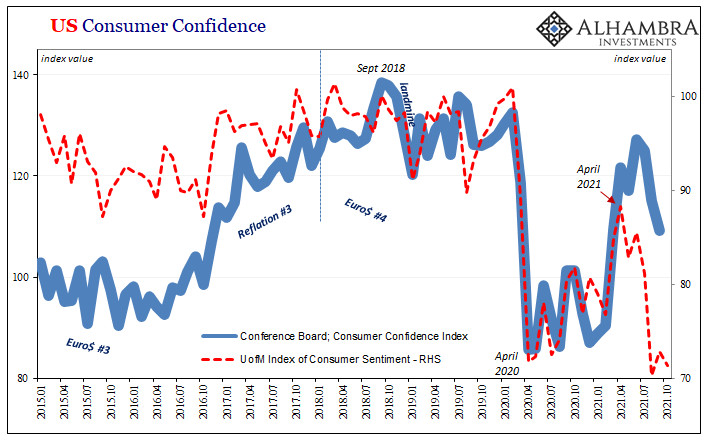

A couple of Economists have caused some noise by reviewing consumer confidence estimates in the United States, associating big declines in them with imminent recession, and then pointing out such substantial drops in both of the major consumer sentiment surveys just recently. If valid, their correlations would seem to suggest a US contraction.

We’re meant to take these seriously for one of those academics, David Blanchflower of Dartmouth, had once “set interest rates at the BOE during the 2008 financial crisis.” Hardly a good place to start winning converts.

He and his co-author Alex Bryson of UCL are pretty adamant:

The economic situation in 2021 is exceptional, however, since unprecedented direct government intervention in the labor market through furlough-type arrangements has enabled employment rates to recover quickly from the huge downturn in 2020. However, downward movements in consumer expectations in the last six months suggest the economy in the United States is entering recession now.

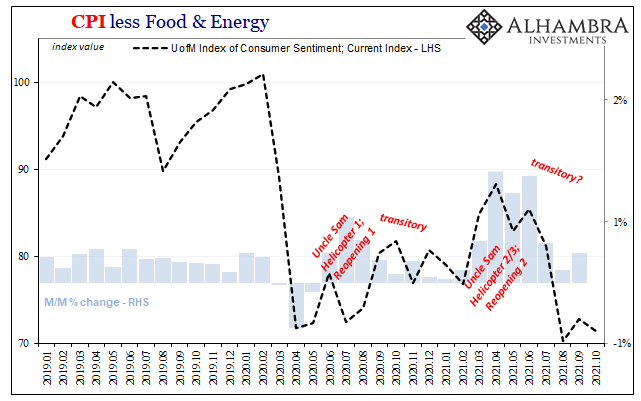

The Conference Board’s more optimistic measure has indeed become far less lofty very quickly. And while the University of Michigan’s sentiment index never rebounded near as much, it has likewise fallen backward when it should be surging in recovery. The latter’s newly released preliminary assessment for October 2021, increasingly free from delta COVID’s influences on governments, wasn’t good; slightly lower after a slight gain in September.

Scraping along the bottom:

Whether this means recession or not may be beside the point. What is the point is how even academic Economists can’t help but notice how the US and global Economy is not in any shape like what’s been said all year and predicted for the rest. I seem to recall the term “red hot” being thrown around by unassailable luminaries as if a certainty.

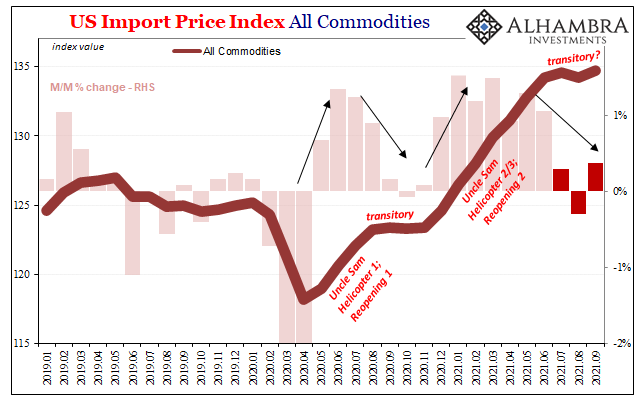

The economy certainly had accelerated earlier but not for economic reasons; the non-economic interference of global fiscal policies, especially those of the US federal government.

Typically, academics see such intervention as thoroughly positive not just in the short run more so believing these programs dependably contribute much to the intermediate and longer-term trajectory – even as experience consistently shows they never do.

