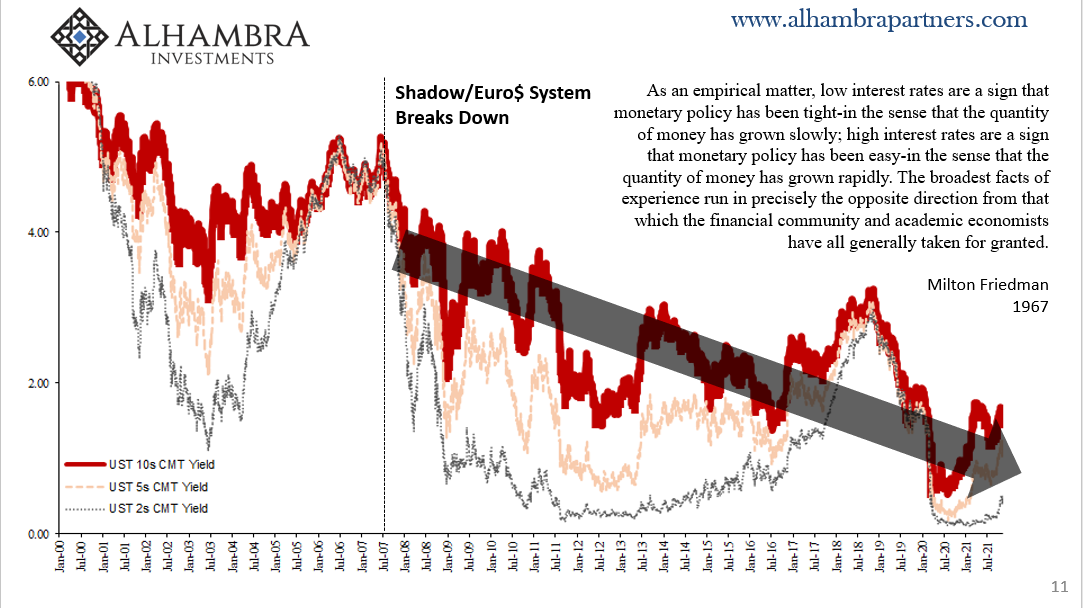

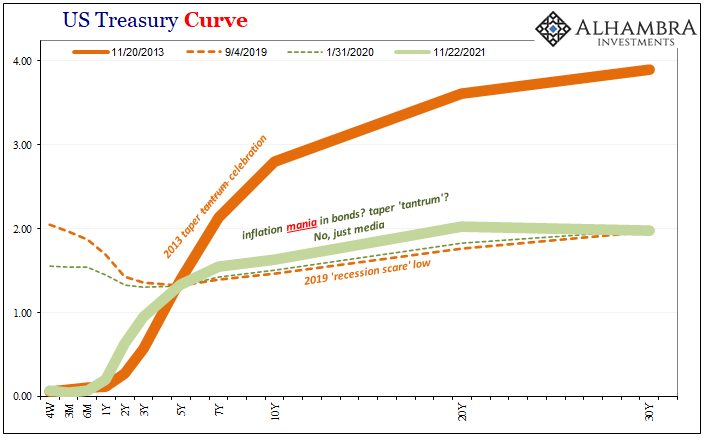

Where is the “tantrum?” If there is one, to this point it has been historically minor changes limited to the shorter end of the yield curve between the 2-year and 5-year USTs. This section of it is more influenced by what the market believes Jay Powell’s Fed will do especially now that it likely will be Jay Powell’s Fed for another (dismal) four years.

That’s not tantrum territory, however. What is supposed to be is the long end where growth and inflation expectations trade more exclusively. Everyone would have you believe the FOMC is the best source of information and forecasting; bonds understand just how false this myth has been as well as how long it has been this way.

The lack of tantrum, therefore, is nothing more than legitimate, time-tested skepticism about what in the mainstream is otherwise just taken for granted; whatever Jay Powell and his models say, that’s what we’re all supposed to believe.

Once you realize the bond market isn’t rigged like how everyone says, and that the yield curve remains chock full of useful information at all times, it’s hard to take these other things seriously ever again. The desire to dismiss the anti-inflation stance traced out by these specific curve shapes instead comes from those who don’t like its historically-validated disbelief.

