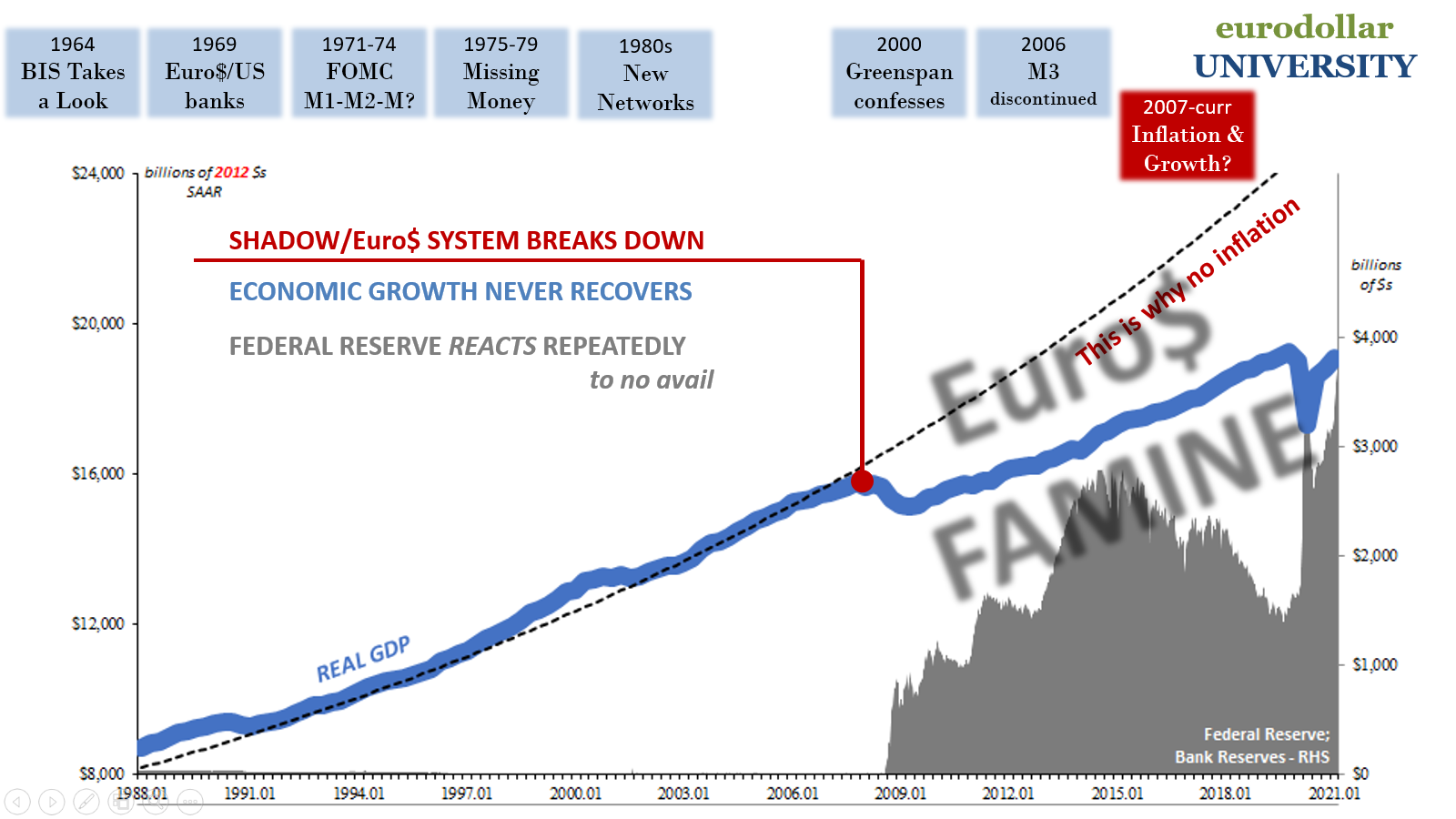

Picking up where we left off from our review of the first series of landmines, including the big one at the end of 2008, the world has been rocked by these things in almost continuous succession. Every couple of years, “everyone” says the world is recovering from the previous “unexpected” shock only to find instead how the global system ends up stepping on another.

So, is this landmine a reaction, or the thing itself?

Sort of both. It is the bond market telling us in real time what’s actually going on in the monetary system as the economy. If conditions in either, likely together, are tilting the wrong way, then we’d see that reality get priced in lower growth and inflation expectations – falling yields.

