In a very real sense, neither the current rate of PCE Deflator “inflation” nor any more expected to be added by the reported LABOR SHORTAGE!!! are what’s pushing the Federal Reserve toward its next taper error. The Fed doesn’t do money, so that’s not an option for them by which to set policy parameters.

All that’s left, then, is “expectations.”

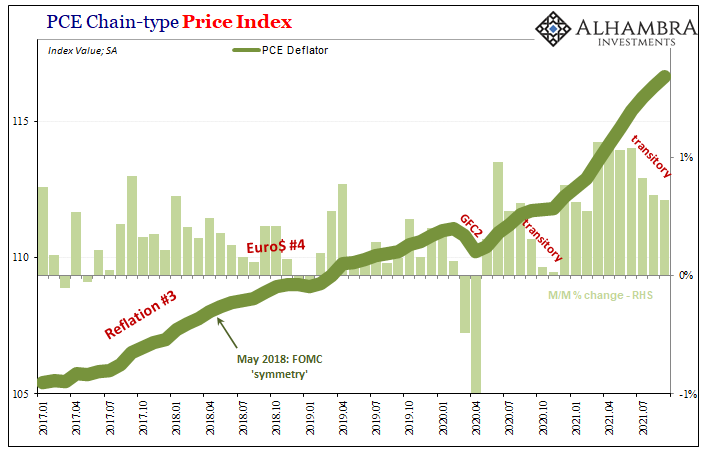

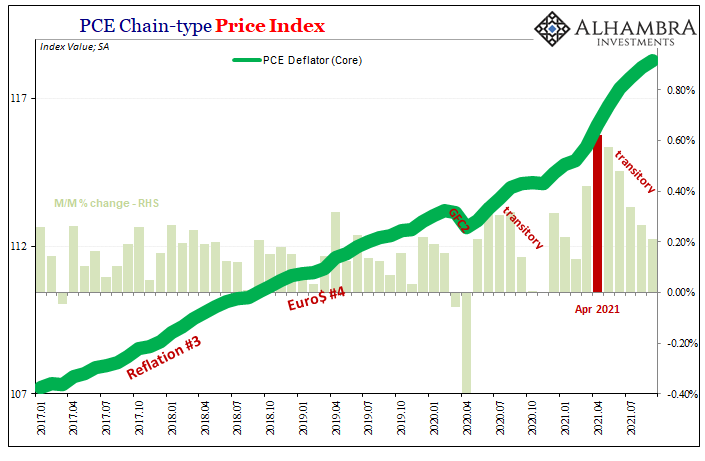

Jay Powell was perfectly clear (and correct, for once) about consumer prices earlier this year. Transitory. All the data, including the latest PCE stuff today, shows this is going to be the case. The increasingly obvious bends in all the various indices, including the headline despite stubborn energy prices, are rounding nicely into shape (and this shape is, believe it or not, a familiar one, as I’ll get to later today).

Hearing all about supply bottlenecks and logistical nightmares, port snafus and shipping rates, Powell is attempting to connect dots that aren’t really connectable – or even real. What’s got him concerned is that if non-economic price factors like those keep up and then the unemployment rate’s low level really does kick in sometime soon, then all these factors might just blend together in the consciousness of consumers and businesses.

Yes, these people aspire to the Amazing Kreskin rather than Walter Bagehot.

In short, nearly the whole FOMC like central bankers around the rest of the world (see: Australia) are equally terrified of something for which there is absolutely no empirical evidence. Zilch. Nada. Yet, because they don’t do money, this remains at the very center of their worldview anyway even if solely a matter of faith and cultish ideology.

Expectations.

Powell’s taper is about consumers who he suspects might increasingly normalize their personal thoughts and emotions to these various and unconnected price features because blended and added together they don’t appear like the same low (still unexplained) inflation of the previous decade. He wants to put the stop on it before these same consumers (as well as businesses) come to expect this is some new paradigm.

It has nothing to do with money, mind you, instead the FOMC’s job, as it sees itself, is to read your mind.