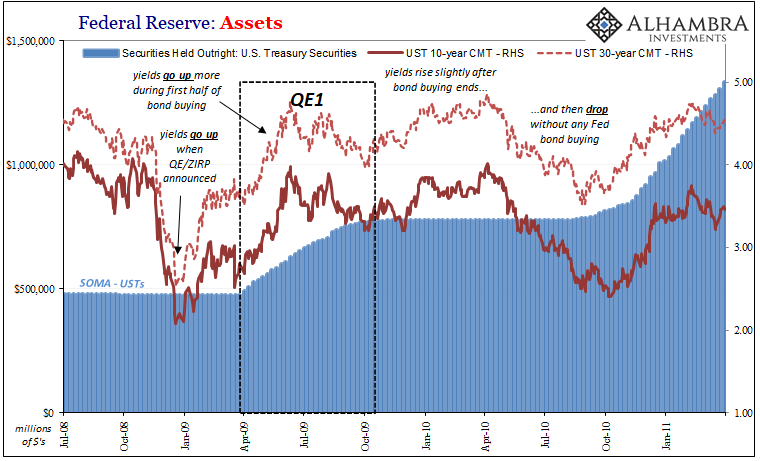

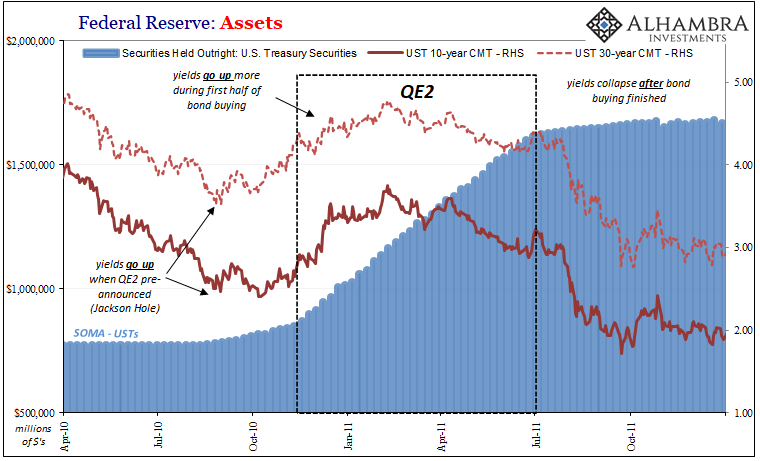

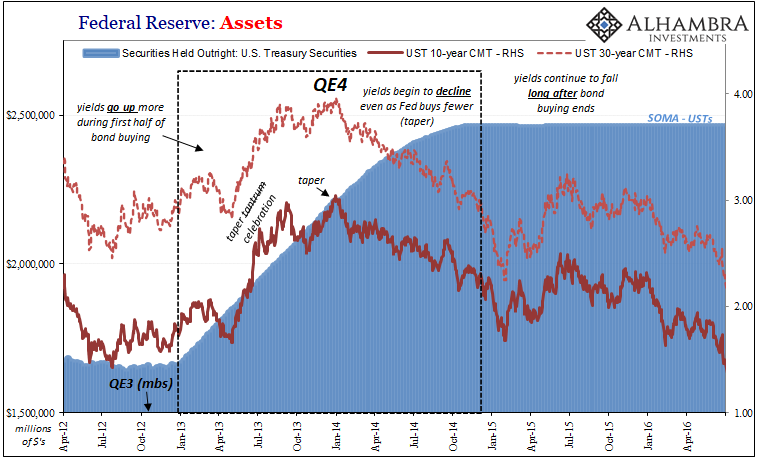

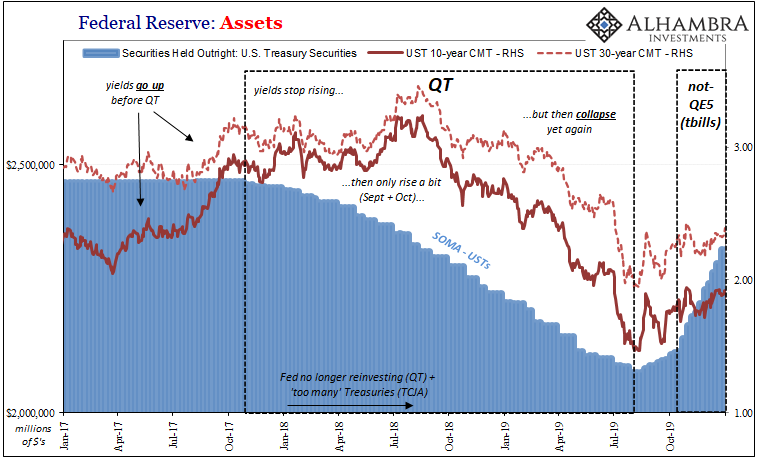

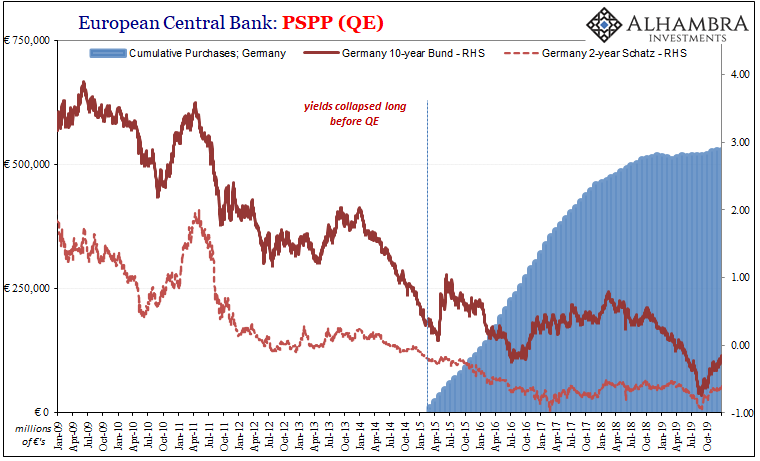

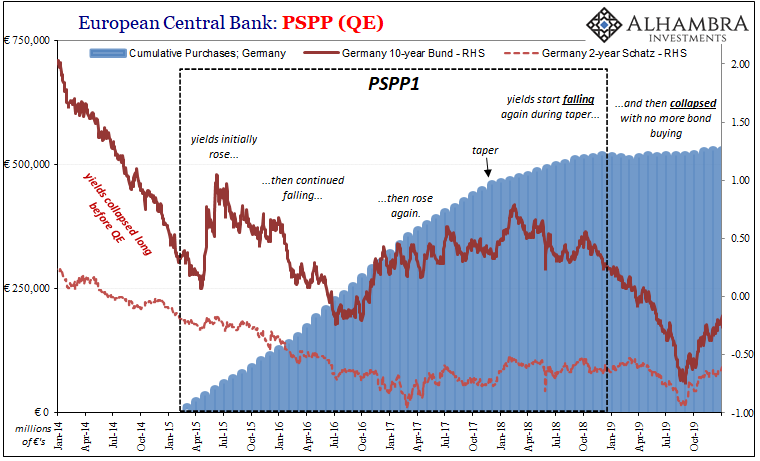

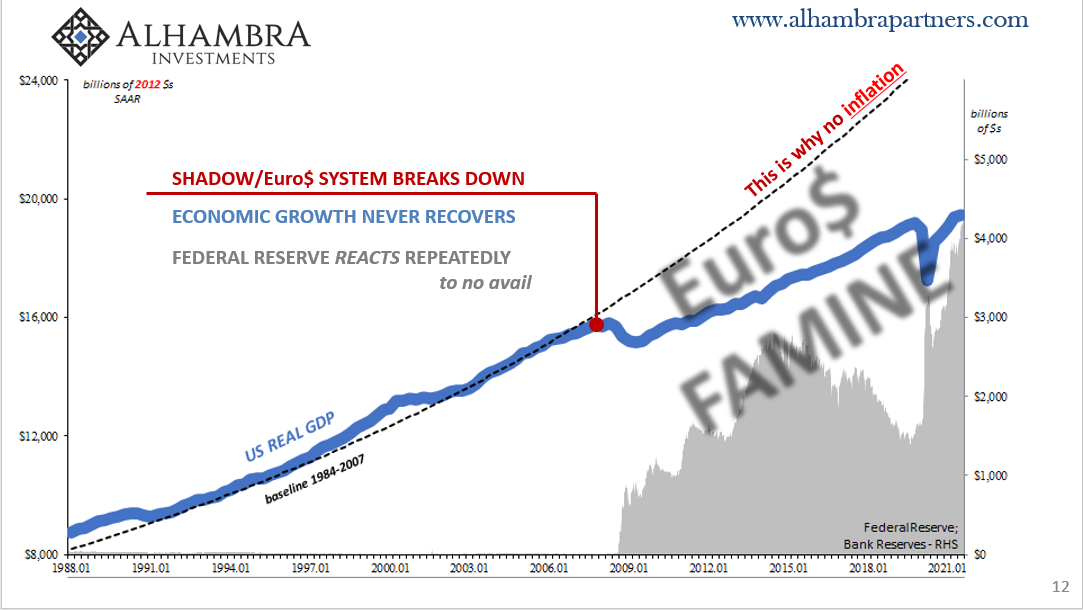

We’ve heard about imminent inflation ever since the very first QE, as well as how each time this happens it is different than the