Those pesky base effects. For most of the world’s economic data, these have contributed much to creating the misimpression the global economy is doing well, if not on fire. By comparing data now (or a month ago) to the same a year earlier, boy can it look splendid. In the stock business, they’re called easy comps.

The Chinese, however, have just upended the whole love affair. And more than any other place on Earth, much more than the American economy once overflowing with digital product of Treasury’s helicopter, it is China’s grand ability which means economic life or death for much of the rest of the planet. Inflation, recovery, a return to normal (at the very least pre-2020 normal), all of it depends upon Xi Jinping’s support and approval.

His National Bureau of Statistics (NBS) reported last night some truly ugly numbers. They’ve been bad so far, sure, like Japan (or Europe) this year which is now more than half over has been a colossal dud. But August 2021 puts a little extra emphasis on it. So bad that the NBS flunky, the unfortunate Zhang Min, in charge of “interpreting” Chinese retail sales blamed much of their badness on, yes, base effects (from Google translate):

In addition, the growth rate of total retail sales of consumer goods in August last year turned positive for the first time this year, and the “base effect” also had a certain impact on the market sales growth this month.

As usual, technically true yet misleading all the same. Let’s cut straight through it by comparing retail sales in August 2021 with retail sales in August 2019 (retail sales in China are not seasonally-adjusted, so the only “fair” comps are with those in the same month).

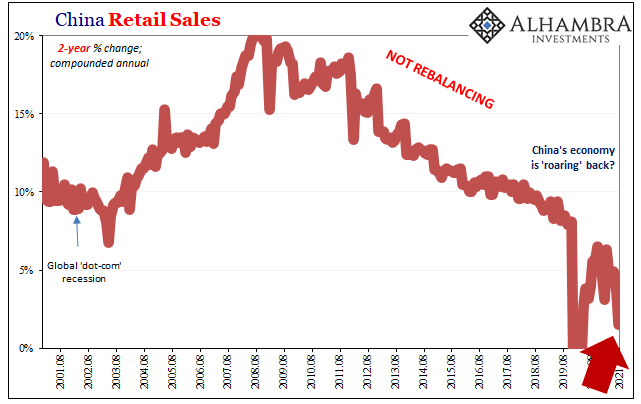

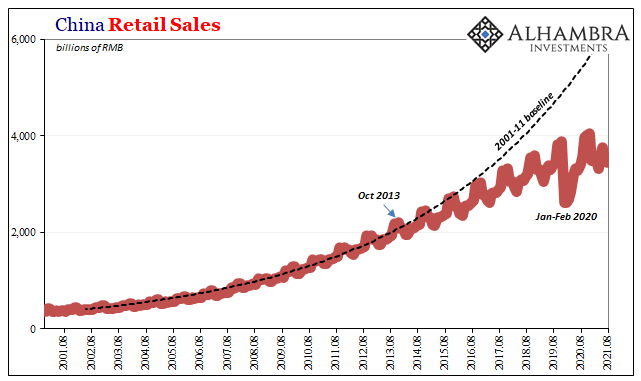

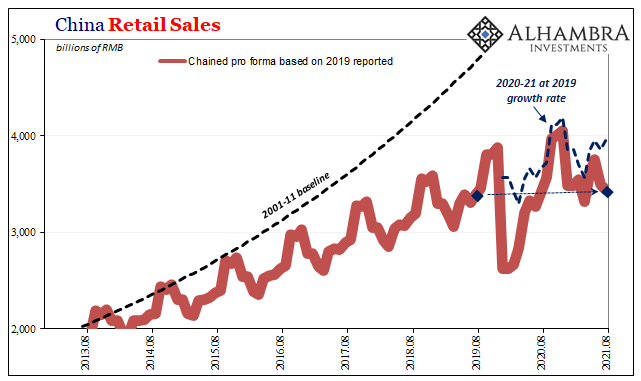

According to the NBS growth rates, retail sales in August this year were 2.5% more than August last year, which means they totaled just 3% above August 2019. Once upon a time, only a few years ago, Chinese retail sales growth had only grown by less than 7% once, and that was a statistical quirk back in ’03.

Before 2019’s “unexpected” (not by China) globally synchronized recession, retail sales growth had never been below 8% (save the one). Not in a two-year timeframe, but as any single year’s growth; prior to 2020, the absolute worst 2-year change for China retail sales was 16.4%.