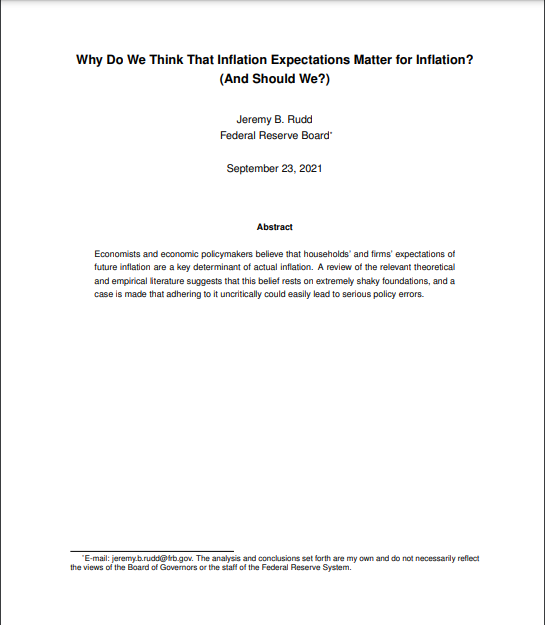

The fact that there is no sound basis behind this nonsense of expectations is what motivated the Federal Reserve Board’s Jeremy Rudd to write his recent scathing paper.

It all began with the Volcker Myth. Yes, myth. From Rudd:

Second, the fact that inflation’s stochastic trend manifests its last persistent level shift after the 1990–1991 recession also seems relevant, in that it suggests that ‘whatever happened’ to inflation might be more related to its actual level’s having been kept low rather than to any ‘credibility’ that the Fed gained as an inflation fighter following the Volcker disinflation.

I’ll translate in case you don’t speak econometrics: Economists hoped that “expectations” was a thing that could actually explain the real world they otherwise could not, and it seemed to be somewhat plausible until around, say, 2008 when it became increasingly and more obviously difficult to assign any value to the idea especially since it was all just made up in the first place.

Essentially, we’ve been lulled into believing that ever since Volcker “conquered” the Great Inflation the central bank only has to manipulate emotions to achieve its aims. And we are told to believe that is only emotions – certainly not money these Economists can’t define – which ultimately matter (circular logic).

Just how did the mythical, larger-than-life Volcker defeat inflation and set non-money monetary policy on this path? No one can actually explain it without resorting to this emotion-y hogwash (let me tell you, as I plan to do more, Volcker didn’t have a clue, either). Instead, you should be reminded of Stock and Watson’s far more honest assessment which seriously considered it could just as well have been “random good luck” as this other drivel.

Like Ben Bernanke’s ridiculous global savings glut, both that and random good luck are actually the same thing, the eurodollar system hiding from econometrics stuck purposefully outside their exceedingly limited economic/monetary worldview.

At least Mr. Rudd had the gumption to say the first part out loud, our naked “emperor”, even if he left the important second part out of it. As I wrote last week in response to this shortfall:

Whatever you think of consumer price behavior in 2021, it has not been due to excessive money printing or any money whatsoever, yet it is totally understandable why an exceedingly large proportion of the public thinks this way anyway and more than a few have still acted (especially financially) on those thoughts.

It isn’t even what the Federal Reserve does, a fact of operation preceding Paul Volcker. They know it, have known it, and know better that you don’t. Expectation theory has never been anything more than a coverup, trying and failing to fill in these gigantic inflationary blanks left over from monetary evolutions which stretch even further back in time.

Further and actual empirical proof in 2021 is being provided by transitory “inflation.” The Treasury Department simply accomplished what QE never could or will. But even though Treasury’s massive influence at least produced a couple camel humps, it isn’t lasting, either.

