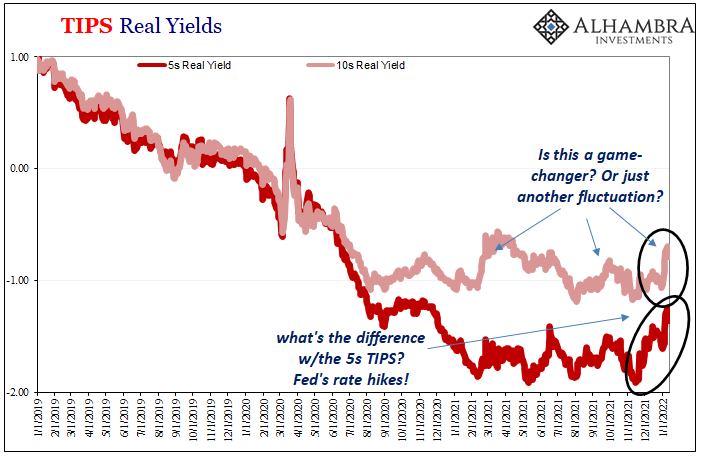

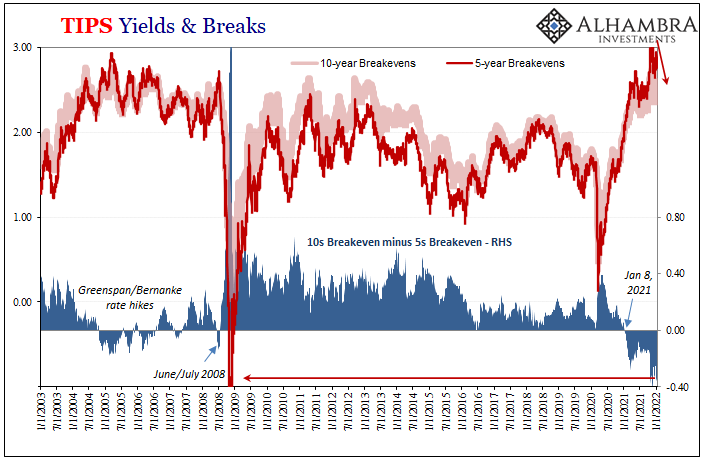

Real yields have moved higher, surging, actually, to start this year (up until more recently, that is). The 5-year TIPS rate has gone from ungodly ugly mid-November, sunk down to -191 bps, to a still-awful but much less so -130 bps as of today. That’s a 61 bps move in less than two months, thirty of those coming since the end of December.

Good news? Something else?

No sense in dragging this out, spoiler alert, the answer is quite clearly something else. Unless you take the Fed’s rate hikes for good news. Given recent history, as I’ll go through briefly, there’s simply no reason to.

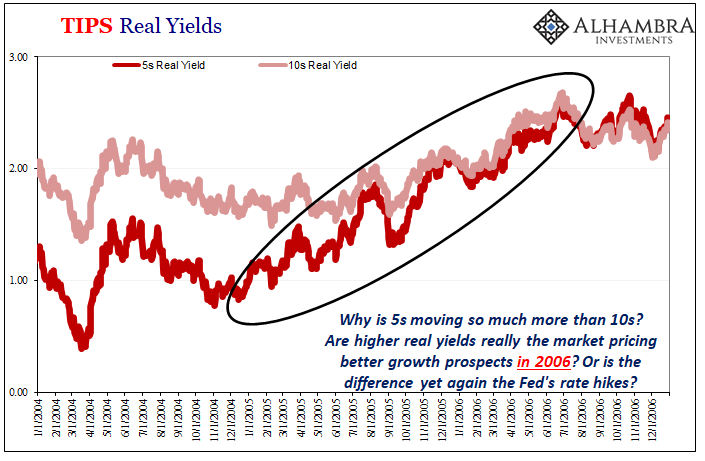

The FOMC’s rate hikes – both in action as well as perceived upcoming action – influences curve dynamics nominally, as noted previously, but also TIPS, too. This non-economic interference is sharpest at the front, because of all the reasons I spelled out for the nominal yield curve.

