Though I’d like to say it was because of some inside connection, or even clairvoyance, it was just random coincidence. I wrote on Monday of the updated sordid details behind SOFR’s unsuitability and largely the rejection of it in favor of keeping LIBOR (or maybe adopting something else). It’s not that the government’s handpicked replacement won’t work, it can’t work.

On that very same day, the usual suspects of empty government heads wrote a formal letter – and not an ironic letter – to the heads of important trade groups (like the Chamber of Commerce) addressing the curious lack of follow through on this topic. It basically acknowledges how despite almost ten years of public scolding and making serious threats, banks don’t seem to be doing much replacing of LIBOR even as its mandated “end” draws nigh.

Time is short, but it really doesn’t seem like it’s being taken very seriously at all.

With signatories including Jay Powell and Janet Yellen, along with FRBNY’s guy John Williams, I especially love this particular passage eulogizing their joint disgust and dismay:

The transition is at a critical juncture, and we were thus concerned to hear your members report that nonfinancial corporations are, in most cases, not yet being offered such alternatives despite the short amount of time left in the transition.

Why is that, exactly, Janet and Jay?

When you have no idea how things really work:

— Jeffrey P. Snider (@JeffSnider_AIP) August 25, 2021

Govt: no more LIBOR and *we mean* it.

Govt: Why is everyone still using LIBOR?https://t.co/q7CbAIg6PQ pic.twitter.com/EOJQUB1xrK

As I wrote, I spelled that much out on the same day the letter was officially dated and sent. I wonder how many staff members the figureheads had to involve just to bang out barely more than a single page to this joint agency effort, and whether it might have been a more efficient use of resources to have them working out what’s actually wrong with this whole picture.

Then again, with the central bank’s key players allocating themselves to another virtual Jackson Hole this week, a conference which will be dedicated to “inequality”, it’s not as if there’s much demand inside the Fed to understand what the Fed is supposed to be doing as if a central bank.

That should’ve been reflexively rejecting SOFR as an incredibly dumb idea, a truly stunning unforced error, realizing that by imposing it anyway this has only exposed systemic, institutional incompetence. Their only saving grace is that the public doesn’t know this issue, or that it is an issue of what it is.