But what might be happening today isn’t necessarily conclusive; that is, maybe things are going wrong though it’s not quite clear whether wrong today will lead to wrong tomorrow as well as many more tomorrows.

Everything is filtered through a potentially wide probability spectrum.

The distinction of the landmine is such that the market judges collectively – and forcefully – that whatever is going wrong today has gone wrong in such a way so as to reorient that spectrum further toward the downside. The real monetary system malfunctions and the real economy gets hammered by it, leaving almost no doubt as to the longer run implications.

Yields don’t just fall on rising potential downside risks in both money and economy, they plummet as the probability of reflation or general optimism likewise collapses.

In this way, the landmine is almost like a black hole. It exerts substantial monetary attraction on the real economy, this deflationary potential acting like gravity, but before crossing the event horizon there is still a chance to escape the slide further toward oblivion. The closer the system is pulled toward the horizon, the more yields will decline as the probabilities of breakout – by whatever means – more and more diminish.

The landmine is when we cross over the event horizon; on the other side there’s little to no hope of turning everything back around, nothing escapes what is no longer downside risk it has instead become just plain downside reality.

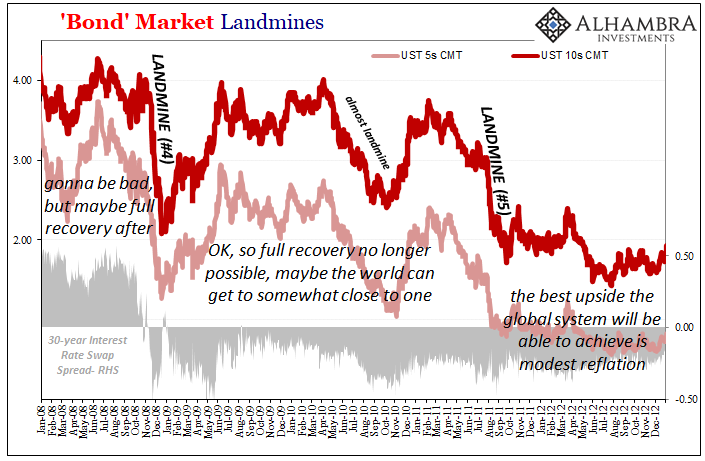

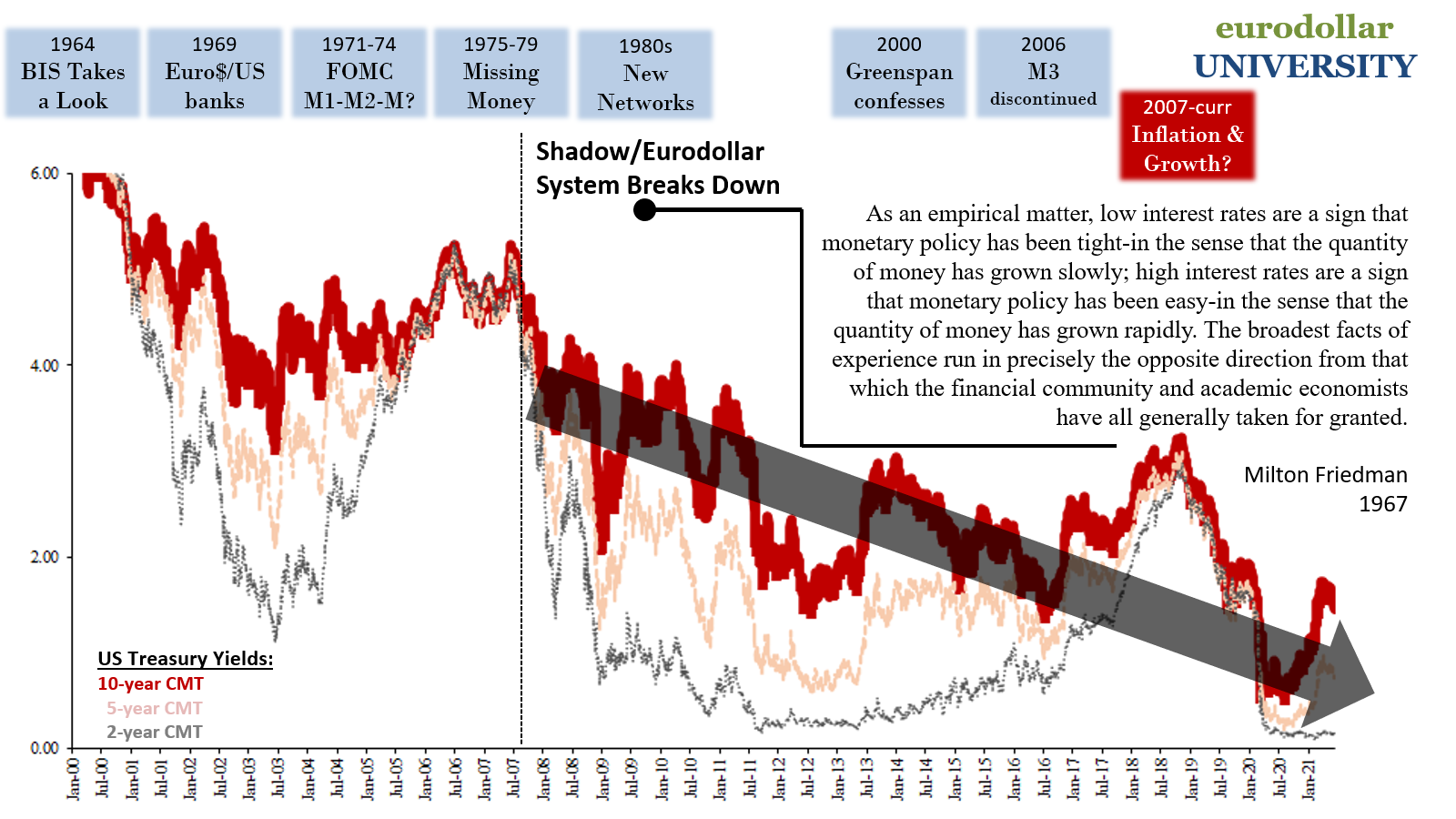

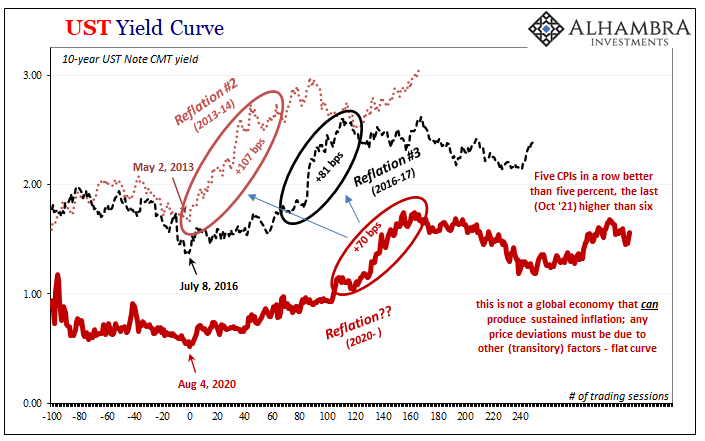

Following 2008’s big one, the fourth one, what we see in and of these post-crisis landmines is, essentially, a ratchet effect. Passing beyond subsequent new ones, that is the bond market judging the probabilities of reaching closer to recovery (or inflation) as being permanently lessened every time.

