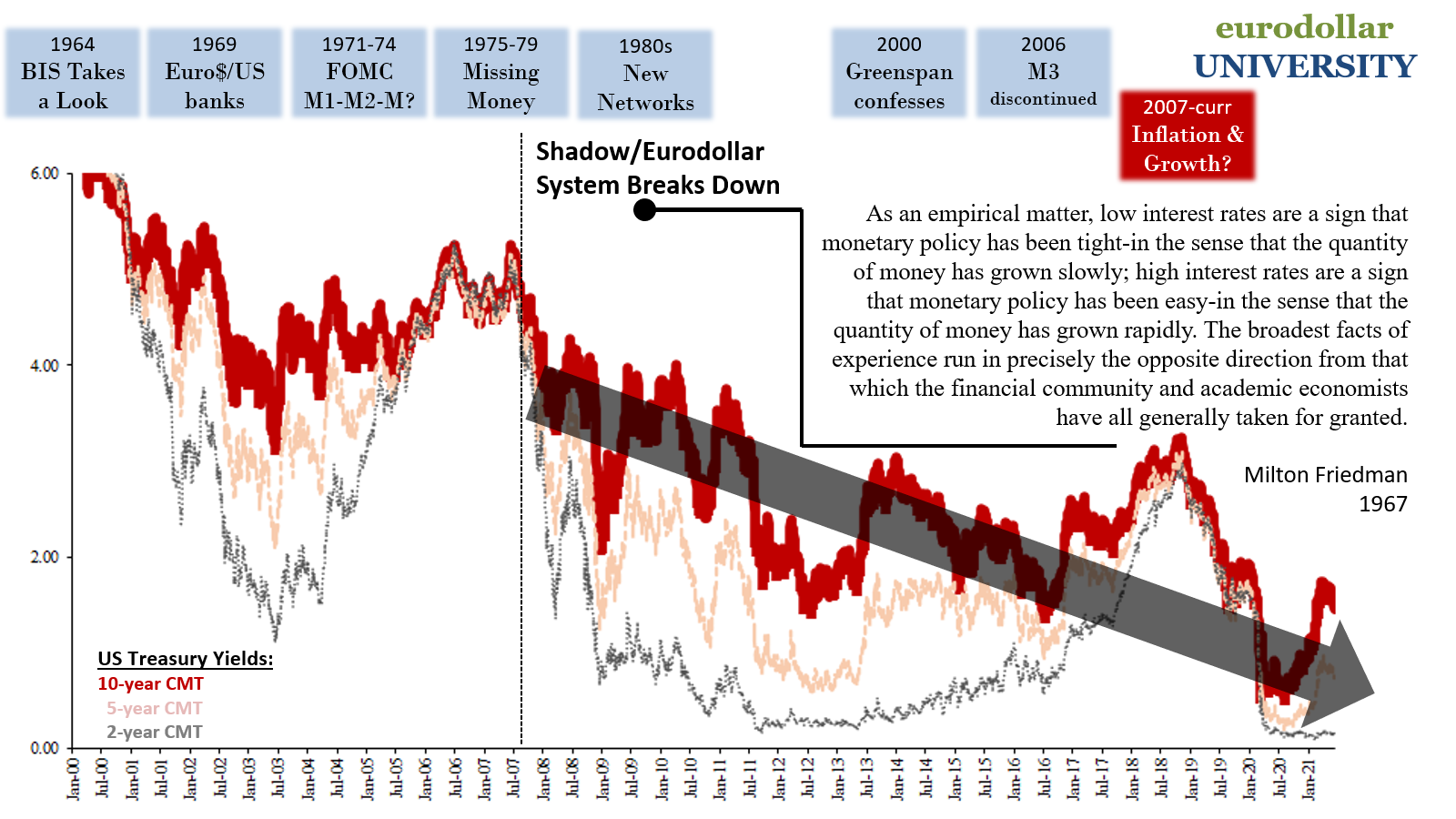

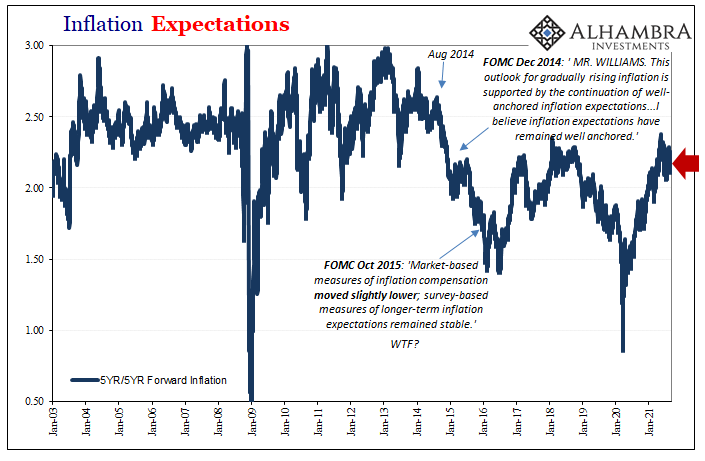

Almost universally, the comeback is always QE. Whenever trying to discuss the bond market’s unmovable pessimism in 2021, especially now about six months after reflation ended, people just don’t want to hear about such low (and lower) growth and inflation expectations in nominal yields. No, that’s not deflationary potential, they’d say, it was and is the Fed buying bonds which has kept a lid on rates.

If not for Jay Powell and his penchant for “monetizing” his buddy Yellen’s offerings, then, you know what with CPI’s and all, that’s when rates really, really skyrocket to where they “should” be.

This unmovable deflation and low rate business brings out emotions at the expense of rational analysis; people want inflation and a broken down Treasury market if only to get the rest of the world to take note of this utter insanity (or to bludgeon whichever occupies Congress and the White House). Maybe because that might be the only way to stop it before it’s too late.

And it is insanity; no question about it. Arguing against inflation and interest-rates-have-nowhere-to-but-up does not mean you must sympathize with and support Team Reckless. Far from it. You can, in fact, remain firmly in the vigilante camp while at the same time acknowledging other factors.

Not just other factors, these are what actually set the whole stage. The US federal government absolutely is the brokest, most unwise spendthrift organization the darker side of human civilization has ever been able to conjure. But as bad as that is, it is still, even now, a tomorrow problem which takes a backseat to the more immediate and detrimental today shortcomings which will always come first so long as they remain.

