There is no “decoupling”, at least there hasn’t been yet. Why would this time end up any different? The history of the term has itself changed over time, but by doing so has offered further proof this is a fact of global economic life in the post-August 2007 eurodollar era. It always goes like this: globally synchronized reflation (not growth); the transition out of reflation initially excused as decoupling; the inevitable globally synchronized downturn making a mockery of that idea for another time.

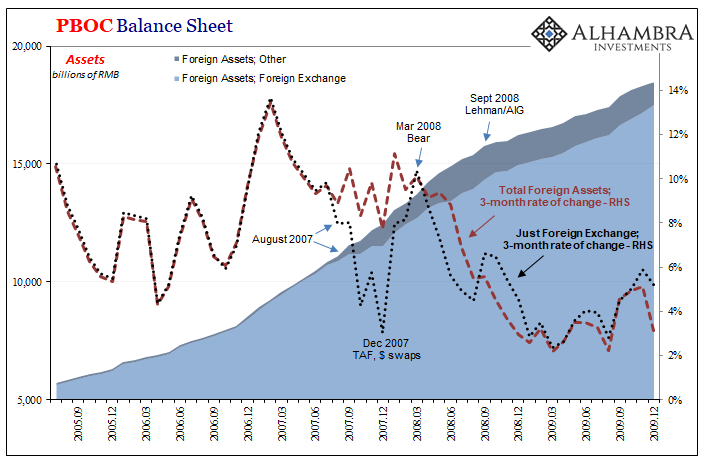

Back in 2008, the first version actually focused on the rest of the world’s ability to withstand US and European economic weakness. This was and remains the central problem; if you thought the Great “Recession” was about US subprime mortgages, then, sure, why not recession (how would that capture Europe, though?) limited to the US.

Instead, the coming re-synchronizing was already advertised on the Chinese central bank’s very own balance sheet. Lesson: in the end, before too long, the eurodollar comes for everyone if not all at the same time.

It would appear again in 2012 before coming back strong in 2014. Only in ’14, with the Fed tapering and then exiting QE’s 3 & 4, this time “decoupling” was flipped all the way around. The US (to a lesser extent Europe) was said to be rising and incredible, the “best jobs market in decades”, while China and emerging markets were sinking fast.

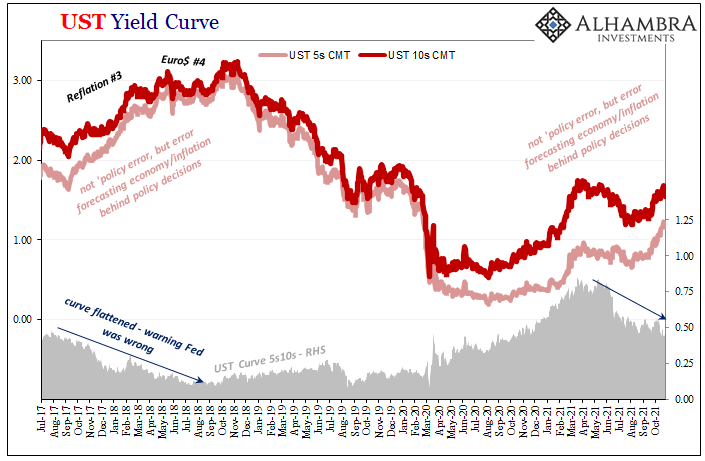

Warnings were all missed or dismissed (flat yield curve) so that by later 2014 only central bankers and their media could have still thought anything of “decoupling.” I wrote in November of that year:

This narrative rests itself upon the assumed divergence with China, of all global supply chain participants. Economists in the US see US recovery, but then puzzle about China’s well-documented sputtering; and therefore can only conclude of Chinese idiosyncrasies. The data just does not support that interpretation, though clearly China has its own internal imbalances weighing on currency circumstances.

