Representatives in Congress from both parties were understandably apoplectic. Amidst the world’s worst monetary chaos since the Great Collapse after October 1929, legislators had been told by everyone from central bankers to all the right Economists how laws needed to passed right away, no delay, which would give the Bush Administration authority to buy up the “toxic waste” each had declared the underlying cause of the crisis.

Restore markets for subprime mortgages and the whole thing would be over.

The Emergency Economic Stabilization Act (you can always tell what won’t happen by the name of these things) took some doing, but the quick descent into panic and utter chaos pushed even the most reluctant lawmaker to take these unprecedented steps on October 3, 2008. The law established, among other controversial measures, the Troubled Assets Relief Program.

TARP, as it came to be known, gave Treasury Secretary Hank Paulson a $700 billion fund which was initially meant to do just what its name said. One of its chief supporters, Paulson had made it sound just this easy.

Not even two weeks later, however, on October 14 Paulson’s Treasury began using $250 billion of TARP funds to purchase the preferred stocks of eight “banks”: BofA saddled with ML; BoNY Mellon; Citigroup; Goldman Sachs; JP Morgan; Morgan Stanley; State Street; and Wells Fargo. Now the government is “recapitalizing” banks?

Even worse, early in November, Paulson again announced how TARP would be further altered this time for a deeper, more comprehensive bailout of Citi. Seems like the situation was only getting worse.

Understandably confused as to what in the hell was going on, why it was all going wrong despite all those previous reassurances, Congress demanded some answers. Called up to Capitol Hill to testify, the defiant disburser of TARP claimed:

When the facts changed and the circumstances changed, we changed the strategy. We didn’t implement a flawed strategy. We implemented a strategy that worked.

There are those to this day who swear subsequent events somehow proved Paulson had been right; that, like the later QE or ZIRP, without TARP the damage would have been far greater (jobs saved!) Even President-elect Barack Obama in mid-November 2008 was clearly coerced into opining, “I think the part of the way to think about it [changing TARP] is things could be worse.”

Was this true; had Paulson implemented a strategy that worked?

Of course not.

A more accurate way of describing events is far simpler and depends on not a single counterfactual: the original strategy was changed because it was doomed from the start.