last time when inflation didn’t. The yield curve has told the public to remain unconvinced, if not (since 2014) even more outright opposed. Thus, those still calling for inflation desperately want the bond market to be rigged otherwise 2022 will turn out to be yet another hysteria.

It’s easy to say bond yields are rigged by the Fed because it sounds plausible allowing the seller to continue the inflation sale, counting on the public to simply accept the myth despite every shred of evidence and empirical data which unambiguously declares this to be incontrovertibly false.

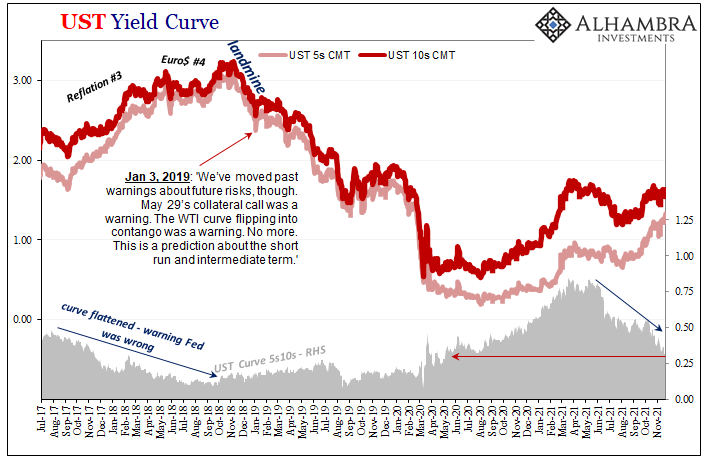

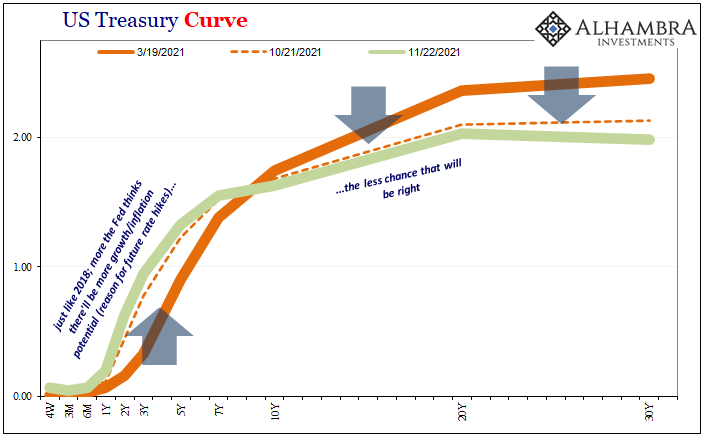

Interesting, therefore, how today with Jay Powell’s renomination all but assured, the yield curve greeted the news by flattening even more spoiling his party a little more still.