The following year, 2015, as “unexpected” US economic weakness came about thwarting the Fed’s rate hike liftoff schedule, that version of decoupling took an intermediate narrative step toward “cleanest dirty shirt” before, by the end of the year, back to unmistakable uniform global downturn.

There really isn’t any insight to pointing out what is a highly visible repeating pattern, one that was established quite a long time ago and has been maintained through four completed iterations before the end of 2019.

As to the fourth, it went largely the same as the third in the sense of US “strength” unspoiled by again China’s woes. The difference reached its most in those middle months of 2018 even as the dollar rose and the yield curve again flattened. I wrote in mid-July:

So, sure, the US economy is fine. Why wouldn’t it be? Jerome Powell testified in front of Congress that he sees nothing to make him think otherwise. Especially global growth.

Make that globally synchronized growth.

And check out the contemporary headlines to that article (compiled by Mr. Simmons in Canada).

Within a few months, decoupling was dead; all mainstream assurances aside, for every last bit of Fed “hawkishness” the American economy ended up converging with China and Europe rather than the other way around before the entire lot was pulled further into the globally synchronized downturn of 2019.

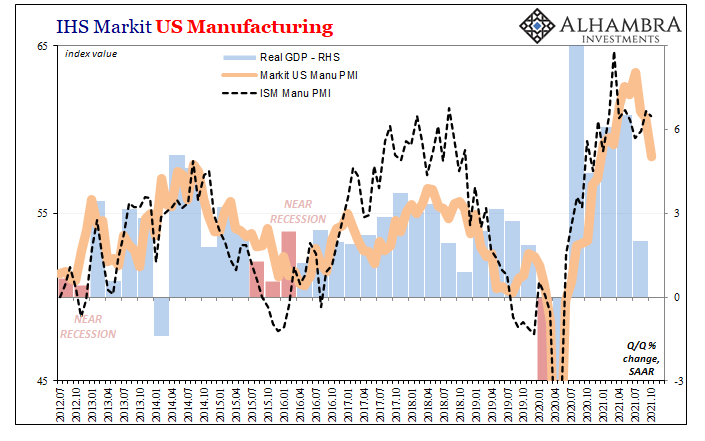

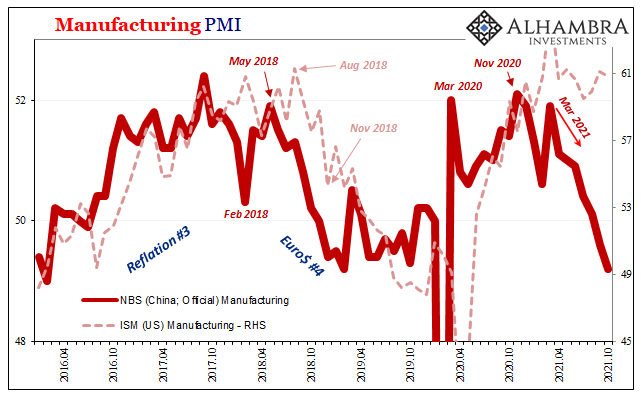

The Institute for Supply Management (ISM) reported today that its sentiment gauge for the domestic manufacturing sector declined ever-so-slightly in October 2021 from September. At 60.8, compared 61.1 the month previous, everything may seem to still to be humming along quite nicely.

This might hide, however, the hidden macro danger already being exhibited in those familiar other places around the world: from China to Germany and Japan right now.

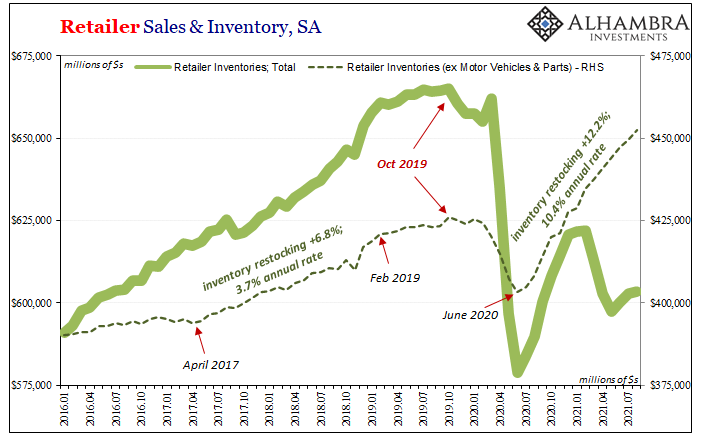

Inventory.

