136.2 Sorry, US Treasury Yield Curve Delivers Bad News

———Ep 136.2 Summary———

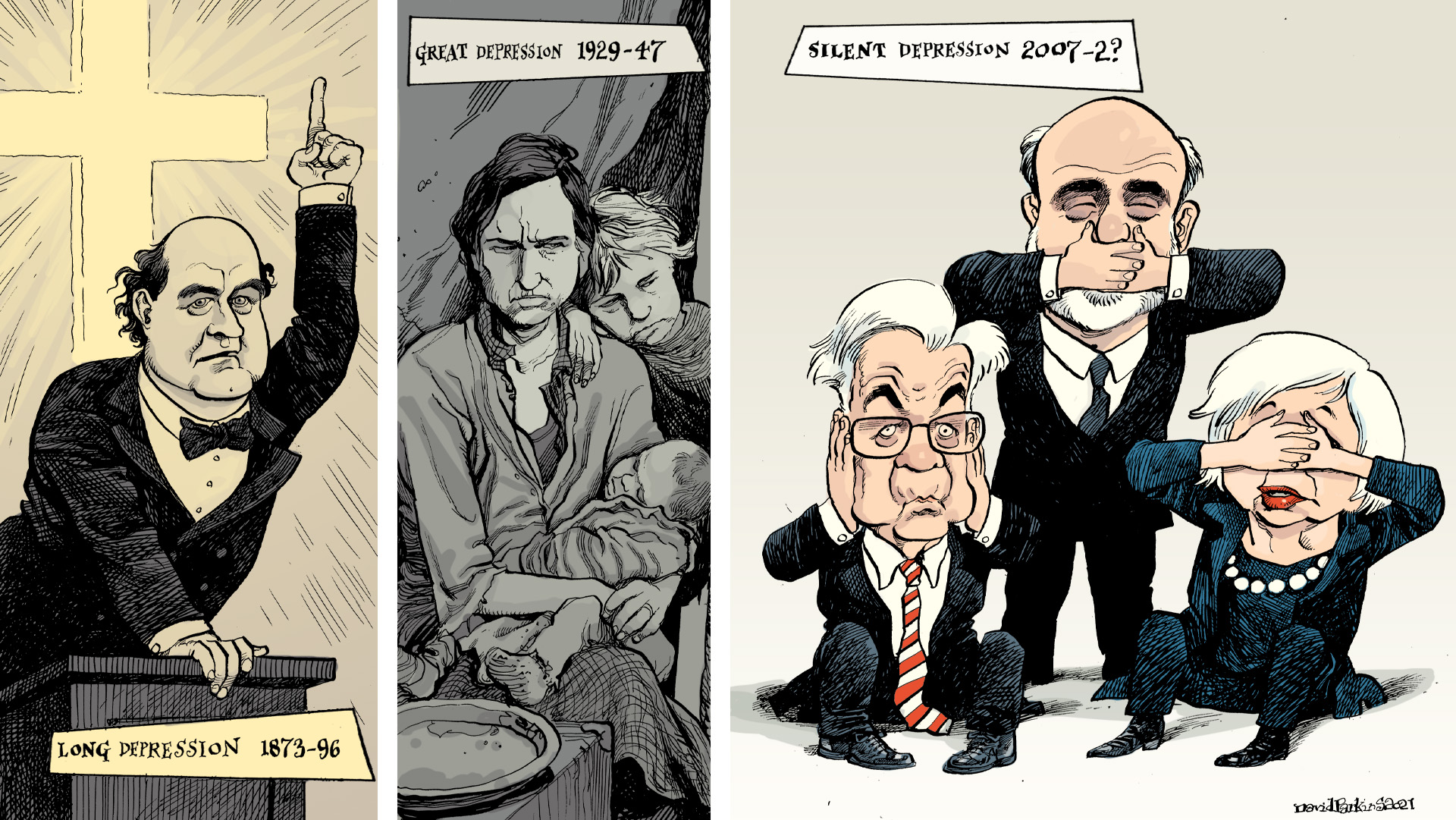

The US Treasury yield curve IS NOT inverted and, therefore, is not signaling a recession warning. But IT IS warning that the Federal Reserve’s reasoning to “taper” its quantitative easing program (i.e. economic recovery/health) is unfounded. We saw this in 2018. And 2014. And 2005.

———Sponsor———

Macropiece Theater with Alistair Cooke (i.e. Emil Kalinowski) reading the latest essays, blog posts, speeches and excerpts from economics, geopolitics and more. Interesting people write interesting things, why not listen and hear what they have to say? You could do worse things with your time (i.e. Bloomberg, CNBC, et cetera). Recent readings include thoughts from George Friedman, Lyn Alden, Daniel Oliver, Michael Pettis, the Bank for International Settlements and yes, even Karl Marx.

———See It———

Twitter: https://twitter.com/

Twitter: https://twitter.com/

Alhambra YouTube: https://bit.ly/2Xp3roy

Emil YouTube: https://bit.ly/310yisL

Art: https://davidparkins.com/

———Hear It———

Vurbl: https://bit.ly/3rq4dPn

Apple: https://apple.co/3czMcWN

Deezer: https://bit.ly/3ndoVPE

iHeart: https://ihr.fm/31jq7cI

TuneIn: http://tun.in/pjT2Z

Castro: https://bit.ly/30DMYza

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Pandora: https://pdora.co/2GQL3Qg

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

PlayerFM: https://bit.ly/3piLtjV

Podchaser: https://bit.ly/3oFCrwN

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

ListenNotes: https://bit.ly/38xY7pb

AmazonMusic: https://amzn.to/2UpEk2P

PodcastAddict: https://bit.ly/2V39Xjr

———Ep 136.2 Topics———

00:00 INTRO: The 2021 yield curve is a combination of 2013 (hope!) and 2018 (realism).

00:36 Debt ceiling relief has loosened collateral constraints in the US Treasury Bill market.

02:38 Will risk perceptions change for the reflationary with the debt ceiling delay? For long?

03:40 The yield curve, what information does it convey about risk-return perceptions of dealers?

07:26 During the 2013 Taper Tantrum the yield curve steepened – what does that mean?

10:28 Was the 2013 hawkishness and 2015-16 rate increases (two) a policy error by the Fed?

15:02 In 2021 the Fed announced a taper but there has been no yield curve celebration of it.

19:43 Fertility rates u-turned in 2008-11 for the same reason there was no 2020/21 baby boom.

20:41 OUTRO: The 2021 yield curve is a combination of 2013 (hope!) and 2018 (realism).

———Ep 136.2 References———

The Curve Is Missing Something Big: https://bit.ly/3jm0lNa

Alhambra Investments Blog: https://bit.ly/2VIC2wWlin

RealClear Markets Essays: https://bit.ly/38tL5a7

———Who———

Jeff Snider, head of global investment research for Alhambra Investments with Emil Kalinowski, Trevor Something listener. Art by David Parkins, coloured-pencil pamphleteer. Show produced by Terence, focused visuals. Podcast intro/outro is “Aurora Borealis” by Chill Cole found at Epidemic Sound.

Stay In Touch