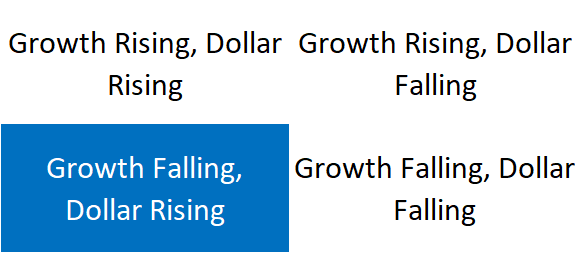

This week marks a change in our economic environment or at least our perception of it. Last year, post-COVID onset, we characterized the environment as one marked by a falling dollar and improving growth. To be exact, that is the environment the markets reflected; interest rates were rising, the yield curve was steepening and the dollar was falling. That changed somewhat at the beginning of the year when the dollar stopped falling and we shifted to a neutral dollar stance. Then, in the spring, interest rates peaked and started to fall and we shifted our view again, to one of falling growth and a neutral dollar. After the action in the dollar last week, I think we have to now shift our view once again. We now characterize the current environment as one of a rising dollar and falling growth. That isn’t a particularly comfortable stance because it is, by far, the most difficult investing environment of the four we identify. I do think this may prove to be a short-term shift but I calls them as I sees them, as the old saying goes.

Falling growth does not mean the economy is contracting. It merely means that the rate of increase is slowing. The economy continues to expand but at a more subdued pace; how much it slows is something we can’t know yet, but it is exactly what we’ve been expecting for months as we watched bond yields drop. Somebody asked me recently why we put so much emphasis on bond yields and all I can say is why wouldn’t we? There is a perception these days that bond yields – specifically Treasury yields – do not mean what they once did because the Fed is distorting the market. The Fed is certainly a big player in the Treasury market and has an impact on yields but I think the impact is less than most believe. Nevertheless, I tend to look more at rates of change than levels and I do think that the change in bond yields provides valuable information. One reason I think the current environment may prove to be short-term is that the rate of decline in the 10-year Treasury yield is slowing. The 3-week and 1-month rates of change have turned positive already. It isn’t enough to say the drop in yields is over but it is certainly on my radar.

A rising dollar changes how we expect various assets to perform. A rising dollar is generally not positive for real assets – gold or other commodities and real estate. We have reduced the allocations to those assets in our portfolios over the last few months due to changes in momentum and now the dollar market confirms that choice. For gold, it has been a very interesting few months as real rates kept falling and gold just couldn’t get off the mat. That is not what we normally expect and it was a major factor in my decision to reduce our exposure. Gold and real rates have been joined at the hip for a long time; real rates fall, gold goes up. Except it didn’t work that way this time. When you have a model of the world – a very simple model in this case – and it doesn’t work, you need to reassess. Models are not reality. They are always less complex, less detailed, and easier to understand than reality. They offer certainty where there is none and make us feel comfortable with our choices. But they aren’t reality and we have to remember not to believe in them too much. They are false gods.

The dollar is in a short-term uptrend and that is neither negative nor positive. The long-term course of the dollar – the really long-term – will be determined by our long-term economic performance, absolute and relative to the rest of the world. Being saddled with a feckless political class would seem to put us at a disadvantage but the rest of the world isn’t exactly knocking the ball out of the park right now either, so that chapter of American history hasn’t been written yet. As a committed optimist, I think the great American wealth creation novel still has quite few chapters left but I may be in the minority on that one. We’ve still got a few things going for us, even if few of them are found in Washington, DC. In any case, the current short-term uptrend is within the context of a multi-year trading range and we are, for now, still in the bottom half of that range. The trend is up but it is not yet anything to be overly concerned with. And that could change very quickly.

The things we watch for clues about future economic performance are not flashing warnings right now. The yield curve is positively sloped, the 10-year Treasury rate is almost double where it was a year ago, credit spreads are well behaved and the CFNAI shows an economy growing slightly above trend (we get an update on that this week so that could change). Credit spreads have widened over the last month but the change, despite a plethora of articles on the subject in the last week, is minor. The HY spread has risen by 40 basis points but is basically the same as it was in January 2020, pre-COVID. Junkier bond spreads have widened more with CCC up about 90 basis points from the low but, again, much the same as they were at the beginning of 2020.