Despite social media being lit up with pics and posts of empty shelves, there is and has been an enormous glut of goods out there…somewhere. Retailers and wholesalers have been ordering, and have been receiving, even if it has been rough at times pushing that glut of goods over the goods economy’s mythical last mile.

The confidence to have stuffed so much stuff into the supply chain merely hoping something comes out on the other end has been placed in, oh boy, Economists. These priestly econometricians have been fully confident if not overconfident in actually decrying a “red hot” system already bubbling over into what they warn is “overheating.”

Inflation, or whatever.

But what would happen macro-wise should all that in-process inventory begin arriving while confidence in the priesthood once again predictably ebbs? Having seen the acts of ritual fade in exactly the same way four times already, one thing that’s for sure is American wholesalers and retailers not wishing to drown further in goods, they will call a halt to the stuffing.

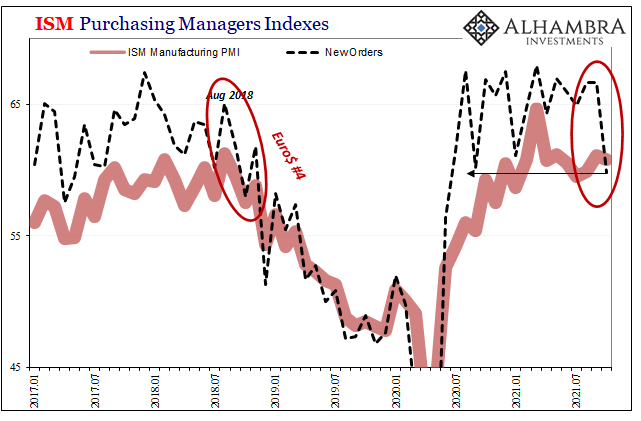

Orders.

This is what today’s ISM was really about. Though the headline remained sharp, as it has in the past, the New Orders component dropped sharply. While October’s 59.8 is nothing to suggest imminent recession, the fact that it was 66.7 for both August and September, and that 59.8 is the lowest since June of 2020, those facts begin to raise those same decoupling doubts we’ve grown accustomed to seeing repeat.

From August 2018 to October, the ISM’s New Orders index dropped from 65.1 to 58.0; and that had been across two months rather than one. These were two of the most highly contentious months, though, given the stance on “decoupling” right then.

And it’s not just a single month for a single sentiment survey component; if that was all then we might be more inclined to chalk it up to statistical noise, at most. Maybe it is for the ISM or the US manufacturing sentiment, but this trend has been developing all year in other places around the world, especially China.

