I do long for the day when no one cares even a tiny bit about something like this. Sadly, that day remains our very distant future because nothing has changed. This, rather than anything useful, is what everyone means when they use the word “stability” to describe these situations.

For months, there had been rumors Jay Powell would be one-and-done like his immediate predecessor Janet Yellen. The whispers (FWIW) all whispered the name Lael Brainerd, one of Powell’s already-top lieutenants. According to most sources, it may have been the current bout of “inflation” which appears to have swayed President Biden back toward Jay in the end.

This is one key area in which there is bipartisanship; both parties are absolutely terrible when it comes to economic policies, only beginning with their total and unshakable deferral to Economics and its high priest practitioners. Together they still – somehow – believe that it is more important to maintain continuity than to “risk” figuring out an actually useful and legitimate answer to the tough problems plaguing the world ever since around, say, August 2007.

Hooray for Jay!#continuity pic.twitter.com/sQtMW5KO8R

— Jeffrey P. Snider (@JeffSnider_AIP) November 22, 2021

As Einstein supposedly said, the definition of insanity is to keep nominating the same (type) person for Fed Chair and expecting a different economic result.

That’s the true and terrific (for Jay) irony today; that 2021’s “inflation” seems to have made him the only palatable choice to the Congress of illiteracy.

Renominating Mr. Powell — who won bipartisan support moments after the announcement — also spares the White House what might have been a bruising confirmation battle if the president had instead chosen Ms. Brainard, who has fewer Republican supporters in the Senate than Mr. Powell.

The guy spent his first year in the office as “hawkish” as they come, at least nowadays. Absolutely convinced (in public) that inflation was about to break loose, his initial period in 2018 was rate hike after rate hike, in between splashed with the heated rhetoric of more and acceleration to follow by 2019.

Yet, none of that did because, again, Mr. Powell hadn’t got a single thing right (see: below) about inflation or the economy (starting with how he still doesn’t get that it is a global economy).

Talk about insanity, Powell’s Fed is about to commit to the exact same errors in very nearly the same sordid sequence. The only difference, after 2019’s debacle (“unexpected” rate cuts), between then and COVID the Federal Reserve would admit to its longstanding inflation “problem” – they couldn’t figure out where it was, or even what it was.

That isn’t just weird, it’s disqualifying for, you know, what’s supposed to be a central bank.

Twenty-twenty’s big recession and the supply problems on the other side of it, this “inflation”, has breathed new mainstream media life into Powell’s candidacy. He still thinks 2022’s inflation is what it wasn’t in 2018, while correctly determining 2021’s “inflation” sure does require the quotation marks.

The former had been depending exclusively on the unemployment rate (and JOLTS JO) which did him in the last time when inflation went missing, and this time first taper and then next year’s rate hikes are built exclusively on the unemployment rate (and JOLTS JO) all over again.

What truly matters politically isn’t inflation or even economy. Instead, they’re all terrified of the Fed’s true weapon – which isn’t a money printer, it isn’t even money (central bankers haven’t a clue where to find any), rather it is entirely stocks.

Equities. Share prices.

A spirited inflation debate with @ErikSTownsend on @MacroVoices

— Jeffrey P. Snider (@JeffSnider_AIP) November 19, 2021

Inflation or "inflation" is not semantics. It's history. It's our future. It's bond yields today.

Either way, Erik will *always* remain Chancellor (emeritus) of Euro$ University.https://t.co/jwTjbZ7qyz pic.twitter.com/kv7t01TKOP

Why keep Powell? Why not? The alternative is to admit to the public the Fed isn't a central bank and doesn't have influence let alone control over the (euro)dollar.

— Jeffrey P. Snider (@JeffSnider_AIP) November 22, 2021

Better to keep failing and have the people wonder why than confess to THEBIGLIE.#jaypowell #continuity pic.twitter.com/jZmgpRands

This is what “they” all mean when they say “stability” or more so “continuity.” In general times of at least uncertainty if not outright turmoil, like now, no politician will risk even a small downturn in stocks. Every single one of them at every level demands to be able to point to the S&P 500 as if a record high for the stock index is equivalent to an equally high job performance grade.

Stocks tank and the conversation ends before it can begin in politics. Thus, don’t let stocks tank – ever. And if they do, should they manage to crawl their way back up, do nothing different even if it means sticking with the same which had been part of the reason stocks tanked in the first place.

