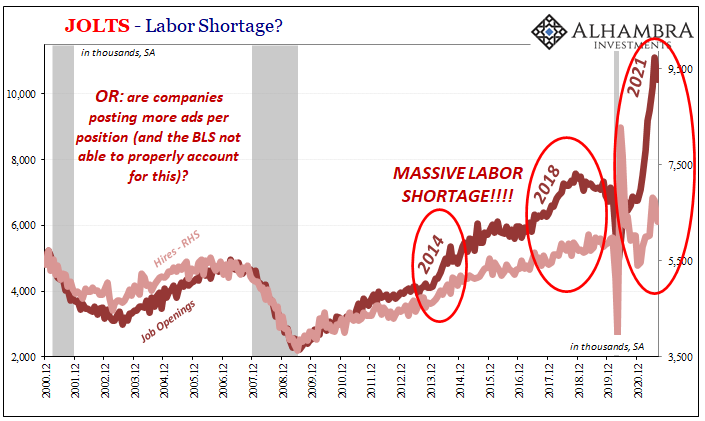

The number of Job Openings for the month of July were revised upward, the BLS now thinking there had been more than 11 million of them during that month. Companies seem to be desperate for workers, at least judging by this one measure. The latest estimate for August 2021 came in well short of either the revised figure (11.1 million) or the previous one.

Yet, at 10.4 million that’s still greater than June’s 10.2 million, all of these summer months pegged at more than a third higher than the 2018 peak. Is the decline in August from July substantial, the start of a downtrend? Or, because this was still better than 10 million, therefore another month of LABOR SHORTAGE!!!! if a little bit less extreme?

Since Job Openings have continuously sent a false signal going all the way back to the “best jobs market in decades” of 2014, I don’t really believe it matters either way.

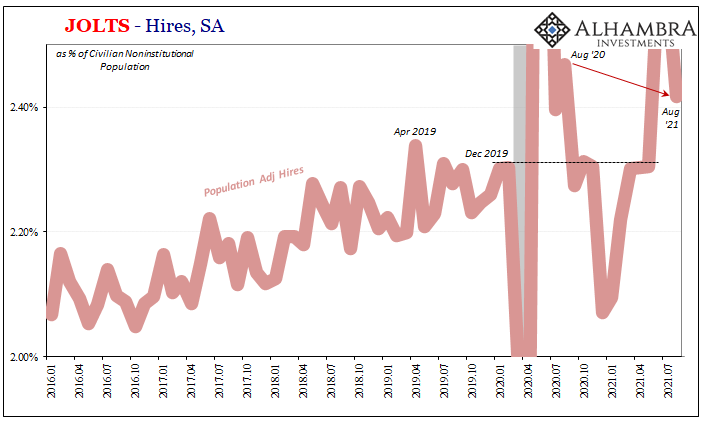

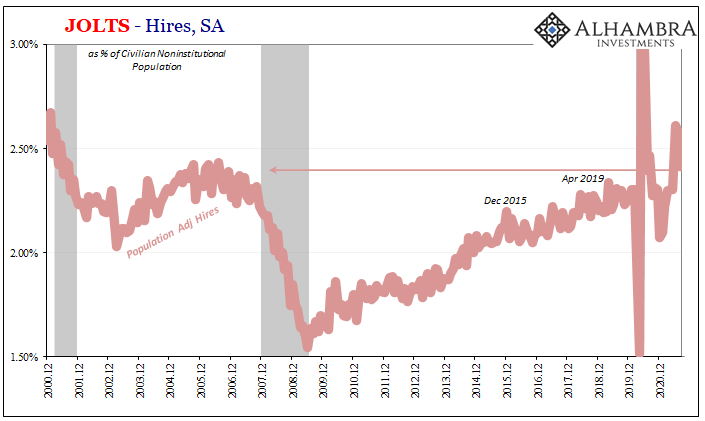

Instead, that the rate of hiring (Hires) declined sharply in August following a reopening-like high rate in June and July. At 6.83 million then 6.76 million, respectively, these were consistent with the payroll reports (Establishment Survey) which had so enthused Federal Reserve policymakers upon tapering their (irrelevant) QE6.

