The incidences of what’s downright bizarre have curiously become more frequent. Sign of the times. Pick your realm or timetable, there’s so much going wrong while completely disconnected from the “official” description of, or explanation for, whatever. Along these lines, did the US VP just warn America’s children from Singapore that Santa Claus’ legendary trade will be delayed, perhaps canceled?

Summer bummer from Ms. Harris:

The stories we’re hearing now about the warning that if you want to get Christmas toys for your kids, now may be the time to start buying them, because the delay could be several months.

While first blaming Climate Change for a piece of the puzzle (she’d fit right in at this week’s Jackson Hole gathering where central bankers who consistently screw up their mandate by having nothing whatsoever to do with money seek some other way to relate themselves back to that same economic mandate), the Vice President was really talking about the seriousness of supply chain matters.

Things are, we’re constantly told, not just good but inflationary good. After all, Jay Powell just might mention “taper” once on Friday!

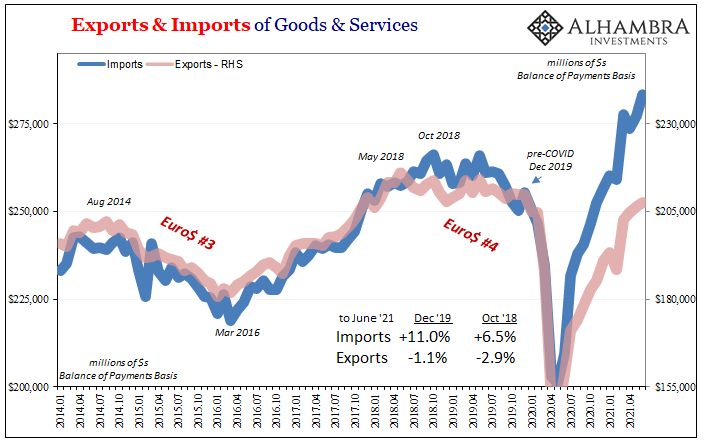

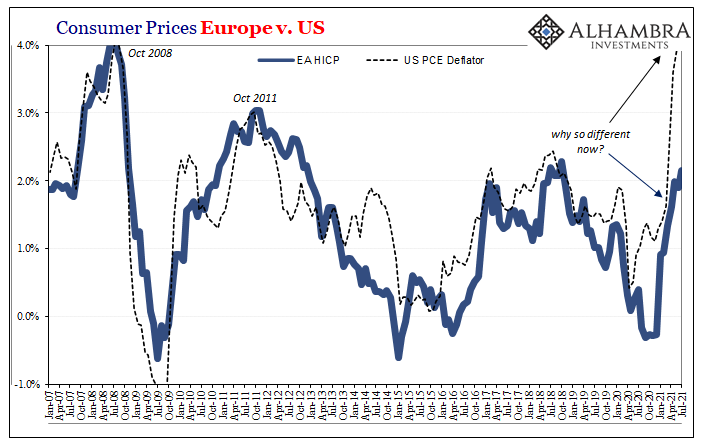

Yet, outside of the US goods trade there is nothing at all in any way associated with good let alone inflationary. On the contrary, any broad survey of conditions from around the rest of the world apart from American retail sales (starting with American services) plainly indicates the very opposite of the stock market’s prices.

If you start with the premise the economy is booming, which is right where every single VP who ever served always does, then there must be something to explain why the economy is great or awesome but isn’t acting as such. On this current occasion, there’s the twofer: supply chain issues could explain both “inflation” as well as account for at least some part of ongoing macro digression.

But those are, in a very real way, also contradictory. Bottlenecks cause all manner of price adjustments – which we’ve seen in CPI’s if only in those of the US – but also huge opportunity. Any sustained, sizable gap between supply and demand unmet by existing supply will very quickly (on intermediate timescales) get filled by something else.

Outside of the world’s automobile sector, this is already happening as we noted not very long ago; from Walmart to Costco, the big retailers have already stocked up ahead of the year-end celebratory seasonality (which is probably right where VP Harris “heard” about the blaming).

So why isn’t the world on fire with enormous industrial recovery given purported fires of demand?

If demand is there, then so is opportunity. Nobody seems to be taking advantage, perhaps there isn’t the opportunity in the first place because demand isn’t what everyone says. Or if it really is, then maybe not likely to stay that way for long enough.

Out of the many major trade partners with the United States, you’d think that our Southern neighbors in Mexico would be lapping up the overflowing economic rebound ostensibly going on just on the other side of their border. No sir.

