136.1 USA Debt Ceiling Reprieve Saves Chinese, and World?

———Ep 136.1 Summary———

The ‘debate’ in the US Congress about the debt ‘ceiling’ prevented the US Treasury Dept. from issuing UST Bills, the ultimate risk-free asset. This put serious stress on the Chinese currency. Now, with the ‘debate’ tabled till December, Beijing (and the world) are safe… for now.

———Sponsor———

Macropiece Theater with Alistair Cooke (i.e. Emil Kalinowski) reading the latest essays, blog posts, speeches and excerpts from economics, geopolitics and more. Interesting people write interesting things, why not listen and hear what they have to say? You could do worse things with your time (i.e. Bloomberg, CNBC, et cetera). Recent readings include thoughts from George Friedman, Lyn Alden, Daniel Oliver, Michael Pettis, the Bank for International Settlements and yes, even Karl Marx.

———See It———

Twitter: https://twitter.com/

Twitter: https://twitter.com/

Alhambra YouTube: https://bit.ly/2Xp3roy

Emil YouTube: https://bit.ly/310yisL

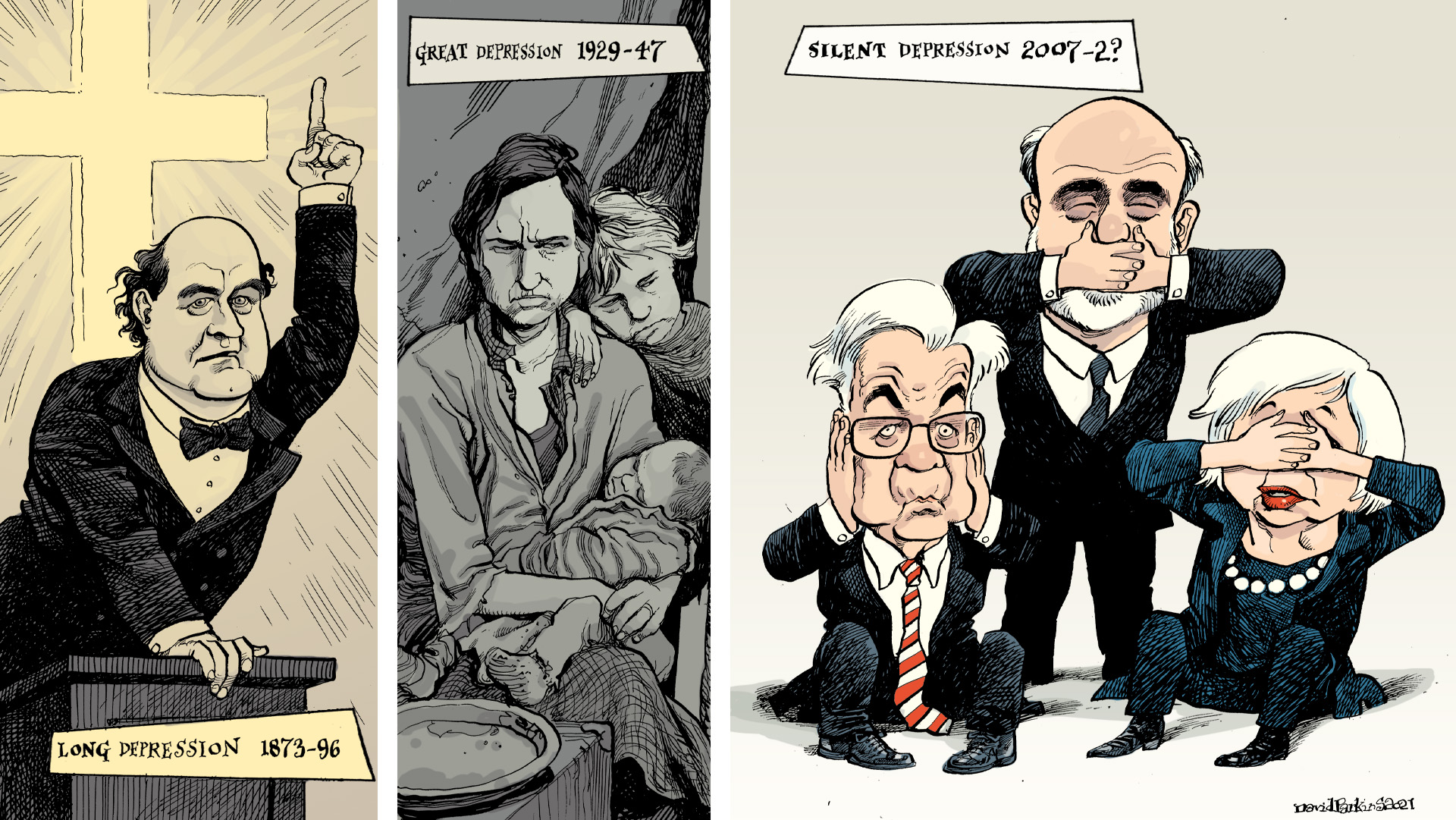

Art: https://davidparkins.com/

———Hear It———

Vurbl: https://bit.ly/3rq4dPn

Apple: https://apple.co/3czMcWN

Deezer: https://bit.ly/3ndoVPE

iHeart: https://ihr.fm/31jq7cI

TuneIn: http://tun.in/pjT2Z

Castro: https://bit.ly/30DMYza

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Pandora: https://pdora.co/2GQL3Qg

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

PlayerFM: https://bit.ly/3piLtjV

Podchaser: https://bit.ly/3oFCrwN

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

ListenNotes: https://bit.ly/38xY7pb

AmazonMusic: https://amzn.to/2UpEk2P

PodcastAddict: https://bit.ly/2V39Xjr

———Ep 136.1 Topics———

00:00 Intro: China’s yuan was suspiciously stable, recently it has begun to gain – what changed?

00:43 Beijing likely was holding the yuan stable against depreciation pressures.

01:48 The PBOC may have used “contingent liabilities” (off-balance sheet) to hold the CNY up.

04:09 The CNY went up on October 13 and 19 when the US Treasury ‘reloaded’ US Treasury Bills.

06:20 Money dealers may have more UST Bills to work with, but do they want to (risk/return)?

09:14 A review of UST holdings by China (and Belgium) as of August 2021.

13:09 Money-credit-collateral availability is positively correlated to economic activity.

13:47 How did official institutions (not just China) behave in 2021 with respect to UST?

16:44 Similar behavior (selling US dollar assets) was observed in private market participants.

18:53 OUTRO: The Spring and Summer 2021 were bad, but might the future be better?

———Ep 136.1 References———

While The Fed Chases The Unemployment Rate, TIC’s Eurodollar Deflation Case Is Unusually Unambiguous: https://bit.ly/3G8Rgkr

Alhambra Investments Blog: https://bit.ly/2VIC2wWlin

RealClear Markets Essays: https://bit.ly/38tL5a7

———Who———

Jeff Snider, head of global investment research for Alhambra Investments with Emil Kalinowski, Trevor Something listener. Art by David Parkins, coloured-pencil pamphleteer. Show produced by Terence, focused visuals. Podcast intro/outro is “Aurora Borealis” by Chill Cole found at Epidemic Sound.

Stay In Touch