Falling back to 6.32 million in August, though, while better than earlier this year and much of last, this isn’t a thrilling pace you’d expect given all the excitement about the labor market. In fact, this was fewer hires than calculated for August 2020 (-1.7%).

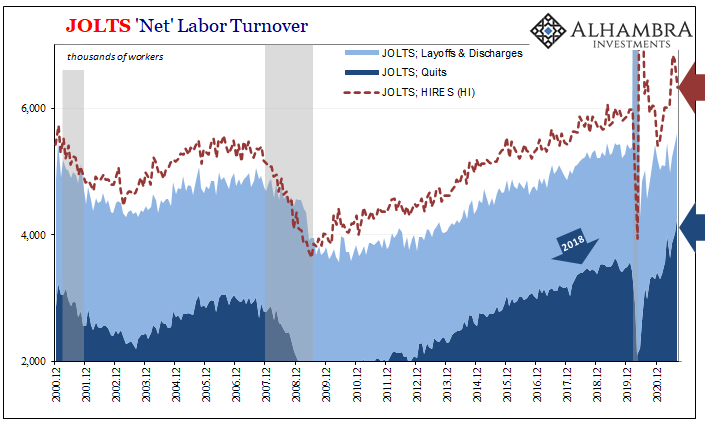

Overall, adjusting for population, the rate of hiring two months ago wasn’t that much better than the pre-COVID April 2019 peak, nor is it any more than the pre-2008 period during the lackluster middle-2000’s housing bubble. Heading lower anyway from June and July, how quickly the labor market – from the employer side – seems to have decelerated significantly at a time when it was expected to stay off-the-charts to justify upcoming FOMC adjustments.

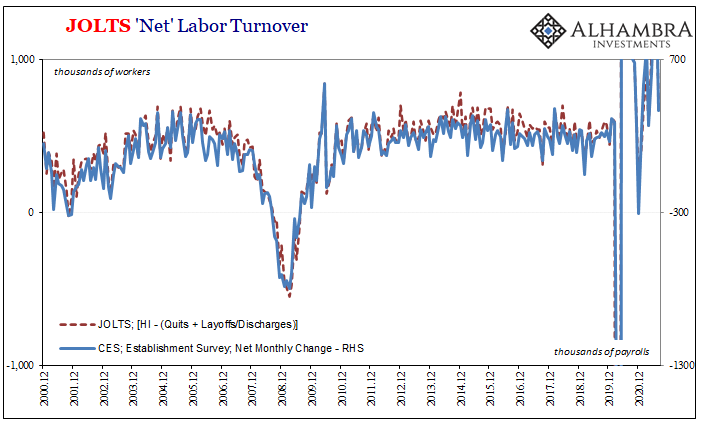

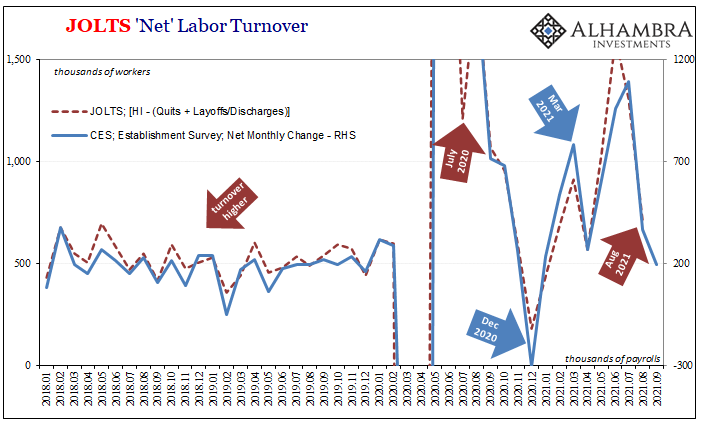

Doing the math to “convert” JOLTS into CES, the net turnover for August was practically spot on when compared to the revised monthly payroll change for the same month – the first one which disappointed and missed compared to those taper-inspiring swells June then July.