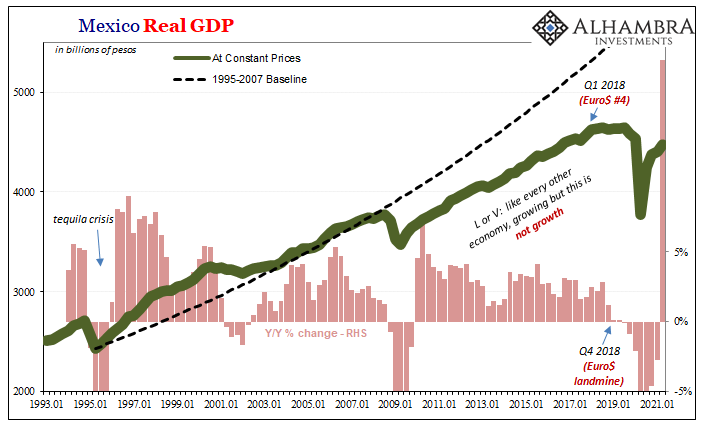

As usual, however, the statistics at first do make it seem as if Mexico has finally caught the inflationary virus we’re told rages here. According to that country’s Instituto Nacional de Estadística y Geografía (INEGI) earlier today, real GDP increased by 19.6% year-over-year in the second quarter of 2021, Mexican GDP’s first plus sign in nearly two years.

Not just the first positive comparison in a long while, also the highest on record.

Having been through this same statistical trick with China, you know what’s coming and therefore what’s really going on here. While GDP may have been almost 20% better than 2020’s second quarter, the COVID quarter, it was also 3.5% less than 2019’s Q2.

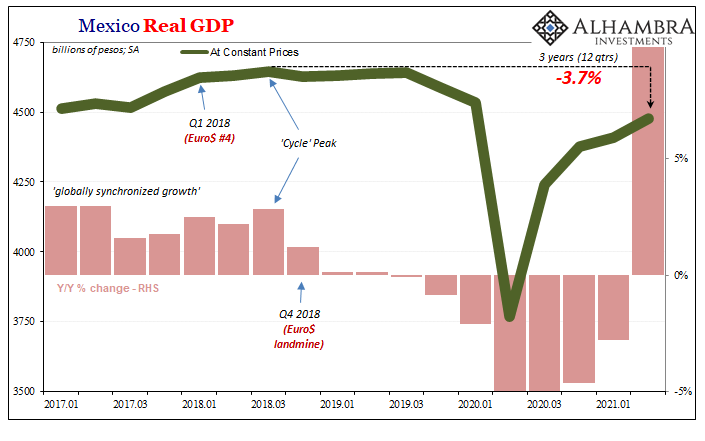

In fact, total estimated inflation-adjusted output in Mexico was still 3.7% below the prior “cycle” peak set way, way back in Q3 2018.

If someone were ever to tell you about an economy whose real GDP was nearly 4% less after three years, the last thing you’d associate it with is inflation, recovery, or any qualifier remotely approaching decent.

And that’s because it’s the time value, and time is indescribably valuable, more than the -3.7%.

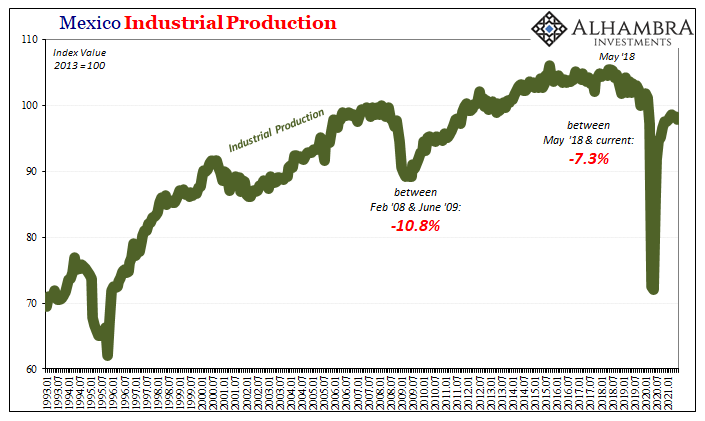

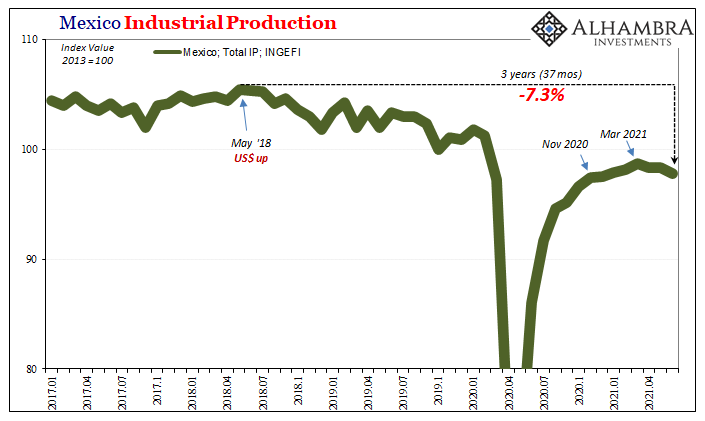

To our current debate, the key reason why Mexico keeps lagging in this way is its industrial sector output has traced the very same pattern, if to an even greater deflationary degree:

Estimates provided by Mexico’s same government agency show that Industrial Production there is an enormous, Great “Recession”-sized funk of 7.3% behind its prior peak also set three years back from here. Twenty-twenty’s COVID was an unwelcome and serious addition to a recession already quite extensive and prolonged.

