Jay Powell and his group have been talking taper for months. The build up has been excruciating to some, if only because this central banker adjustment is supposed to mean something. Something especially big specially to bonds who just can’t thrive, everyone says, without the “monetization” of QE.

With first less and then no Fed, who will buy them? Too many Treasuries, right?

So, as the leadup to taper, yields that were gently rising were said to be inspired by this “hawkishness.” Then, even before the actual announcement Wednesday, yields have gone back down again, big move today, which is said to be because of how “dovishly” the FOMC handled the communications.

The real world is the opposite of the way we're taught. It's bonds that don't give a crap about what the Fed is saying (or doing).

— Jeffrey P. Snider (@JeffSnider_AIP) November 4, 2021

As usual, @Hedgeye nails it.

'Tantrum' https://t.co/z8so6xlI1p

But it’s not just UST’s that are seeing renewed bidding interest regardless of the Fed’s buying intentions, yields globally have been – as they often do – synchronized sinking.

Must also be “dovishness”, too, even as much of the world’s central banking clan is simultaneously “hawkish.” For every Bank of England holding rates, there’s the ECB out in front with its own tapering. A Bank of Canada or a Reserve Bank of Australia more than itching to stamp out the common “inflation” somehow supposedly behind both doves and hawks right now.

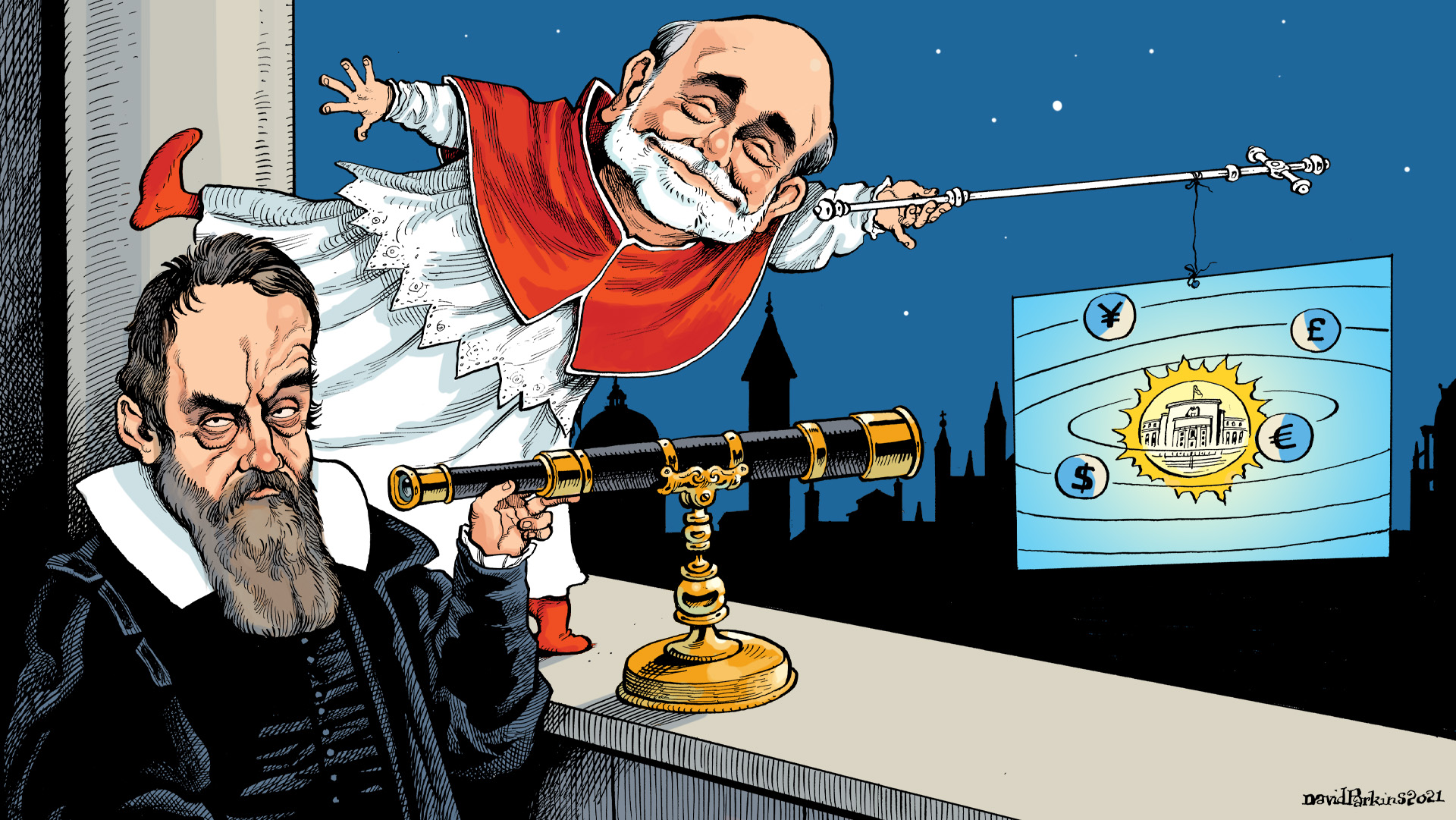

This is the tortuous and circular “logic” one has to keep up with in order to hold the central bank as the center of the financial and economic universe. If something happens, it must be because the FOMC wanted it to.

