Dark leverage, that’s the real stuff. In a ledger-based monetary system, money creation comes from expanding leverage. Simple. Clean. Obvious. How it gets done, that’s the genius, the beauty, and the disaster.

Call it money of account, or ghost money, fictional currency, whatever. It’s the secret sauce which, when you see it, you just can’t un-see it. This is the real red pill, as it were.

The policymakers at the Federal Reserve play central bankers on TV. They talk the talk and make the necessary noises, but at the end of the day their only policy tools are sentiment and bank reserves; so, just sentiment. Bank reserves don’t really have a place on or around the ledger which isn’t already taken up by private ledger resources.

To explain even a few of the intricacies behind balance sheet construction in this ledger-based system to any useful detail would take more space than I have to give. This is not a cop-out on my part, rather an explanation given just how unsuitable this kind of medium is for the subject. People ask me all the time to explain this as I might a fourth-grader; but this just isn’t fourth grade material.

I don’t mean this to be condescending in any way; like I wrote at the top, once you see it the whole thing makes so much sense and it becomes almost easy, second-hand. It’s getting over the intuitive and intellectual hurdle that’s the hard part, and it comes from so many different angles and features, absorbing mind-bending concepts one after another after another.

Regardless of these caveats, I’m going to grossly oversimplify pretty much everything anyway.

To make money, to create monetary resources (ledger “space”) it isn’t printed instead expressed in the language of modern ledger money. Mathematics. The one mathematical variable which destroys balance sheet mechanics thereby ledger space the most is volatility.

Another way of saying volatility is uncertainty. Think about it this way: if you have two assets and one has exhibited so much more volatility than the other, given a level of starting capital and a desire to remain in business, which do you prefer?

You might really like the volatile one which presents a greater upside, but you have to account for the uncertainty; one unexpectedly good day and you retire filthy rich, yet any number of bad days means you’re bankrupt (with a knock on your door from JP Morgan letting you know). Financial asymmetry of this sort is an actual feature.

Thus, what would be an ideal solution is to find a way to create some more certainty about the downside of the more volatile asset without giving up too much of its huge potential upside.

Hedging.

This isn’t strictly about the profit potential and risk characteristics of individual positions, nor portfolios of positions. Banks work as any real economy business does on a budget; only theirs isn’t just about payrolls costs and operating expenses. Their entire output – this ledger of money/credit – is likewise governed by a budget predicated largely on computed risks.

How much in assets can a bank stuff onto its balance sheet? Theoretically, the amount is unlimited, infinite. In the ledger system, there’s no need for real physical money like bullion or vault cash since convertibility isn’t actually an issue for fictional currency and ghost money. Therefore, total systemic “money” supply for the entire global reserve (fictional) currency system is what’s added up from all the balance sheets on the shared ledger.

However, for every asset you do add to the asset side of the balance sheet (setting aside the liability side) you incur risk. Thus, the effective limit to balance sheet space is the likelihood of future losses wiping out the accounting fiction of capital reserves or ST borrowing capacity (if we’re being more realistic, that’s the endpoint real constraint); when booked losses are greater than a bank’s retained equity or repo viability, really long before then, it’s game over.

Therefore, there exists an enormous desire to quantify these risks often expressed as volatility. Banks have come up with several ways of doing so, including things like VaR, which gives them a sense of aggregate risk capacity.

From that, each one can define a sort of “risk budget” to assign to various purposes within each firm.

Let’s just simplify this down to its most basic format (again, this isn’t a realistic example). Assume a bank has a “risk budget”, a total mathematical limit of 100 just because it’s a round number. The more volatile an asset might be, the higher its volatility score counting against that limit. Thus, for assets that have, say, a volatility score of 50, you can only afford to put two of them onto the balance sheet and stay within budget.

Of course, this limits your profit potential, meaning that you’d prefer to have more than two of these assets given their upside but you realize you shouldn’t go any farther than two without it creating material risks for a catastrophic downside.

