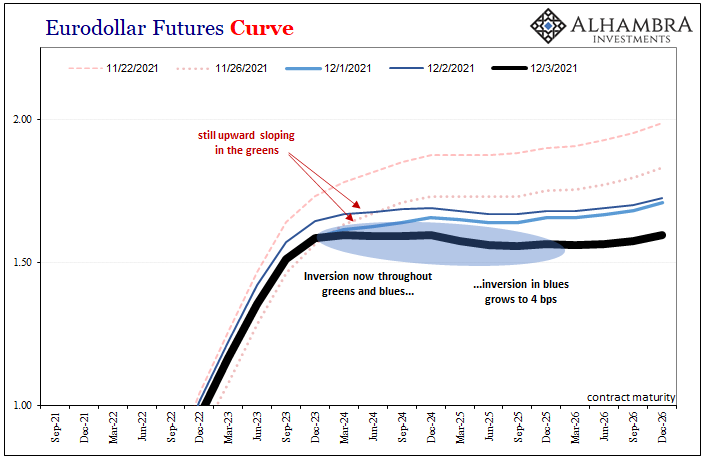

The Euro$ curve inversion of 2018 wasn’t an isolated case by any means. Along with all the other “bond market” stuff, these together had been a useful warning three years ago for reality as it unfolded the opposite way from the narrative about accelerating growth and inflation. Not just the one curve kinked, an escalating stream of alarms.

There was the dollar’s exchange value which “unexpectedly” went upward. The US Treasury curve became flatter and flatter until, May 29, 2018, the collateral system buckled. Inflation expectations (TIPS) then topped while swap spreads compressed.