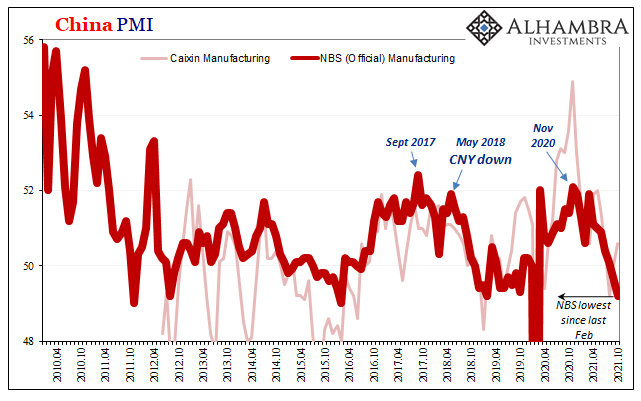

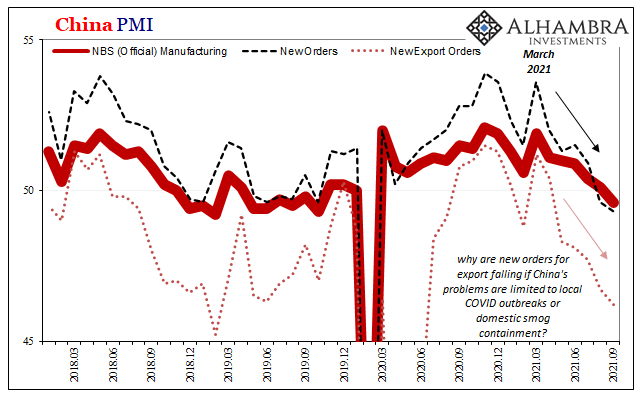

Last night China’s NBS reported another drop in the “official” Manufacturing PMI, down to 49.2 and blamed for a whole range of factors that make it seem otherwise as if this was nothing to do with increasing global weakness. On the contrary, the trend began all the way back in April which is the same month (March inflection) which has shown up all over the world (and all over markets).

The new orders index for Chinese manufacturing continues to fall, dropping to just 48.8 in October.

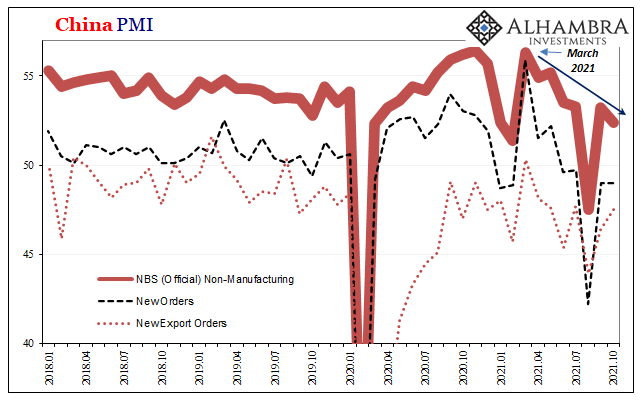

Relatedly, China’s Non-manufacturing PMI declined to 52.4 in October after having only rebounded to 53.2 in September following August’s delta COVID negatives. This low level, 52.4, is among the worst in the entire series, strong evidence that weakness isn’t really about the pandemic (government reaction to delta in August only made a bad situation that much worse).

These cycles continue to repeat because there is one thing, and only one thing, common to each. The excuses (from trade wars to subprime mortgages, now COVID) come and go with every “decoupling” transition, yet there is always the one uniting factor which governs the process.

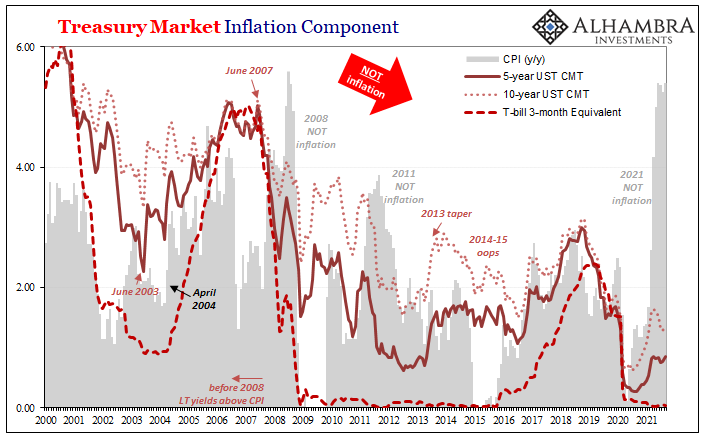

Inflation promises. Growth scare. “Unexpected” deflation.

Globally synchronized growth. Decoupling. Globally synchronized downturn.

Rinse. Repeat. Why? Because the world still thinks QE is money printing, and that inflation is the only kind of CPI.

Stay In Touch