We use a model to help us in our investment process. Our strategy commits us to invest in 5 asset classes: Large and small-cap stocks, real estate, commodities/gold, and bonds. The strategic allocation model we use holds those assets in specific proportions and we deviate from it reluctantly. It has produced consistently good results across multiple economic environments (why would we use it if it hadn’t?). We do make tactical (relatively short-term) changes to the allocation using various known techniques (momentum, etc.) and our own internal research. Jeff Snider’s research is, obviously, very important to that process. But as I said above, models are not reality and in that regard, our version of the world is no different than others’. But we recognize that, which is why what you will never see in our portfolios is what I call “all or nothing” investing. Each of those asset classes in our portfolio have a minimum and maximum weighting; they will never go to 0% or 100%. Our models of the investment universe are not perfect. I can, will, and have been wrong plenty of times. Jeff has too. It comes with the territory and it is why we don’t do “all or nothing” investing. A little humility goes a very long way in this business.

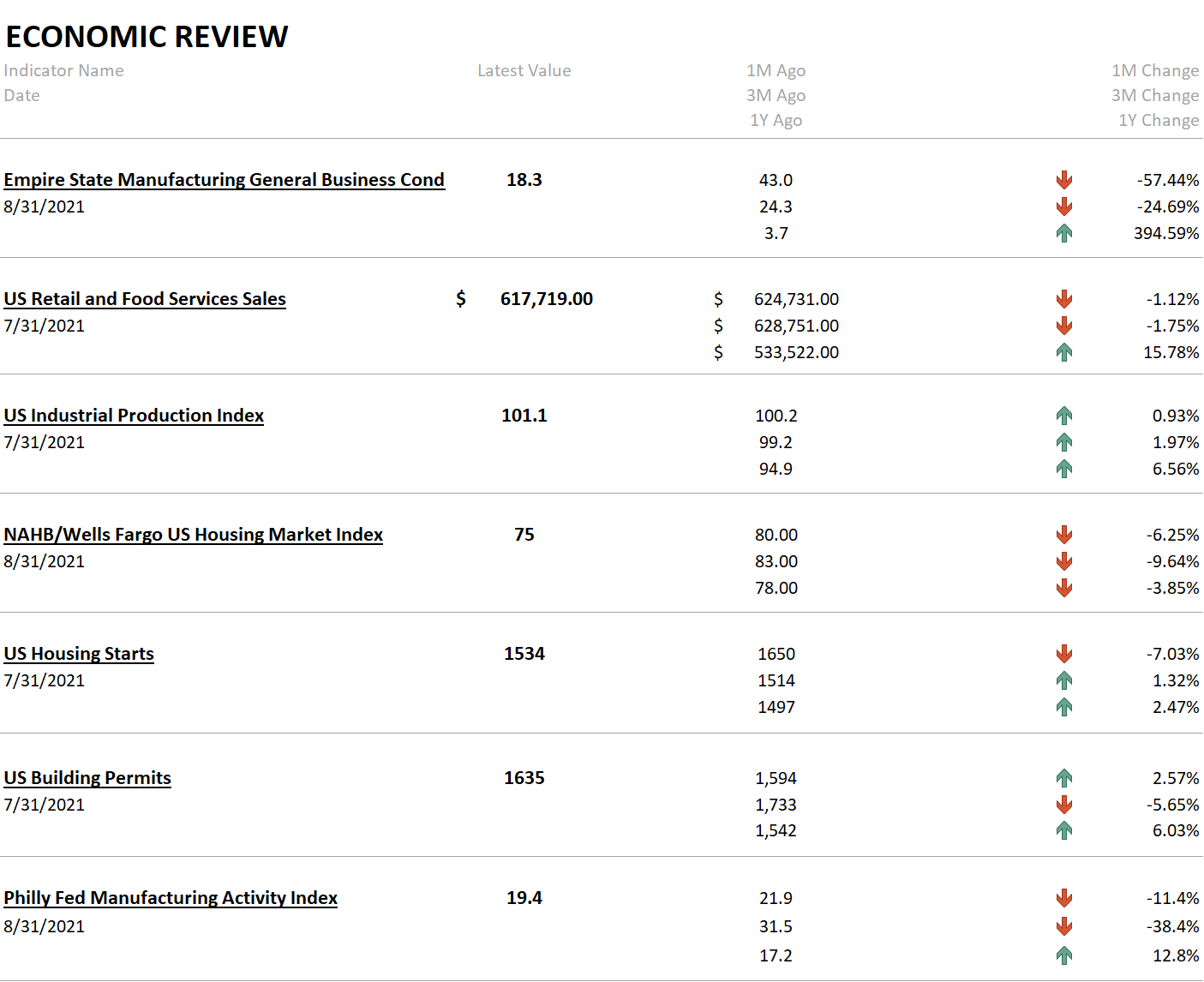

We are positioned for the current environment because we saw the markets changing and reacted to it. Bond yields fell and we believed the Occam’s Razor explanation – growth expectations were falling. Then we saw the economic data fulfill those expectations. Look at the data released last week. The Empire State and Philly Fed indexes are down from a month ago and three months ago. Retail sales, the same. Industrial production is up but it is still less than it was in 2018. The Housing Market Index, housing starts, and permits are all down from recent peaks and residential investment was a negative in last quarter’s GDP report. Notice though that with the exception of the HMI, all the data is up from a year ago. We’re still growing, but slowing. I’m not sure how much more obvious it could be. So, we adjust. No extreme measures, no all or nothing, no crystal ball required.

