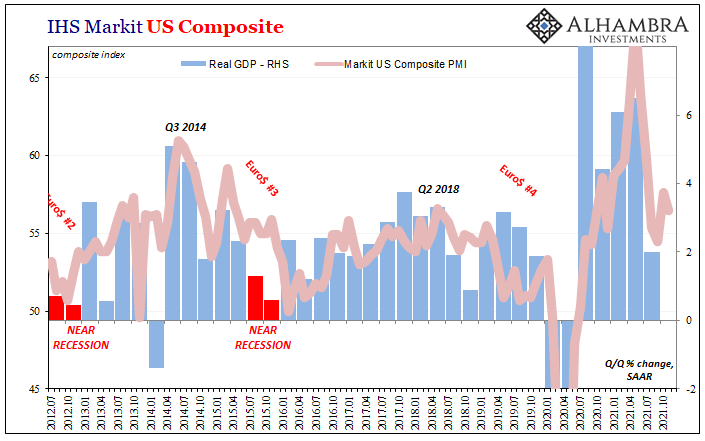

If markets seem a bit on edge, I guess omicron seems a good reason if for no other reason than we don’t know much about it. But even that reaction points toward something else. A truly robust economy has little to fear from such unknowns, even from what might be predictable overreaction across the entire public sphere.

The knee-jerk negative sentiment provoked only just recently speaks to far more underlying uncertainty. We may not know what the newest COVID variant holds, but it may not actually matter. The economy is already questionable and has been more and more for quite some time already, having topped-out maybe the rebound simply cannot afford any more questions of even the lightest potential variety.

In other words, the issue at hand isn’t necessarily omicron nor really a “growth scare” grown more scary by another possible round of the pandemic.

This is about demand.

That’s why, I believe, the sharpest reaction came from something like oil which up to now has been surging based on the physical world undersupplying given a previous perception of steady demand. If “the market” starts thinking omicron’s another chapter to the corona story alone, then we’d also expect any more lockdowns to further menace supply.

Such a hypothetical situation would be oil price-positive, not so thoroughly (for the short run, anyway) sell-at-any-price.

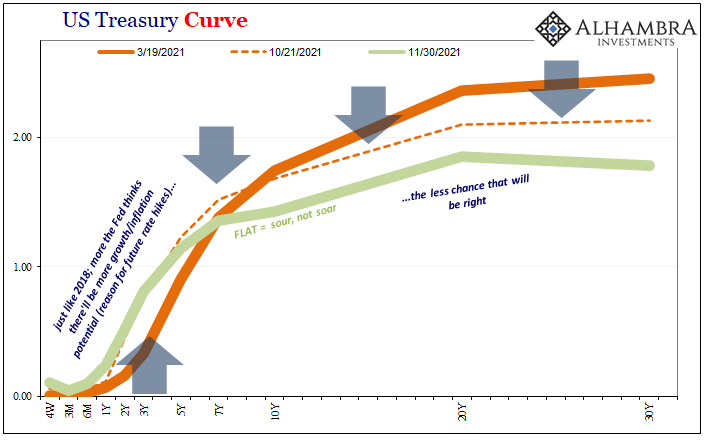

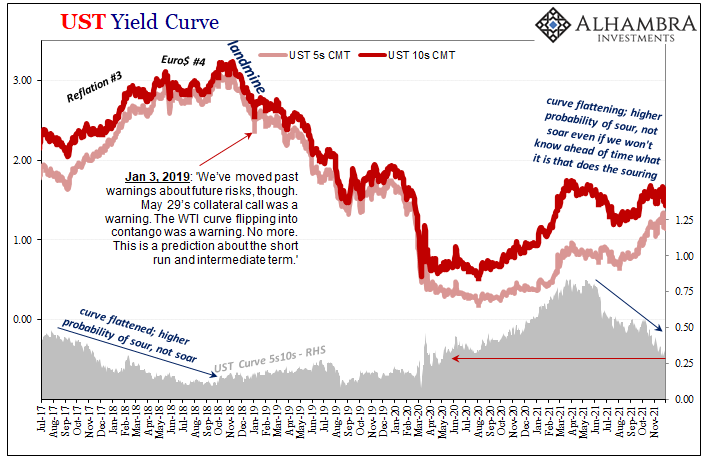

No, the market is, right now, further questioning the demand side of the physical price formulation – and it is doing so on top of substantial questions about demand which have been lingering around for more than half a year so far. No matter if unreported in the mainstream financial media still cheering on a BOND ROUT!!!! that refuses to materialize, jittery traders have been moving in this direction (flat curves, after all) long before the unwelcome whispers.