What if, though, you could find a way to reduce the expected volatility on these assets so that instead of a volatility score of 50, you get them down to something like 25? In this case, you’d be able to own four rather than two for the same downside risks to the firm (reminder, oversimplifying).

This means the bank’s balance sheet becomes wildly more efficient; for a given level of capital or borrowing capacity and expected danger to it, there’s more assets for the same (modeled) downside.

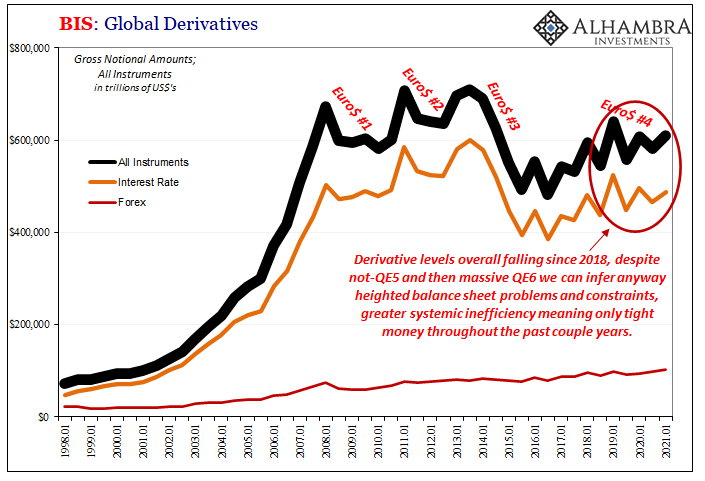

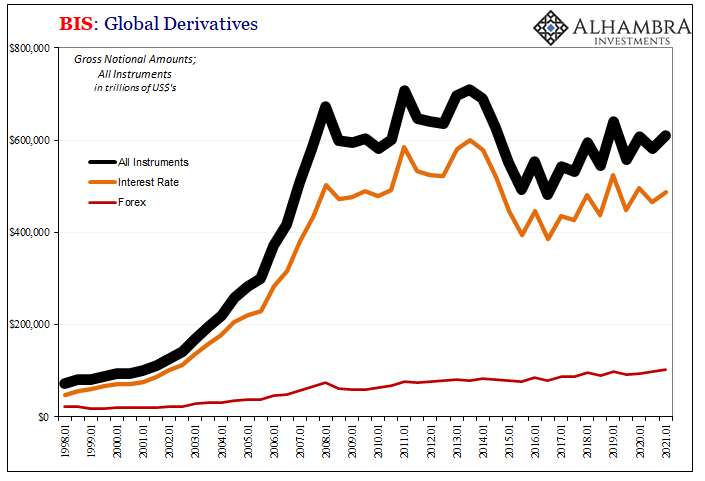

And this is where all those hundreds of trillions in global derivatives come in. Why are there so many? Not strictly hedging demand, rather demand/supply for balance sheet construction. The imperative to make assets fit into the operational constraints placed upon balance sheet procedures.

Everything from credit default swaps (regulatory capital relief) to interest rate swaps and even forex. They all have a majority purpose which is to redefine asset or even classes so as to maximize the illusion of controlled volatility, thereby making balance sheets so much more efficient for given levels of constraints.

It is what I call dark leverage.

It’s an illusion because, well, chaos theory – the unpredictability of complex systems. For all the math including VaR itself, the flaws simply abound.