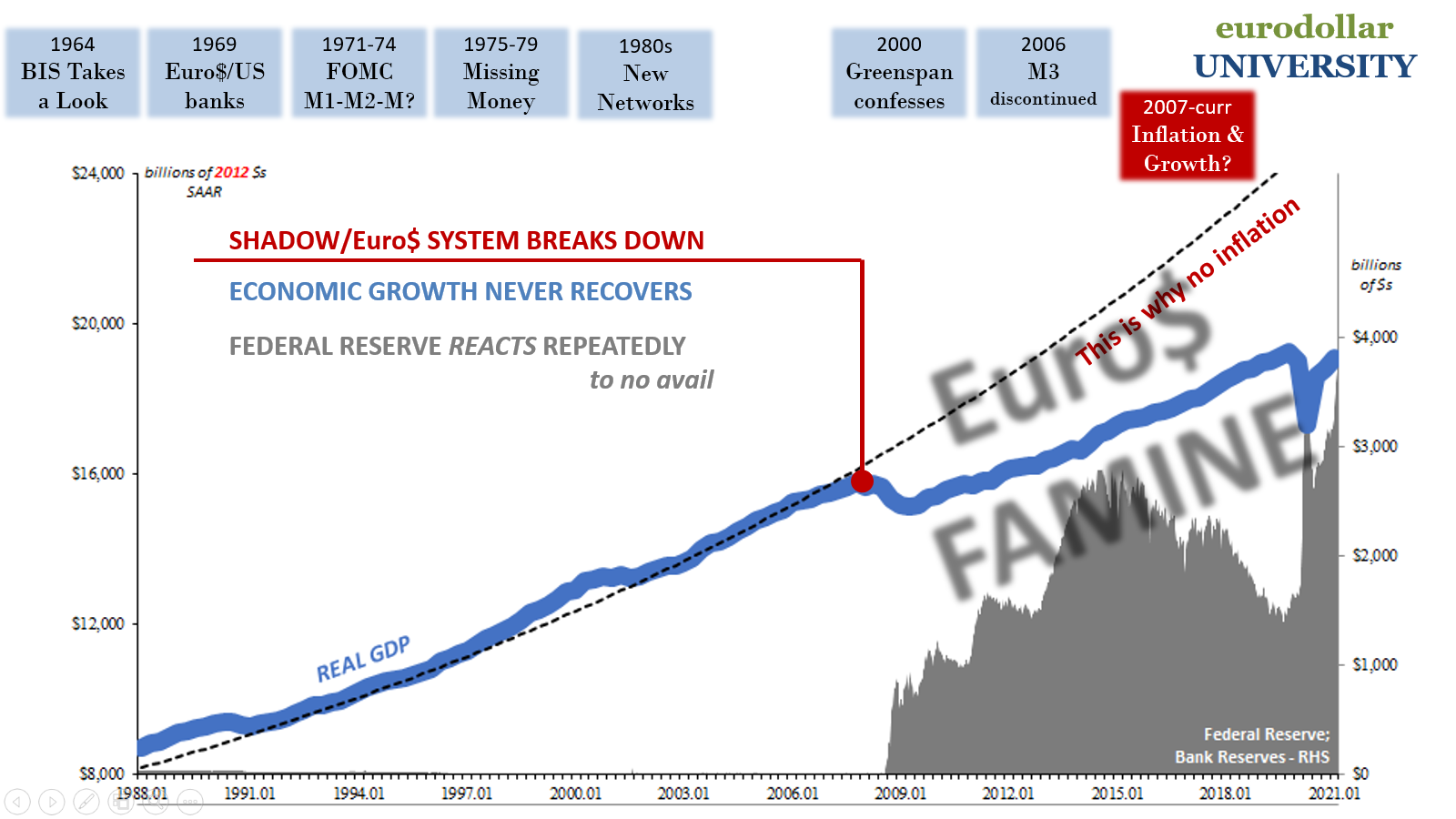

Treasuries aren’t really investments. Sure, they are to you and me, the small-time investor. In truth, on the contrary, they really are balance sheet tools, a currency-like system all its own which manifests in the shadow world behind all the world’s post-August 2007 troubles. You need to keep that in mind each and every time you correctly, wisely, and emotionally curse how fiscal sanity is so incredibly absent from both partisan “sides.”

Uncle Sam, and his political minions, get away with it because they’ve piggy-backed on this special monetary situation – without knowing it. I don’t believe they are shooting for this, there’s no conspiracy just ignorance, but so long as we are stuck with a generally deflationary real money background the government has – obviously – no reservations whatsoever about taking advantage of it so long as it possibly can.

How very Japanese of everyone at the federal level.

