How does QE work? That’s actually a trick question given how all the evidence produced in examination of the various programs undertaken across the world under that label uniformly indicates that it doesn’t. On the contrary, the most studied and tested government efforts in history have yielded consistent results up and down the board.

It’s just that the public has never been told what they are.

Instead, the media continues to be filled with stories about trillions of whatever currency being poured into whichever economy when none of those things are true.

That’s not even how those who believed in it said it was supposed to work.

The way it is meant to go, in theory, is by at least one of three ways: lowering interest rates; portfolio effects; or, positive sentiment. When the Japanese were thinking all this up more than two decades ago, they’d expected, if it was to be successful (the Japanese were actually quite doubtful), it would probably be a combination of the three.

Taking the last first, sentiment simply means that consumers and businesses become more optimistic simply because a central bank did something the same central bank told consumers and businesses would be highly accommodative and helpful to the economy. QE Theory™ posits that the public is immensely gullible and will reflexively react without question or fail.

On the second channel, as to interest costs, it does sound like it should work, and work well and easily; central banks buy bonds thereby bidding up their price(s) leading to lower interest rates. Yet, again, results are conclusive; the market and only the market sets interest rates everywhere and all the time.

We’re being re-reminded of this fact right this very minute with ongoing Taper Rejection all over US markets as well as those in Europe.

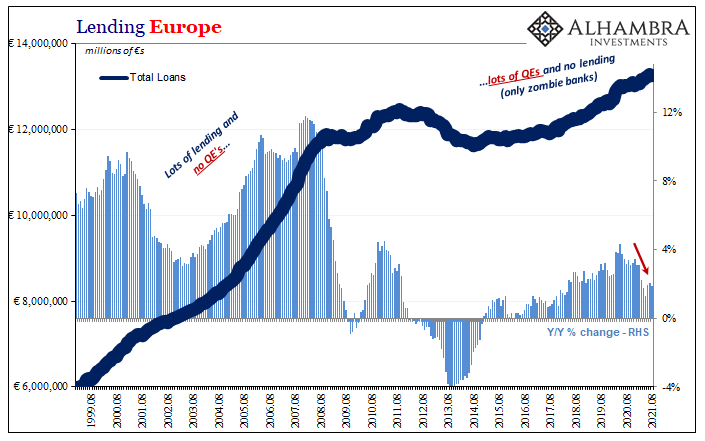

That leaves just the presumed portfolio effects, which all along had been thought the primary channel for financial and economic “stimulus.” The central bank buys bonds from primary banks, exchanging them for bank reserves that pay very little return; or, in the case of Europe like Japan, come attached with an outright cost to hold them (NIRP).

In either instance, the banks who sell the bonds to central banks end up with reserves forcing them to seek out riskier assets with far better returns to make up for the diminished income potential given this set of transactions. Maybe a government bond didn’t yield all that much, but now that the bank has sold it to the central bank it holds an asset that yields far worse (especially where NIRP is in effect), thus it seems reasonable to have expected these banks to offset the lower returns by going into the market and either buying a much better returning asset or, ideally, creating new, higher-yielding (and economically beneficial) loans.

