Empty shelves at the grocery store are an easy way to get likes and clicks. The highest CPI in decades, like there almost certainly will be at tomorrow’s release, relatedly a hot news topic. On the contrary, hardly anyone will publish therefore notice that wholesale inventories during October 2021 increased by the largest monthly amount on record.

It just doesn’t fit the intended message, whereas the other two do nicely.

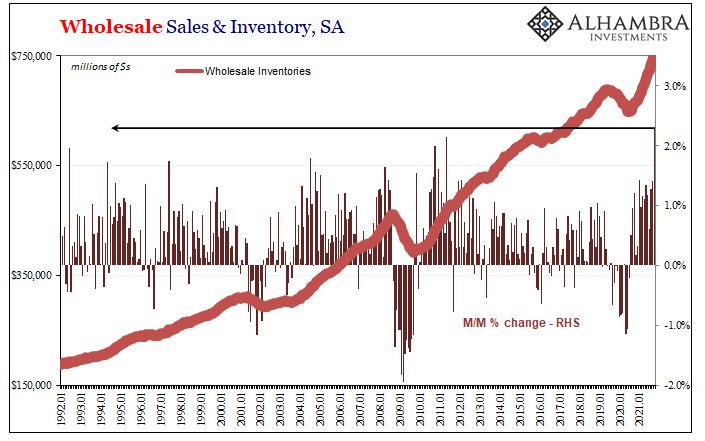

According to the Census Bureau today, overall inventories reported by wholesalers surged by 2.3% in October compared to September. This was the single biggest monthly rise in the data going back to 1992. Inventories here have gone up by 13.5% just this year, a compelling contradiction to the emptying of car dealer lots and carefully-selected barren shelving.

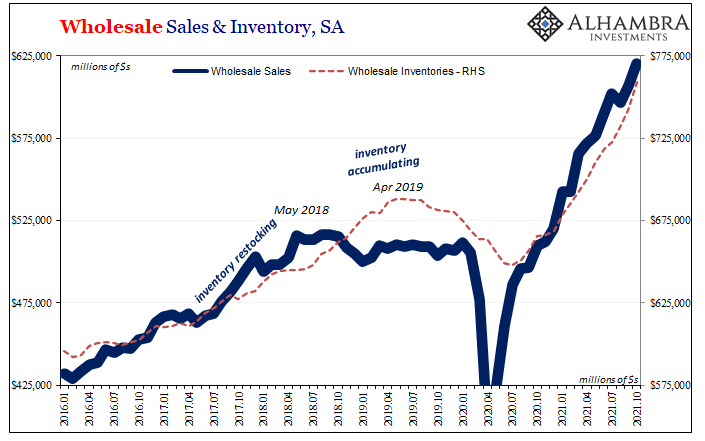

For one thing, wholesale sales have likewise jumped. These were up a similar 2.2% month-over-month in October, which is why there is little expressed concern as to the overall inventory situation. At first glance, the economy does seem to be red hot.

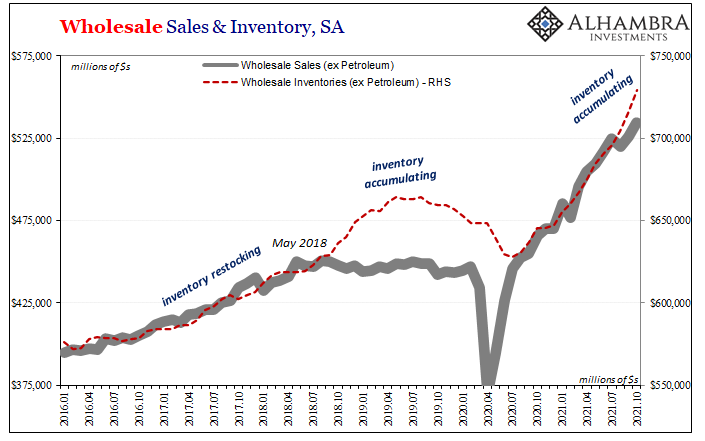

As we’ve noted before, however, extreme differences in the condition of inventory across sectors is playing a mathematical trick, of sorts, complicating our interpretation of these numbers. For example, while overall wholesale sales rose by $13.5 billion (seasonally-adjusted) September to October, $5.4 billion of it, or 40%, was petroleum alone.