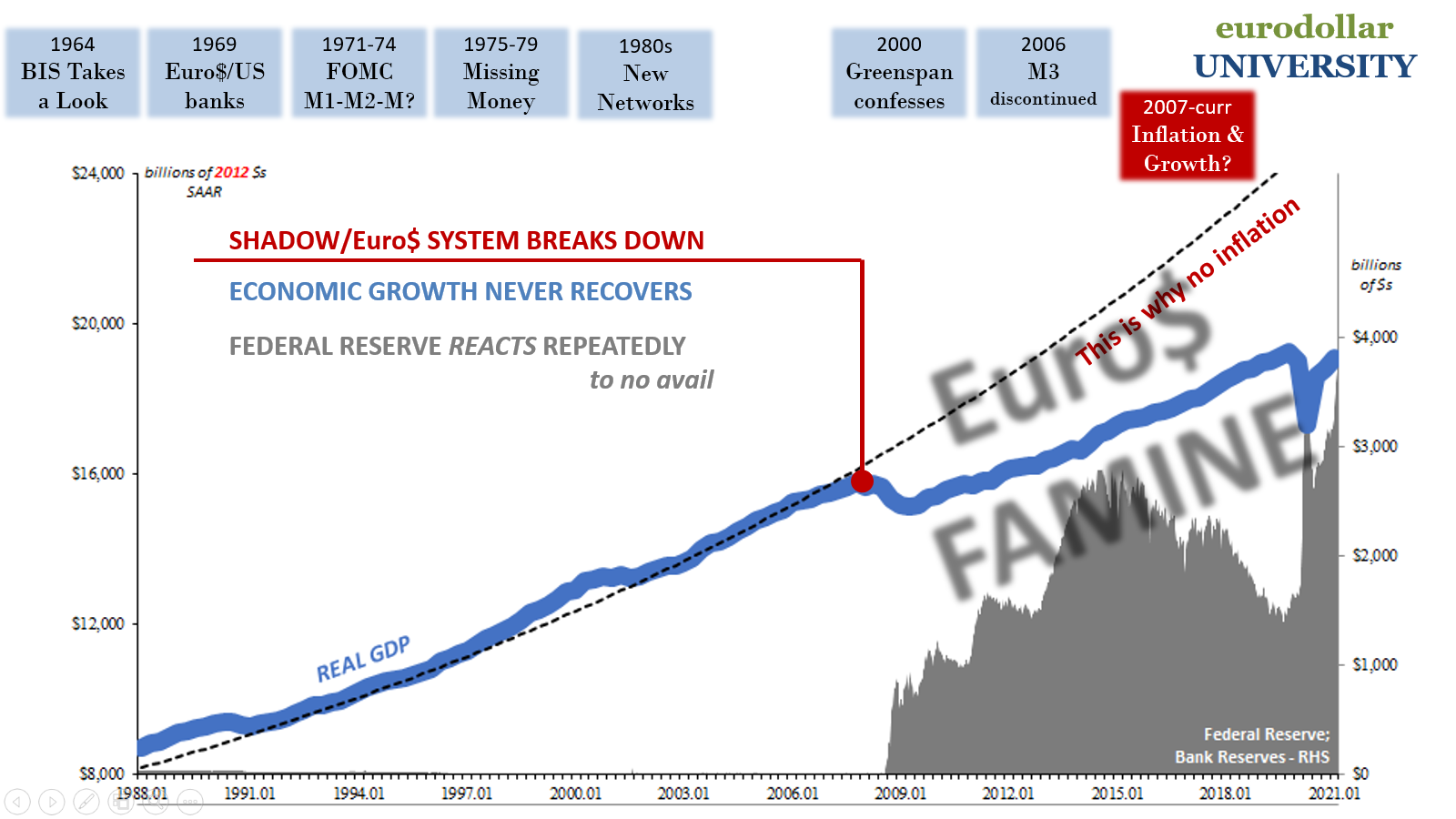

So, what might happen to our simple ledger money setup if – rather when – the math which reduced volatility scores is revealed to have been calculated under faulty assumptions? This more accurately describes the first Global Financial Crisis than anything you’ve ever seen from the Federal Reserve or mainstream media.

Especially credit default swaps, the process of recalculation had the net effect of forcing balance sheets to constrict because they could no longer be so efficient; you had four assets with a volatility score of 25 because you thought 25 was realistic enough given the hedging via credit default swaps or interest rate swaps, whatever.

Those markets break down, and suddenly you realize the more realistic score is much higher, maybe even closer to the original 50. Unless you are willing to raise your total volatility budget beyond 100 – and do this during a less-than-desirable time period when your operations are being questions inside as well as from the outside – your balance sheet must adjust by shedding some of the assets (a GFC, or just a bout of global dollar shortage) lest you become the next Bear Stearns.

