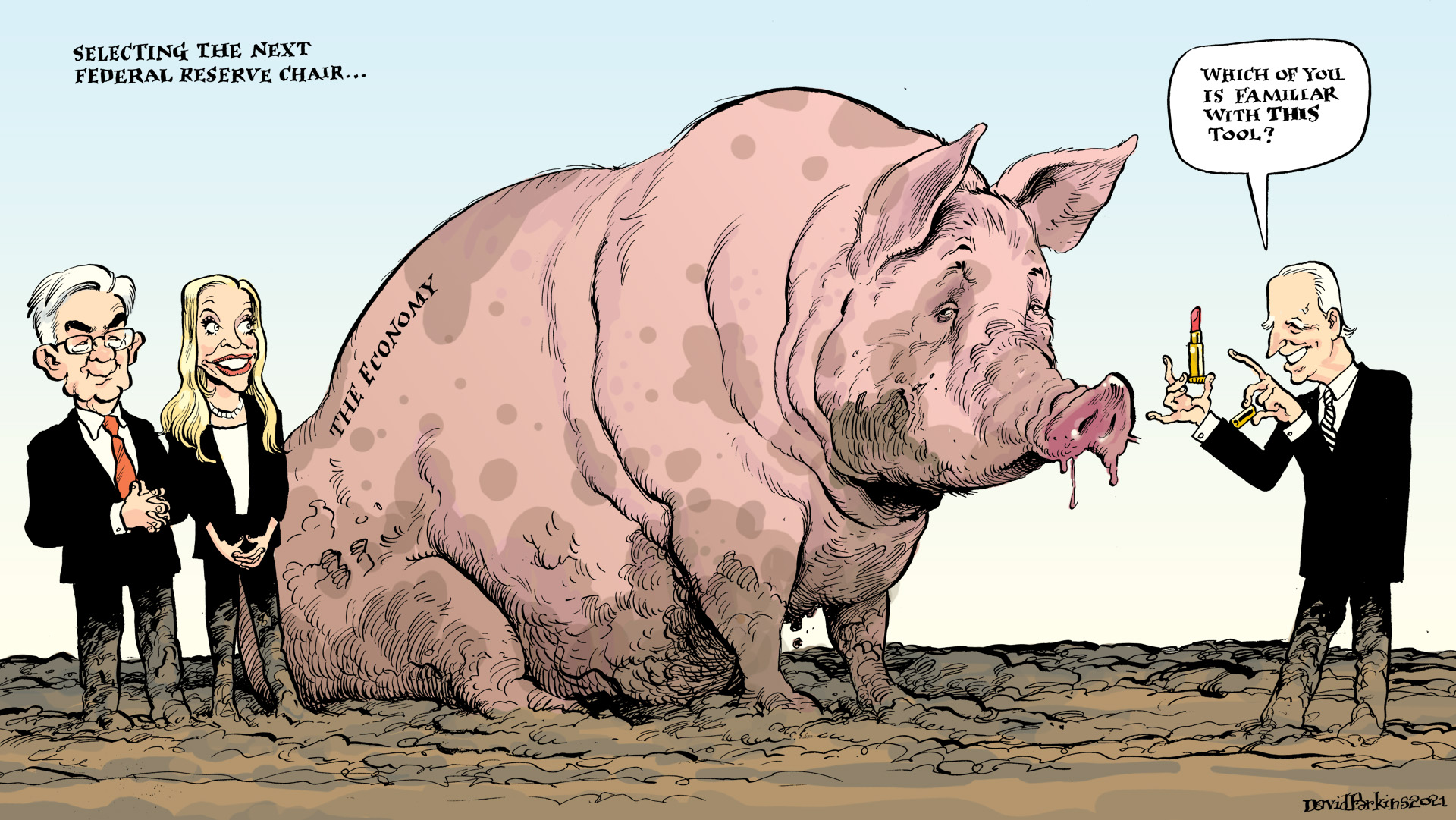

157.3 Will the Next Fed Chair be a Theoretical Grammarist?

———Ep 157.3 Summary———

The last time the Federal Reserve tapered its QE program the central bank spent HOURS and HOURS and HOURS and HOURS on determining which adjective to us. Adverbs. Dangling participles, onomatopoeia, clauses, subject and object. What was NOT discussed? Money. Credit. Collateral.

———Sponsor———

Macropiece Theater with Emil Kalinowski (a/k/a Alistair Cooke, a/k/a Alistair Cookie) reading the latest essays, blog posts, speeches and excerpts from economics, geopolitics and more. Interesting people write interesting things, why not listen and hear what they have to say? You could do worse things with your time (i.e. Bloomberg, CNBC, et cetera). Recent readings include thoughts from: Adam Smith, Arthur Schopenhauer, Bank for International Settlements, George Friedman, J.P. Koning, Jean-Paul Sartre, Karl Marx, Liberty Street Economics, Lyn Alden, Maroon Macro, Matt Stoeller, Michael Pettis, Myrmikan, Perry Mehrling, Robert Breedlove, Rohan Grey, Velina Tchakarova and yes, even Jeff Snider.

———See It———

Alhambra YouTube: https://bit.ly/2Xp3roy

Emil YouTube: https://bit.ly/310yisL

———Hear It———

Vurbl: https://bit.ly/3rq4dPn

Apple: https://apple.co/3czMcWN

Deezer: https://bit.ly/3ndoVPE

iHeart: https://ihr.fm/31jq7cI

TuneIn: http://tun.in/pjT2Z

Castro: https://bit.ly/30DMYza

Google: https://bit.ly/3e2Z48M

Reason: https://bit.ly/3lt5NiH

Spotify: https://spoti.fi/3arP8mY

Pandora: https://pdora.co/2GQL3Qg

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

PlayerFM: https://bit.ly/3piLtjV

Podchaser: https://bit.ly/3oFCrwN

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

ListenNotes: https://bit.ly/38xY7pb

AmazonMusic: https://amzn.to/2UpEk2P

PodcastAddict: https://bit.ly/2V39Xjr

———Ep 157.3 Topics———

00:00 Intro: What can we learn from the 2013-Taper and how it applies to the 2021-Taper?

00:37 The Federal Reserve tapered in 2009, 2010 and 2013. Yet we only talk about 2013.

02:18 Why did the bond market not ‘tantrum’ / celebrate the end of QE in 2009-10 like in 2013?

04:04 What discussions did the Federal Open Market Committee have with the 2013-taper?

07:01 Was James Bullard concerned about money supply/demand or manipulation of confidence?

08:55 Was Charles L. Evans concerned with market operations or psychological operations?

13:30 Was Jeremy C. Stein concerned with printing money or propaganda media.

15:21 Was William C. Dudley raising the topic of Eurodollar Futures as a warning for the Fed?

18:46 Presently, what is the Eurodollar Futures curve telling us?

———Ep 157.3 References———

What Does Taper Look Like From The Inside? Not At All What You’d Think: https://bit.ly/3C77qYf

Alhambra Investments Blog: https://bit.ly/2VIC2wWlin

RealClear Markets Essays: https://bit.ly/38tL5a7

———Who———

Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Art by David Parkins, lipstick lampoonist. Podcast intro/outro is “Moonshiner’s Turn” by Martin Landström found at Epidemic Sound.

Twitter: https://twitter.com/

Twitter: https://twitter.com/

Art: https://davidparkins.com/

Stay In Touch