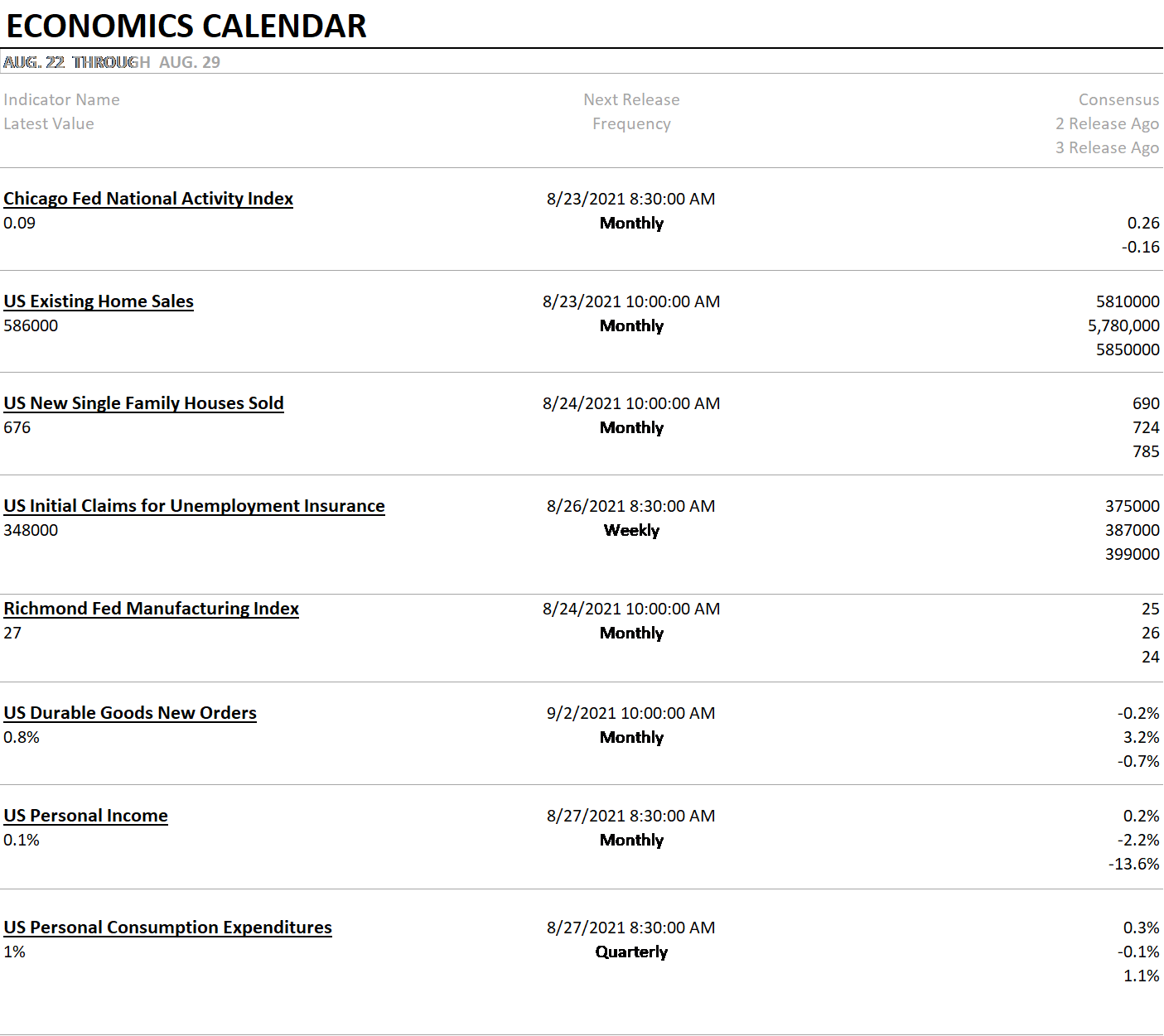

As I said above, we get an update on the CFNAI this week. Based on the recent data releases (remember the CFNAI is a weighted average of 85 economic indicators), I would not be surprised if the monthly number turns negative. And if that goes negative, so likely will the 3-month average which would mean we are growing below trend. That just confirms what we already know from other indicators. For a little more timely release, watch personal income and spending next Friday. Both are expected to be up, spending more than income. Both could give us more information about how people are reacting to the Delta variant. We’ve already seen some anecdotal evidence of slowing services spending – airlines warning about traffic falling off – but we need context, which this report may provide.

