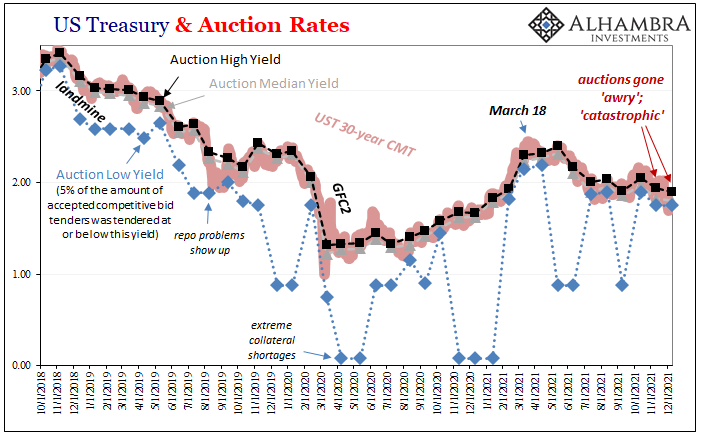

The bond market is imploding, right? It has to be going by everything you hear. Did you know that the last two 30-year bond auctions had gone “awry”, as one mainstream news outlet put it? Another “media” shop declared them “catastrophic.”

The second of those long bond sales was conducted just yesterday afternoon, right in time to run into the buzzsaw of the November CPI figures released today. According to the BLS, yep, the highest rate of general consumer price increases going back to before anyone knew who Alan Greenspan was (if only we could go back in time, at least on that one account).

And we can’t also forget that the Fed is tapering its bond purchases and has even hinted at accelerating the cutbacks. As everyone “knows”, without Jay Powell’s balance sheet there’s no hope for Treasuries.

Put these things together, and it absolutely must spell doom for the whole curve; the entire market. Given this, the 30-year yield must be shooting up, what, 30, 40, a hundred basis points?

Of course not.

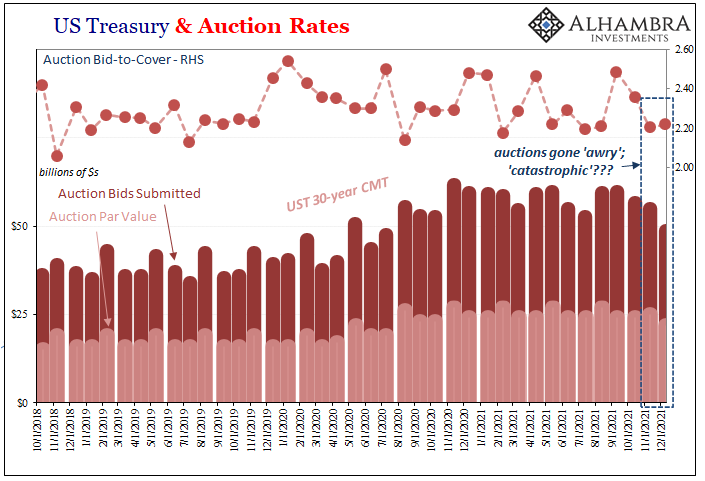

First off, the last two 30s auctions were hardly “awry” in any sense. Plenty of demand, the bid-to-cover ratios for the last pair were lower if only when compared to the previous pair. As you can plainly see (above), however, demand for the long bond was basically the same it’s been going back at least to 2018 (and farther). The ratios were actually a touch lower earlier this summer.

Instead, what’s going on here especially in the financial media is that pretty much all of it had sold what soul anyone had left for the inflation narrative. A true hysteria, a second one, it wasn’t just reported as one possibility among several paths, it has been described everywhere as already fact, guaranteed, done-deal. The bond market’s very clear, historically dependable, utterly consistent yet very simple and straightforward contradictory signals are more than an inconvenience.

Therefore, anything and everything to try to water down or muddy the troublesome debunking that’s been going on in real time for a long time already. Having promised there could only be inflation only to see the most accurate markets price something else, yet again, irrationality is to be expected along with the narrative falling apart.

“They” really are trying to cancel bonds when the yield curve and the rest of the global “bond market” is instead here to help you, them, anyone. Just listen, observe, take in the wise advice rather than fall into these counterproductive fits of self-delusion.