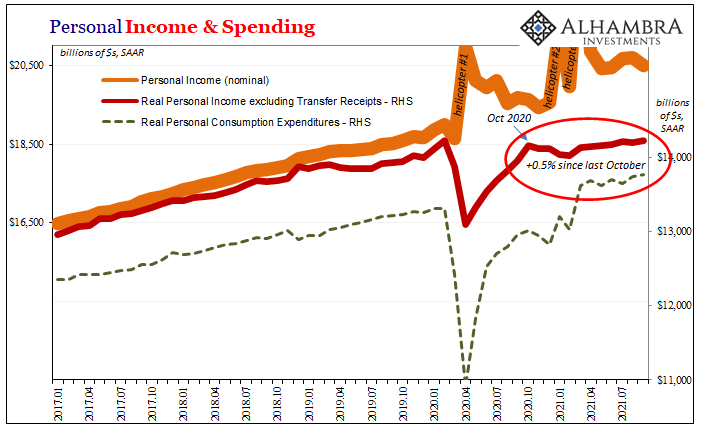

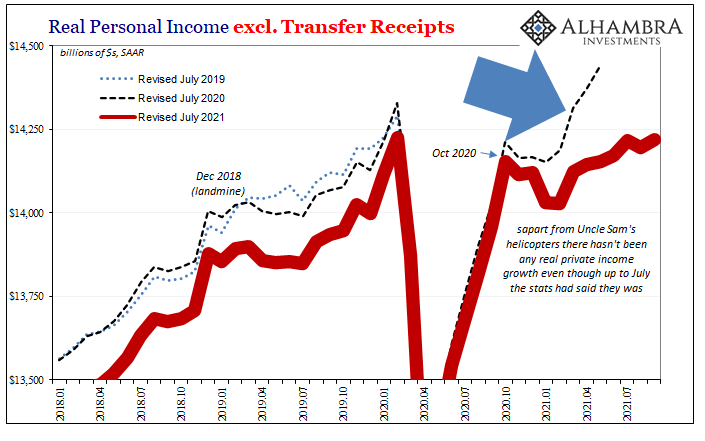

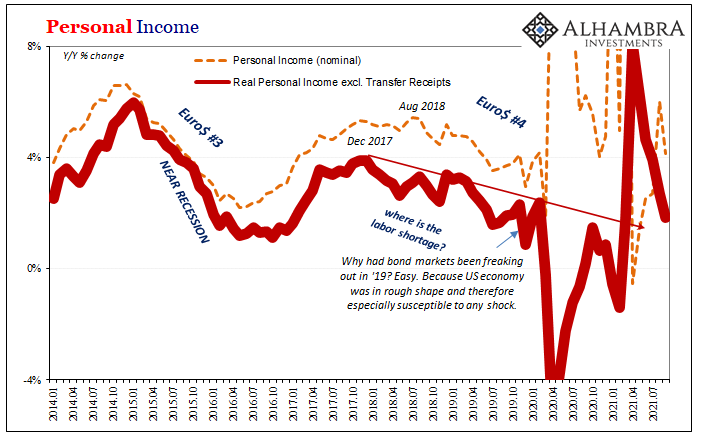

Without the money (lack of money therefore holding back labor and income; see: Real Personal Income ex Xfers below) consumer prices have to be something else. That “else” easily identified as a combination of helicopters and the supply imbalance.

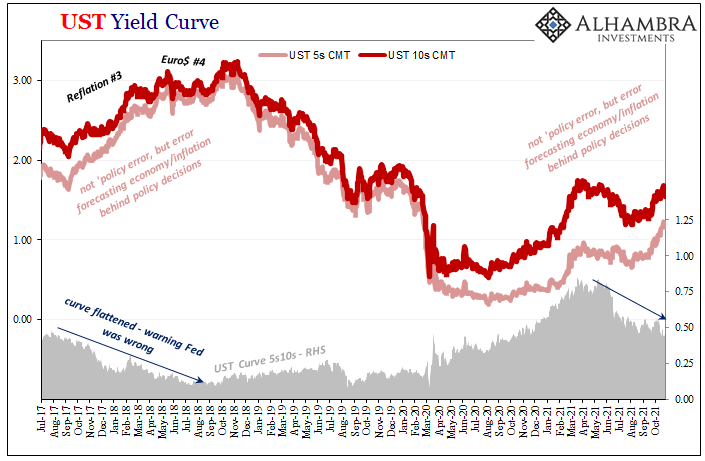

Jay Powell is worried that expectations won’t be able to reset before becoming “anchored” differently by this combination of issues having nothing whatsoever to do with money – and this absurd, unscientific astrology is what’s behind their rush to taper the already irrelevance of QE6. And it’s the same which is driving the yield curve flat.

No wonder Jeremy Rudd was incited to include the otherwise obvious; “And in some cases, the illusion of control is arguably more likely to cause problems than an actual lack of control.”

In the case of 2021 becoming 2022, that’s the Fed attempting to chase dreams and fantasies of inflation it presumes has begun to enter the minds of the population while a very real and increasingly priced out repeatedly deflationary “growth scare” comes at the real economy yet again. It’s truly mind boggling how many times I’ve had to write essentially this same ridiculous paragraph. That, unlike what the Fed has, actually is evidence.

Stay In Touch