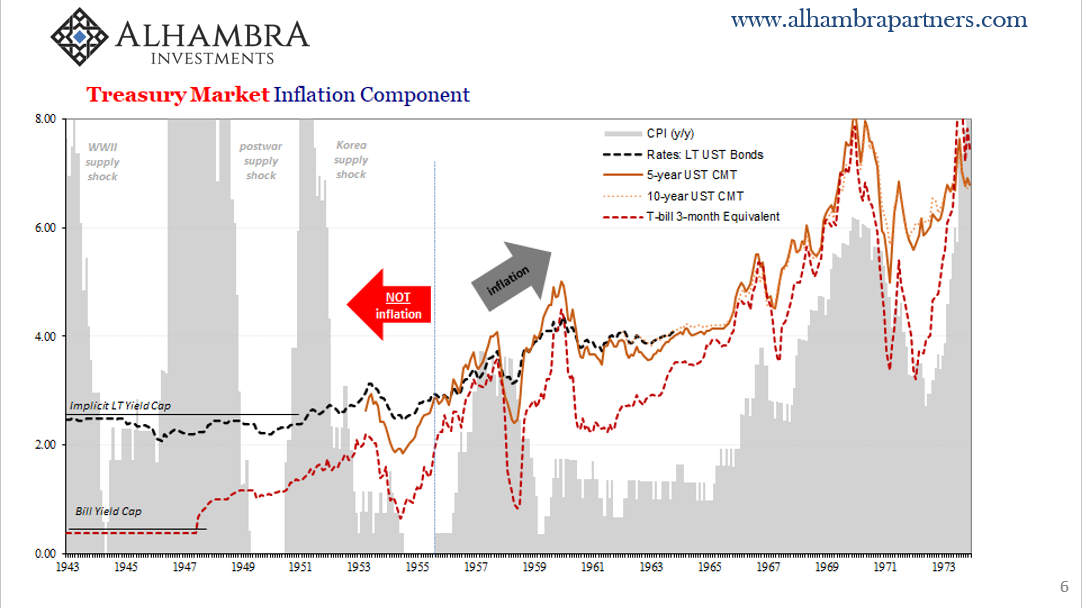

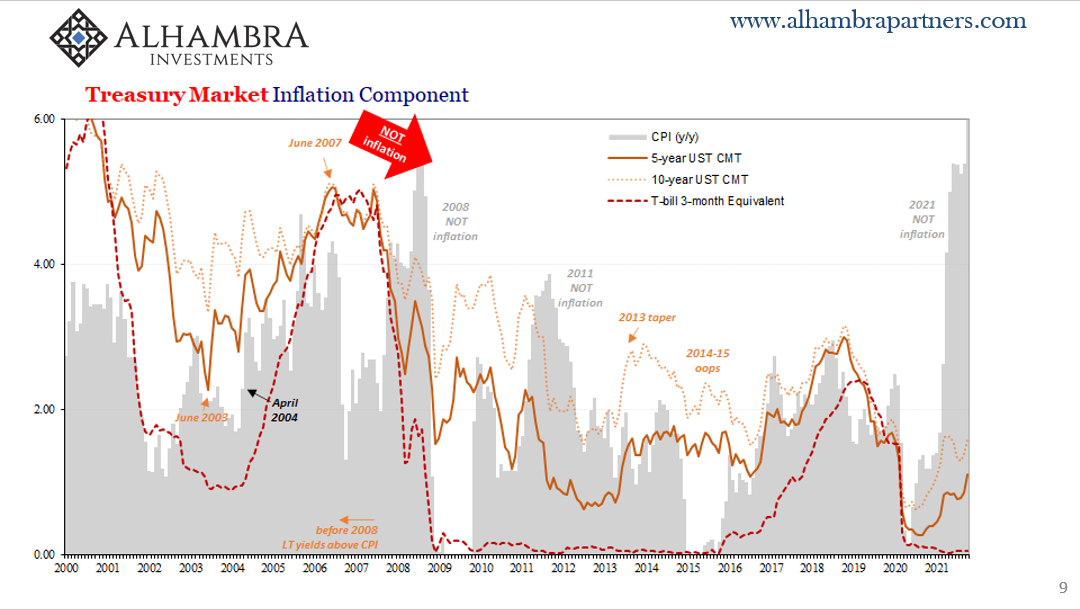

The bond market’s verdict has already been rendered. In fact, the judgment was made even before this year’s CPIs surged to the highest they’d been in a long time. The most consistently accurate and only historically validated source for sorting and signaling inflation, low yields aren’t just skeptical in being low they are unequivocal in remaining steadfastly ultra-low.

For those who have been forecasting inflationary doom since the first QE (in America; none of them pay any attention to the exact same results from Japan which predated and presaged what we’ve seen here), the bond market is more than a thorn in their side, it is an unbearable monstrosity which stands in the way of this peculiar brand of demagoguery (thanks to the un-demagog-like Mr. Tateo).