Yields between 2008’s #4 and the next one, 2011’s #5, rate actions were basically saying that while the possibility of full recovery had fallen to zero after #4, the chance the global economy might get somewhat close to recovery remained a realistic opportunity.

But then the middle of 2011.

Even the Fed, in private, realized the first part of the landmine’s topology. In early August 2011, as it was taking place, with everything going wrong some unusual honesty in the FOMC conversation:

MR. TARULLO. Despite the past year’s debate in which we’ve had different views, every member of this Committee is united in having been too optimistic. I think that the most pessimistic among us, of whom I was one, certainly did not expect that growth over the past four quarters would be only about 1.6 percent, and would not have thought so even if we had been told about the impact of Fukushima. Who among us today would stand behind the projections we made last year for GDP growth during this year—and particularly in the second half of this year? Almost none, if any, I suspect.

And yes, economic growth – lack thereof – can and does have an impact on financial and money conditions. These actually feed back on each other as risk aversion, which dampens money thereby creating more strain on the economy causing even more risk aversion.

Again, bond yields the combination of opportunity and risk. Even Ben Bernanke had trouble with the usual FOMC self-denial at that moment:

CHAIRMAN BERNANKE. I think instead that there are some important connections between what’s happening in the financial markets and what’s happening in the economy. First of all, financial markets are giving us information. They’re telling us that there has been a general darkening of mood and expectations about where the economy is going. Second, financial conditions themselves have real effects on the economy. Not just lower asset prices, but increased stress and reduced risk-taking will affect the ability of the economy to recover. [emphasis added]

Bingo. Past failures don’t dissipate into history, the system actually piles them on top of each other. They are cumulative.