Layoffs and Discharges declined by about 80,000 to 1.34 million monthly, yet quits (voluntary) increased another 150,000 to 4.27 million in August. So, that’s 5.61 million exiting work for one reason or another and 6.32 million finding it (hires) combining for a positive net turnover of 709,000.

After adjusting for the JOLTS factor, turnover gives us pretty much the August payroll figure (revised +366,000 then adding the 300,000 factor equals +666,000, an insignificant difference from the net +709,000 tallied above).

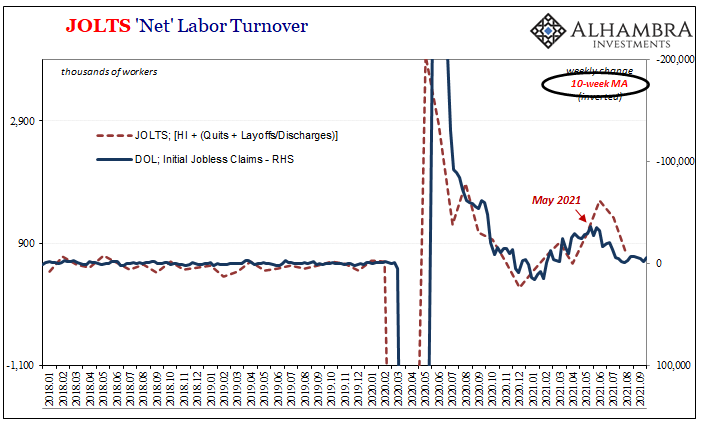

It is the quits number which has caught a lot of attention – and rightly so, as we noted several months ago. For August, this was the highest on record by quite a bit and the trend is solidly rising. Is this evidence of that labor shortage? Or is it another seemingly ambiguous (when considered in isolation) datapoint suggesting something else entirely?

What we said about May JOLTS/Payrolls applies again for both in August:

In other words, what JOLTS is proposing is that for unknown reasons an extraordinary slice of the employed workforce decided they no longer wanted to work at the same jobs – even though, by the same data, they were not hired on anywhere else!

Take this job and shove it!

While it ties into the payroll miss, it doesn’t do much for the LABOR SHORTAGE!!! except to potentially suggest the same problem as in 2018. The key component which, now, historically, and forever after (assuming no MMT), balances labor and business is, obviously, wages.

The part always left out of the LABOR SHORTAGE!!! thesis is just that; there is never really any labor shortage, instead companies who are “desperate” to hire workers just must not be paying the market-clearing wage. Their anguish is quite really a function of their own bottom lines. All the data shows conclusively this enormous slack.