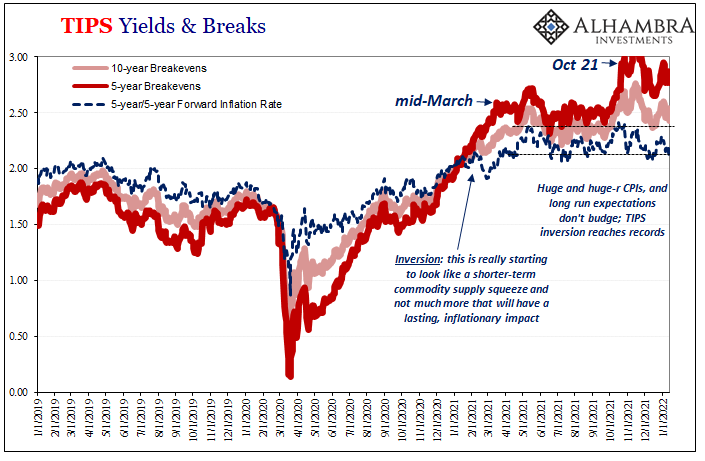

Over the same recent timeframe as the 5s TIPS, the 10s have added significantly less while the 30s even less still; far more buoyant only up front. Just like flattening on the nominal curve, the FOMC is pushing down the prices of inflation-protected securities for reasons that have nothing to do with inflation protection; or real growth prospects.

Real yields certainly weren’t rising at the same time as omicron fears were reaching their peak. Hawkishness from November on, however.

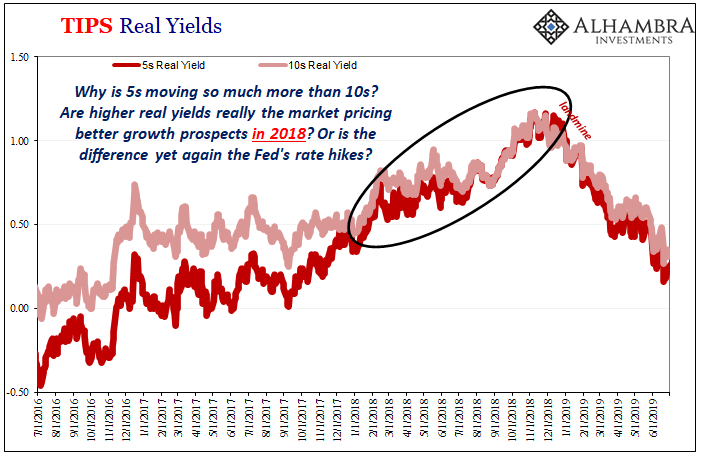

Again, quick review of history shows this is the established pattern and what anyone should come to expect. Back during “globally synchronized growth” of 2017, the 5s real yields moved much more than either the 10s or 30s, eventually colliding in 2018. Was that the market really saying growth expectations were materially improving…in 2018?

Obviously not, this was instead the bottom-up influence of rate hikes – until even those were overcome during that year’s landmine.

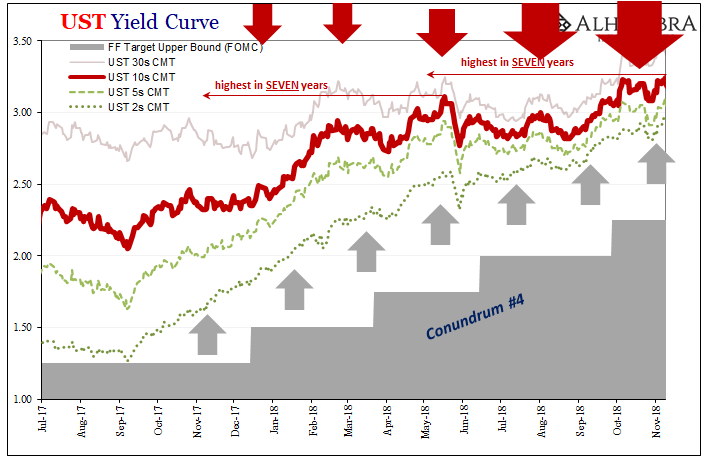

What about the previous rate hike cycle? No surprise, it worked out in exactly the same style.

The 5s TIPS go up more than the 10s (or 30s), eventually they collide and both rise but not because of rising growth prospects only non-economic policy interference. Had the TIPS market been pricing a far better forward real economic growth picture…in 2006? The answer like in 2018 was a solid, “no.”

