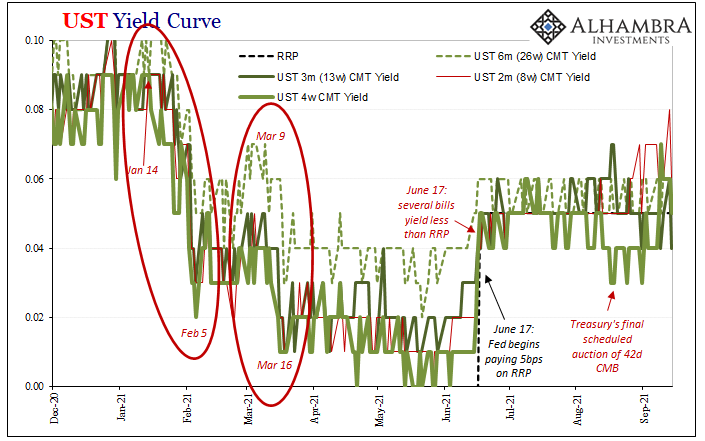

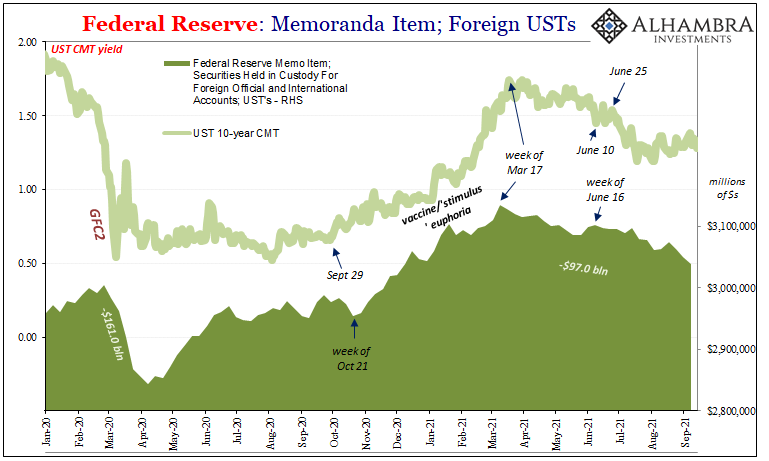

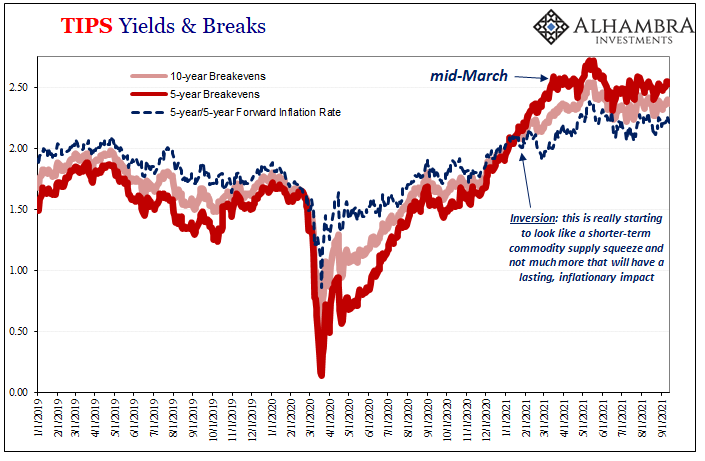

The dollar stopped falling on January 6, beginning a reversal which has lasted more than eight months. This forewarning was joined two days later when TIPS breakevens crossed, inverting the 5-year when compared to the 10-year. About a week after that, T-bills.