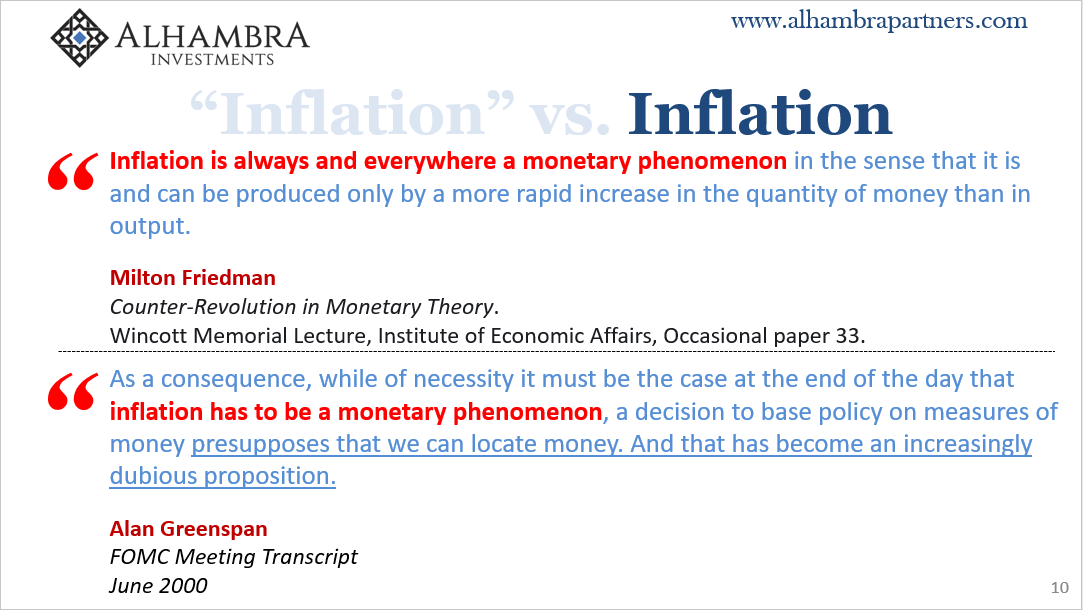

Inflation is emotion out there, rather than dispassionate analysis in the huge sums swirling via Treasuries or German bunds. Out of control governments are ruining the country, the entire world, and the only way to stop them is for the public to see that ruin in the form of gasoline and food prices. Connect those dots to salvage civilization.

That’s their emotion.

When the bond market declares unequivocally just how misplaced their calculations, it isn’t a declaration against the soundness of the argument against unsound governing. That’s a problem, too, except in the (real) world of rates and yields other an even bigger, more consequential problems (deflation) must be resolved first.