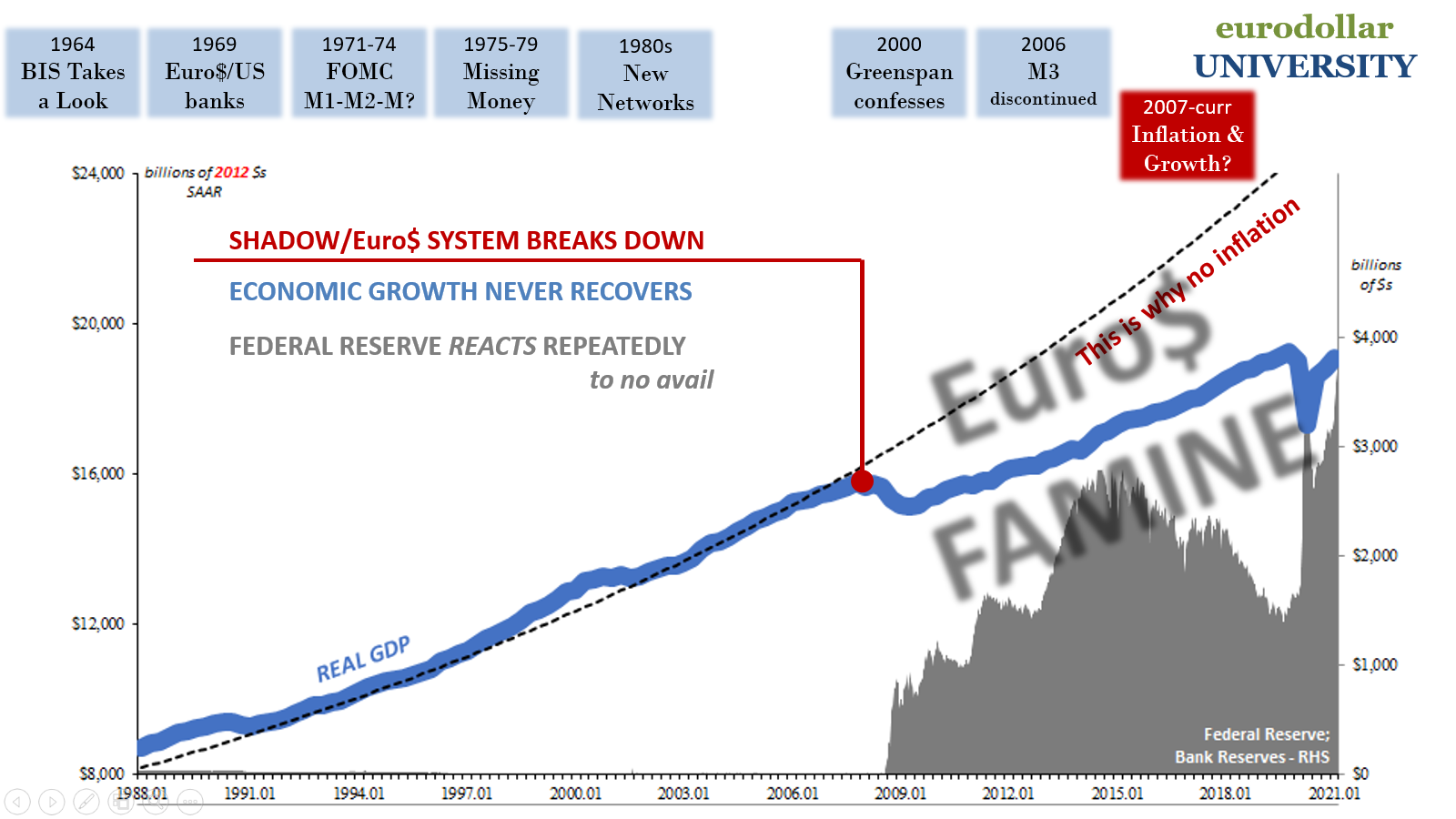

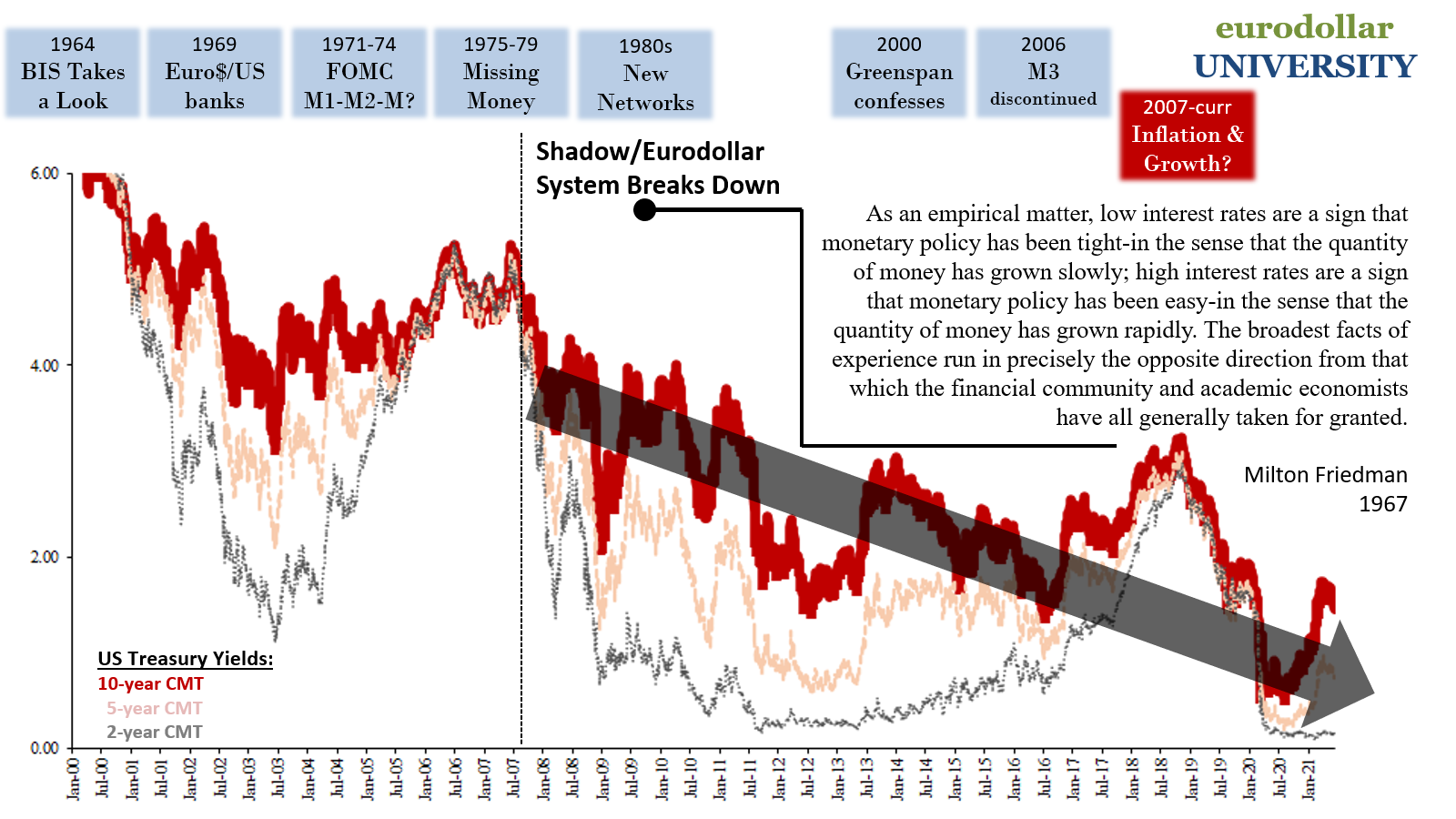

Why is the economy (globally) so much more “uneven” in the first place? SOFR and LIBOR may not immediately spring to mind but they are a substantial part of the answer.

Better to keep LIBOR and be thought a fool, than to continue trying SOFR and remove all doubt.

Stay In Touch