It only leads to this mass confusion which, on the other hand, is quite easily settled once you realize central banks are not central – not even in their own backyards.

They’re not even central banks.

A prime example, as I wrote on Taper Day, is taper itself:

They really believe that taper, which isn’t tightening in their view, could magically transform into that very thing if they don’t describe their plan in just the right way. And here you probably thought monetary tightening would have to do with, you know, not enough money.

According to Fed, taper only becomes tightening when the Fed doesn't describe taper the right way. It's basically magic.

— Jeffrey P. Snider (@JeffSnider_AIP) November 5, 2021

I'm not making this up. These people spend hours parsing adverbs, not money supply figures or definitions.https://t.co/PA6jnaT6y4 pic.twitter.com/swbxXrldi0

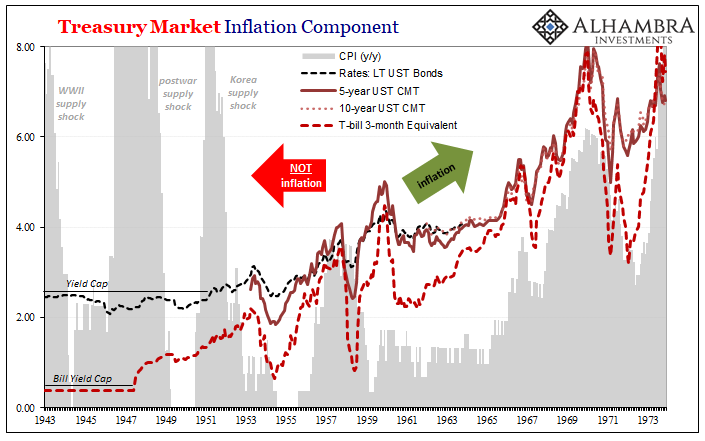

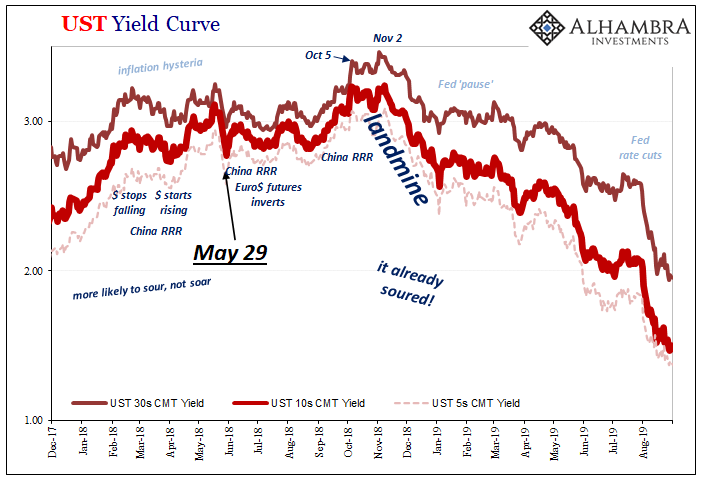

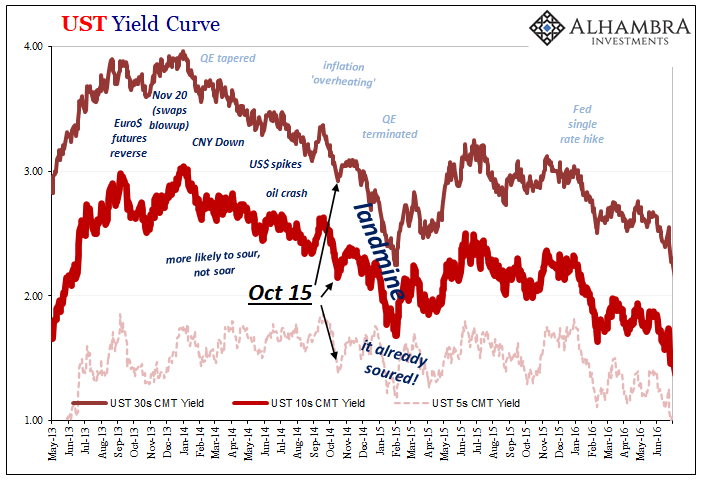

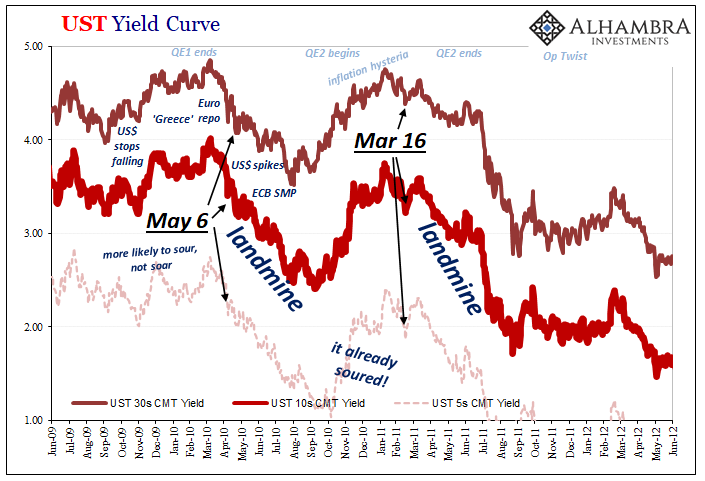

But Wednesday was actually the third instance of taper (fourth, if we keep count using real rather than central banker math), not the second. In truth, none of them matter though recounting each time one had happened – along with the one, QE2, which wasn’t tapered – is useful in its own way in extending your journey toward the light of monetary truth; the light shone most brightly by interest rates.

In recounting Taper #1, you still can only end up with the following:

Bank reserves were meaningless. Discussing the presumed merits of tapering or not tapering was itself meritless. There were no differences between stock or flow since there was nothing gained by QE.