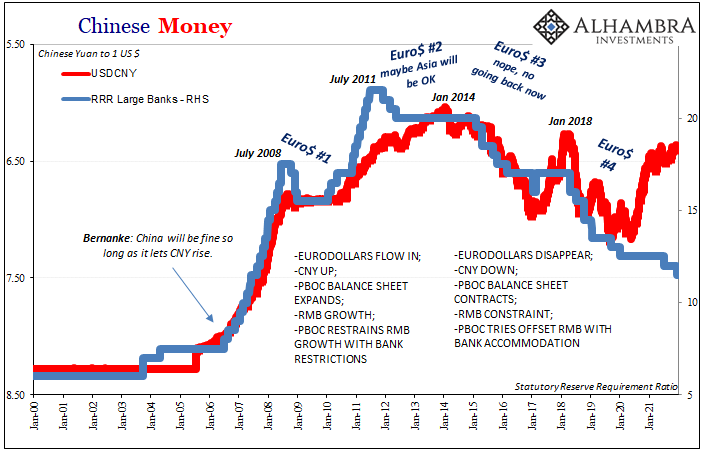

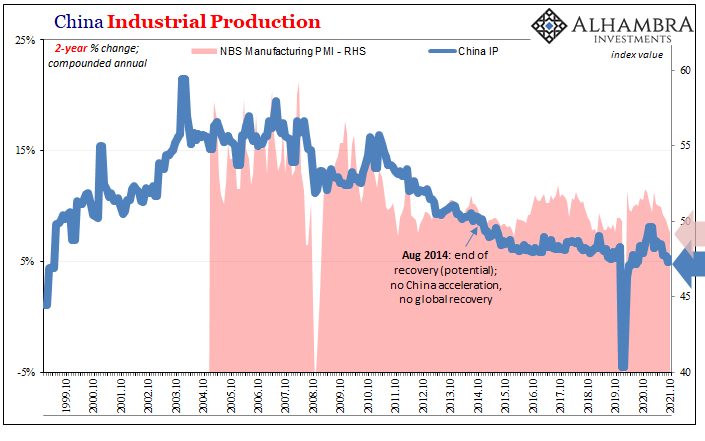

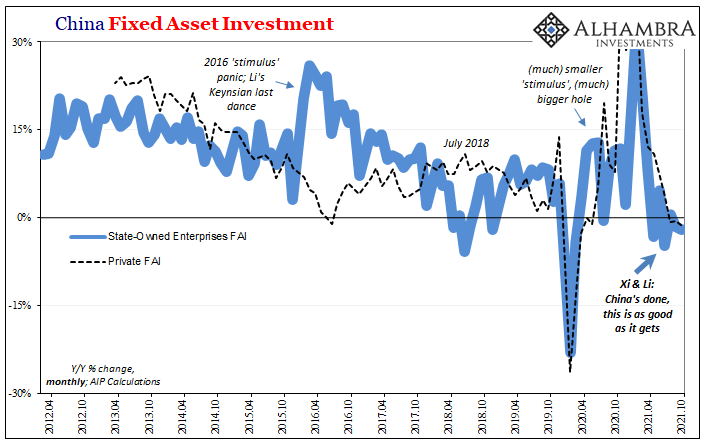

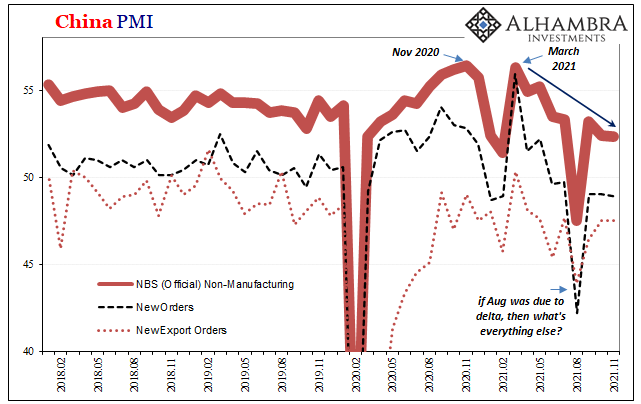

And the Chinese had been there, too, with their own contributed deflationary warnings. The RRR had been cut not once, not twice, but three times by October 2018; the second and third of those being implemented after the eurodollar futures curve inversion (and then three more in 2019 as more cautions/useless gestures).

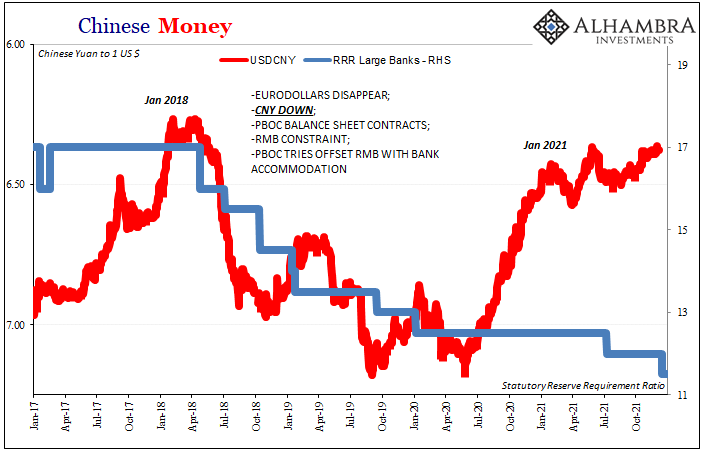

In terms of escalation this year, 2021, the US$ is on the rise, the yield curve flat and flatter by the week, and last week the first eurodollar inversion which, as I wrote, was a truly big one for the deflationary case.

And now, “all of a sudden”, last night China’s central bank announced an RRR cut. Mere coincidence?

Not a chance. All of these are, essentially, different angles by which to analyze the same thing. From Euro$ curve to RMB RRR’s, there’s trouble brewing.

There had already been one RRR cut earlier this year which had been equally ominous even though, like 2018, the hysteria surrounding inflation has been hyped even more than ever. Repeating the pattern, we’ve got curves and cuts coming faster and more furious as the year travels on.

As I wrote back early July when last the time RRR had been adjusted:

This is uniformly described as “stimulus” when, as noted above, it doesn’t end up stimulating anything. The reason is that these correlations, and the causal chain behind them, are nothing but unfixable trouble. Thus, whenever the RRR is reduced, rather than view it as “stimulus” you need to see it as a warning – that this causal reverse is becoming such a serious problem that the PBOC figures it has few other alternatives (because, in truth, it doesn’t).