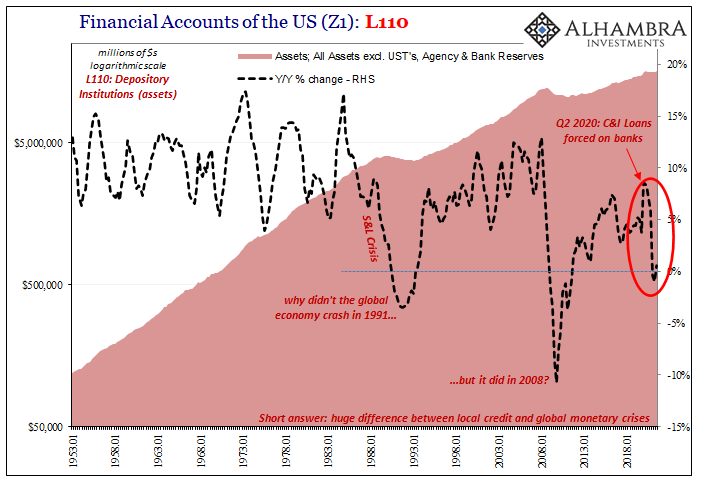

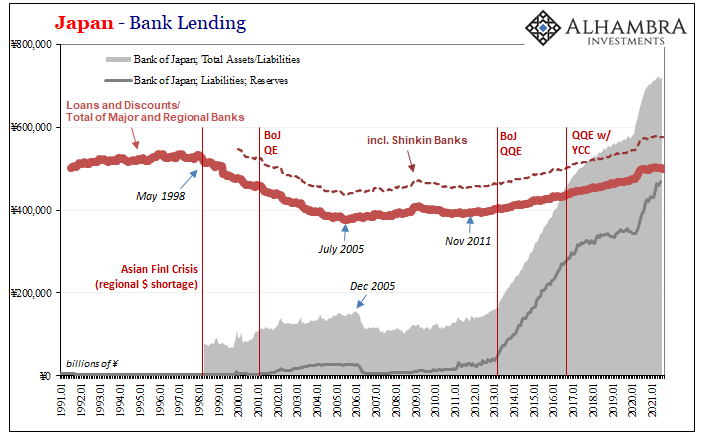

Yet, once again, all the evidence for hypothesized portfolio effects is abundantly clear. They just don’t happen. Banks do sell their safe, liquid bonds to central banks…and then go out and buy more of the same safe, liquid assets.

The Japanese had even warned the world long before the 2008 crisis and the introduction of QE in the West how flawed and ineffective “bond buying” in practice had been, particularly with regard to the portfolio effects that never materialized. From one important 2005 BoJ study the Economists all ignored:

The portfolio rebalancing effect — either by the BOJ’s supplying ample liquidity or by its purchases of long-term government bonds — has not been found to be significant.

Another fifteen years later and so many additional QE’s you can’t count them all (and I’ve tried), absolutely nothing had changed.

What is it someone once said the definition of insanity must be? That person had never met a central banker.

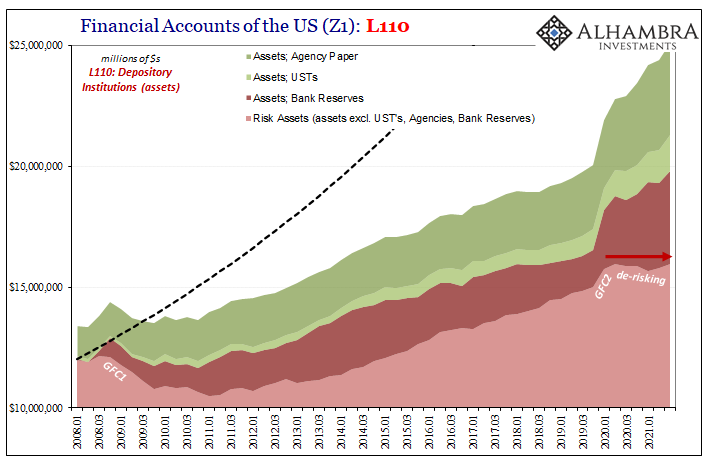

In one of those tragic cases of unappreciated irony, the Federal Reserve, one of the biggest current purveyors of QE Theory™, published more results disproving their very product back on December 9. The Financial Accounts of the United States, or Z1, contain comprehensive data on the activities of the financial institutions operating in the US.

Among those, L110, is an aggregation of the entire banking sector’s held assets and matched liabilities.

