mainstream source everywhere as if set into eternal stone by Weimar’s Friedrich Ebert. As I wrote earlier this year “celebrating” its 20th anniversary:

The fact that this “had not been sufficiently discussed”, in the official recollection of Ms. Shinotsuka’s words, is a huge red flag – one implicating obvious desperation. They didn’t know what else to do, so they flung QE against the wall hoping it would stick.

It never once has stuck, but they’re still flinging away anyway a fifth of a century later. Maybe desperately chucking up bank reserves is a German play for: we really don’t know what we are doing.

Fine, but to then believe that something has significantly changed, inflationary changed, in 2021 in any place around the world is belied by every single bit of evidence and outcome, all summed up to the simple sad truth nothing actually has. That’s the problem as well as the answer.

Stay In Touch