In fact, I did just that in early October 2018 when the third RRR cut in only a few months not only refuted the Inflation Hysteria of the time it directly indicated an escalation of the negative money situation which had been developing all year before it. The timing was near perfect; the landmine, as we call it, exploded (globally) barely weeks afterward.

Boy, history sure does rhyme, doesn’t it?

November 2021 with eurodollar inversion and another RRR in close succession.

But why?

There are any number of reasons, none mutually exclusive. In fact, the list of potential negatives is entirely too easy to assemble; getting easier by the month. Start with the monetary basics like collateral scarcity, sprinkle a generous portion of “growth scare”, and then some pandemic pensiveness just to stir the pot of anxiety (risk aversion) a tiny bit more than it has been.

All of these are contrary to established convention. This year, 2021, was supposed to be the year of “too much money”, an economy more likely to have been overheated than otherwise, and a pandemic speedily and happily overcome by vaccines and stimulus combined. Failing one or even two of those risked major setbacks just in terms of sentiment; coming up way, way short on all three, well, there be landmines.

Collateral-wise, just look at the state of bills and yet another “coincidental” debt ceiling drama which just so happens to have been roiling the market for the best of the best of the best collateral (I’ll get to this later). For the corona and governmental overreach, another Greek letter has entered the discussion.

Then there’s this “growth scare.”