Mexico – and this goes for far too many places around the world – has yet to pull out from the one let alone both. Supply issues hardly explain much weakness in 2021, and Mexico, like those other places around the world, has been enduring contraction and decline for years on end.

Of that more recent trouble, here’s where Mexican data gets more interesting in its most serious way. IP, especially, seems to have taken that economy’s rebound a step down beginning last November. There has been a more recent outright decline since March (again with March and April), but this industrial slump dates back to around the end of last year.

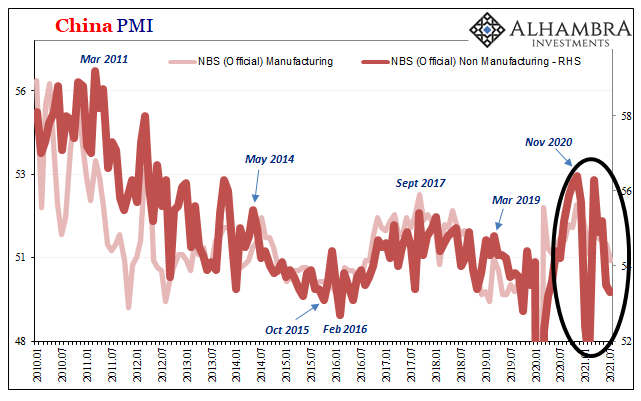

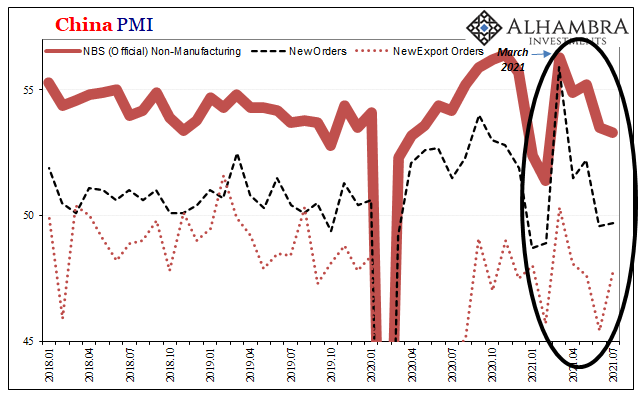

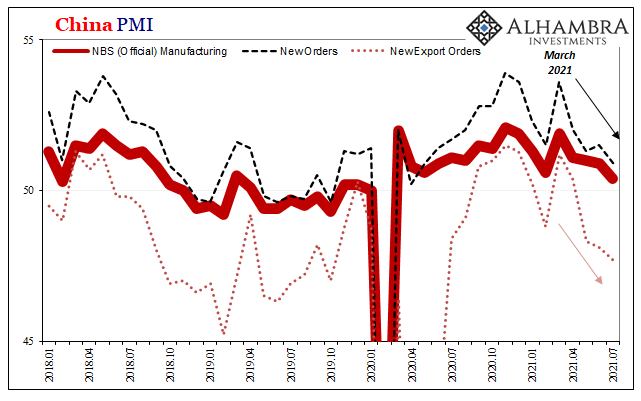

Where else have we observed this same thing, these very same months?

Those particular two months are all over Chinese data – and not just the PMI sentiment figures shown above. November 2020 then March 2021. China’s rebound seems to have peaked way back when, and then mired in a steady slowdown from a zenith way too low.

During those same months, the massive opportunity in American demand came up. Prices never more favorable (or rarely this good, especially for the last more than decade), Uncle Sam’s checks deposited in private consumer accounts as well as businesses, and the goods orders flowing to someone somewhere.

Which accounts for Mexico and thus all the others around the world looking almost exactly like this economy? Is it delta corona combined with supply chains stretched beyond limits by all these coronas? Yes, that’s a problem, several problems.

Those are, however, not the only problems nor are they Mexico’s biggest. On the contrary, insofar as macro is concerned – meaning this concerns everything and everyone – the issue remains a shortage of global economy and not just temporary shortages of certain supplies. The US goods sector may be booming, for now, but hardly anything else is.

Like the “unexpected” bad sales during the American Christmas of 2018, landmine and all, if there are real issues with the rest of this calendar year and beyond they have as much to do with that long ago time period as they would this year’s several versions of “trade wars.”

Mexico’s obvious and obviously protracted struggles aren’t really about Mexico. While Jay looks toward taper, global factors again.

Stay In Touch