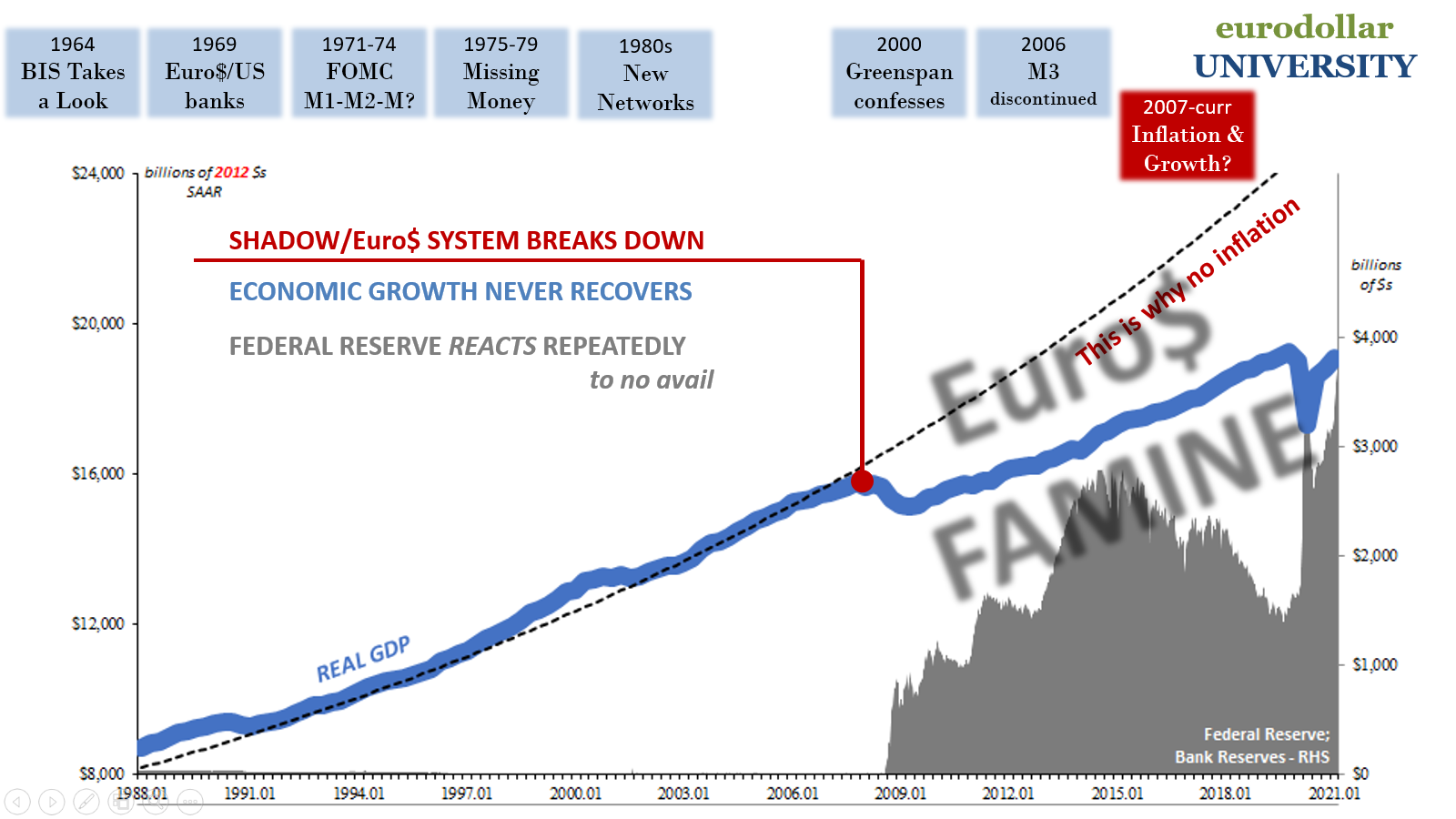

And because it was doomed from the start, a reactive TARP was forced by its own lack of effect into even more changes to its “plans” as the crisis spiraled further out of control. The more it did, the more the crisis did massive – and global – economic and financial damage as a result of these people not understanding the true nature of the calamity (dollar shortage, not subprime mortgages as relevant specifically to a program stupidly tied to the relief of troubled assets) and being left basically to throw everything at the wall in the vain hope something might stick.

Congress and the public were thoroughly confused, and remain so to this day. However, the monetary system itself (does not include the Fed) was not. This won’t just be the judgment of (honest) scholars looking back from the distant future freed from the outdated worldview, it was the contemporary position of the whole global bond market!

How do we know? Landmine.

And not just timed randomly, a landmine which struck several months after Lehman during which time All The Kings Horses and Men taking their escalating shots at Humpty.