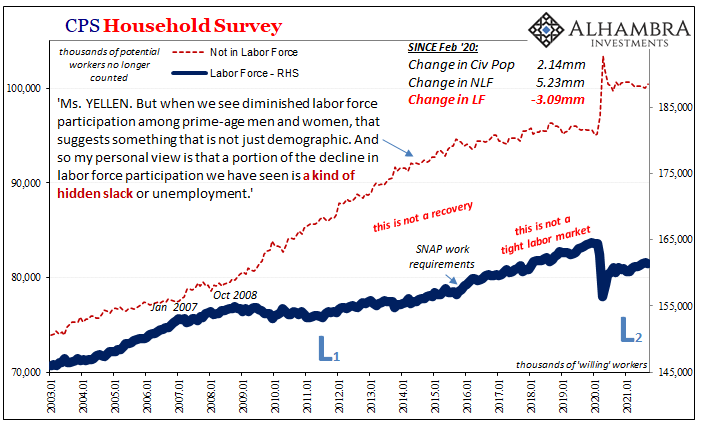

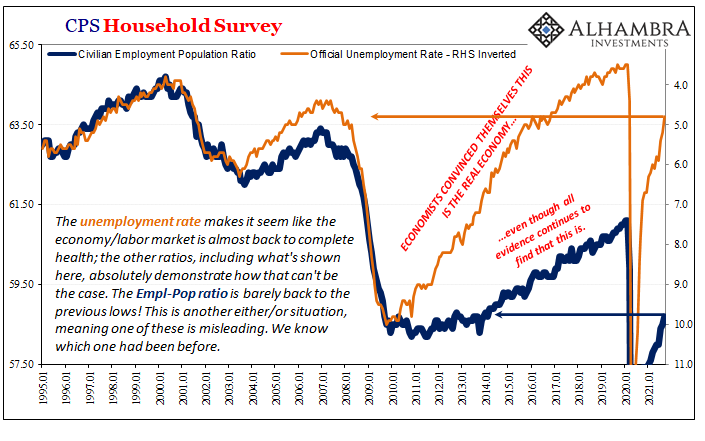

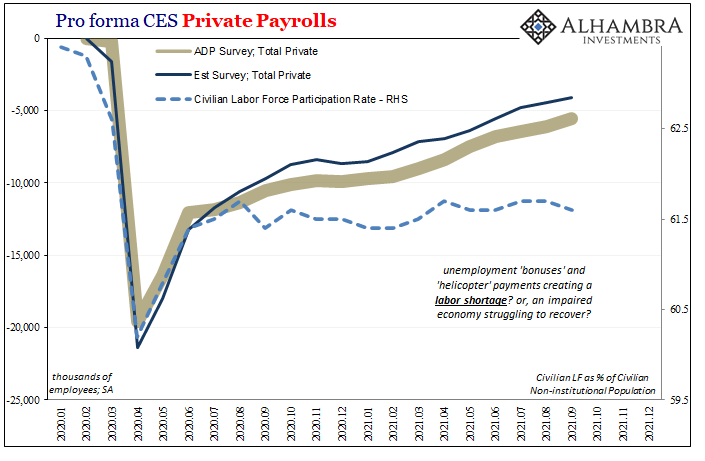

This did/will be taken a step further when the September JOLTS numbers come out next month. What I mean is, at least in August the labor force (taken from the CPS Household Survey) added about 190,000 workers whereas in the latest payroll data for last month it declined by very nearly the same number (-183,000).

In other words, companies hired less in August (likely September, too) at the same time more workers left their jobs and then exited the labor force entirely (added to hundreds of thousands who failed to enter). The one explanation puts these as too lazy, whereas the other yet again puts the economic “recovery” into scare quotes.

As to the latter, companies aren’t offering enough pay to either meet their purported needs for more workers as well as keep existing staff around for more than what seems like a temporary look-see.

For some, sure, maybe it is more economical to remain on Uncle Sam’s dole and to take the government-funded vacation than to get paid relatively little at a job that anyone might rightfully despise and despair. However, this still doesn’t answer the wage/pay issue, especially as by September the federal government’s generosity faded further into history (and the excess rolling off the excess dole).

This is not strictly an either/or situation, but the rest of the labor (and global economic) data strongly indicates far more stuck in the category of recovery shortage (especially since May) rather than labor shortage.

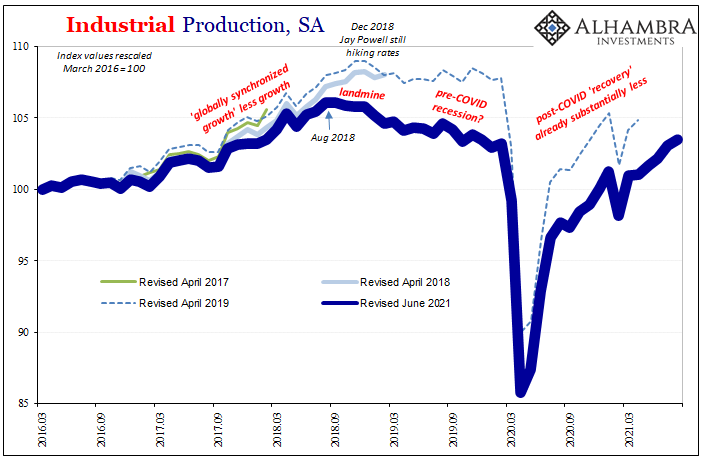

And we’ve seen this before, if not to this extreme; these same JOLTS problems amplify with each cycle. During the last inflation hysteria, LABOR SHORTAGE!!! in 2018, the monthly rate of quitting increased noticeably alongside Job Openings – as you’d expect during a “boom” period when already-employed workers begin to feel confident enough to leave for what they hope is a better job already waiting.