With this set of circumstances, you’re also going to forgo future expansion to your balance sheet, too, so long as they remain in place. It’s just too costly absent previous efficiencies.

One key structural problem of this arrangement is that there never was some exogenous risk control; you are buying hedging from someone else who’s actually in the same boat as you are! The whole thing is incestuous in a profoundly pro-cyclical manner.

With regard to CDS:

It was, essentially, the start of the death spiral, a self-reinforcing reductive process from which there was very likely no escape. As CDS providers stopped writing them, Gaussian copula mechanisms inferred the changing prices of CDS as rising correlation, hitting the ends (the vast majority) of CDO’s harder than the rest – even though the risk of actual loss on each was still minimal (I don’t believe that by the end there was ever a single cash loss on any senior tranches). And as senior CDO valuations were questioned, CDS providers grew even more shy, distorting CDS prices and creating still higher inferred correlation, and on and on.

You’re trying to buy hedging derivatives from the next guy who was supplying them, but now he’s got his own volatility budget to deal with (because those hedges he sold you have to be accounted for under his own parameters which are now going haywire, too) which means he can’t supply the same hedges for the same costs or even the same hedges at all (what happened in CDS).

Having learned all this the hard way, there is simply no way to make balance sheets as efficient as they had once been. Supply of hedging, and in some ways demand for it, shrinks.

So, working backward (again, realizing how much has been oversimplified), we can reasonably expect a correlation between the amount (gross notional) of derivatives supplied globally knowing their true purpose in balance sheet mechanics.

The fewer derivatives, the more constrained or less efficiency.

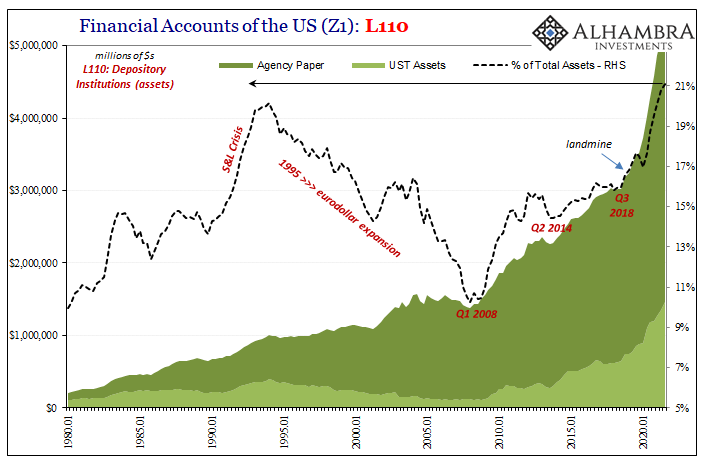

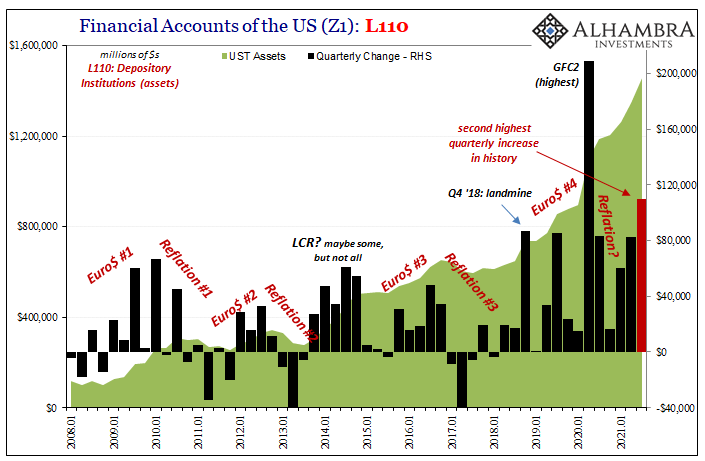

When you look at the BIS data on derivatives from the red pill perspective, not only do you see the lack of role for bank reserves and the Fed (or ECB) you also immediately come to understand one key reason (repo collateral the other) why banks will only hold the safest and most liquid instruments.