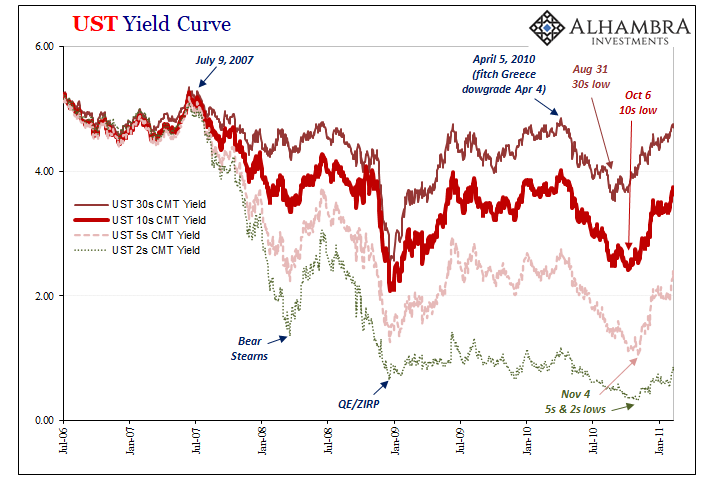

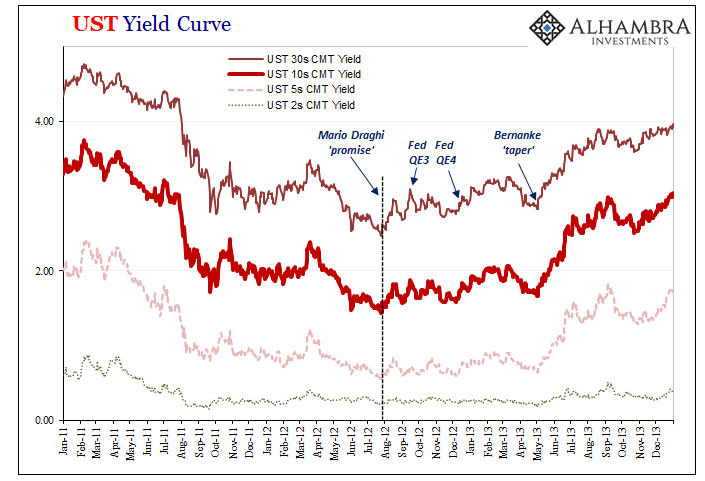

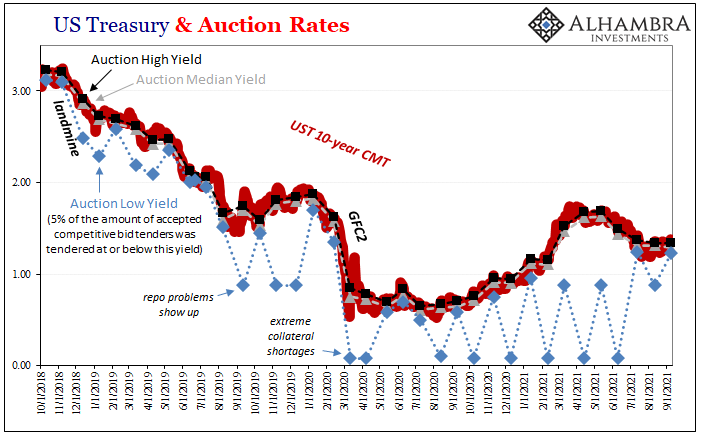

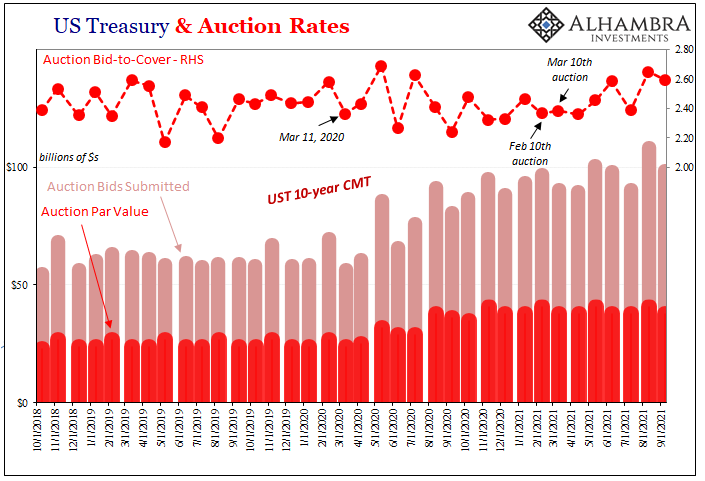

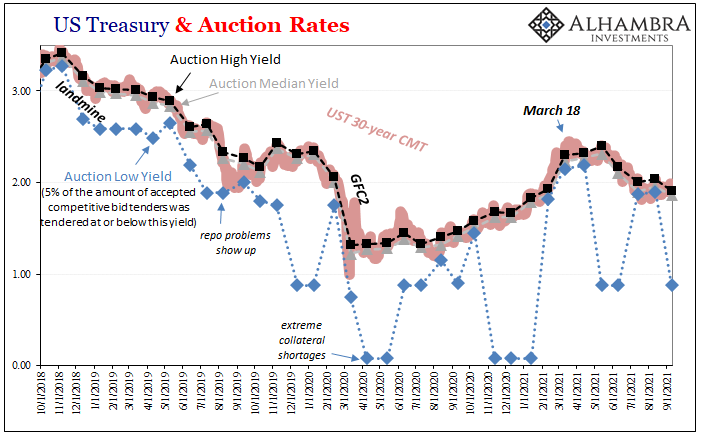

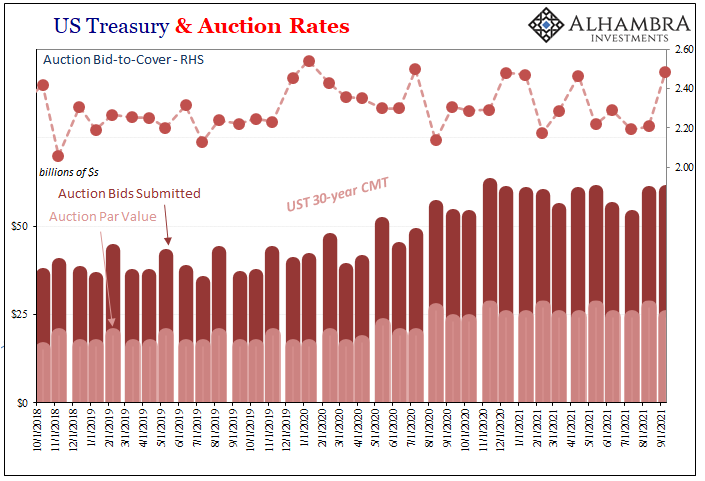

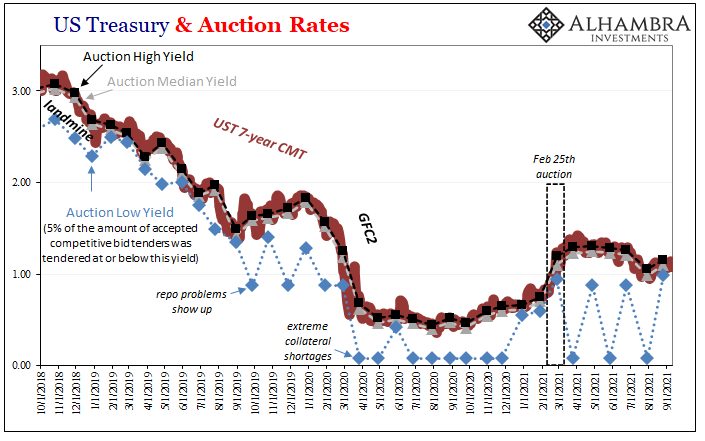

Thinking the Federal Reserve, like the Bank of Japan, has anything to do with this is a big mistake. One only needs to pull up a chart of bond yields to see how more often than not those yields behave in direct opposition to central bank bond buying – therefore, comprehensively independent of what the Fed-centered theories propose.

Those theories, as noted above, have led to repeated and increasingly shrill claims the Treasury market cannot withstand Treasury bond, note, and bill supply without QE. As I started, people have been conditioned to believe central banks control so much more than they ever realistically could.