While the turnover data seemed to argue for this, the payroll data concurrently looked as it does today – a far smaller increase in the labor force which indicated other more general macro problems inconsistent with any kind of labor shortage. Those who had work were leaving and moving to another job in rising numbers, yet that “robust” “booming” labor market somehow failed to bring in others off the sidelines where’d they been stuck for about a decade by then.

In the mainstream, they were slandered as “lazy”, too, only back then it was claimed for reasons of fentanyl addiction and an unwillingness to learn to code. Now we’ve got unemployment benefits to juice what some have to be insinuating as a natural, inborn tendency to indolence that only showed up in the media desperate to explain why so many years into the aftermath of 2008 the economy had never once lived up to so many QE’s and so much government debt/spending.

What that had really meant was not a labor shortage but a labor market shrinking; bifurcation. Too many were being left out not for those reasons or by choice. Those fortunate enough to have been and remained in, they increasingly took advantage of more alternatives under modest reflationary conditions – if only for a time (Euro$ #4, after all, meaning 2019 as a globally synchronized downturn erasing all those 2018 “labor shortage” gains and easiness).

I find the “lazy” argument itself lazy and in the same way as an entire generation of Americans has been similarly insulted and maligned – Millennials were said to have grown too comfortable in their parents’ basements, not willing to come out of them for work, buying cars, moving into their own households, etc., a myriad of serious economic difficulties and shortfalls laid inappropriately at their doorstep if for no real reason than to let QE and its Economist and central banker proponents off the hook.

What if this entire generation (the same turning positively to socialism, by the way) simply couldn’t afford to leave the basement, buy cars, and whatever else because there were no good jobs available that might allow for those things? Not only would that hit a little too close to home, it would also ring familiar throughout the period; including now.

The argument all fell apart by 2019 when the wage-driven, labor shortage inflation which was supposed to have confirmed the mainstream explanation instead itself proved to have been suspect all the while. The “boom” an illusion, the participation problem as problematic as ever.

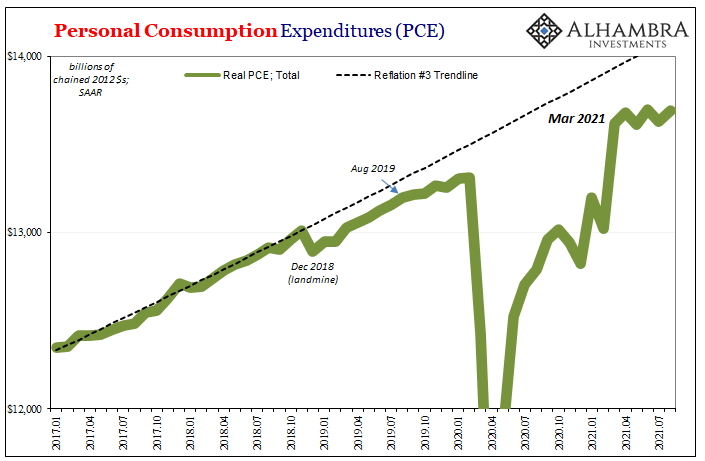

In light of that history, and how it does appear to be repeating, is there room in the basement for this time to really be so different? On top of all this, we are supposed to believe that after having suffered a 2019 downturn and maybe even recession (certainly globally) and then a COVID-shutdown and GFC2, after all of that the economy is as good as it has been, no permanent damage taken in all that time and disaster in between.

Not just as good as ever, maybe even better than ever.

And this by the grace of QE’s and fiscal dumps.

Yet, companies refuse to pay what the labor market wants. That much, anyway, yes, very consistent throughout the last decade and more. It doesn’t add up with such lazy math.

Stay In Touch