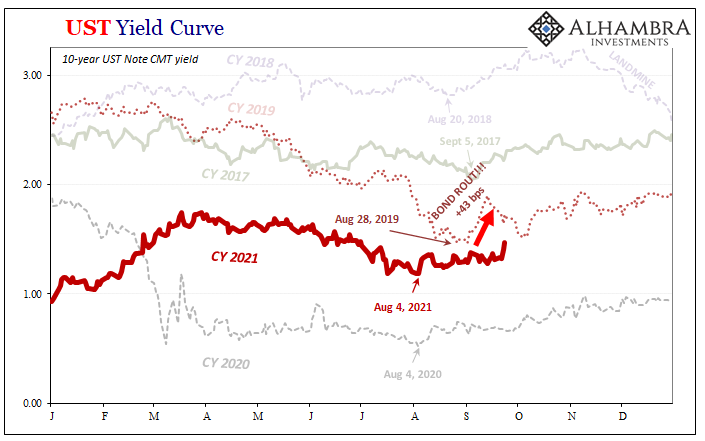

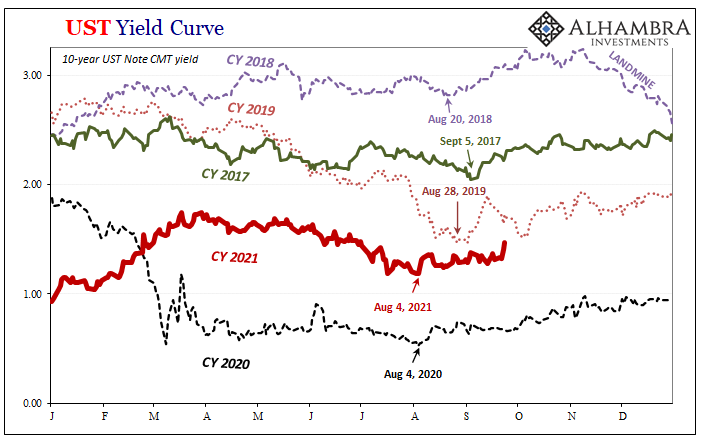

Barely more than two weeks. That’s all was needed for the headlines to scream “bloodbath”, “end of the bull market”, and the always popular BOND ROUT!!! The 10-year Treasury yield had bottomed out in August and by mid-September 2019 this key benchmark rate screamed upward by 43 bps in just seven sessions.

Yes, seven.

To think, the financial media has made the last few trading days in the bond market seem like some uniquely gigantic earthquake never before witnessed in all of modern investment history. Less than 20 bps higher, somehow this is the final warning behind the Federal Reserve’s mighty, irresistible tapering.

In reality, the past few days barely rate for what I wrote on Friday has become a regular feature (though some exceptions) of the current calendar landscape.

As we know, there was no “taper” drama let alone a tantrum released by it two Septembers ago. Quite the opposite; back then, at the start of this prior “bloodbath” had been a reanimated European QE on top of one Federal Reserve rate cut about to become two (and then later three).

Those were rudely interrupted by repo, which only pushed Jay Powell’s dazed FOMC to do even more, toward eventually not-QE5.

Maybe September just isn’t the month to be in UST’s. Spring is supposed to be the season for rebirth and regeneration, when the darkness of winter is cast off for the warming sunshine of seasonality representing the always eternal unwritten future; the chance for a do-over, maybe for once something will actually go right.

For the world’s key collateral marketplace, this sort of revival seems to register each year – almost every year – after August. Autumn, not Spring, that’s when hope resprings and bond bulls die.

Well, they don’t die, obviously. Like bears (pun intended) they only ever hibernate for a few months, sometimes less, before coming out of their slumber as pessimistic as ever. This is certainly what happened before the end of 2019, even before COVID would become a household term.

The variability in this seasonal pattern seems to be in its length. September and October aren’t good months for the safe and liquid, even when safe and liquid might otherwise seem to be the wisest choice for financial participants relying on those characteristics to maintain their very survival.

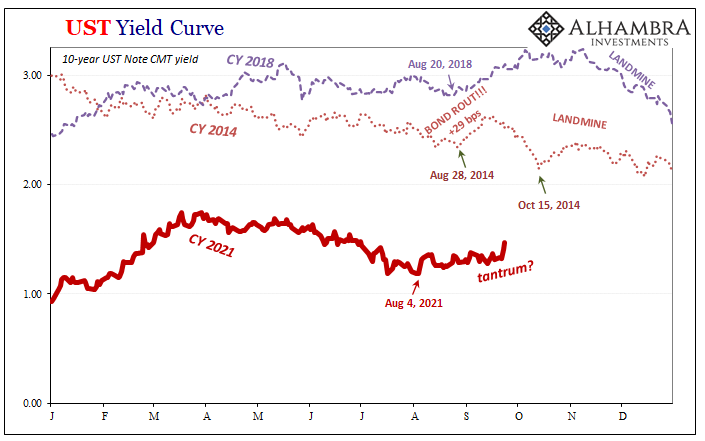

An example of the shortest: 2014.