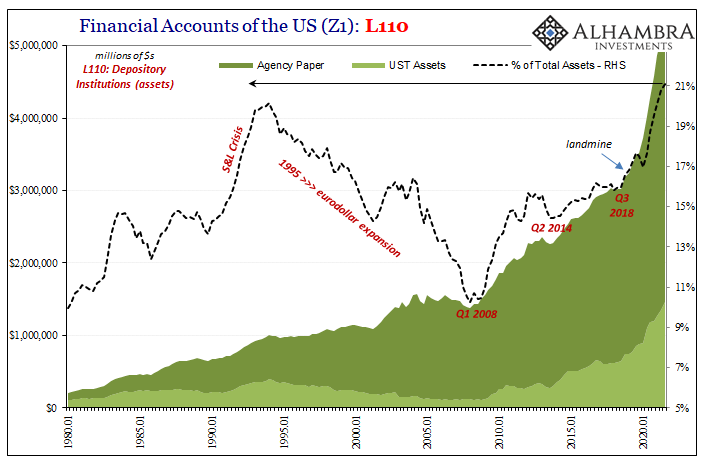

Like in the Japanese cases, US-based banks (which include a healthy number of domestic subs of foreign parents) are churning through UST’s and GSE MBS, buying these securities by the boatload at primary auctions and then selling them over time into the secondary market to an assortment of motivated buyers which includes the Federal Reserve.

This is nothing unusual; in fact, that’s what dealers are supposed to do. They buy at auction and then sell afterward. They could not care less who they are selling to, whether it’s some hedge fund, insurance company, or FRBNY’s Open Market Desk.

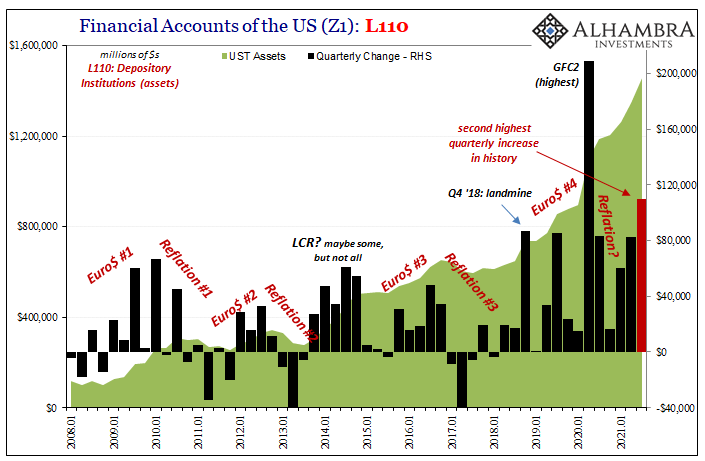

What is unusual, particularly since October 2018, is how much the overall depository system keeps holding onto (above). As we continue to document quarter after quarter, banks in general have been obviously motivated to load up with UST’s and agency debt securities.

As of the latest figures for Q3 2021, the holdings of UST by US Depository Institutions increased by the second most in the series history (second only to Q2 2020, the immediate aftermath of GFC2)! The same three months that CPI’s have skyrocketed, Fed taper became a certainty, and everyone said Treasuries were doomed.

No matter how much the Fed buys from banks, giving them low-yielding bank reserves in the process, banks refuse portfolio effects by favoring safe, liquid instruments exclusively. In fact, the proportion of those (UST’s + GSE issued) being held in the aggregate is the highest in more than sixty years.

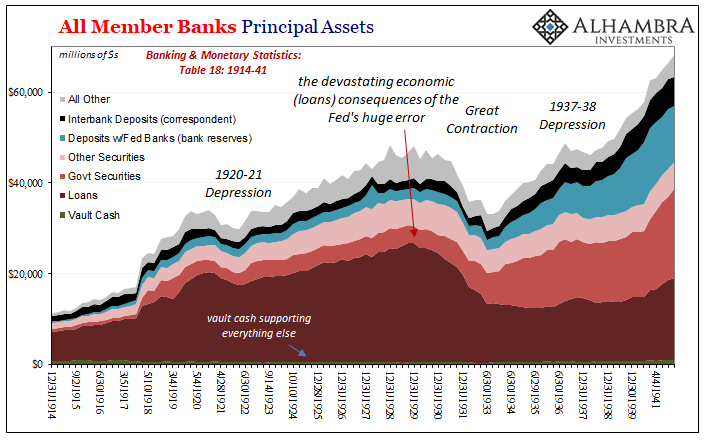

It’s like the 1930’s all over again. Seriously.