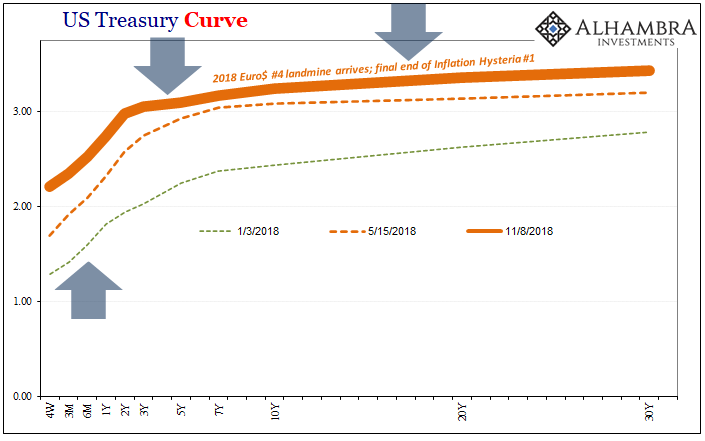

Having remained rational and sane the last time we did this, 2018, the bond market is quite confident about the pattern which is already playing out in the same general way: Jay’s growing hawkish for all the wrong reasons, thinking growth/inflation potential better in the intermediate future when bonds know he’s absolutely wrong.

Just like 2018.

This transitionary spot on the yield curve, the all-important 5s10s, finishes today at the flattest since May 4, 2020!

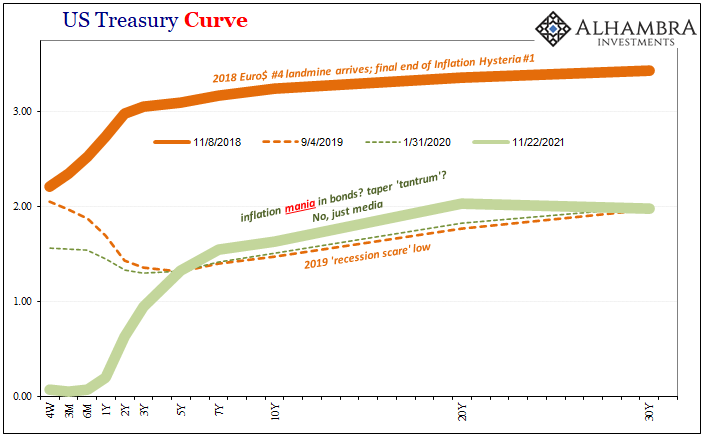

Worse for Powell and his implied choice of bird, the curve is actually behaving slightly differently than it had three years ago – and not in a good way. Back then, up to November 2018, when the yield curve was flattening at least it was rising nominally front to back; the calendar spreads may have been collapsing, but the whole curve was up in nominal terms.

This time, since mid-March 2021, as Jay’s hawk becomes more likely, back-end nominal yields haven’t budged even as they still flatten out; flattening while nominal long-end rates are themselves flat to lower.

It leaves the entire yield curve much closer (almost identical) in overall shape and position to August 2019 – the “recession scare” which wasn’t a scare – than anything to do with the pseudo-hawkishness of 2018 let alone something like the “tantrum” of 2013.

In other words, the best and most-historically validated inflation/growth measure humans currently have available, the one thing to rely on in lieu of discovering some infallible crystal ball, this indicator is actually behaving today even more skeptical of Jay’s mainstream inflation fantasy than it had been – correctly, remember – three years ago.

How’s that for #continuity. Another perhaps more appropriate term is #predictable, or #predictablywrong. We’ve seen this play out every single time: Fed extrapolates modest reflation into something it isn’t, real inflationary pressures; the bond market bets against the extrapolation while the media fills up with hysteria and hysterical rather than honest criticism of low yields; bonds prove to be correct and no one ever demands an accounting as to why.

One reason why the curve is even more unyielding in 2021 than it had been in 2018, and it had been pretty stubborn already back then, is this idiotic, self-defeating #continuity.

Stay In Touch