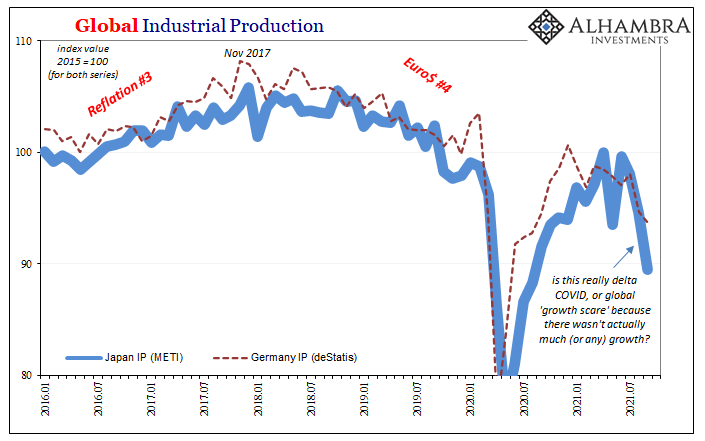

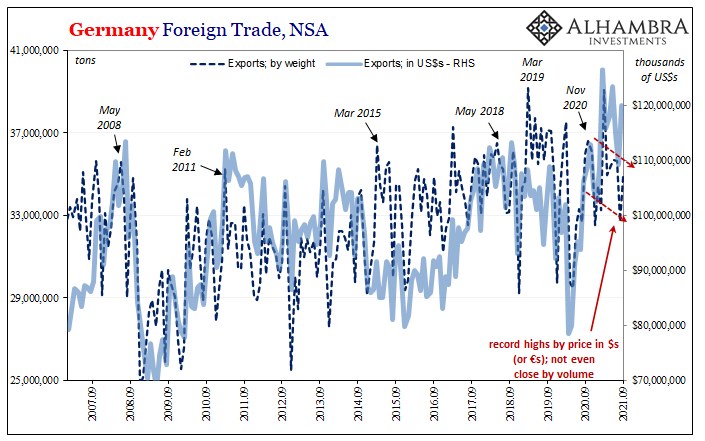

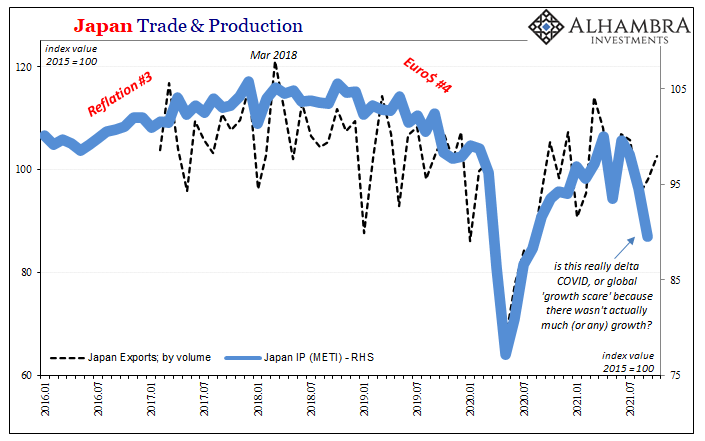

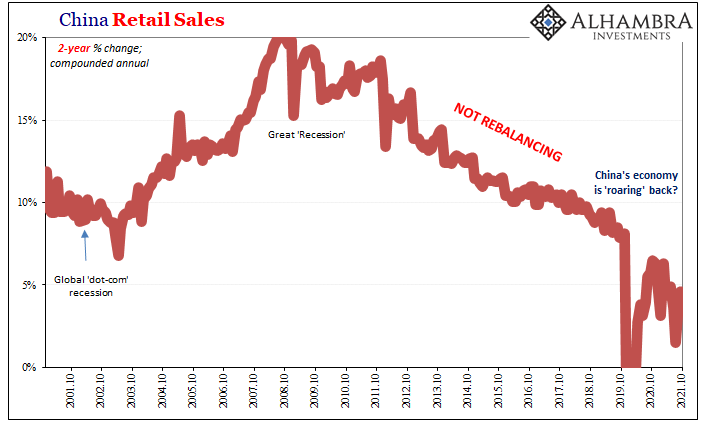

All along, though it has been disguised by “inflation” and the supply shock’s squeeze on prices, actual production levels globally have been truly pitiful even during their best days earlier in the year. Forget a boom not booming, the rebound didn’t bound all that much from 2020’s lows such that the world remains (including US labor usage) steadfastly fixed to a substantially lower (meaning worse) state when properly compared to the prior 2018 peak.

“But wait!”, everyone said. The supply shock itself is responsible for the setbacks in production. Just look at new orders where the future is immeasurably bright. Once the logistics get figured out production will revert upward to orders, finding easy equilibrium in full recovery mode.

Except, orders may have been tainted throughout in a different way – this other kind of inventory cycle.

Suppose retailers (outside of automobiles) grow concerned about supply availability or shipping times. They might naturally react by boosting their current order flow if only to increase their chances some product makes it through the clogged shipping channels.

As that increased order flow unrelated to demand continues to move back through the supply chain, it probably would only make the transportation issues that much worse. It’s already a mess, and because it’s already a mess the entire supply chain tries to stuff more goods through it rather than less, rather than giving the system some time and space to work out enough kinks.

This, of course, would probably convince retailers to do it all over again, ordering even more they don’t need now or in the near future, now more desperate to try and raise their chances of receiving anything. More trouble for the shippers and so on.

Having intentionally over-ordered, and then over-ordered again (and again?), this time what happens when the logistics get more sorted out and then deliveries rather than trickle through come pouring out? This is the cyclical question for early 2022, not the unemployment rate.

Maybe it’s the question bothering the world already in late 2021, too. This really could be our “growth scare” at least from its starting point.

How things change in just a few months. WSJ headline:

— Jeffrey P. Snider (@JeffSnider_AIP) November 24, 2021

"Today’s Shortages Could Soon Become Tomorrow's Gluts"

*insert william shatner shocked face herehttps://t.co/47EGK6tQdt

What might/would happen if, for example, retailers and merchandisers all over the world who really had been doubling or tripling their order books suddenly get cold feet about demand? They know there’s a pile of goods coming their way that not long ago they thought would easily sell (or put right to work, in the case of capital goods).

A little more unsure today, and with so much already having been ordered and on its way, wouldn’t it make sense if they start canceling any orders they can? Not just canceling what’s been ordered, also reducing even eliminating future orders, too. The rejection begins at the margins, in the marginal producers like those in Japan or, yes, Germany.