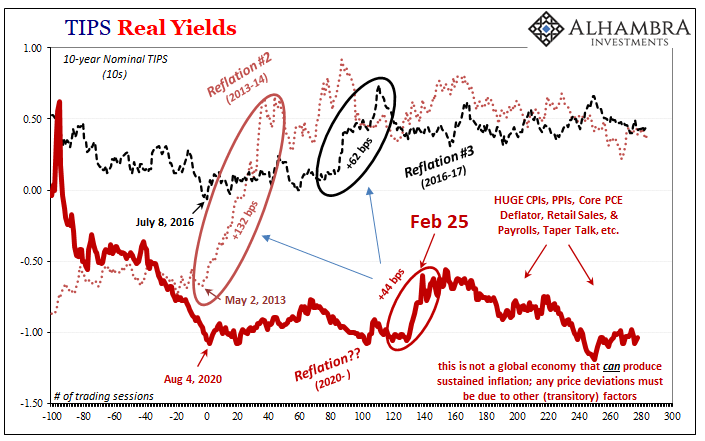

In other words, as I had written up last week, there actually were quite a few contrary indications in January 2021 just like there had been during September 2017. These may have been less loud than four years ago, yet proving to have been just as serious as when Reflation #3 and globally synchronized growth began to be forced into Euro$ #4 and its globally synchronized downturn by what these all represent.

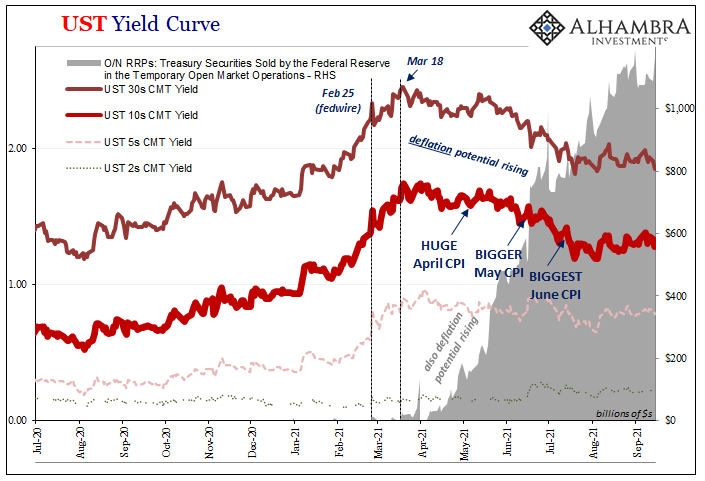

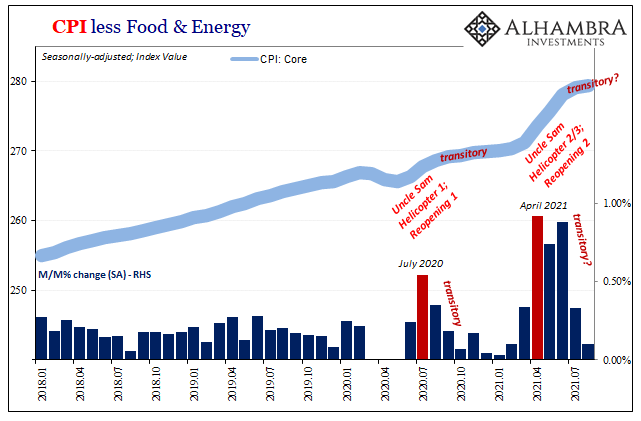

Deflation potential rather than the presumed, promised, even near-guaranteed inflation.

And it’s that last one, bills, which we’ve focused a lot of attention on this year – for very good reason.