Not wishing to wait, to sell “inflation” in the absence of any chance for inflation requires diminishing if not entirely canceling the bond market’s longstanding indicator(s). Its signal has been muted or corrupted, they claim, by none other than the chief villains in their sordid currency fairy tale.

The Fed is buying the bonds!

I hear this all the time, especially whenever I can get out the historical charts (included at the bottom) and show anyone who’s honest just how useful the bond market signal has been; accurately, dependably sorting all CPIs from those driven by actual inflation for longer than any of us has been living.

Rather than engaging in useful analysis, the response is always: QE, duh. The Fed rather than inconveniently (to their argument) low inflation/growth expectations is the only thing keeping rates down because even it knows without its own buying Treasury prices will plummet and rates will skyrocket to catch up with already-surged consumer price indices of all varieties.

This is either the laziest or most obviously disingenuous counterargument, and it should immediately disqualify anyone attempting to use it. Either they don’t have five seconds to pull out a chart of whatever yield history – any of them around the world in which QE is being conducted – for a quick and dispositive debunking of this sorry yet-somehow-universally-accepted myth; or, the other is simply selling you an agenda and seeking whatever sounds most plausible to keep the sale alive.

And, on the surface, central bank bond buying does sound like it could possibly spoil the message. After all, some “all-powerful” government agency is going to be, you know, buying bonds at prices that have nothing whatsoever to do with any sort of fundamentals. It will purchase them by the bucketload at whatever price, so how can it not keep prices artificially high therefore yields artificially low?

The lazy WSJ headline above makes its irrational case: the Fed rigs the bond market.