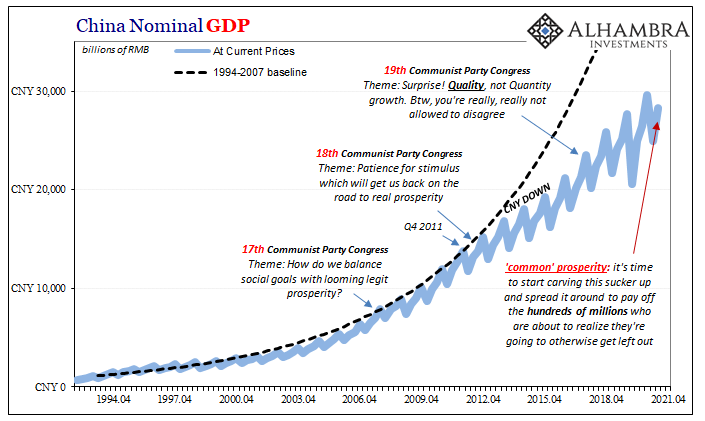

In the post-recession (or is it?) economy of 2021, Chinese retail sales last month were basically unchanged from two years ago. And don’t forget, because Xi surely hasn’t, it is internal demand in the form of Chinese citizens buying goods which is (or was) supposed to lead China’s transition (rebalancing). The fact that internal consumption has flagged and lagged the most is almost certainly why that idea has been superseded by what’s now being called “common prosperity.”

You can read all about this unnerving development here, which will only mean far less economic development, so if you live in or near China you might want to prepare yourself first. My conclusion will suffice for the full range of August 2021 data:

China’s skyscraper phase was itself an outgrowth of its capitalist growth phase. It’s all over now but the crying. And it won’t just be those inside China unwillingly filled with tears. The global economy shifted long ago, and the Chinese are shifting again with it but now going back to their unchanged, fundamentally Marxist and Maoist starting point.

The Western world is still looking for recovery, a second one, as well as the sustained inflation which would confirm it even as every potential pathway for legitimate growth was exposed in Wuhan to have been extinguished a very long time before COVID-19 showed up.

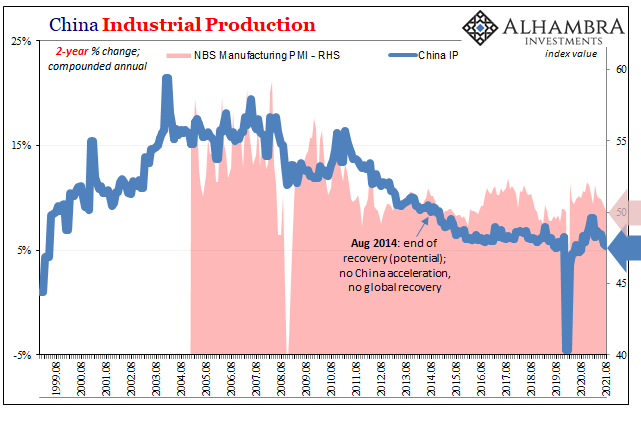

In the context of China’s retail sales, as well as IP and FAI, it isn’t really about August 2021. Sure, delta COVID (which Zhang also quickly references) has been a problem, but as you see below the Chinese consumer has been struggling mightily, unusually for a lot longer than just last month – the entire rebound since early last year has only gotten farther away from recovery.

Which means that weakness in August actually is not unusual; the degree to which it happened for August can be attributed, to some extent, to corona’s spread, but this new and more obviously lower baseline level from which that gets subtracted should be the whole world’s primary concern.

China’s economy downshifted permanently once beginning around 2011 and 2012 (Euro$ #2) becoming perfectly clear with the added gut punch of 2014’s start to Euro$ #3.

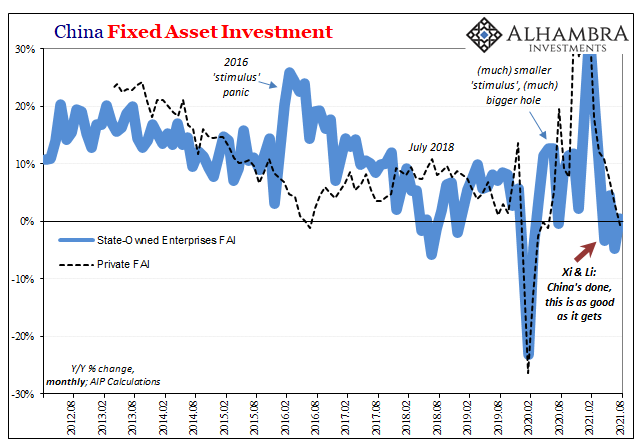

By 2019, Xi was busy working away preparing the Communist Party already for a world without the same growth potential. A full-on recession in between, by 2021, common prosperity, Xi is even busier working away preparing the Party for the same world with even less growth potential. A second great shock whose effects are becoming clearer by the month.