Therefore, this July/August 2011 landmine was the bond market saying that even the downgraded assumptions in growth and “recovery” before then had to be further downgraded. Not just about the prospects for 2011 or 2012, but, like the prior, the long run potential.

Where not-quite-recovery might have been somewhat plausible in that 2009 to early 2011 period, this second monetary breakdown (Euro$ #2) which was shattering all those “having been too optimistic” Fed projections was priced in bond yields as another turn of the ratchet; from not-quite-recovery to then not-going-to-get-close.

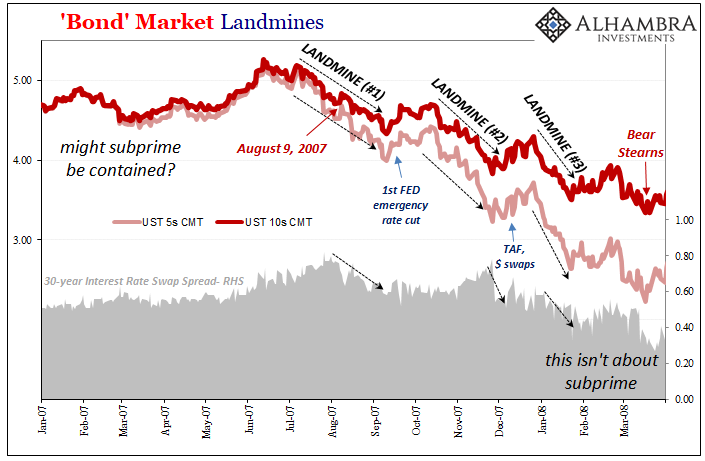

There’s much to understand just in just this four-year sequence between the first landmines and this other: before Landmine #1-3 in 2007, there was a chance “subprime” mortgages would be contained. After them, in early 2008, there wasn’t. Global dollar shortage inevitable.

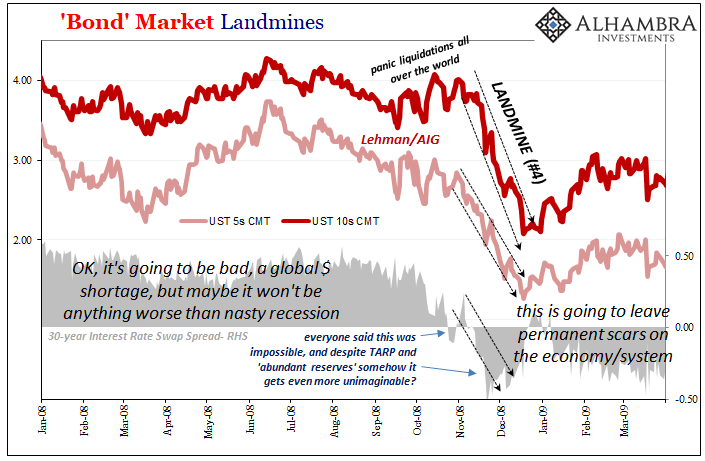

Before Landmine #4 around November 2008, there was a chance that even after the developing monetary crisis, maybe the global economy could emerge with no more damage than a nasty but not permanent recession. After, it was clear GFC1 was going leave lasting scars.

Before Landmine #5 in the middle of 2011, there was a chance that though the world economy wouldn’t be able to fully recovery, it could get somewhat close to one. After, the best the global system would be able to achieve is modest reflation which is really no more than the absence of further contraction.

The primary reason why these things are so bad is that they are another and further reminder how for all the bluster and certainty in the mainstream in practice it has been shown and proven there is no fix; the monetary system which began to break down all the way back during Landmine #1 would continue to produce negative economic and financial consequences that no ridiculous QE or forward guidance could do anything about.

There’s always the next breakdown.

Each subsequent post-crisis landmine has been the bond market acknowledging each subsequent monetary interruption and registering its further negative consequences on real economic potential.

In this way, the latest landmines are the most visible signal of when that next turn of the ratchet has taken place; they mark the calendar spot when reflation possibilities leftover from the last landmine, whatever limited upside potential, gets exhausted.

The entire world is weaker still. Thus, yields go even lower, and won’t ever fully retrace.

Next week, the relevance of the 2018 landmine as well as what any 2021 repeat could mean for well beyond 2022.

Stay In Touch