It has been a few weeks, thereabouts, since Jay Powell said it. The Fed is absolutely going to end up buying fewer Treasuries going forward, on course to end its sixth QE entirely by mid-year or so next year. Officials have looked into the unemployment rate and it tells them to move toward such “hawkishness” and maybe more quickly.

So, without as much QE bond buying ahead of us, just who will be left to buy all these bonds?

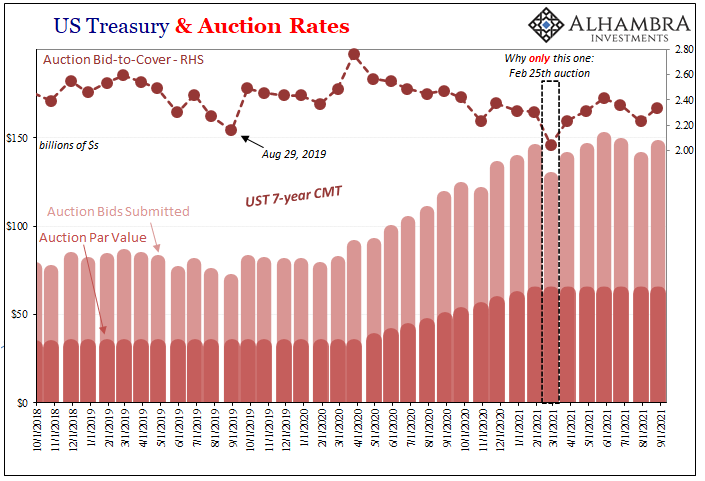

The answer is pretty self-evident, as it has been over the past more than three years (actually five; one particular Hungarian first and ridiculously raised the cry of “too many Treasuries” all the way back in 2016!) Supply. Supply. Supply. No Fed.

In the first set of auctions since Powell said “taper”, unsurprisingly these have been overflowing with bidders and buyers like always. Even more in these first few than usual. Again, I personally wish they’d boycott the madness but I absolutely understand the survival issues why they don’t and won’t no matter what “monetary” policy comes out with.

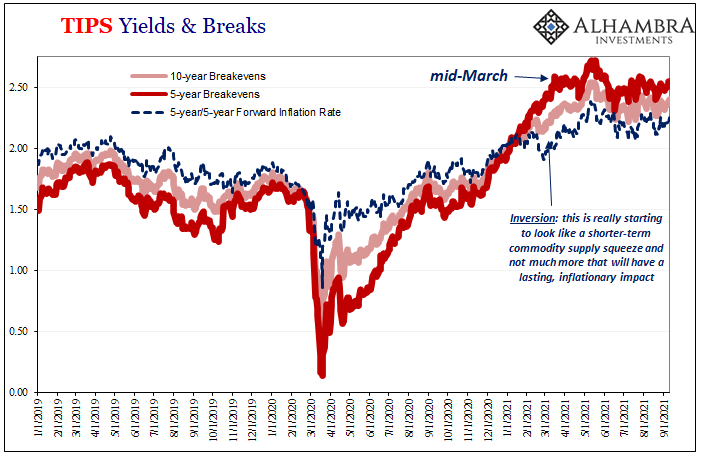

Nominal yields outside the very short run (and there are serious questions up front, too) over even short timeframes don’t care about what the Federal Reserve (or any central bank) is doing, rather if or how what it is doing (or not doing) could realistically lead to some higher combination of growth/inflation.

If not, if the real, shadow money world continues to conspire against them meaning us, then the word “taper” like the act taper won’t mean diddly. That situation is the same situation as it has been since August 2007.

There still aren’t “too many Treasuries” and one reason why is there is no money in monetary policy. That, even more than Crazy Uncle Sam, will end up being the real story behind 2021. It already is – and not just at UST auction.

Stay In Touch