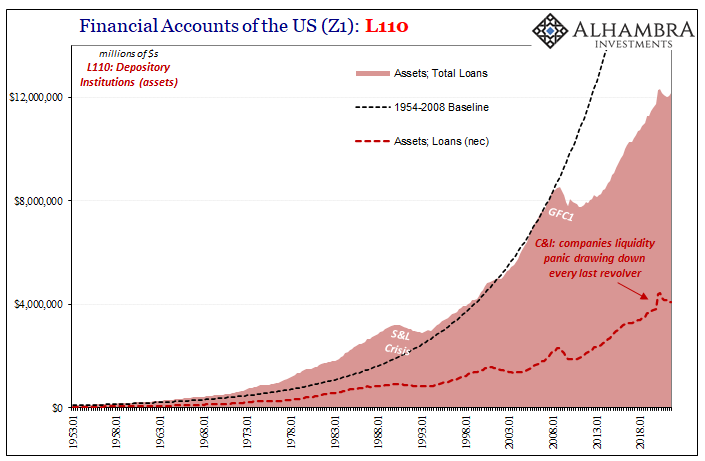

Pouring trillions of dollars into the US economy? No sir. Pouring trillions of bank reserves into bank books, yes. But then what? Lend? Nope. None of that.

Taper Rejection is already another great and powerful example of QE lacking, in that instance failing via the interest rate channel.

The Fed’s Z1 for Q3 2021 further adds to the already mountain of evidence burying portfolio effects.

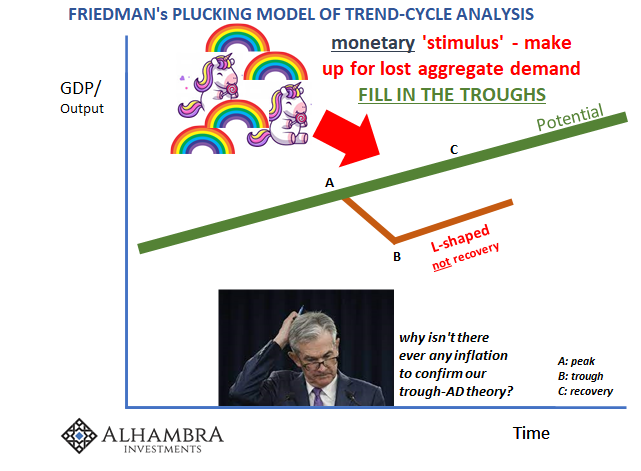

All that’s left is, and I’m really not making this up, sentiment. When I first produced my graphic representation of QE as rainbows and unicorns (below), it was slightly tongue-in-cheek, sure, but in terms of actual evidence as well as any honest account of the real world it’s not really that far off the mark, either.

And it circles back to Taper Rejection which is really global bond and money curves being reshaped (lower and flatter) by rising deflationary potential. Jay Powell’s Fed and Christine Lagarde’s ECB both are tapering on the belief inflationary pressures are building, which “everyone” has also claimed the entire theme of 2021 therefore the likely results of 2022.

Not so. On the contrary, all the while throughout the year it has been deflationary money and finance in the starkest of terms regardless of transitory consumer prices.

The world’s banking system – the actual money printers – haven’t just rejected QE, or the justification behind each taper, they’ve also indicated that where the real money is or should be they’ll only hold to the most safe and liquid instruments regardless of anything said, printed, or done in the media or on whichever central bank’s behalf.

If banks are exclusively in the market for safe and liquid, and banks not central banks are effective money, what does that tell us about safety and liquidity?

Despite the omnipresence of QE Theory™, actual QE in practice doesn’t print money, it can’t affect interest rates, and it fails to produce portfolio effects. All that’s possibly left are the colorful rainbows and whimsical unicorns each quite naturally unable to do much about deeply troubling and momentous real-world money/finance/economy issues.

Safety and liquidity. There’s your 2022.

Stay In Touch