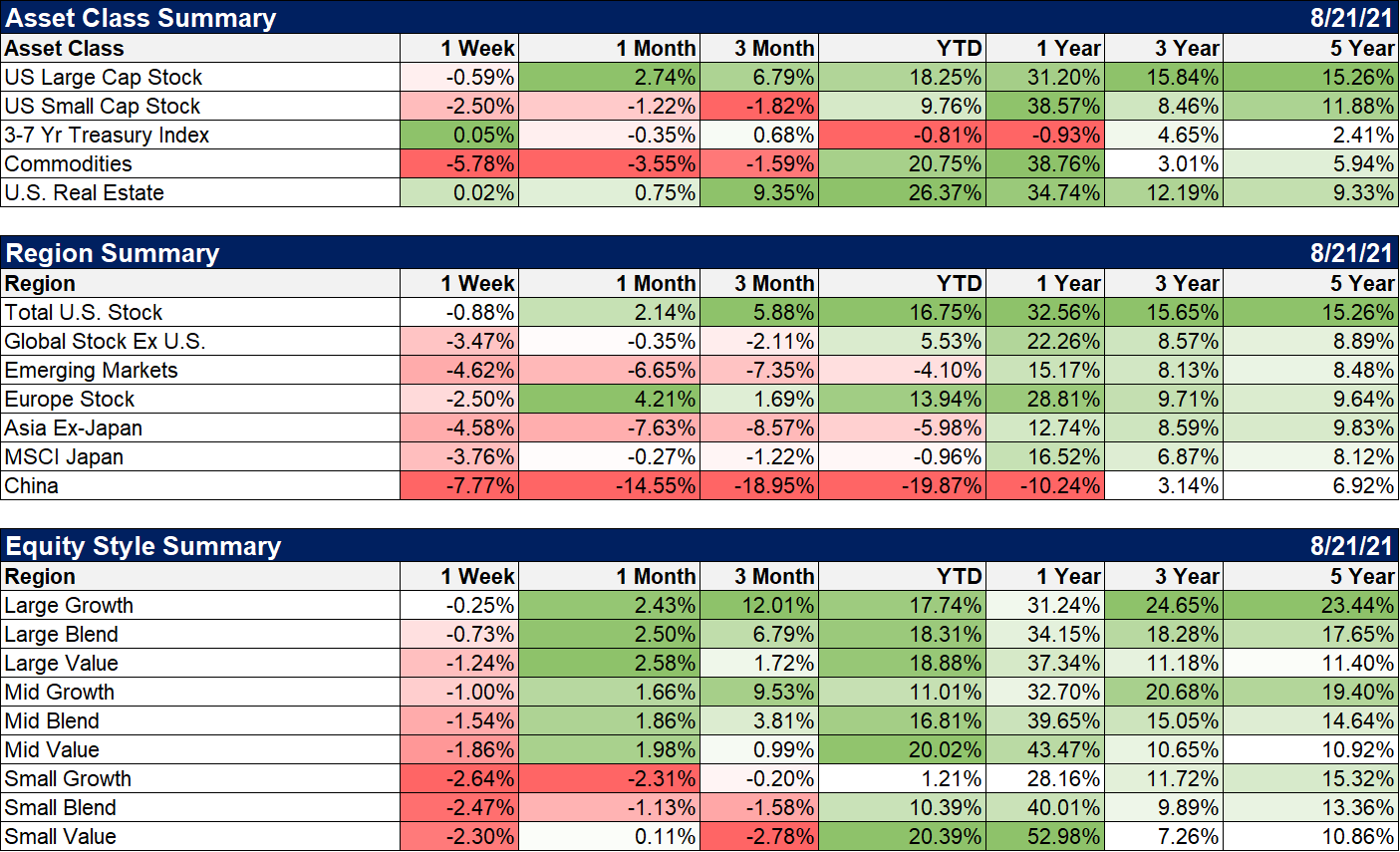

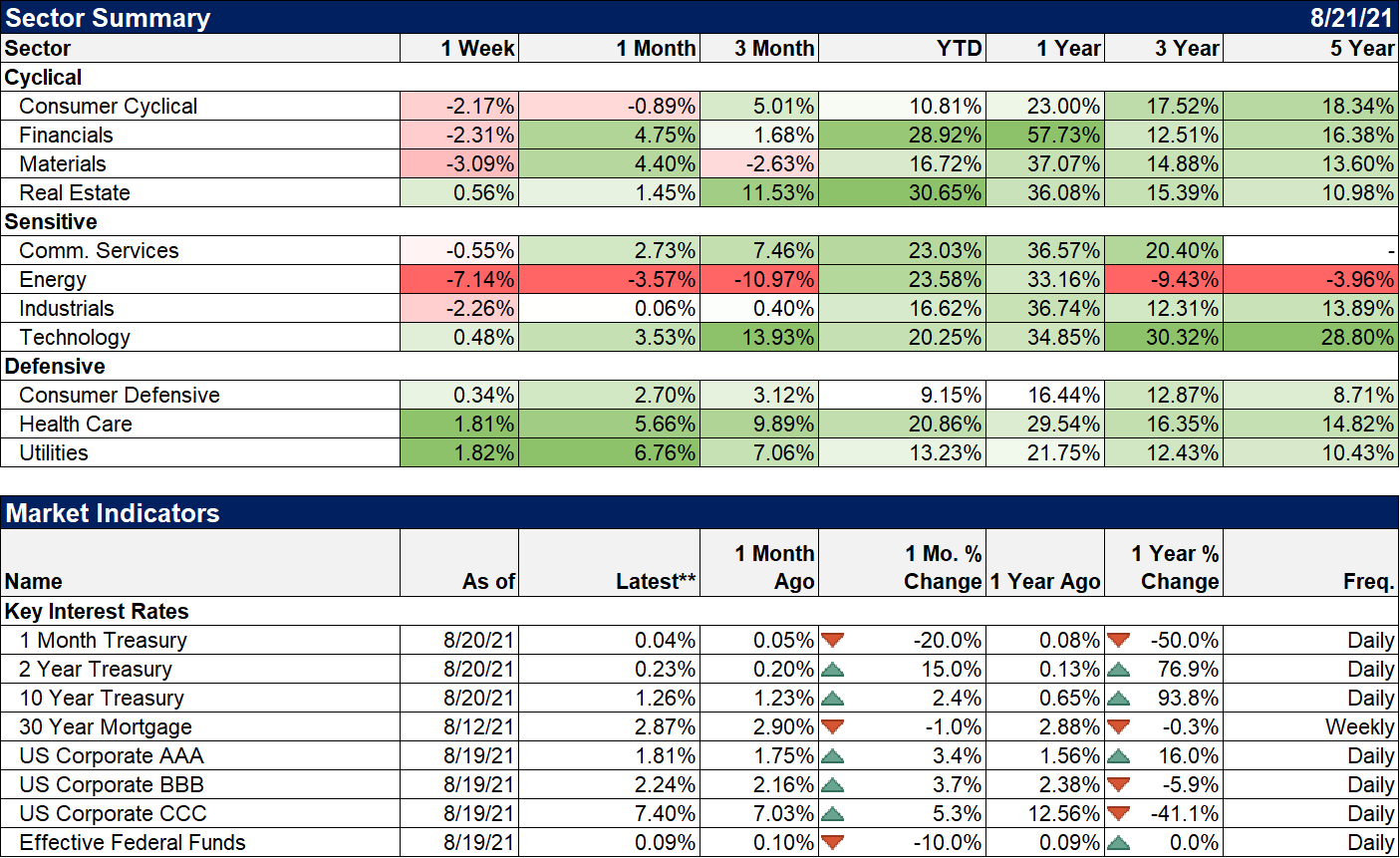

You can see the slowdown across markets. Stocks were down on the week but commodities took a bigger hit. It seemed as if a lot of investors threw in the towel on the reflation trade last week. Mining stocks like BHP and RIO got clobbered. Small caps were also hit hard last week. I wonder if we might be nearer the end of the slowdown fears than the beginning. For small-cap stocks, it should be noted that speculators are very short the Russell 2000 futures right now. Not quite an extreme but getting close. The action in the energy and mining stocks last week looked a bit panicky to me. Short interest in RIO and BHP are at multi-year highs. Foreign markets are down quite a bit more than the US. Unless the dollar trend is about to shift into