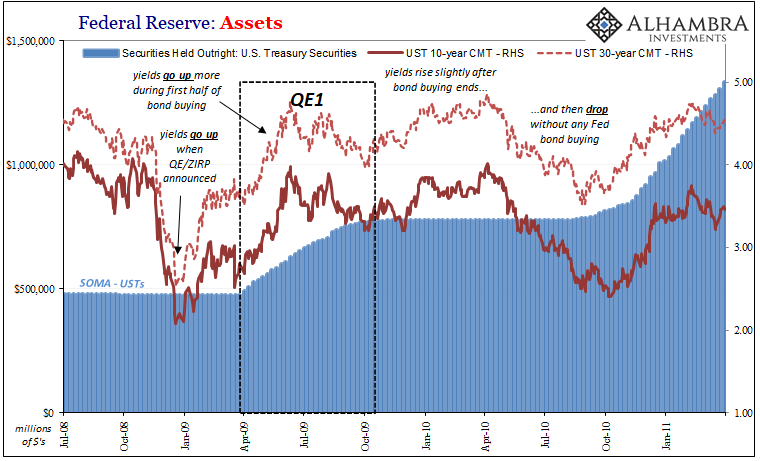

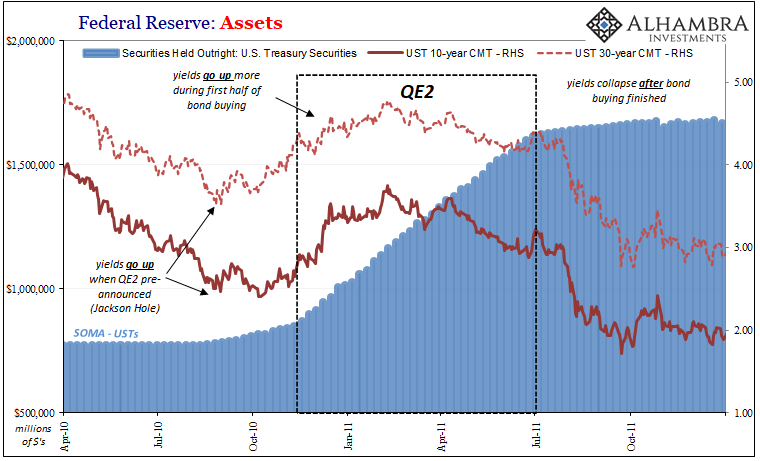

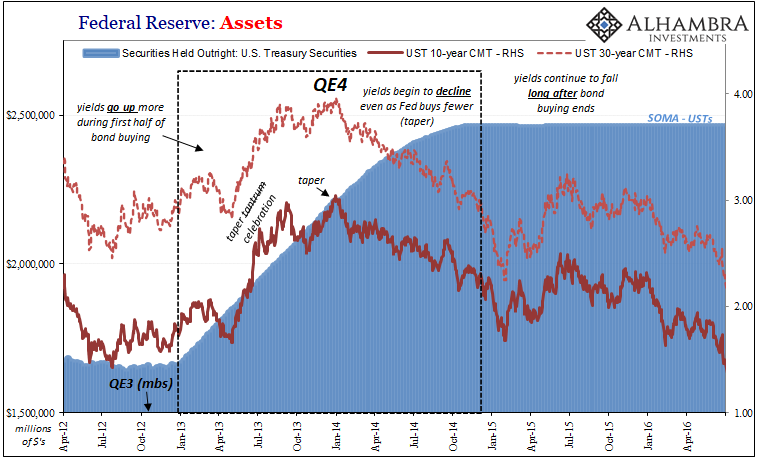

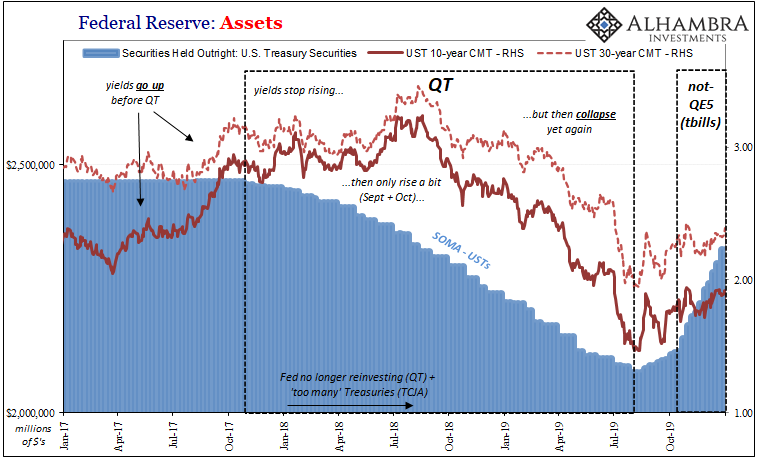

Again, it takes but five seconds to disabuse what has never been anything more than useless theory:

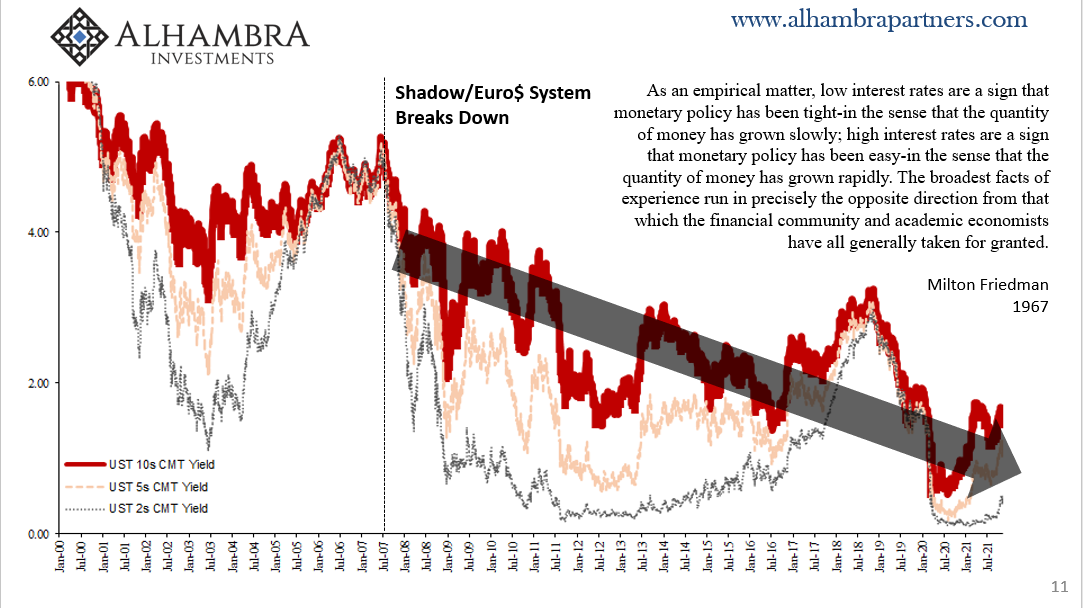

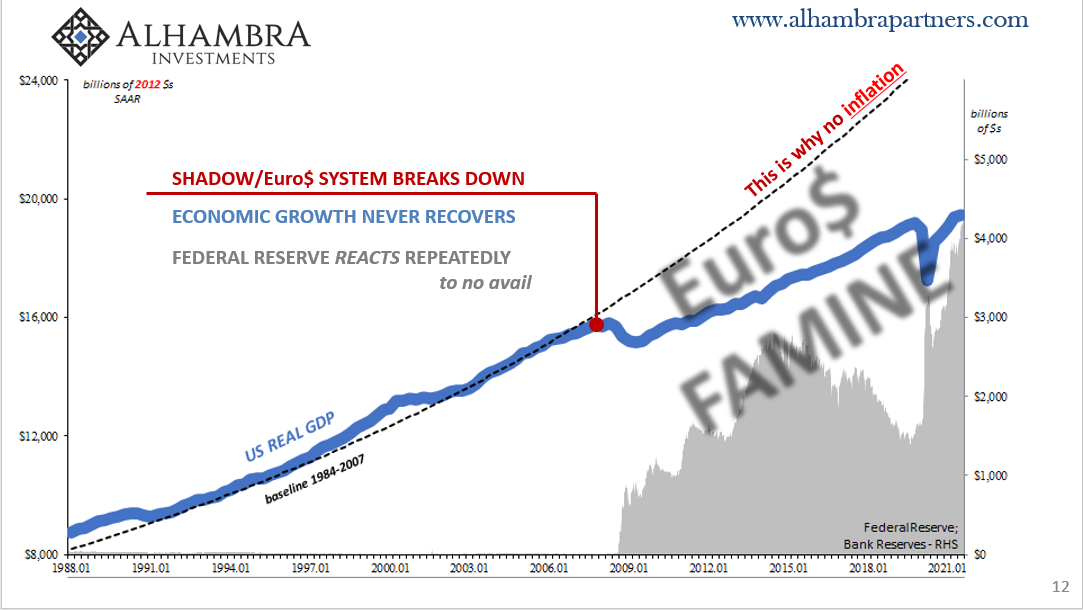

The clear evidence speaks for itself. It does not speak well of either inflation or the Fed’s ability to do much outside of control the level of bank reserves (see: below). Prices in real markets don’t seem to be bothered whether the Fed is buying, tapering the pace of its buying, or flat out not buying.

In fact, this evidence is so clear, it also didn’t matter back when the Fed was scaling back its balance sheet; like QE, QT also proved to be just as irrelevant to how markets set longer-term Treasury yields. And that was during a time when the federal government debt was exploding (remember the “too many” Treasuries nonsense?)