Thus, Obama renominated Ben Bernanke in August 2009 even after Chairman Bernanke had for two years let the worst monetary crisis since the Great Depression run amok across the entire global financial system and economy. Yet, apparently, the guy and that level of obscene job performance was indispensable to the nation and the world.

“There has been a considerable amount of speculation in the marketplace, both in the market and among observers of the Fed, and going into the fall the president [Obama] wanted to end that speculation,” Austan Goolsbee, a member of the White House Council of Economic Advisers, told Reuters Television.

Quickly added to this note was what had been its only true point: “U.S. stocks were slightly higher in afternoon trading, buoyed by news of Bernanke’s nomination…”

Contrast 2009’s continuity with 2017’s dispatch of Ms. Yellen. In the earlier period, the “recovery” was still believed in its infancy (when in reality it never materialized) whereas eight years later everyone thought “globally synchronized growth” was a real thing.

Trump sure did, buying his own positive economic press even after having run for office after having correctly surmised, and then campaigning on, the unemployment rate’s crucial fallibility. In office, he immediately embraced the rate, the synchronized “growth”, and replaced one-term Yellen with Powell because stocks surged on the slogan.

Like Bernanke, Powell is renominated not for his demonstrated skill, but entirely the opposite – the worst they screw it up, the more politicians fall into the trap laid for them, this “continuity.” The more the boat sinks, the less anyone seems to want to “rock” it if only because the authors of each failure tell them that if they do rock the boat it might sink some more (jobs saved!)