a higher gear, I’d expect that to even out a bit. Whether that is by the US coming down or international coming up, I don’t know, but based on sentiment I’d say probably the latter.

The slowdown fears show up in sectors too as healthcare and utilities led the way.

I once read a book titled “Golf is Not A Game of Perfect“. The gist of the book is that in golf you are going to make mistakes. It isn’t a matter of if but when. Your score will depend on how you handle those stressful situations, how you recover from your inevitable mistakes. Investing is, like golf, not a game of perfect. It is, per Charley Ellis, a loser’s game, or a game won by making the fewest mistakes. In golf, winning the loser’s game means hitting the ball straight is much more valuable than hitting it far. In tennis, winning the loser’s game means getting the ball back over the net and letting your opponent try – and miss – the hard shots. In investing, winning the loser’s game means adopting a realistic strategy that works (and what that means is different for each investor) and then sticking to it. It means making tactical changes reluctantly and incrementally. It means not attempting the impossible, observing rather than predicting. It means never going all in or all out. Selling all your stocks in October of 2008 looked like a very good move until August of 2009, less than a year later. If you waited until the end of the year you were feeling quite good in March when the S&P dropped to 666, but you were underwater on the trade by May. If you waited a year to get back in you were behind by over 20%. That’s how you lose the loser’s game.

Joe Calhoun

Stay In Touch