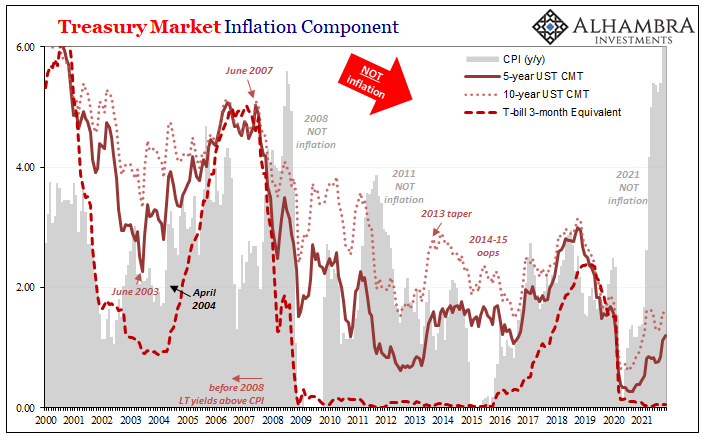

It only begs the question, CPI’s along with the Fed’s taper, why aren’t yields like inflation numbers skyrocketing?

Quite simply, because this is not inflation. Furthermore, “inflation’s” days appear to be numbered.

Consumer prices have gone up, way up, though for very different reasons apart from money or even something resembling economic health.

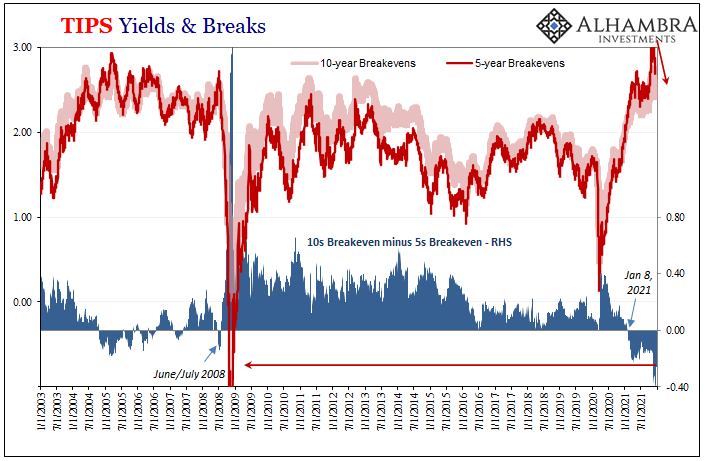

Looking outside specifically the nominal yield curve, take TIPS. You would likewise believe, and have been left with the impression you should believe, inflation breakevens (market-based expectations) must have jumped with today’s epic CPI report.

No. On the contrary, the 5-year breakeven (the difference between the nominal 5-year US Treasury yield and the “real” 5-year TIPS yield) fell 4 bps from yesterday. It is down 12 bps just from Wednesday’s close, and 41 bps lower since peaking in mid-November. These 5s have been where short-run consumer price expectations have been most like the “inflation” story.

Longer-run breakevens haven’t agreed with all that, which is why the TIPS “curve” continues to be highly inverted. The market specifically devoted to pricing the CPI has – all year – priced only “transitory” from it. More since late October (see: below).

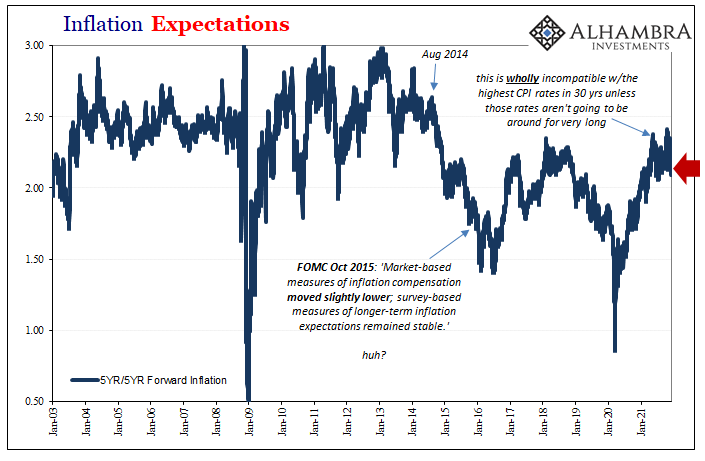

Even more thoroughly convincing than nominal TIPS has been the derived 5-year/5-year forward rate which never once achieved 2014 levels let alone something like multi-decade highs. On the contrary, like falling nominal yields and a dramatically flatter UST curve overall, the market is making its case for the growing opposite of both inflation as well as “inflation.”