Given that, the latter merely a pile on.

And what better way to try and assess global demand than from a Chinese perspective. Not just the world’s second biggest economy, this is the nexus between developed and emerging, the pivotal junction of economy and money (eurodollar) therefore the juxtaposition of all these factors at once.

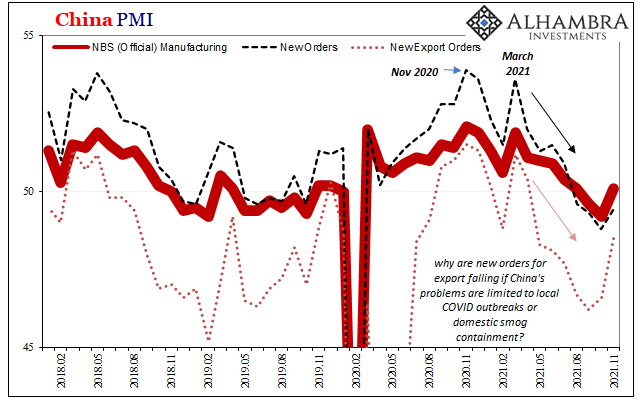

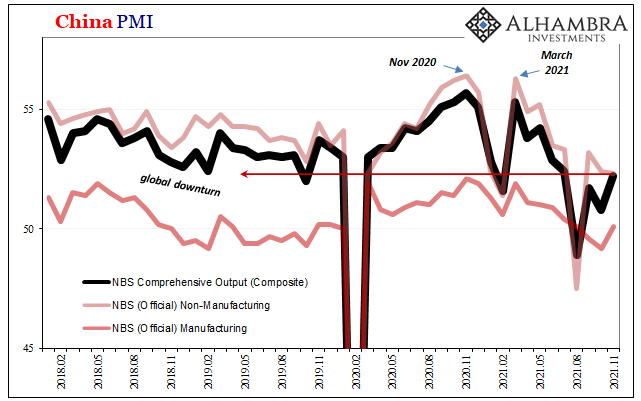

Late last night, China’s National Bureau of Statistics (NBS) reported what were further reported to be “strong” results in its sentiment indicators, the various official PMI’s. I’m not sure in what world these numbers would be consistent with that interpretation, it’s just not the one we all inhabit.

Their manufacturing sector PMI barely managed above fifty, coming in at 50.1 for November 2021. That’s up from 49.2 in October, for one month breaking a string of declines dating back to March – which was a one-month break to a string of prior declines. And this is the “good” news.

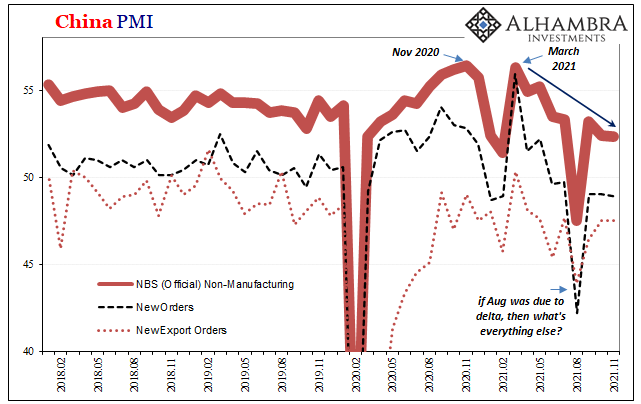

NBS’s non-manufacturing or services PMI declined to 52.3 this month from 52.4 last month. Both of those are incredibly low by any historical comparison except the depths of last year as well as August this year.