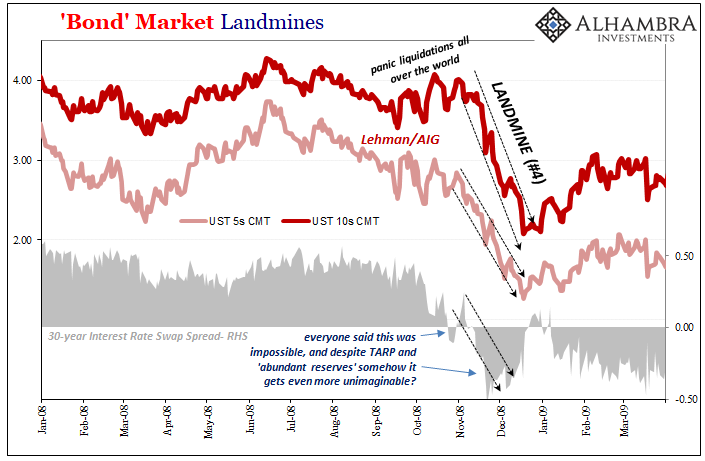

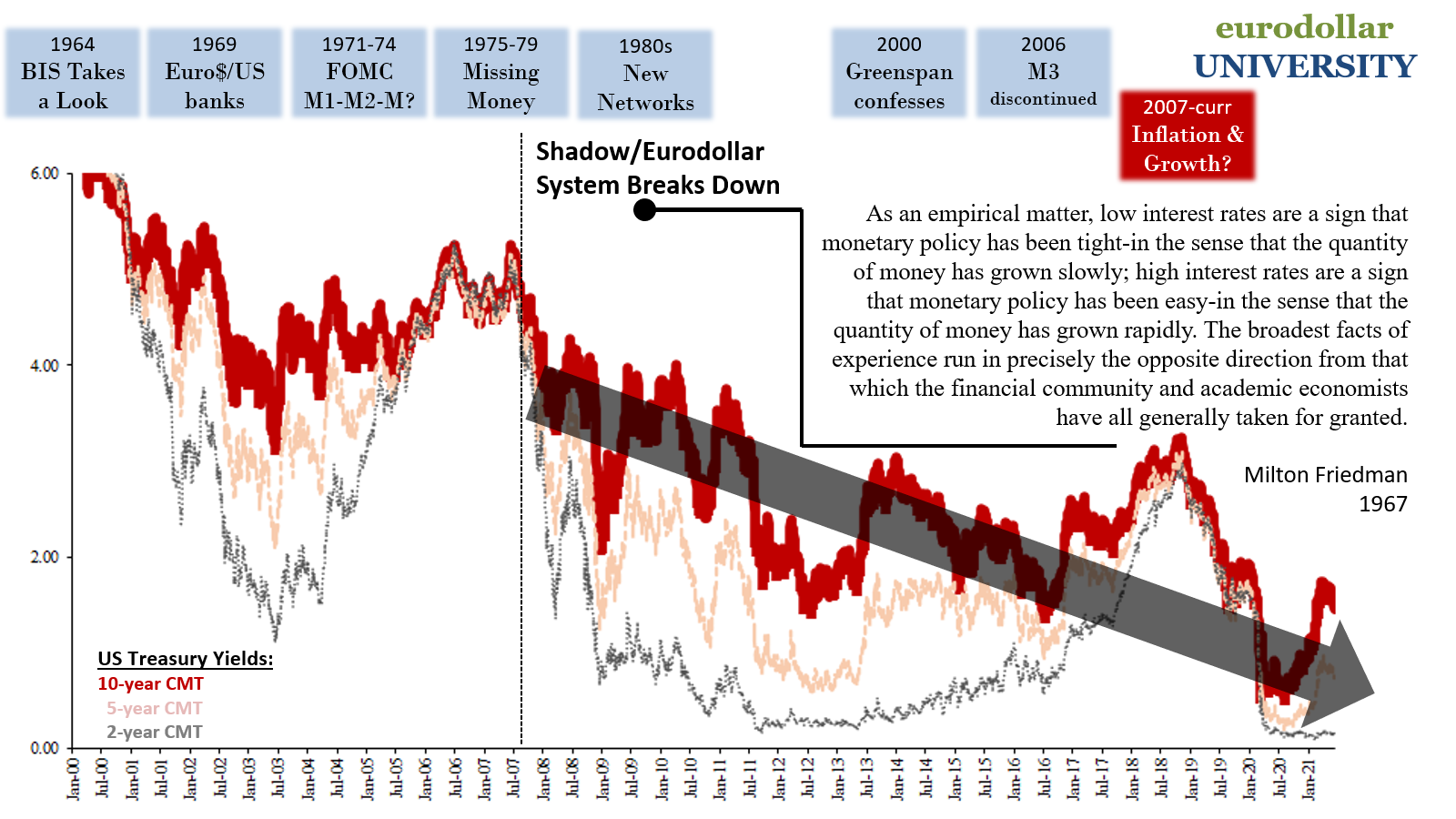

Between November 13, 2008, and December 18, in an incredibly short amount of time the 10-year US Treasury yield utterly collapsed, going from 3.84% to 2.08%. The 5-year UST had begun its sharp descent earlier, on October 31, dropping from 2.84% to 1.26% in just 33 trading sessions.

