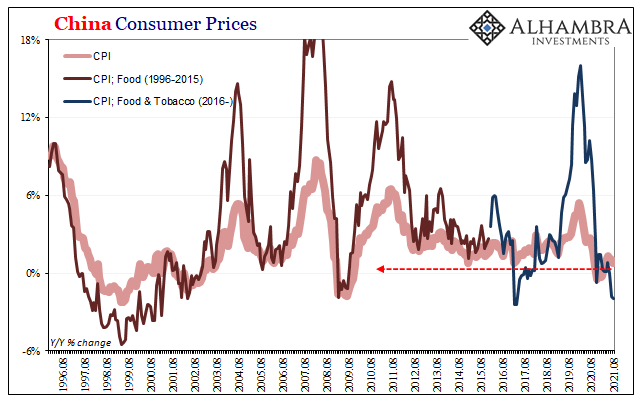

The inflation hysteria striking the US just hasn’t caught on elsewhere. China is a perfect example of resisting the strain. According to new figures from the Chinese government, consumer price inflation had retreated again during August 2021. The year-over-year change for their CPI was just 0.8%. This was the lowest since March, the fourth straight month of decelerating price changes.

China’s consumer price top was reached, like a whole bunch of other data, back in May. At 0.8%, it was once more among the lowest inflation rates in modern China history.

A part of this disinflation is due to base effects, though in the opposite way of those adding to consumer indices around the rest of the world. Chinese consumers had suffered rampant disease wrecking pig livestock herds through 2019 before COVID, therefore serious food inflation particularly via the price of pork.

Last month, food prices were on average 2% lower than they had been last August.

Even without the drag of pig pricing, ex-food China’s CPI gained only 1.2% year-over-year with, again, the peak rate months ago.

While easy to blame delta corona, the truth is that last year’s second (and third) wave of the original COVID flavor wasn’t able to put a dent in prices. Beginning last November, even the CPI began to accelerate once freed from the much larger big base effects in food.

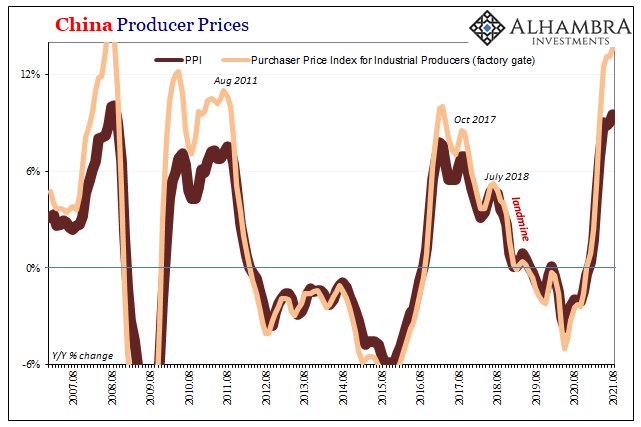

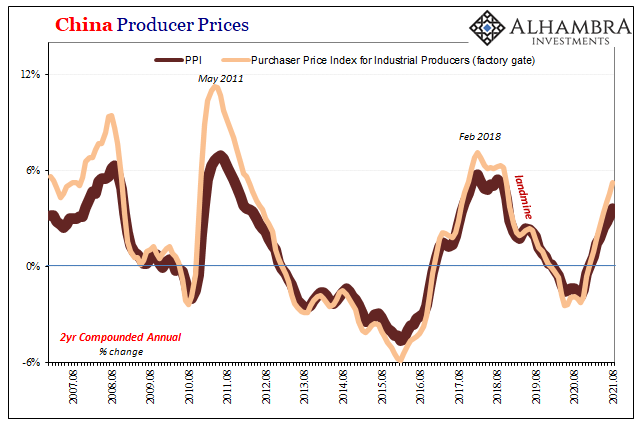

It has been the same in other forms of pricing data, too. The Chinese PPI, for example, it had steadily accelerated all throughout 2020 despite renewed diseasing fears right up to the same month of May.

Before then, back in January, it had been reported:

China is battling the worst outbreak of COVID-19 since March 2020, with one province posting a record daily rise in cases, as an independent panel reviewing the global pandemic said China could have done more to curb the initial outbreak.

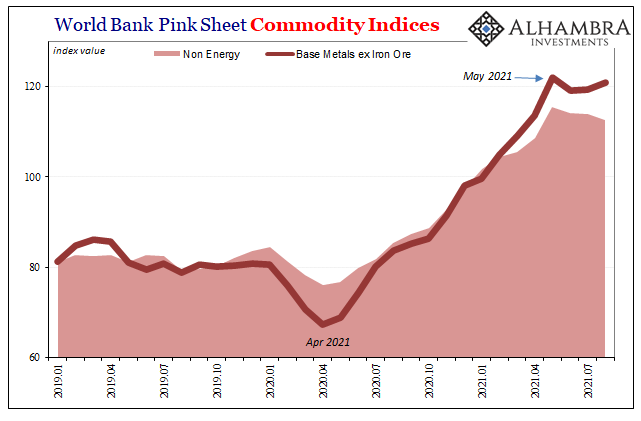

While producer prices have quickened a little bit more since May, rising 9.5% year-over-year in August, 13.5% at the factory gate, the second derivative obviously changed in that same timeframe as the CPI, imports, etc. The acceleration has declined noticeably, and given what’s happening in the commodity world this likely will continue leading to outright deceleration within a few more months.