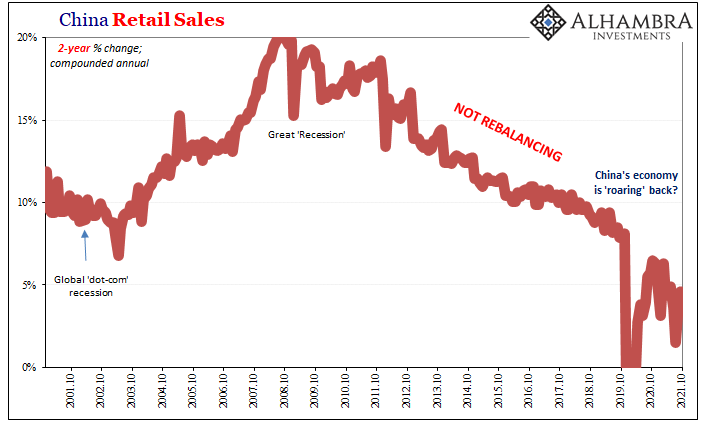

This latter low is important to point out and appreciate because that was the work of the delta variant (the Chinese government imposing restrictions for it). And while that may have been the reason for the depths of both PMI’s and more direct economic data like retail sales, also like retail sales the rebound from August is hardly what any rational observer would claim robust.

On the contrary, thus far post-August the numbers have all been materially weaker than before August; continuing instead the post-March slowdown which had raised the uncertainty about global demand in the first place long before either delta or omicron.

These PMI’s along with China’s Comprehensive Output PMI (a composite made specifically from the Output indices of both the manufacturing and non-manufacturing versions weighted by each sector’s contribution to Chinese GDP) only demonstrate how delta had been a temporary amplification of the existing downward trend.

Like the services PMI, this composite in November at just 52.2 is more alike 2018-19’s downturn/global pre-recession than even 2017 let alone late 2020.

All of them having clearly set their highs way back in March when the global bond market, and UST yield curve, began to raise doubts about realistic prospects for demand going forward.

Even on the upswing from summer’s delta variant in China, there’s so little up to the swing by which to be impressed or convinced there’s so much more to it coming over the coming months. All that even before omicron.

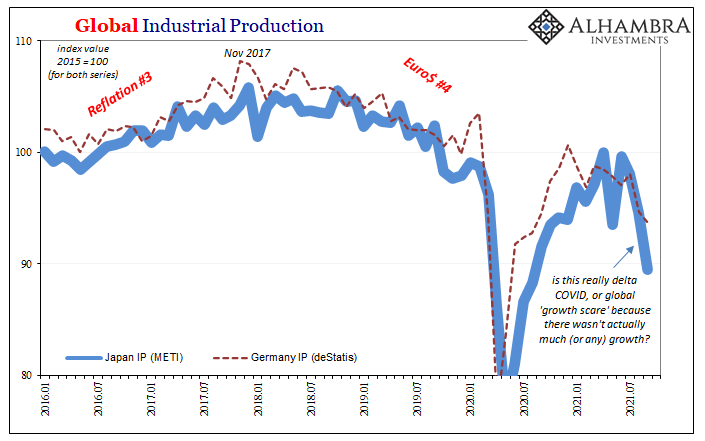

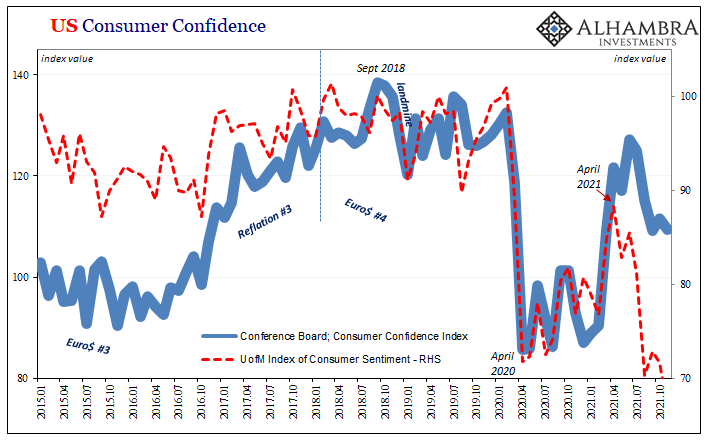

Looking across to other global data, including US consumer sentiment, it’s easy to see just how this isn’t just China, either.

The market’s knee-jerking the past few trading days isn’t really pandemic There remain serious problems and doubts as to the (largely unreported) underlying state of the entire global situation, demand first and foremost, which seems to be sliding (though, importantly, not falling off a cliff) no matter what state of the pandemic.

Stay In Touch