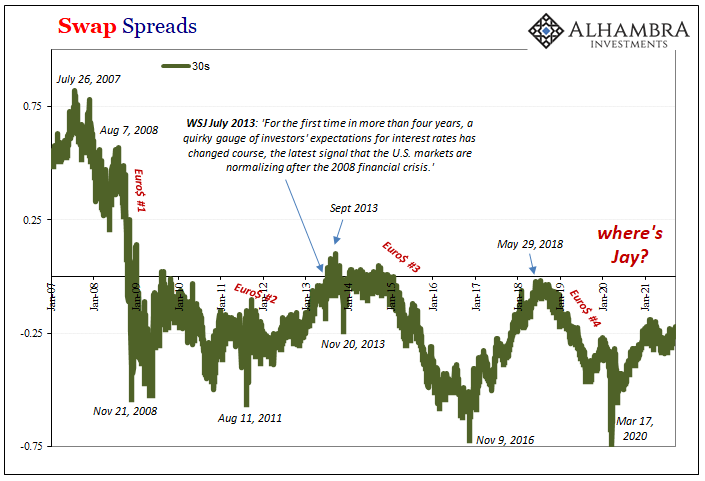

And it wasn’t just strictly UST’s, either. Interest rate swap spreads which had just weeks before turned negative for the first time, an outcome that was widely believed impossible (so incredibly unlikely the rumor mill was immediately flooded with stories of trading software unable to compute a negative swap spread input since no one bothered to code such a “ridiculous” possibility), these, too, would plunge further, falling deeper into the unimaginable.

The bond market wasn’t waiting for a payroll report or some negative statistic for Industrial Production to show it the massive economic disruption, that’s not what goes on here. On the contrary, it was trading on the more and more likely carnage which would be our global future out way past any economic data account – to the growing exclusion of all possibilities, beyond that point, of avoiding such a future fate.

Landmines represent taking a step past some certain point of no return. In the case of #4, that step was when policymakers showed their cards and proved they had nothing other than some despicably weak bluff(s).

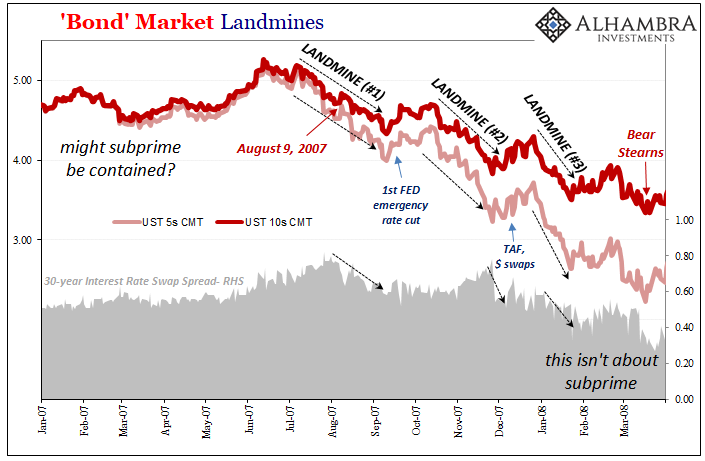

Furthermore, this November/December 2008 landmine wasn’t the crisis’ first, rather its fourth. Yes, there had been three in succession triggered the summer before, almost back-to-back-to-back landmines from July 2007 until January 2008 which had brought these later possibilities into initial view. Each one was clearly associated with escalation rather than mediation of onrushing monetary trouble presaging eventually unrestrained chaos.

The first from July 9, 2007, to September 10, would include the paradigm shifting events taking place on August 9 and signaled how the situation couldn’t possibly be contained. The second following the Federal Reserve’s initial response, a pathetic emergency 50 bps rate cut in mid-September, began October 15 (as stocks had hit a record high) lasting to November 26 indicating the uselessness of the rate cut. Repeating the same pattern, the third landmine kicked off on December 26 despite the Fed’s escalating into full-blown crisis TAF Auctions and overseas dollar swaps, the steep drop in yields lasting to January 23, 2008, and instead pricing events and conditions precipitating Bear Stearns by mid-March.