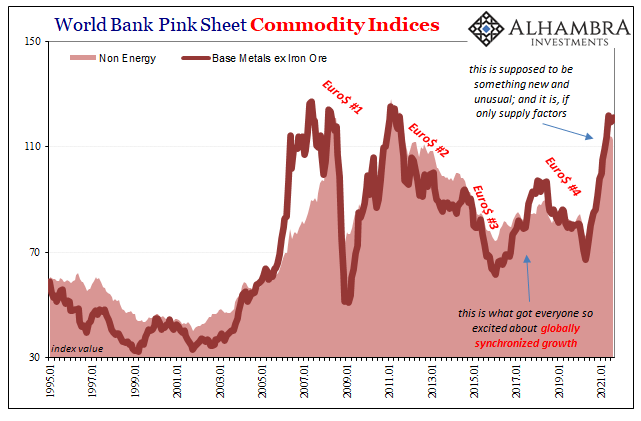

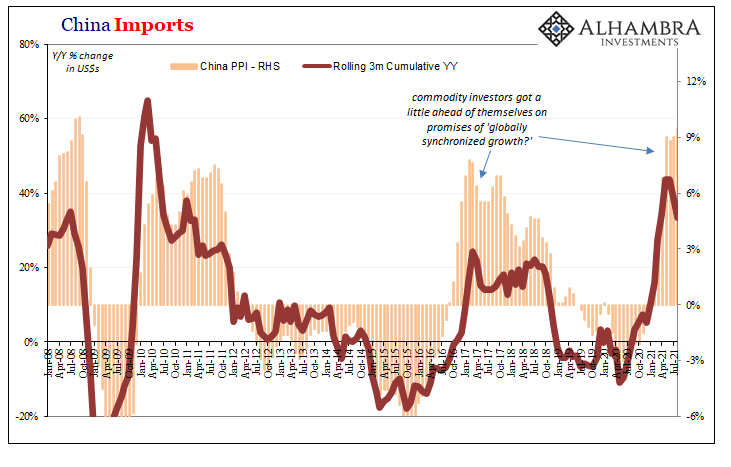

Impervious and oblivious to corona factors if only until the middle of this year. Prices went straight upward regardless of the disease and whichever government’s response to it. It had been the same way in commodity prices as well as, noted earlier in the week, inbound Chinese trade (internal demand, in other words).

To put it quite simply, something absolutely changed around April and May.

Is the delta variant that much worse for China and the global economy? Or has the entire global economy begun to more unambiguously reveal its true state?

That’s ultimately the contribution of Chinese pricing, consumer and producer, along with their correlation to commodities. Both the CPI and PPI (the latter particularly when you strip base effects and look at the 2-year changes) show that China’s economy didn’t really get going all that much to begin with, and like elsewhere around the world – near everywhere around the world – April/May is proving to be an inflection only now beginning to more completely reflect these economic pricing structures.

If you think it was delta the whole time, then the wave of infections receding would indicate not just good news in terms of human health but likewise economic potential, too. But why so much different late 2020 compared to mid-2021?

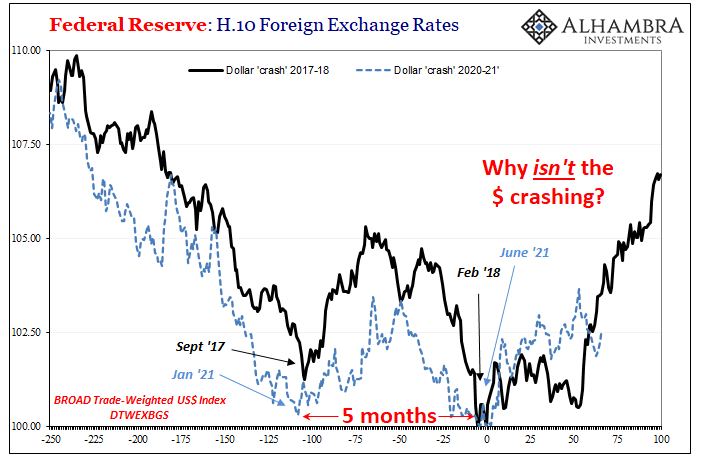

If instead something other than COVID, something like Uncle Sam “stimulus” not having had too much global impact despite all the inflation hysteria, and what impact it did have was only ever going to be temporary, then the world’s economy is left to deal with actual fundamentals left more than a little uglier than many have been expecting (inflation).

These Chinese figures don’t settle the matter, but more importantly they are hardly alone in leaning in the latter’s direction. Perhaps most important of all, it’s the same direction which bond yields had predicted months beforehand. Going all the way back to Fedwire February; maybe even further back still to the US$ bottoming out at the start of this year when all was supposedly going perfectly.

Stay In Touch