Busy little bureaucrats had carved out a living interpreting the strange shadows dancing upon the walls of their restrictive little cave having no bearing on the actual outside world.

QE certainly did not lower interest rates (as even central banks nowadays quietly admit); the market sets them and it doesn’t really care for a second the imaginings of theoretical statistics. Either the program works; or it doesn’t. It fixes a real-world money problem, creating a realistic path to recovery and some inflation; or it leads the mainstream to perpetuate a fairy tale, a myth about “money printing” which then leaves the entire world exposed to the same monetary deficiency which had originally provoked the ugly cycle

The bond market can tell the difference and can tell you the difference.

Thus, today’s market action pays no mind to whichever bird otherwise tries to promote the Aristotelian, Ptolemaic worldview most convenient to the never-falsifiable inflation, red-hot economy theory. Even though we do this every couple years!

Shadows on the wall of the cave.

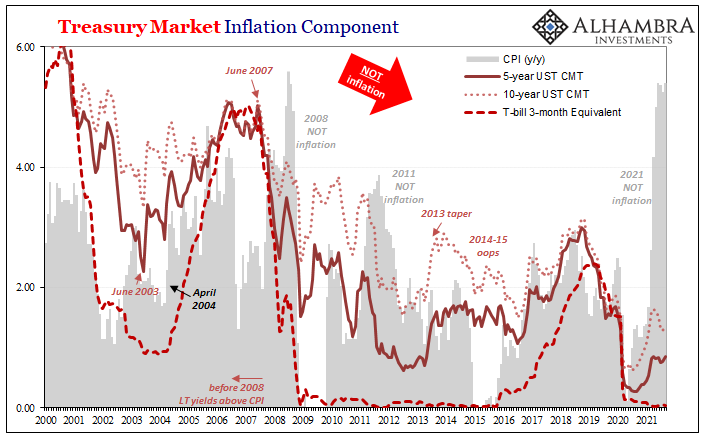

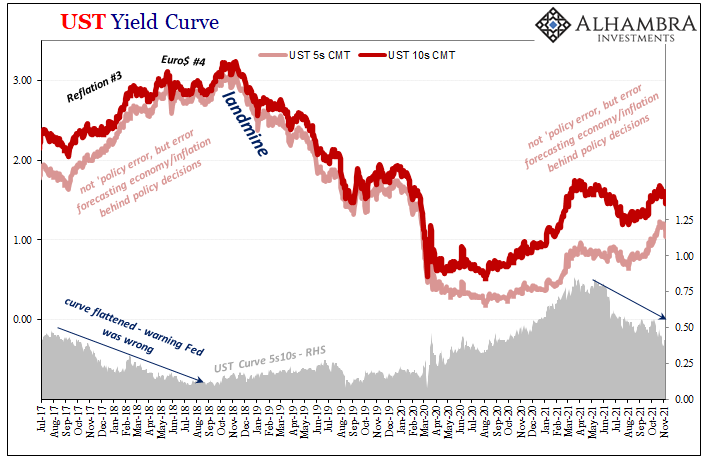

As it is turning out, more than two weeks and twenty bps since the last peak, it does more and more appear like typical seasonality – bonds, for whatever reasons, just don’t do very well in September and October. Every September and October. Outside of those very specific months, that’s when it can and does get real.

There’s potentially the 2017 version, more reflation into November; or the 2018 kind, living through the landmine. The latter much closer to the second (meaning third) taper experience in 2013.

Given the substantial drop in yields despite taper today a reality, next week will be an opportune time to brush up on landmines. These not some unlikely BOND ROUT!!!! are, in historical fact, the real tantrums.

Stay In Touch