If it was nothing more than the single disease, then Chinese authorities would be busy like Uncle Sam filling in the perceived gaps between pandemic-induced weakness today and the surefire, full-blown recovery tomorrow. Unlike Sam, Xi doesn’t believe this is a temporary stretch – why would he after China’s last decade? – and so the Communists throughout 2021 continue to ramp down their never-more-than-meager “rescue” and aid efforts from 2020.

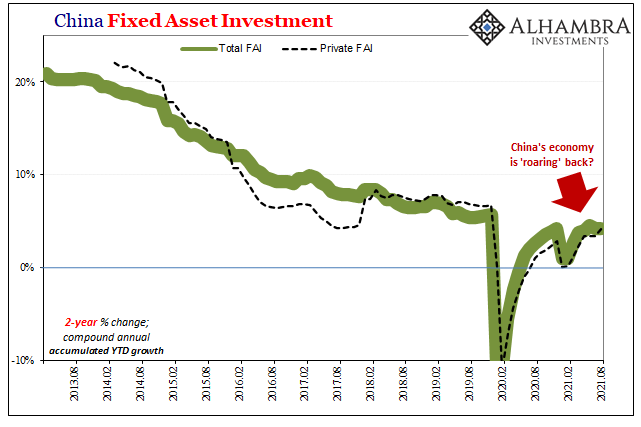

I think Fixed Asset Investment, private as well as State-owned, amply demonstrates the full gravity of this situation:

Like the old saying: it’s not what they say, it’s what they do. But in China’s economic (and military) case, they are both saying and doing the same thing; continuously coming up with new ways to say what’s already beginning to get done.

The difference is most in the West would rather bury their heads in the warm and fluid inflationary sands of “recovery” for the fifth time in just the last decade. The Chinese did that, too, to the same sand-filled level, only the first time back in 2009-11. And then were rudely awakened since authoritarian top-down political structures haven’t the luxury of being able to lie to themselves.

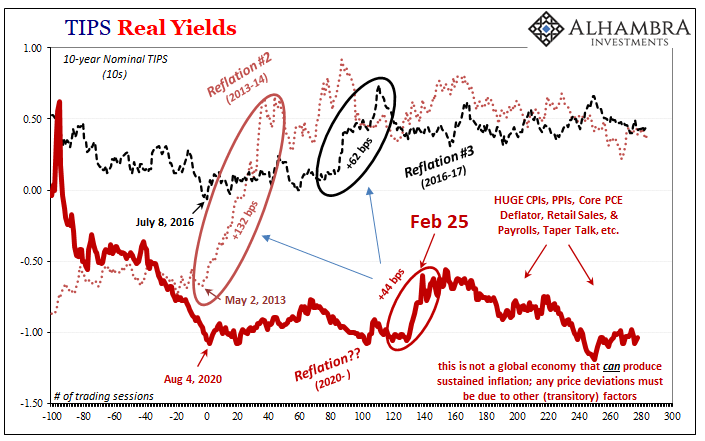

Why is inflation transitory, therefore not inflation?

Because the global economy isn’t just looking to a “surprisingly” grotesque Chinese economy for marginal growth and hoping things turn around quickly. The balance of it, almost certainly the vast majority, also looks like the Chinese economy which really means the probabilities are exceedingly small (see: real yields).

The primary impediment and detriment is not COVID; it is about what was determined by the 19th Communist Party Congress which was more honest with the world than any Free World central banker, Economist, or politician has ever been.

If you hadn’t fallen for the joke globally synchronized growth, you could’ve seen this coming all along. Just two months after Wuhan’s Greenland Center entered its first halt, in October 2017 China’s Communists declared their 19th Party Congress as the one to remember, the one still to be felt long after SARS-CoV-2 fades.

The 2021 waves of renewed coronavirus only create minor detours along the way, the same way China (and the world) has been heading regardless if anyone outside the CCP wants to recognize these facts (And for what? To save the honor of the QE-addled central bank?)

Common prosperity, oh boy, they are outright saying not just what’s happening but what more they’re going to do about what’s not – and that’s anything resembling recovery let alone an inflationary one.

Stay In Touch