As Euro$ #3 dug deeper into the shadows, yet again this same hiccup in the Treasury market. A low point in late August, the 28th this time, followed immediately by the early September BOND ROUT!!!

That particular year, while the Fed was tapering its QE’s down to termination, the ECB would take center stage early in September 2014 (T-LTRO’s and rate cuts). Our benchmark UST 10s would rise 29 bps in yield in the same blink of an eye as 2019.

Afterward, though, it was more like in late 2018, this short-lived 2014 “bond bloodbath” instead quickly interrupted by first the collateral destructivity of October 15, kicking off Euro$ #3’s own landmine and from there back to declining rates as if there was never anything good along the way (there wasn’t).

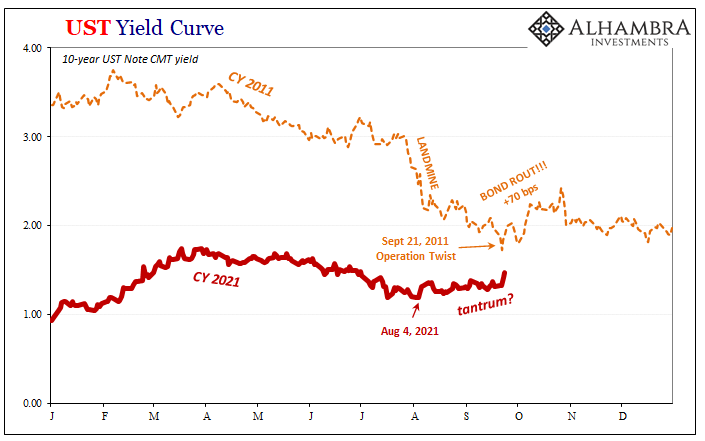

That landmine was much the same as three years before then, after Euro$ #2’s landmine in late July/early August. The 10-year Treasury yield had bottomed out on September 22, 2011. While not specifically August in this instance, still clearly in the same ballpark.

On September 21, the Federal Reserve had announced it would take on Operation Twist after the ECB and Swiss National Bank (euro peg) had come into the global picture earlier in the same month. From those onward, several intense weeks, lasting to the end of October, when UST 10s added a far more robust 70 bps to their low yields.

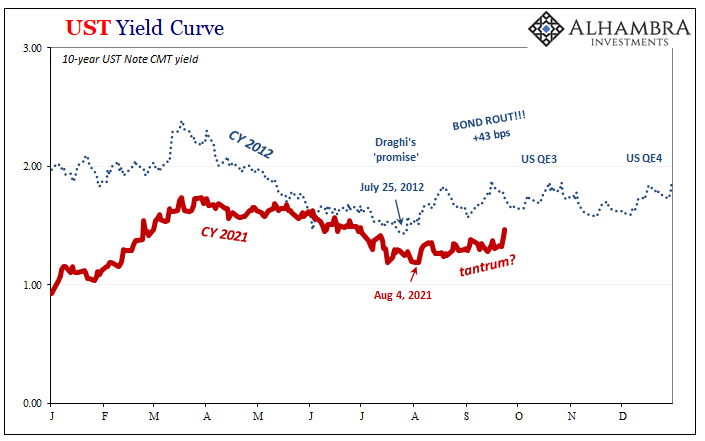

In yet one more calendar year example, the very next year, 2012, pretty much the same pattern plays out. And that one is perhaps most eerily similar to the current one. Though the low point for the 10s fell on July 25 back in 2012, that’s actually even closer to our recent August 4 for 2021.

While tapering QE’s would be something for markets in 2013 to deal with, before they could, in 2012’s recessionary climate (Euro$ #2 hitting the world hard despite all that stuff late in 2011), there would first need to be some QE’s.

Then-Chairman Ben Bernanke had obliged first with QE3. When? Announced in September 2012 (followed by a fourth QE that December). Before those, then-ECB Governor Mario Draghi had already stolen his thunder by making his (in)famous “promise” on July 26 – meaning our 10-year UST yields had reached their lows the very day before.

Almost every September (including 2010’s; not discussed here) seems to be a bad time at the middle and long end of the Treasury curve. Whichever annual “bloodbath” extends more often than not into October and has frequently enough lasted longer in a few of these calendar years.

All of them, they make the current move in UST’s seem like child’s play when having done so.

Not a single one has meant huge inflationary potential, or the brokest human institution ever to grace our fiscal nightmares, Uncle Sam, reaching its vigilantism limit. On the contrary, though these are all, or nearly all, following along the same calendar regimes none of their BOND ROUTS!!! have ever represented anything more than a temporary waypoint in between the way down in yields.

Markets don’t ever go in a straight line, and there’s a regular bend or rebound in it each Autumn. It’s not really about the tapering of, nor the onset for, QE’s.

Still, this can’t be all random coincidence. There is definitely “something” about August, September, and nearly every post-2008 Autumn (2013 no exception, it just got started earlier).

Hope springs eternal, and for our cases that’s not in Spring.

Stay In Touch