157.2 The US Treasury Bond Market “Landmine” is Primed

———Ep 157.2 Summary———

The “landmine” has been part of each of the four global/regional dollar squeezes of the past 14 years (2007-09, 2011-12, 2014-16, 2018-20). The “landmine” is when US Treasury Bond yields decline precipitously and signal that economic potential has been seriously maimed. Where are we in 2021?

———Sponsor———

Macropiece Theater with Emil Kalinowski (a/k/a Alistair Cooke, a/k/a Alistair Cookie) reading the latest essays, blog posts, speeches and excerpts from economics, geopolitics and more. Interesting people write interesting things, why not listen and hear what they have to say? You could do worse things with your time (i.e. Bloomberg, CNBC, et cetera). Recent readings include thoughts from: Adam Smith, Arthur Schopenhauer, Bank for International Settlements, George Friedman, J.P. Koning, Jean-Paul Sartre, Karl Marx, Liberty Street Economics, Lyn Alden, Maroon Macro, Matt Stoeller, Michael Pettis, Myrmikan, Perry Mehrling, Robert Breedlove, Rohan Grey, Velina Tchakarova and yes, even Jeff Snider.

———See It———

Alhambra YouTube: https://bit.ly/2Xp3roy

Emil YouTube: https://bit.ly/310yisL

———Hear It———

Vurbl: https://bit.ly/3rq4dPn

Apple: https://apple.co/3czMcWN

Deezer: https://bit.ly/3ndoVPE

iHeart: https://ihr.fm/31jq7cI

TuneIn: http://tun.in/pjT2Z

Castro: https://bit.ly/30DMYza

Google: https://bit.ly/3e2Z48M

Reason: https://bit.ly/3lt5NiH

Spotify: https://spoti.fi/3arP8mY

Pandora: https://pdora.co/2GQL3Qg

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

PlayerFM: https://bit.ly/3piLtjV

Podchaser: https://bit.ly/3oFCrwN

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

ListenNotes: https://bit.ly/38xY7pb

AmazonMusic: https://amzn.to/2UpEk2P

PodcastAddict: https://bit.ly/2V39Xjr

———Ep 157.2 Topics———

00:00 Intro: UST yields were falling from late-Oct thru early-Nov despite all the ‘good news’.

01:39 A “landmine” is a precipitous fall in UST yields, indicating serious economic malfunction.

04:26 A “landmine” is part of the regional/global dollar shortage process.

05:30 The Global Financial Crisis featured four “landmines”, the last one was ‘perfect’.

07:29 A review of the autumn-2008 “landmine”; it occurred after TARP, Lehman, AIG, et cetera.

11:46 The first three “landmines” coincided with ineffective government actions.

14:59 A “landmine” struck in 2014 too, during the Third Eurodollar Crisis.

17:30 Outro: Presently, conditions for a “landmine” were and are in place.

———Ep 157.2 References———

Landmine Review: The Big One: https://bit.ly/3EXXEJY

Landmine Lurking, Gotta Make Tantrum Happen Before It’s Too Late (again): https://bit.ly/3wBZ3mi

Alhambra Investments Blog: https://bit.ly/2VIC2wWlin

RealClear Markets Essays: https://bit.ly/38tL5a7

———Who———

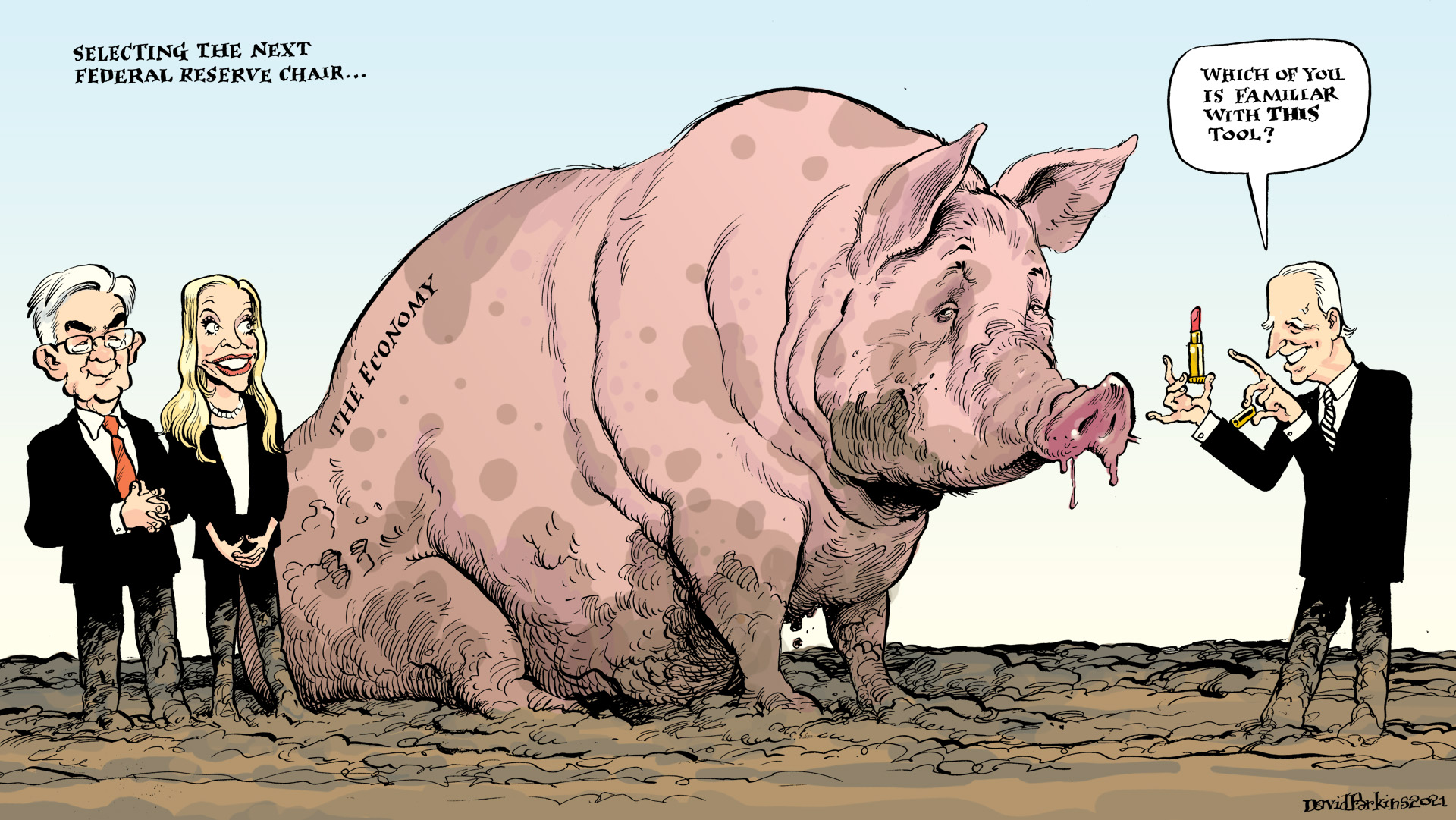

Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Art by David Parkins, lipstick lampoonist. Podcast intro/outro is “Moonshiner’s Turn” by Martin Landström found at Epidemic Sound.

Twitter: https://twitter.com/

Twitter: https://twitter.com/

Art: https://davidparkins.com/

Stay In Touch