It may not be public enemy number one, but inflation is certainly near the top of the list. Since the beginning of 2021, prices of almost everything have gone into orbit. Energy prices are up an average of 56%. Airline tickets are up almost 25%. Used car prices have jumped more than 45%. And it seems there’s no slowdown in the accelerating prices of groceries, real estate, rents, health care, and lumber. Inflation is pulling money out of consumer pockets at a faster rate than their income is growing.

For Social Security recipients, a little help is on the way. By all estimates, next year’s Social Security cost-of-living adjustment (COLA) may be the highest since 1983. Based on consumer price index data from the Bureau of Labor Statistics, Moody’s Analytics estimates an increase of 4.5% while The Senior Citizens League is estimating an increase of 6.1%.

In contrast, the increase that went into effect in January 2021 was 1.3 percent, or an average of about $20 a month for individuals. A 5 percent increase would boost the average monthly benefit by about $77.

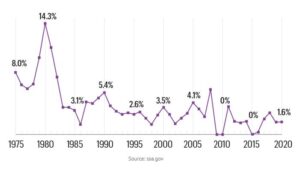

Social Security Increases 1975-2020

The actual COLA will be based on the Consumer Price Index for the Urban Wage Earners and Clerical Workers Index (CPIW), which is an official measure of how much prices change for a pre-determined group of goods and services, including food, energy, and medical care. The CPIW rose 6.1% from July 1, 2020-June 30, 2021.

Each year, the Social Security Administration compares CPIW numbers from July, August, and September with the same period the previous year. The percentage change from the third quarter of one year to the next is the percentage increase of the Cost-of-Living Adjustment. The Social Security Administration announces COLAs in October and it takes effect January of the following year.

Since Congress instituted the COLAs in 1975, there have been three years when Social Security benefits did not increase—2009, 2010, and 2015. If inflation stays the same from one year to another, or if inflation decreases, there is no Cost-of-Living Adjustment.

Social Security is funded by a payroll tax of 12.4 percent on eligible wages — employees pay 6.2 percent and employers pay the other 6.2 percent (self-employed workers pay the entire 12.4 percent). Next year, the maximum amount of earnings subject to the Social Security tax, currently capped at $142,800, will also be adjusted for inflation. The money paid in by today’s workers goes to cover current benefits, with any excess going into the Social Security trust fund.

A high Cost-of-Living Adjustment may make you smile, but you may not see all of it. If you are part of the 70% of Social Security recipients who have Medicare Part B premiums deducted from your Social Security check, a Medicare rate increase will offset some or all of the COLA. With inflation driving up medical costs, it’s very likely that Medicare Part B premiums will go up too.

Stay In Touch