I wrote at the end of January:

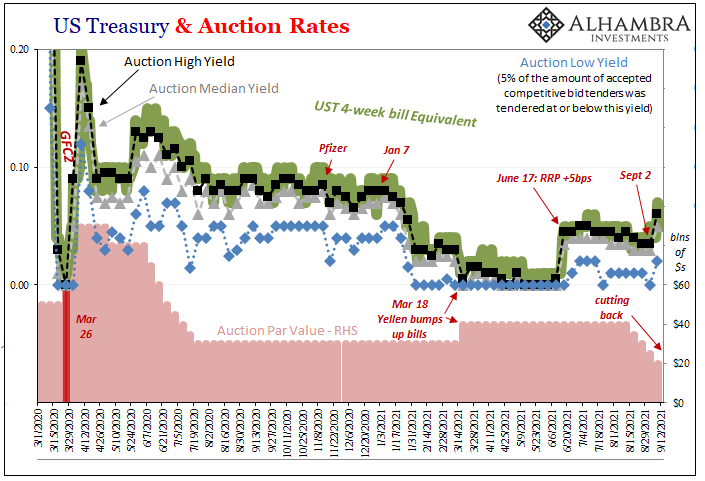

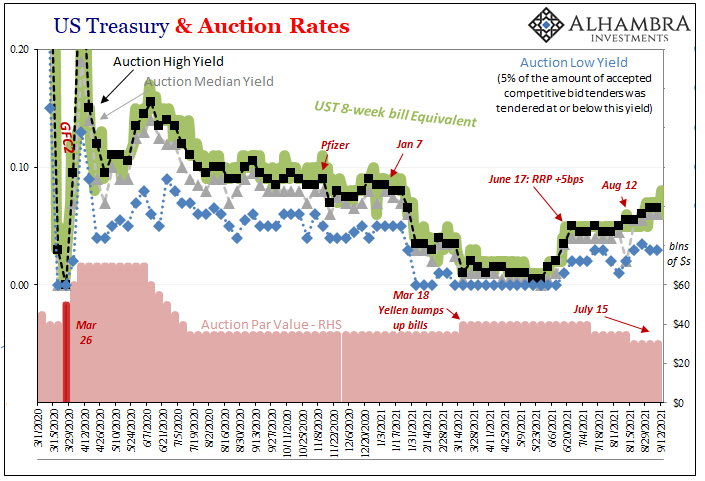

But now a second interruption in the wake of Pfizer’s November vaccine announcement; longer dated UST’s (like crude oil) have experienced a modestly reflationary selloff while at the same time the short end bills have done the exact opposite. And as bill yields have crept downward noticeably closer to zero like March, again, there hasn’t been any change in supply for more than six months.

This latest development is all about demand for the lack of further supply.

And that demand seems to have been reinvigorated in January 2021 even as elsewhere it seems inflationary reflation rhetoric has reached another climax. Amazing contradiction, or partially answering the question about why the long end of the yield curve, in particular, like the dollar’s exchange value, hasn’t moved a whole lot more reflationary than it has?

As I said at the start, it wasn’t just bill yields dropping, there had been a rising dollar defying its money-printing-crash as well as TIPS inversion. All of those things about the wrong kind of monetary potential more than anything – even as these showed up during what so far had been the most hysterical period of Inflation Hysteria #2.

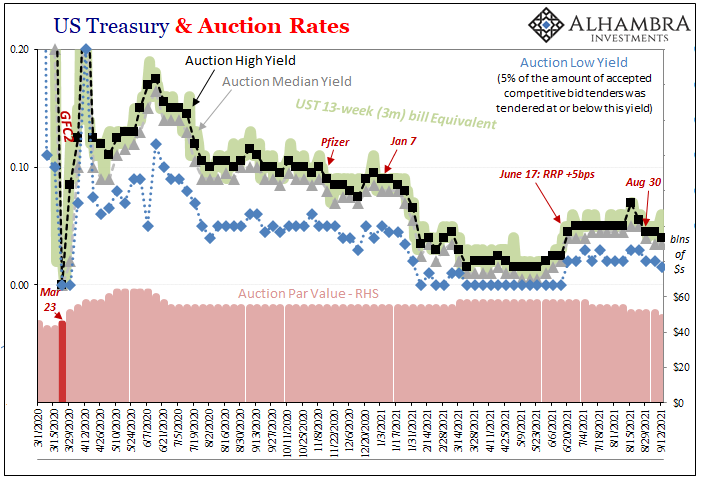

Not even two months later, bill yields dropped again only about a week before the modest (it was only ever modest, thus hysteria) reflationary sell-off in LT UST’s abruptly ended, too, destroying all predictions for BOND ROUT!!!!! Interest rates, once again, did have somewhere to go but up.