With low volatility scores, in reality as well as our stylized example, it’s really the only option for banks trying their best to operate under these post-crisis (the first and second one) conditions. Regulations came later and imposed further rigidities, introducing more inefficiencies the banking system had already imposed on itself when recalculating all their math.

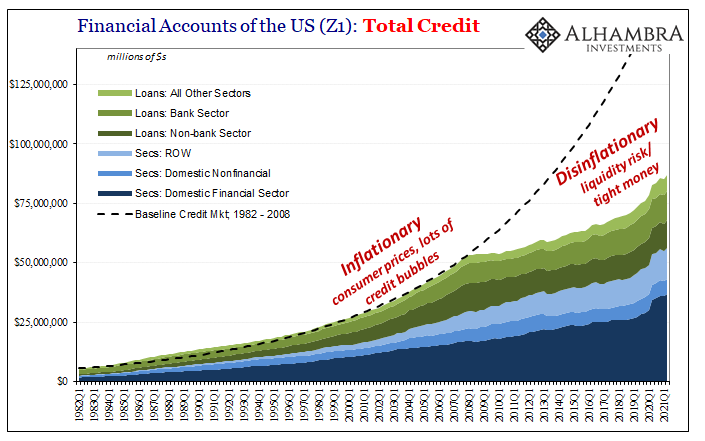

And if the efficiency is limited as the supply of instruments has been, then balance sheets themselves are going to be restrained meaning the supply of money/credit must be, too.