As we’ve noted before, however, extreme differences in the condition of inventory across sectors is playing a mathematical trick, of sorts, complicating our interpretation of these numbers. For example, while overall wholesale sales rose by $13.5 billion (seasonally-adjusted) September to October, $5.4 billion of it, or 40%, was petroleum alone.

Inventory added $17.2 billion, though only $3.3 billion was crude oil. Fewer sales of everything else, but quite a lot more inventory.

The energy sector like the automobile sector has run down inventory, whereas every other sector has gained. Over the past three months, in particular, the difference in “gains” have outpaced even robust sales.

If you start with overall wholesale sales and inventory, the two have largely been equal (shown above) – already very different from how the situation is being widely perceived because this isn’t how it’s being described. Keeping pace on the one side risks the problem of accumulation should the sales side begin to slip for any reason.

At such an unusual, ahistorical situation in US consumer goods spending (as opposed to languishing services spending), would it take all that much (even just rebalancing slightly back toward services) to put this matching pace into imbalance?

When you account for the limited supply therefore inventory of starting with petroleum (shown above), this is no longer an “if” sort of potential situation. Several months ago, inventory levels of everything neither cars nor oil surpassed the level of sales for the same.

Dating back to July, another indication for summer slowdown ’21, wholesale sales slacked off a bit outside of crude while at the same time inventory kept accelerating. There may still be a shipping mess and the related logistical nightmare, but goods are absolutely making it through them and have begun to pile up in between manufacturers and their ultimate retail destinations.

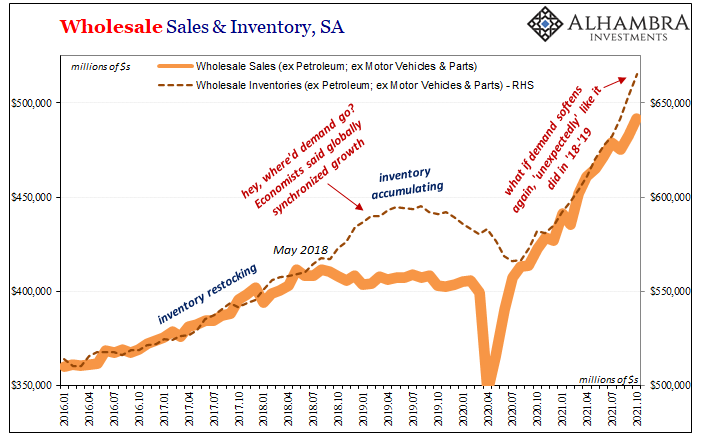

This difference is even more revealing when taking out energy as well as motor vehicles (shown above).

As a result, closely watched inventory-to-sales ratios have been rising apart from those two even during this blistering hot sales climate leading up to the Christmas year-end fluster.

How much stuff was double-, triple-, quadruple-ordered and therefore might remain in transit yet to be delivered even in and through the wholesale part of the supply chain? I doubt anyone has a good idea, even the shippers and order-ers themselves. As they would say in Britain, this is becoming a proper mess.

The bigger question, potential cyclical negative, is late Christmas retail and then after-Christmas inventory. There are all sorts of data and quite a few indications the retail holiday season got itself an early start, perhaps then an unexpectedly early finish.

Yet, there doesn’t seem to be an end in sight for the flow of goods despite what’s already now in inventory across wholesale chains. The risk, as always, sales drop off – even a little – while inventory keeps coming and coming and coming.

Whether hot or less so, it hits or misses, tomorrow’s CPI will dominate the financial media discussion. In terms of what’s ahead, it may end up that today’s wholesale data determines what future CPI’s – and the state of the whole global rebound – may end up being.

Like skeptical bond market curves, we’ve said it for months: all eyes on inventory.

It could very well be that manufacturing remains high because of inventory and not because current potential weakness is only about delta.

Should it turn out to be unrelated, or only somewhat attributable to renewed disease measures, then inventory stops being a pesky annoyance of shipping bottlenecks and potentially starts being more like its old self. While that wouldn’t necessarily mean recession in early 2022, even a substantial downturn (chances would have it globally synchronized) having yet fully recovered from the last two would be enough trouble.

Therefore, eurodollar curve inverted indicating, yes, the potential is there and it is rising; though maybe not as fast as the frenetic pace of wholesale inventory.

Stay In Touch