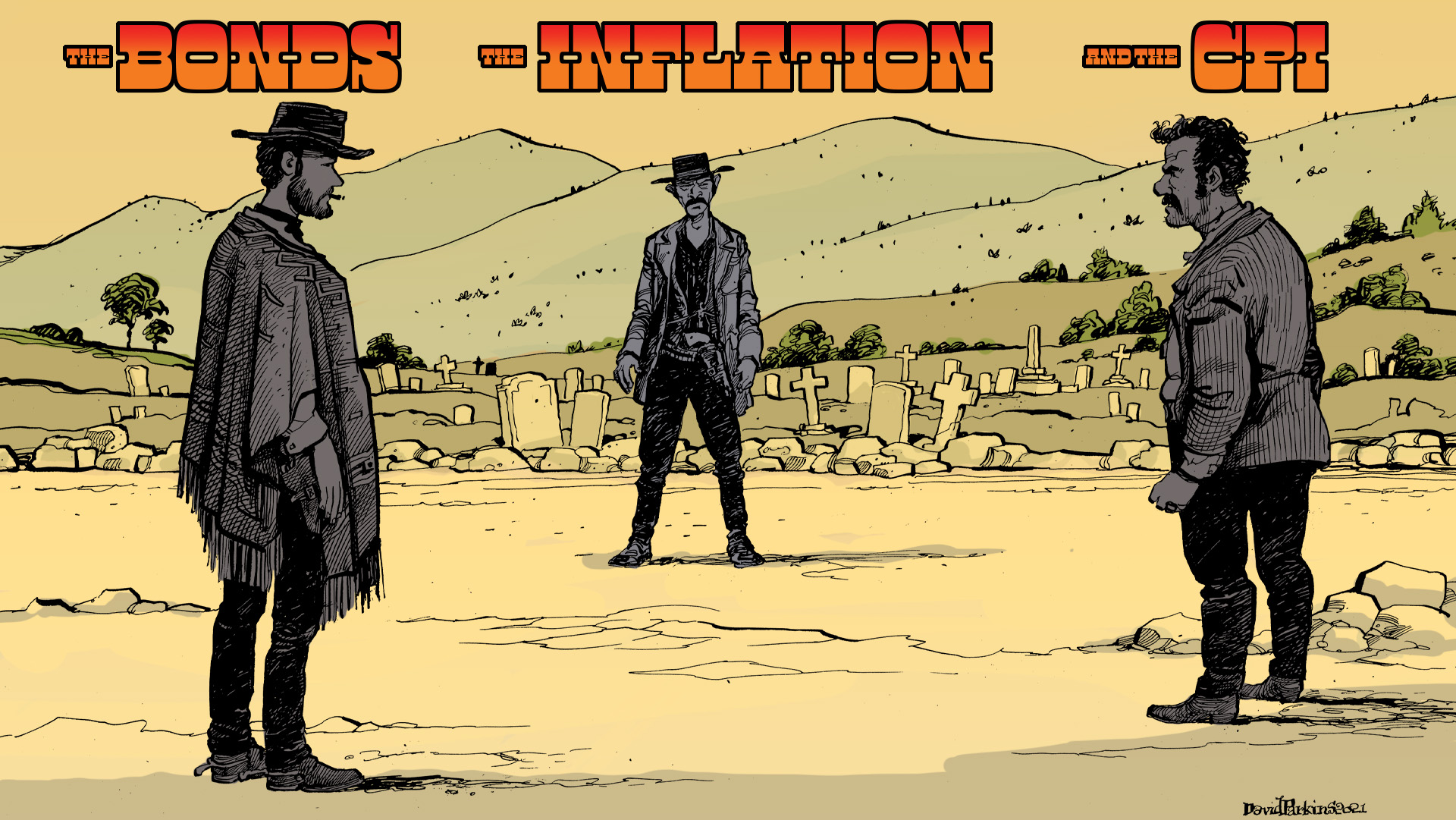

150.1 Huge 1950s CPI-Surge was Transitory, Not Inflation

———Ep 150.1 Summary———

An early-1950s US consumer buying-binge sent the Consumer Price Index soaring. Inflation!? No. It was a transitory supply/demand imbalance brought on by (geo)political factors. The bond market knew it and didn’t overreact. And what about the Federal Reserve? They overreacted.

———Sponsor———

Macropiece Theater with Alistair Cooke (i.e. Emil Kalinowski) reading the latest essays, blog posts, speeches and excerpts from economics, geopolitics and more. Interesting people write interesting things, why not listen and hear what they have to say? You could do worse things with your time (i.e. Bloomberg, CNBC, et cetera). Recent readings include thoughts from George Friedman, Lyn Alden, Daniel Oliver, Michael Pettis, the Bank for International Settlements and yes, even Karl Marx.

———See It———

Twitter: https://twitter.com/

Twitter: https://twitter.com/

Alhambra YouTube: https://bit.ly/2Xp3roy

Emil YouTube: https://bit.ly/310yisL

Art: https://davidparkins.com/

———Hear It———

Vurbl: https://bit.ly/3rq4dPn

Apple: https://apple.co/3czMcWN

Deezer: https://bit.ly/3ndoVPE

iHeart: https://ihr.fm/31jq7cI

TuneIn: http://tun.in/pjT2Z

Castro: https://bit.ly/30DMYza

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Pandora: https://pdora.co/2GQL3Qg

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

PlayerFM: https://bit.ly/3piLtjV

Podchaser: https://bit.ly/3oFCrwN

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

ListenNotes: https://bit.ly/38xY7pb

AmazonMusic: https://amzn.to/2UpEk2P

PodcastAddict: https://bit.ly/2V39Xjr

———Ep 150.1 Topics———

00:00 Intro: Bond yields don’t price the Consumer Price Index, instead they focus on inflation.

00:55 CPI is affected by both money (inflation) and supply/demand imbalances (transitory).

03:38 In 1950 the US economy saw a consumption surge.

08:49 In September 1950 US Congress passed the Defense Production Act – to control the economy.

10:10 The Defense Production of 1950 never sunset and was never repealed.

11:42 Consumer prices surged starting in July 1950 – due to a supply shock / demand surge.

13:52 The Federal Reserve decided that the 1950 CPI surge meant (monetary) inflation.

16:16 The Federal Reserve decided in 1936/37 and 1947/48 that inflation was imminent too.

18:37 In 1950 the US economy saw a consumption surge, a CPI surge but not a bond yield surge.

22:59 Outro: The modern Fed came about when they misinterpreted a CPI spike for inflation.

———Ep 150.1 References———

The Federal Reserve’s Policy Deficit Has Always Been About Money: https://bit.ly/3bJsxFg

Alhambra Investments Blog: https://bit.ly/2VIC2wWlin

RealClear Markets Essays: https://bit.ly/38tL5a7

———Who———

Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Art by David Parkins, quickest draw in the Wild West. Podcast intro/outro is “Electro Animal” by Oh the City found at Epidemic Sound.

Stay In Touch