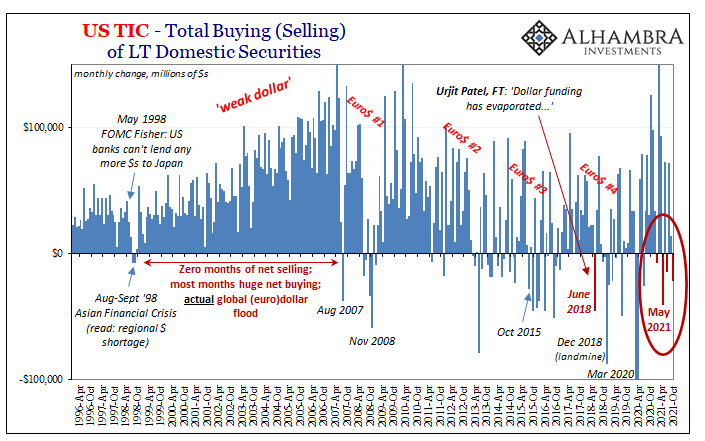

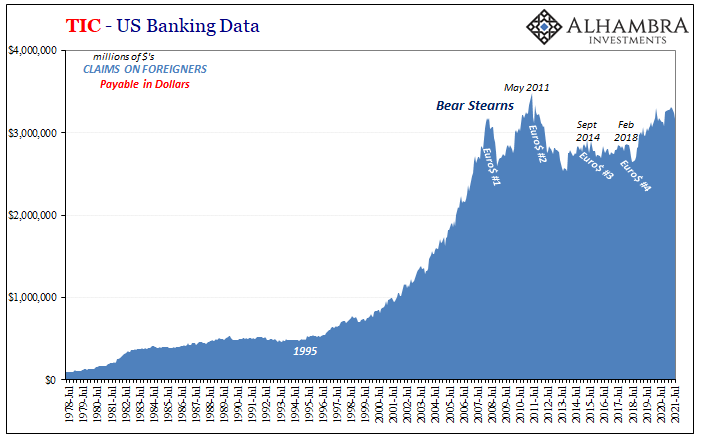

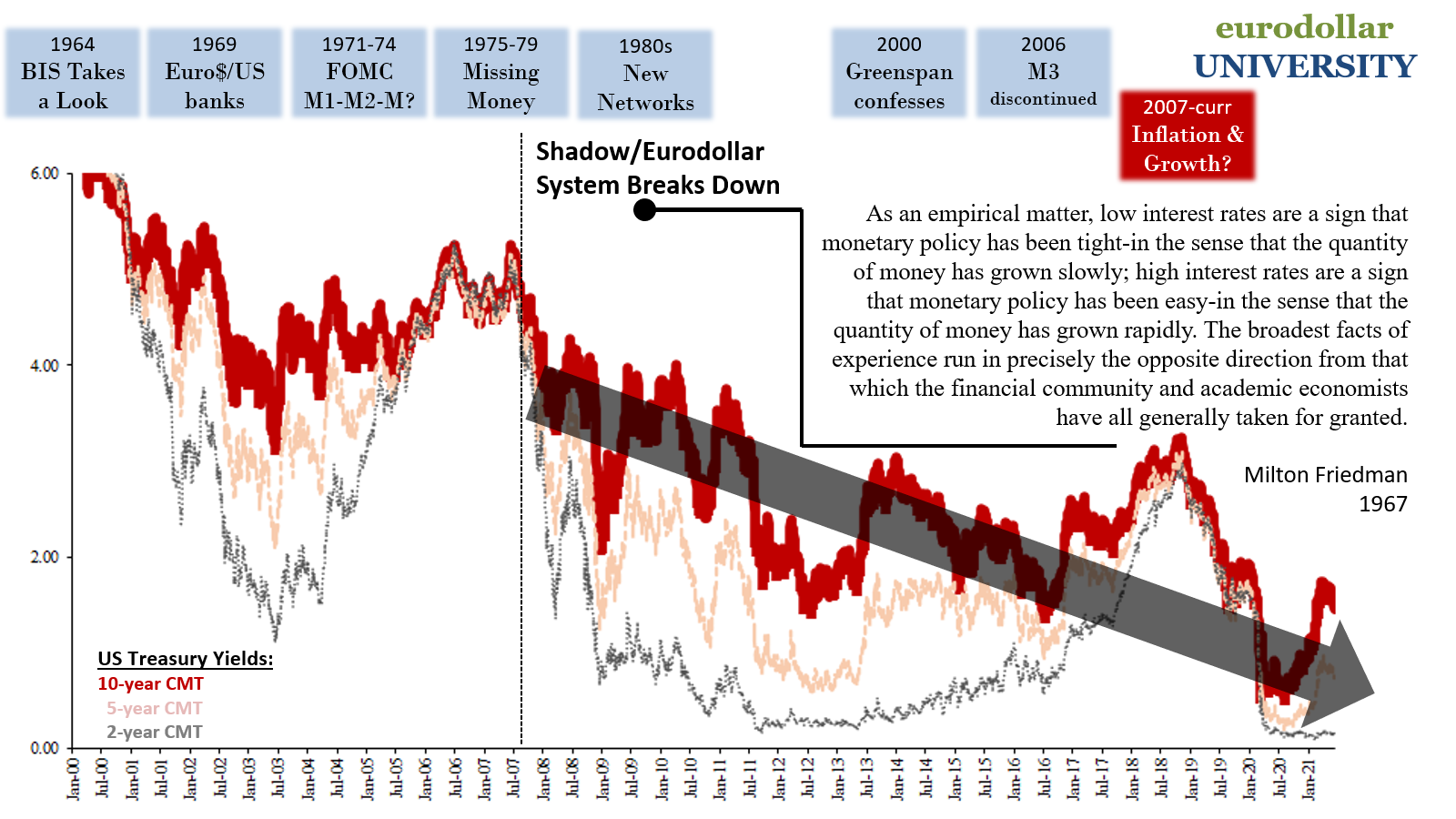

Derivatives, therefore, a relatively decent proxy for the shadow money component of dark leverage. Fewer of them, or just lack of growth (since we live in a non-linear world), can only mean tight money. What you see from the BIS is the same as we find in TIC, Z1, the interest rate fallacy, all of it including GDP falling off worldwide.