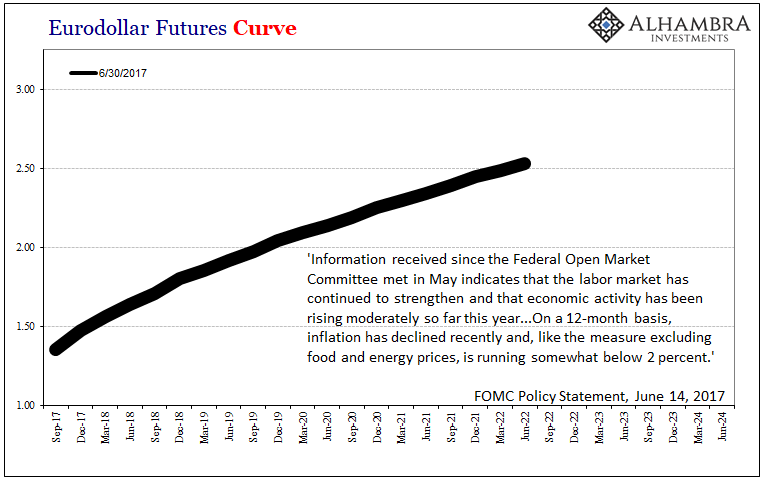

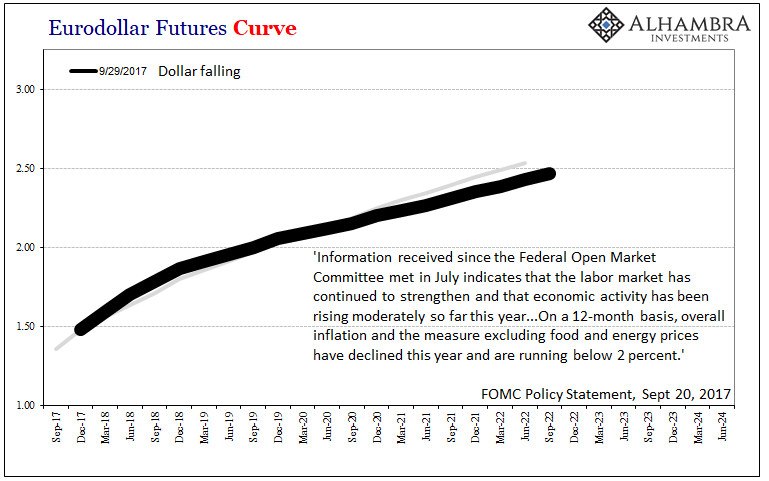

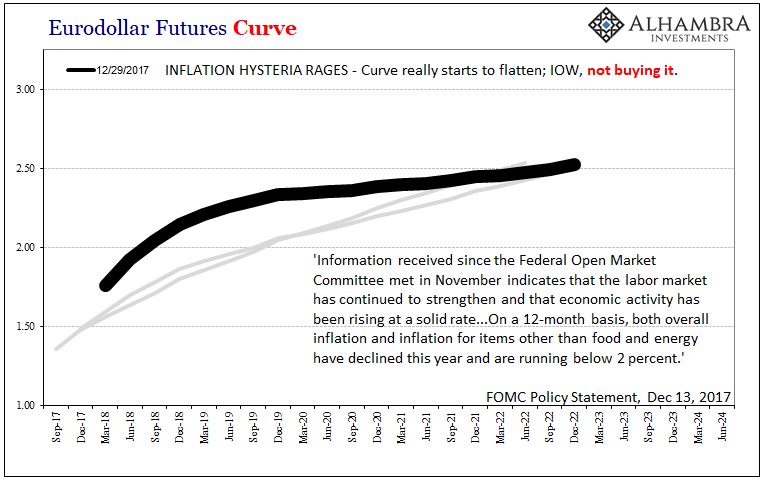

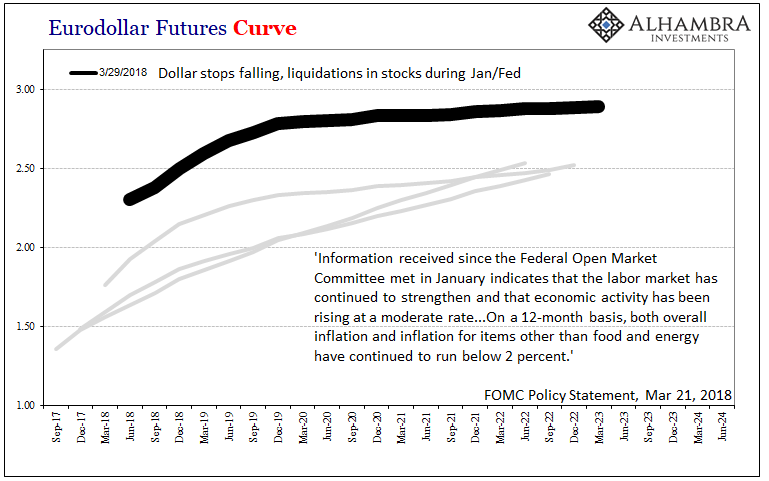

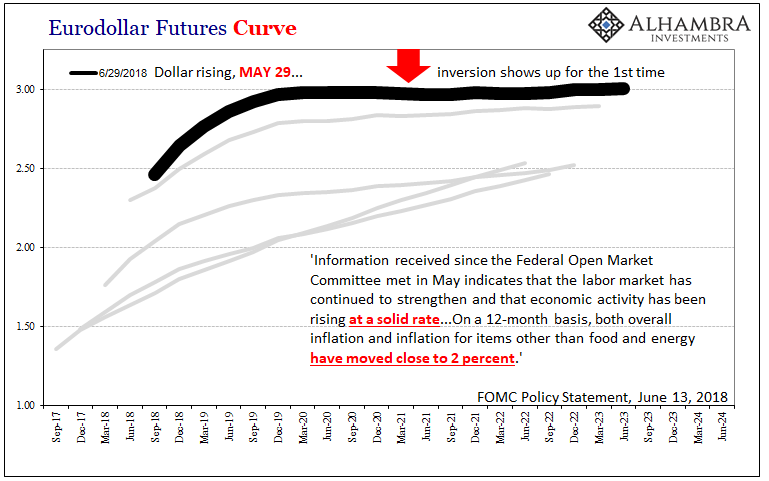

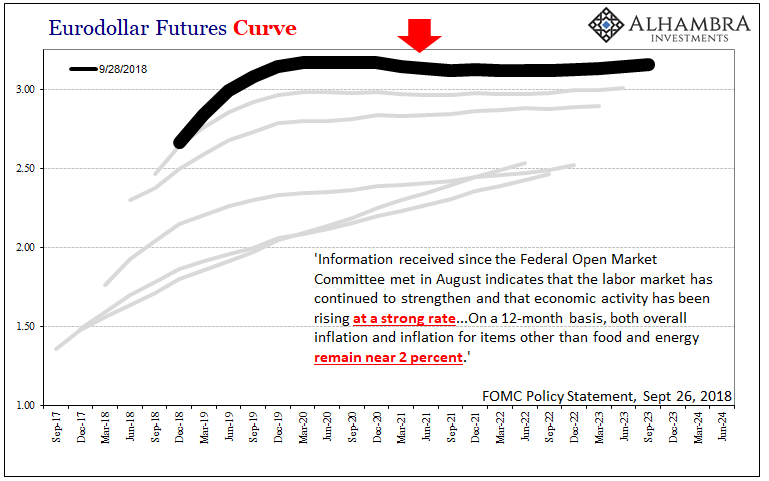

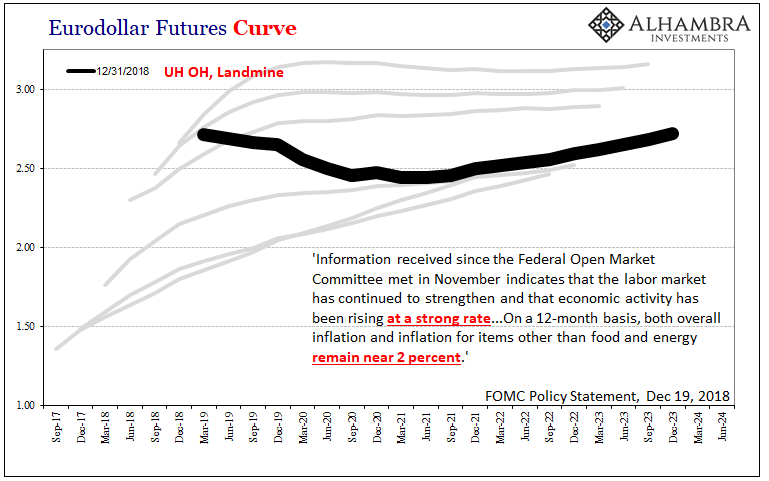

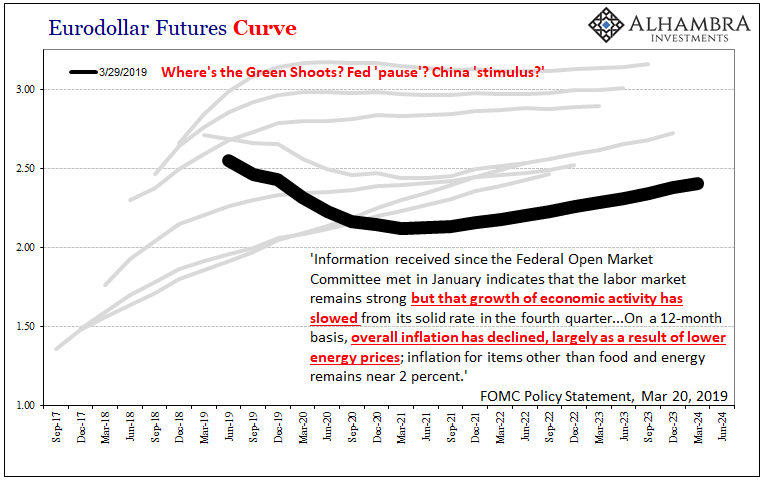

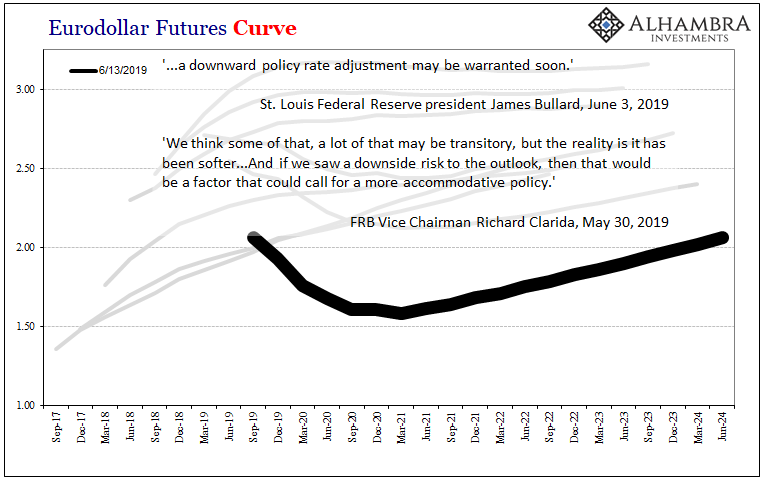

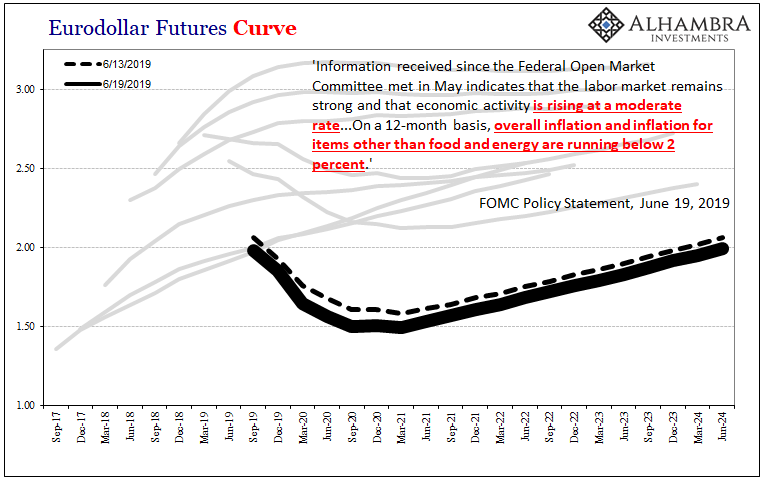

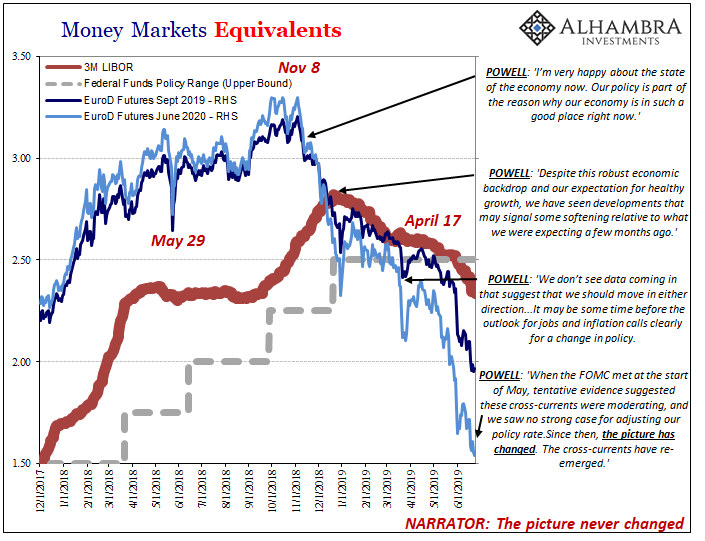

I produced the charts below all the way back in 2019, keeping them handy for just this sort of occasion. The markets had warned Powell, the media, the entire world he was wrong about inflation (flattening curve) because he was wrong about everything in money and economy for months on end long before the end of 2018 and its sudden landmine.

We can’t risk turning to someone else, allegedly, because Jay Powell is somehow irreplaceable? This guy? His FOMC?

As it would turn out, there wasn’t a single thing the FOMC got right – not inflation, not rate hikes, certainly not globally synchronized growth. And because of so much failure, had his term been up, for some reason, in 2019, Jay Powell would’ve been swiftly renominated back then.

“We” never reward Fed officials for their successes, the government is instead made to fear how their failures might spawn even worse. And those fears become the justification for sticking with the same gross errors.

This is, obviously, perverse and disgusting, yet it does make logical sense. The more they got it wrong, the more they try to convince us we can’t do it without them. The more wrong, the more it becomes specifically the same person. Einstein was right; there’s nothing sane about it.

Someday the public will figure all this out – almost certainly before any of the politicians – and demand the Fed’s demotion (if not full and complete revision) back to where it belongs as an afterthought (as it had been for the vast majority of its history). By then, no one will care who runs the Fed or even what the next Chairman’s name might be.

And that won’t just be a good thing, it will be the best thing.

Especially since 2021 is just a repeat of 2018-19. At least we know how it’s likely to turn out, and how Jay Powell will be the least useful person to turn to.

Stay In Touch