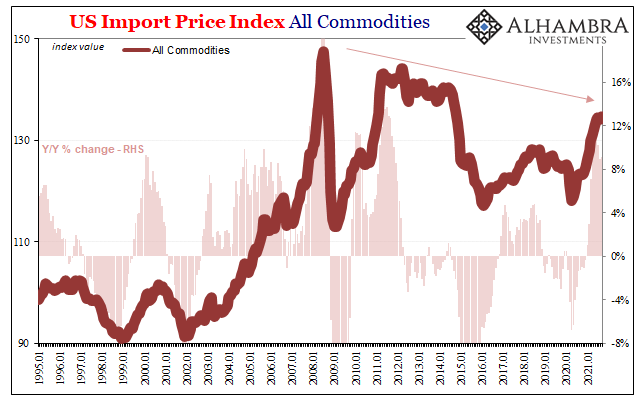

Since April or May, a global slowdown at first denied has slowly become practically undeniable as more and more the weak data comes back and sticks around. This is also true of “inflation”, the other side of transitory, the downslide of the camel humps in whichever consumer, producer, or now trade price index.

The third of the BLS’s series after first the CPI then next PPI is import prices, along with export prices. Even the latter, export prices, which have been more impressive than the far less impressive import index (though it might seem from mainstream commentary it would be the other way around), these indices are more clearly bending.

Toward what? Recession?

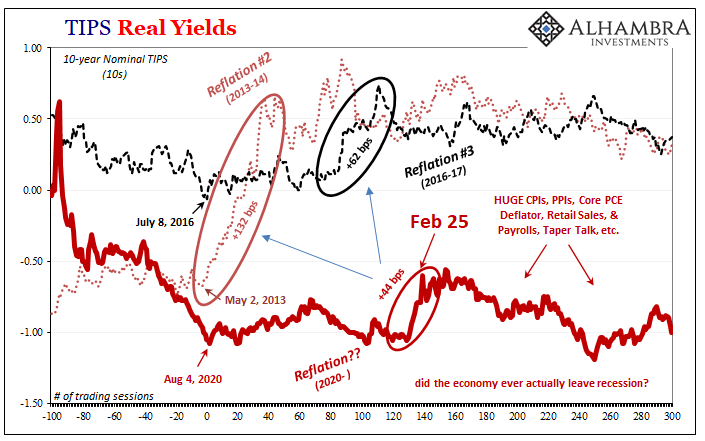

Not necessarily. Given consumer confidence as well as more substantial indications like real yields (TIPS; see: below), it may be a more reasonable question to ask whether or not the global economy ever actually got out of the last one.

If that’s really the case, then for all Uncle Sam’s efforts all it did was fool people into believing inflation and recovery (which many, maybe the vast majority still believe) when in fact those weren’t really happening. That technically makes this current weak spot at least a slowdown, but more appropriate one toward an economy merely reverting to its actual economic state increasingly unbound by non-economic interventions.

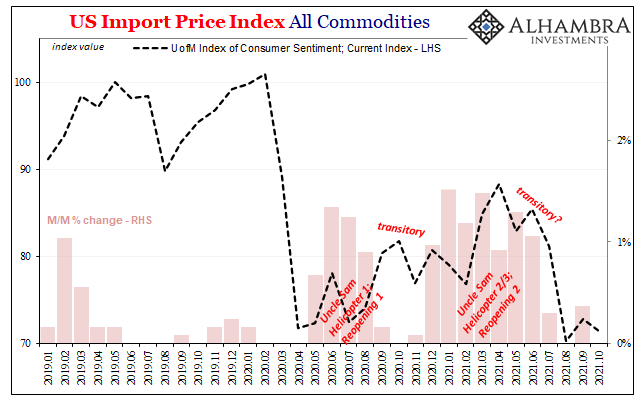

The growing response to the downshift is somewhat interesting; “everyone” is beginning to sense and admit the weakness, but they won’t let go of the inflation. Therefore, more and more the term stagflation is being thrown around regardless of the recession question – because people have been led to believe inflation is something it is not.

As I noted recently, however, if this really is serious and enduring weakness, a reversion back to the non-recovery state, the type of “flation” has already been decided.

The Economist considers this as higher potential for “stagflation”, a term popularized during and about the Great Inflation of the 1970’s. It also made a comeback around 2010 and 2011 – not that anyone remembers now. Quite simply, without the money for inflation what’s left is just the stagnation; which very succinctly and accurately describes the decade which followed 2010 and 2011.

Is this time really different? So far, the stagnation is proceeding almost as if right on schedule; the non-central bank schedule.

No need to call it stag-deflation because that’s just redundant. In other words, as the renewal of stagnation grows larger on the horizon, settling the label’s other half is already being taken care of.

Stay In Touch