These charts are all basically the same thing starting with these problems in ghost money, the money of account, the eurodollar’s ledger:

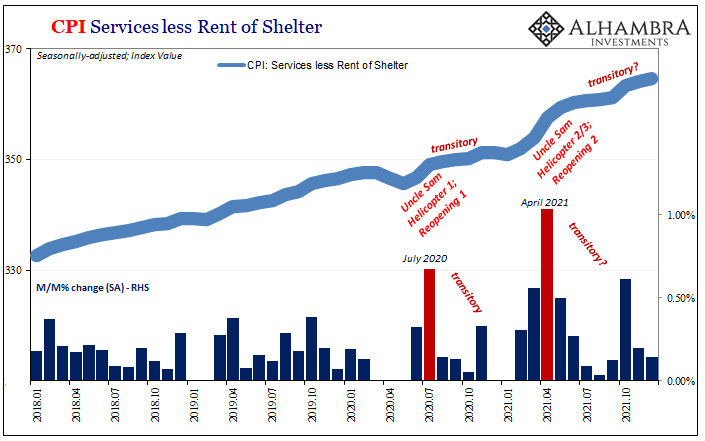

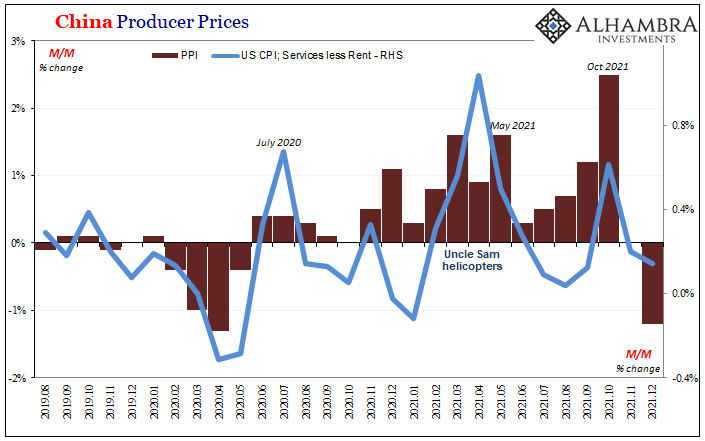

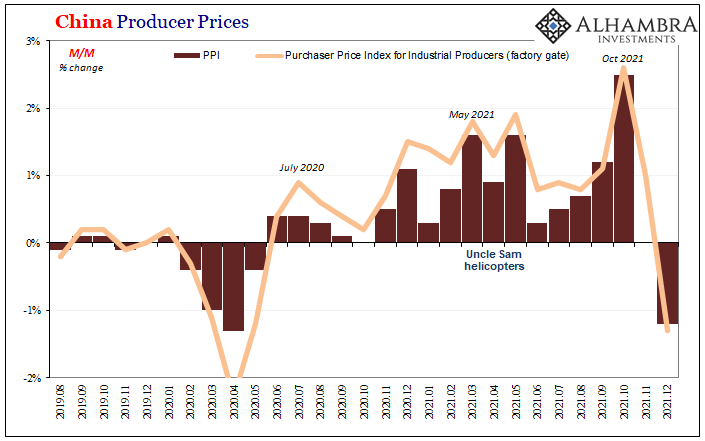

Buying only safe and liquid as the banking system has done the past few years (as the decade before them), and without any change in derivatives offered, in fact fewer since Euro$ #4 in 2019, there was never any money for inflation in 2021 or beyond. The balance sheet constraints, the real if fictional currency behind the ledger, are as imposing and irreducible as ever; if not more so.

For as big as his wallet might be nowadays, and it is impressively scaled up because of everything I just wrote, the demand for safe and liquid because of the balance inefficiencies represented by shrinking derivatives, it still can’t overcome these easily implied yet bigger and structural deficiencies in dark leverage and shadow money globally.

Given all this, “inflation” was only ever going to be transitory with no effective if fictional money behind it, furthermore leaving economic activity as more suspect beyond the limited influence of even Uncle Sam’s gigantic checkbook. The throne still belongs to the eurodollar’s ledger.

Stay In Touch