What these had represented was how there weren’t available answers and that we would pay the price for it in the monetary destruction of growth and opportunity; to remind us, among other things (like collateral), of Irving Fisher’s long-ago decomposition of bond yields into long run perceptions of those critical fundamentals.

By that fourth landmine harshly judging TARP idiocy, it was growth and opportunity which were slammed completely shut in a verdict rendered in real-time by interest rates the conventional view demands we think of as “stimulus.” That’s merely the final illicit bit of illiteracy which perfectly encapsulates the gross ineptitude also captured by these repeated bond market flushings.

The thing by which the public is led to believe indicates policies are working, low rates, are actually a conclusive sign they didn’t and they won’t because they couldn’t nor can.

Before the fourth one, this was a future increasingly bad but one still with some hope that maybe the emergency would provoke an epiphany, a legitimate response even if by, to borrow a phrase, random good luck. When Hank simply changed TARP (and Bernanke tried talking confidently about “abundant” reserves), the discounting took stock of how these people really had no answers, and then priced a very different and dire future swapped in the bond market equivalent of a blink of an eye.

Again, it’s not bonds reacting to some pieced-together piecemeal data reports, it is the monetary system itself taking account of the real world from the closest possible proximity to the real world. It is telling you – and everyone including the Hank Paulsons and Ben Bernankes of the world – how things are actually going on the ground from inside the invisible hand of modern market economies which depend so much on monetary sufficiency.

The steep drop in yields during these things is essentially the most visible confirmation of a forthright, irreconcilable deflationary shift to the acceptable (meaning realistic) probability spectrum.

The economic data comes along only later to confirm the increasingly awful possibilities bonds have already priced (see: later benchmark revisions to 2019 in the wake of 2018’s landmine).

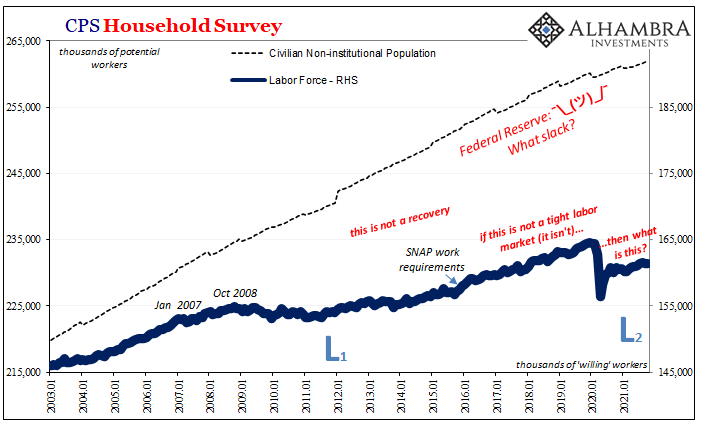

QE, ZIRP, TARP, ARRA, etc., cries of wicked inflationary money printing, it needs to be pointed out how that final landmine had really judged the long run situation near perfectly; in that, the monetary destruction being undertaken by the global economy really did have long-lasting repercussions far into the future.

In terms of US Treasuries, the 10-year yield which last had been 4% on October 31, 2008, when on the verge of the final crisis landmine, it would revisit 4% just one more time (April 5, 2010) in all the years since! Swap spreads have never normalized, or even come close; the 30-year spread briefly positive in the summer of 2013, at most flirting with zero until plunging backward early in 2015.

Does any of that, along with all the clear economic data rolling in later, picture more than a decade of success and stimulus as Secretary Paulson once tried to claim? Or, had Landmine4 told you at the time in real-time it hadn’t and wasn’t, so there was no going back?

Sorry Hank. No luck Ben. The only honest answer is unambiguously the latter.

Up next this week, the post-crisis landmines; what they look like and why they represent something similar.

Stay In Touch