I’m not much for writing, so I’m sure nothing of a song-writer. While that may be the case, what I do know is that two of the missing lines in our Twelve Warnings of Deflation carol would belong to JGB’s and oil. How to fit them in, someone else would have to do so; the number we’d associate for JGB 10s is zero; while in WTI, we’re looking for a similarly negative number.

Setting aside trying too hard to be cute, what I mean is very serious. There have been a bunch of warnings thus far, escalating indications of the deflationary potential type. Just recently, the second RRR followed closely the eurodollar curve’s inversion (still there today).

Looking ahead, what might be next set of escalations from which we might mark the monetary system’s continued descent? A collateral day, sure. The dollar continuing to go up. Yield curve flattening, that’s already a thing.

🎵 🎵 The Twelve Warnings of Deflation (partial lyrics) 🎵 🎵

…

–Five flatter curves–;

Four dollar rise;

Three collateral scares;

Two R R R’s;

And a eurodollar [curve] we don’t want to see.

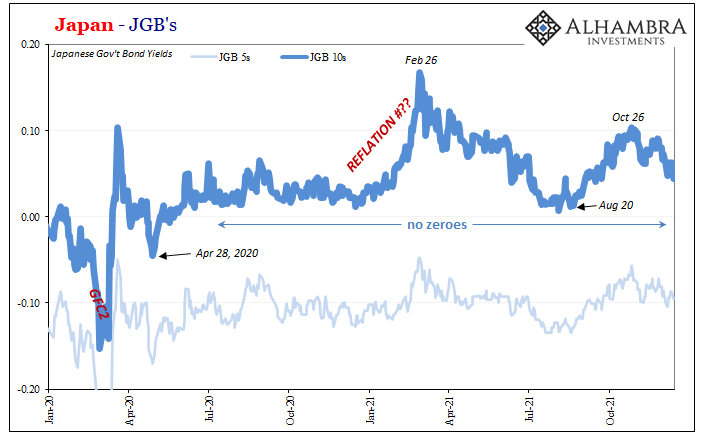

Of those not included in the “song”, not yet, as mentioned before the JGB 10s crossing zero and sticking around with a minus yield would be a particularly strong negative signal along these same lines. The world just barely missed back in August; the JGB market, synchronized with Treasuries, had avoided this trigger.

They are heading down again for another try.

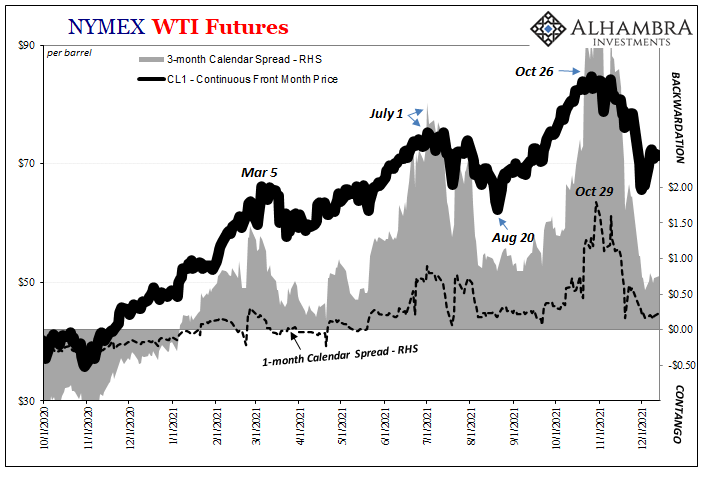

It wasn’t just Japanese federal bonds, either. Oil prices had tanked and the WTI curve itself flattened during the same timeframe. Front end backwardation dived with headline spot crude before turning around right when JGB’s and, not surprisingly, the US$ would: August 20.

All these indications are related via the eurodollar system. Inflation, growth, financial conditions all flow from the reserve currency system.

That’s why since late October these very same markets remain synchronized only now in the opposite direction from the modestly reflation-y earlier trend begun late August. The WTI curve has, like eurodollar futures or Treasuries, re-tanked; front-end backwardation here even more extreme than early summer.

But it hasn’t reached contango just yet. The 3-month calendar spread is still around $0.70 or so, having stabilized over the past few days (above).

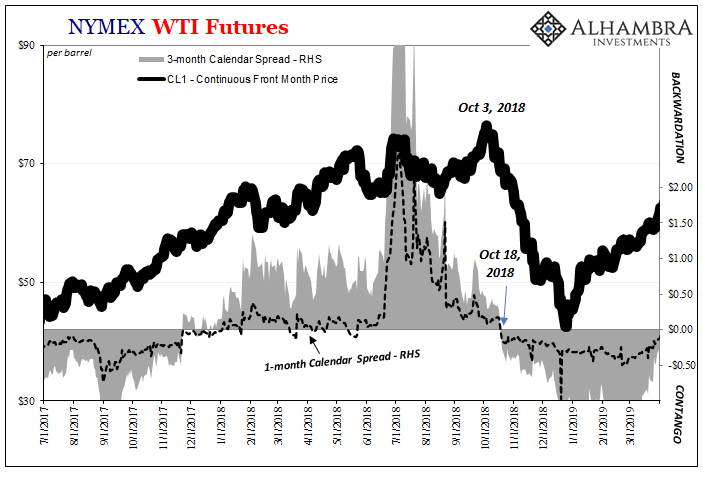

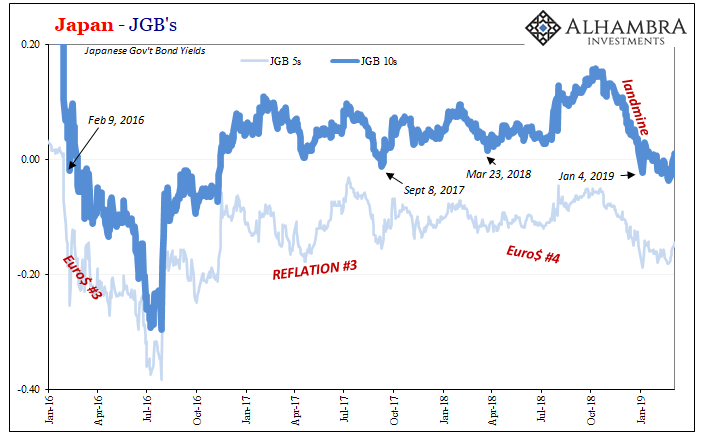

If you go back to 2018, one of the key landmine predictors – along with eurodollar futures and Treasuries – had been WTI contango (also 2014). As those others, that one was likewise about risk aversion here in the context of physical crude delivery.

In other words, serious questions about demand and the financing of oil supplies in the face of what all these things indicated was actually happening (it wasn’t inflationary growth).

As for the JGB 10-year, it didn’t hit the minuses until early January 2019; more of a coincident confirmation of what had already transpired.

Heading into 2022, maybe oil, in particular, the curve reshapes itself like it had late summer; steepening back toward backwardation as the crude system shook off the growing concerns even if those had never quite been overcome across global fixed income.

Perhaps Japan’s 10-year likewise continues its nearly 19-month stretch of unbroken positives, and we avoid the same mess(es).

Eurodollar futures was a big one on the wrong side, however, a worrisome sign of stalling and risk aversion beyond the simple-minded pandemic discussion. Along with the other “days” of deflation experienced already, should the WTI curve end up in contango and/or JGB 10s back below zero, those would be important, crucial confirmations.

Stay In Touch