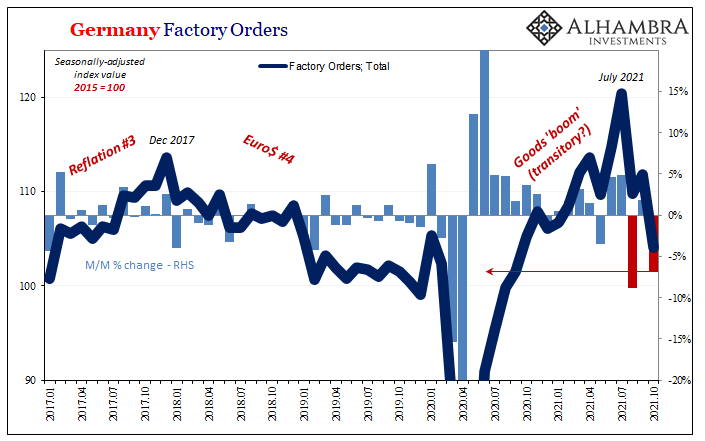

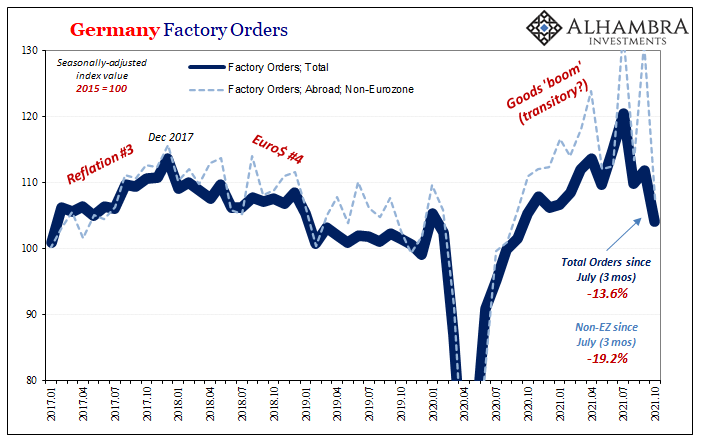

Factory orders in the latter, for example, these have been one place where the “boom” did seem to boom – earlier in the year. The growing distance between orders and production levels appeared to spotlight the supply issues while making underlying demand seem particularly robust.

That was until around June or July (same timing as US labor market). In the three months since July (up to the end of October, the latest data which is pre-omicron, by the way) factory orders from Germany’s vast industrial beast have plunged by almost 14% – and that’s not an annual rate, either.

Orders from outside the Eurozone have collapsed by almost 20% (also not an annualized rate)!

The declines are surely being driven by what have to be canceled orders, and those for capital and intermediate goods (inventory). Not really a growth “scare” so much as a real-time growth re-think turning into growth perspective adjustments on the fly.

There are questions about US demand, sure, but also serious uncertainties related to…China (both short and long run). The world has been told (by Economists) it can count on Emperor Xi to deliver on a “strong” Chinese recovery. It seems as if the world’s commercial agents have allowed themselves to be, yet again, fooled (by Economists), now left holding a gigantic bag of floating inventory necessitating some way out of their (repeated) error.

Xi himself has been perfectly consistent when it has come to his economy: Don’t Count On It. This whole year serious weakness in China has been under-the-radar in the same sort of way as growing deflationary pressures in the global dollar system. Both have been claimed to be bullet-proof; too much money from Jay Powell combined with Xi’s ultra-dependable Chinese resolve and it was going to be inflation, seventies-style.

How could it not?

Now a second RRR cut to go along with one inverted Euro$ curve in close succession.

🎵 🎵 The Twelve Warnings of Deflation (partial lyrics) 🎵 🎵

…

–Five flatter curves–;

Four dollar rise;

Three collateral scares;

Two R R R’s;

And a eurodollar [curve] we don’t want to see.

Stay In Touch