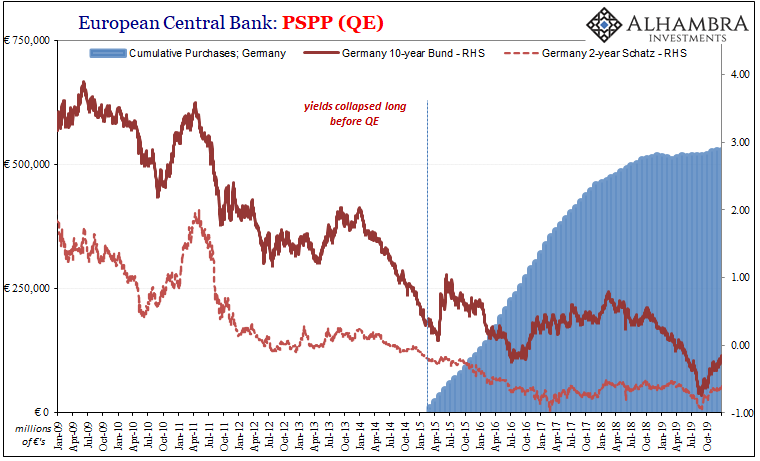

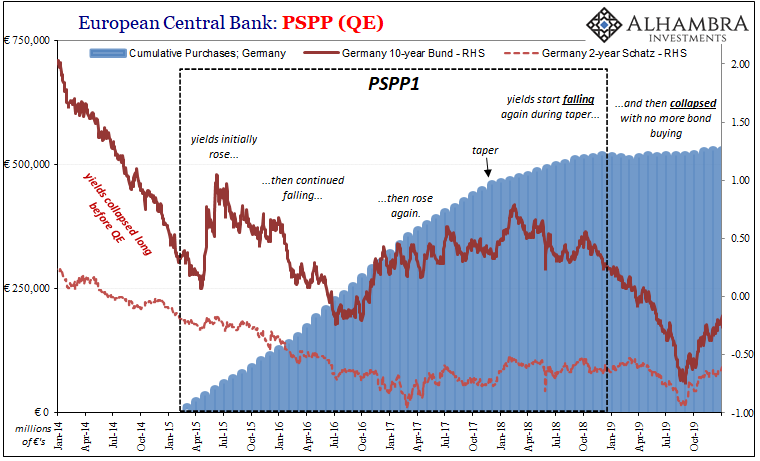

Just to show there is no US or Fed bias in the data, I’ll also include (it only took a few extra minutes) the same from Europe, specifically the ECB’s Public Sector Purchase Program (PSPP), which is just their way of making QE sound more purchase-y (it needed to be rebranded because it works so well?)

Bund yields plunged long before any purchases, moved independently of constant purchasing, and then began to drop during Mario Draghi’s intended swan song (taper) before then collapsing even more into the negative rate mess that still exists today.

This latter plunge without another bund added to the ECB’s inventory in 2019.

Quantitative easing, large scale asset purchases, whatever label anyone might PR-test and slap onto these ineffective central bank endeavors, these are the most real-world tested policy programs around, twenty years and spread anyway near worldwide, and the evidence is incredibly one-sided. They don’t work in any of their theoretical channels, but most of all they don’t reduce interest rates.

They don’t even interfere with how the market sets interest rates whichever direction!

The only factor QE influences is the same useless factor that Fed officials first realized way, way back in the early seventies as the monetary ground shifted out from under them half a century ago. All the way back in July 1971:

A number of members were dissatisfied with the present procedure of placing main emphasis on rates of growth of the monetary aggregates or on levels of the Federal funds rate, and some had come to believe that the directive should emphasize member bank reserves–the one magnitude which the Desk could control more or less directly.

That’s it. The only control the Federal Reserve, ECB, or BoJ exerts is over the level of bank reserves as a byproduct of all this purchasing. And the level of bank reserves is just as irrelevant to financial markets and the real economy as QE is to growth and inflation expectations.

Those other are the only factors driving yields up, or, as the last decade plus, down to stay.

Anyone who says that bond yields have been corrupted by “bond buying” has done you a huge favor; they’ve shown to you how they either don’t have five seconds to validate their idea, or, worse, they’d prefer to sell inflation as a specific agenda unchallenged by facts, history, and every single scrap of evidence.

Stay In Touch