This mid-March inflection, following this second spike in bill demand, was corroborated widely; nominal yields outside the US; real yields inside; inflation expectations in TIPS; the deflationary signal of “disappearing” foreign-owned UST’s from Fed custody; even the sudden interest in use of the Fed’s RRP. All these the opposite of “too much” money.

Escalating warnings as to that rising potential.

Fast forward to late August, and now bill prices are upside down from where they had been prior. First the 8-week and now the 4-week bill yields are heading up even though Yellen’s Treasury is cutting back issuing especially the 4-weeker (the offering this week will be scaled down even more).

Have the early 2021 deflationary warnings been released? At least so far as bills are concerned, all clear in the best of the best of the best collateral?

The fact that the 8-week bill moved first is a big clue: mild uncertainty about the October debt ceiling “deadline” and whether, as well as how, it might get resolved. Right now, the market doesn’t believe there will be much issue, why prices have only changed slightly, and more importantly overall bill demand has simply shifted to the 13-week (3-month) tenor as to bridge over the looming impasse.

What’s happening is largely the same which repeats whenever Congress’ penchant for using fiscal law as an opportunity for political posturing and horse trading comes up. Some money market funds shift out of the shortest-terms out of an overabundance of caution just in case there is a disruption at maturity; therefore the 8-week saw less MMF demand beginning in August and now the 4-week to begin September.

The 13-week bill has received what left those other two (as well as some from the discontinued 42-day CMB, what might not have flowed to the new 21-day CMB). At least week’s auction, for example, this same instrument priced to a high yield of just 4 bps – a full bip underneath RRP – and a low of just 1.5 bps, substantially below RRP.

Collateral demand remains robust. All this simply makes things more interesting in bill’s world.

Interesting enough to push all the way to Euro$ #5 (4b)?

This includes how these debt ceiling “cliffs” (though they never really get shoved off one) appear consistently around more general eurodollar inflections; the changeover period, such as late 2017, 2013, and mid-2011, from modest reflation back into the growing dollar shortage condition.

From prior experience, we don’t expect this political gamesmanship to cause another bout of money/collateral scarcity or worse, rather it repeatedly contributes more to what’s already happening anyway (my main point here). This was certainly the case for 2017, 2013, and 2011. Another reminder of how fragile rather than resilient the system is in reality, sharply contrasting with rhetoric and mainstream description (otherwise “too much” money, like that interpretation of the RRP).

In the sense of fragility, what’s going on now in bills is another sort of escalating warning even if, at the very front of the yield curve, prices today and the rest of the month behave differently than they had when these alarms starting showing up all those months ago.

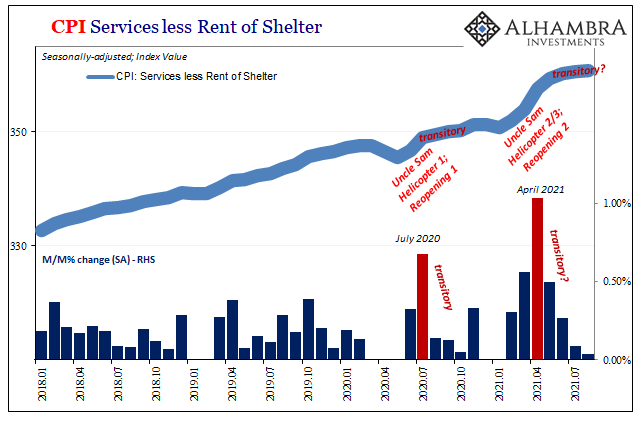

Just in time for CPI’s to further show their/they’re transitory.

Stay In Touch