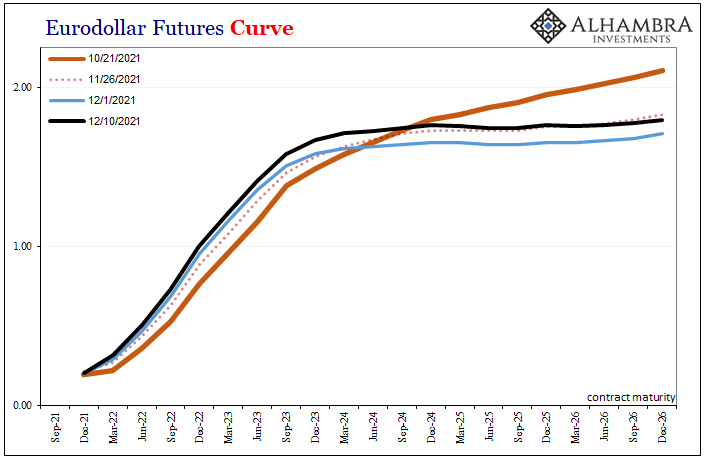

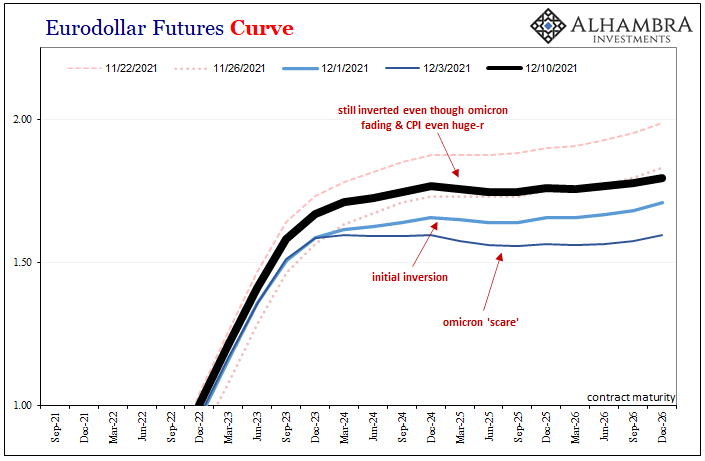

None more so than the related market for eurodollar futures. As noted on December 1, the curve here inverted, a really big development, a truly dependable signal if for the neither-inflation-nor-“inflation” side.

Initially, the inversion may have seemed related to the apparently brief omicron “scare”, but a week afterward the inversion is still here though omicron fears have subsided. The curve overall moved lower (higher eurodollar futures prices, in general) as the latest form of COVID was everywhere (in media) last week, and then the curve moved overall back higher (lower eurodollar futures prices, in general) throughout this week.

Yet, the shape of it (what I said last week we’ll be looking for) has been consistent throughout these downs and ups.

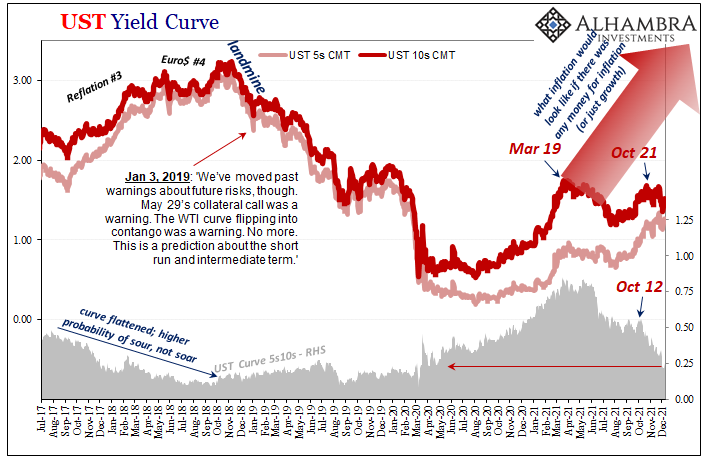

Like the yield curve, it’s about time right now. In other words, the more time passes and these curves continue to do what they’ve already done, the longer they go without correcting themselves back to steepening and upward sloping, the more confident the market is in what the curves are getting at: again, neither inflation nor “inflation.”

Everything, and I mean everything has been said to have aligned perfectly for growth and consumer price acceleration in 2021. As to the latter, yes, obviously, but not because of the former nor any excessively monetary background.

The fact curves keep going further and further the wrong way, the wrong twists and distortions in them, as the days, weeks, and quite a lot of months go by despite CPI’s and media protestations, childish or occasionally coherent if misguided, to deny what’s an otherwise obvious and powerful message can only be purely obstructive ideology.

Consistent. Coherent. Utterly unambiguous.

The consistency and coherence isn’t omicron or any strain of corona. The Fed QE-on, QE-off has made no difference. Consumer prices have certainly left their mark.

The global bond market has peered through all of these things and, from the perspective of the monetary system those bond market participants and their prices represent, they are telling us 2021 has already been an utter disappointment in every way possible, leaving 2022 to begin with serious suspicions, at best, becoming more serious the closer it gets.

Hardly some flash in the pan fear over the fleeting excuse-of-the-moment, we are nearly nine months into this thing. All year, we’ve warned of only rising deflationary potential and it has played out exactly that way in markets as well as data.

With that, sure, bond market auctions catastrophically gone awry. Not true, of course. But what else might we have expected from another inflation panic? Not only do yield and money curves thanklessly sort one CPI from another, they also point out these hysterias for us, too.

Stay In Touch