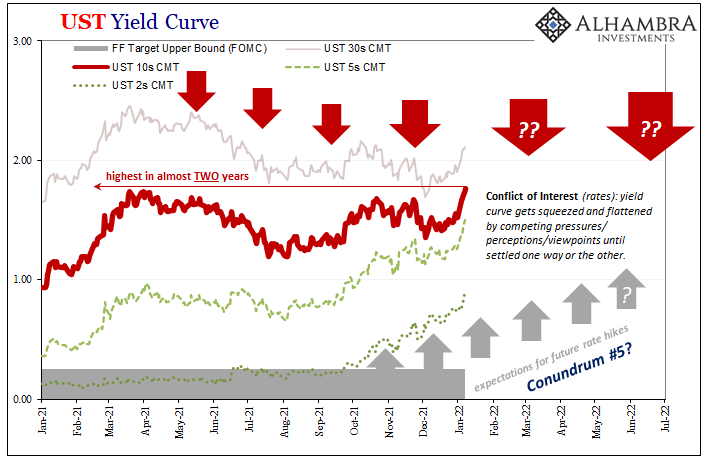

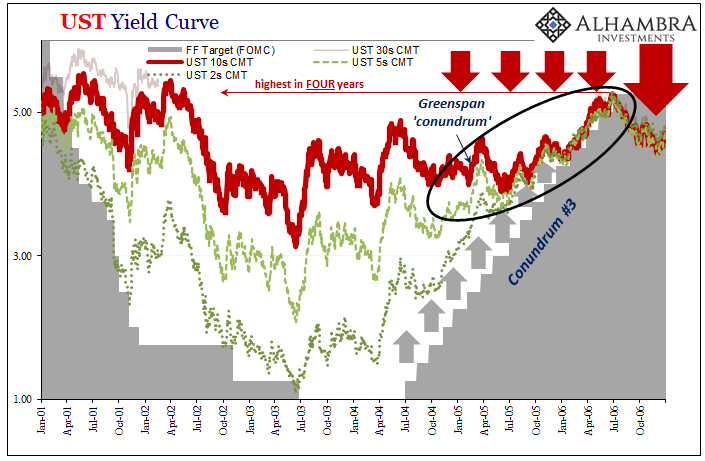

It should be repeatedly pointed out how in both of those cases the nominal yield curve had relentlessly flattened in the same way as TIPS.

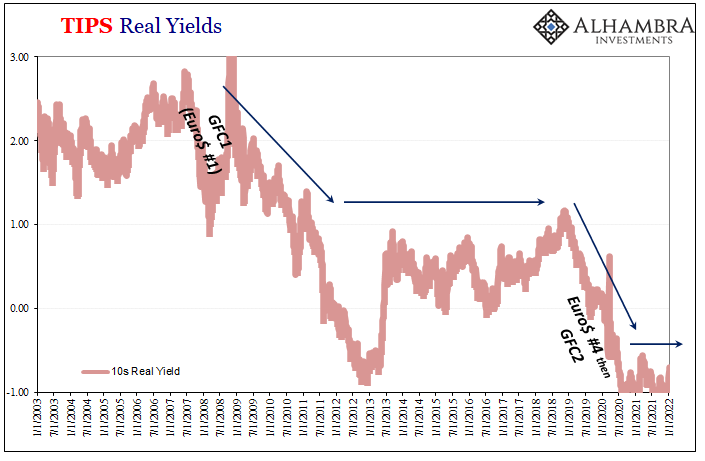

Honestly, the most powerful big picture message delivered by the less-influenced 10-year real yield is this one:

Profound change in real yields? Oh yes, just not anything recent.

What we’re seeing in all facets of the Treasury markets is just commonplace to rate hike cycles. I write about the deep history (dating back to the American Revolution!) behind inflation-indexed securities in more detail elsewhere, but arrive at this same conclusion anyway:

Was real growth potential that much better during the middle 2000’s, the very mania of the housing bubble? No. What had changed was Alan Greenspan’s and then Ben Bernanke’s series of seventeen 25-bps rate hikes. These had altered the nominal frame of reference for the short end of the whole Treasury curve which anchors the choices made by TIPS buyers and holders.

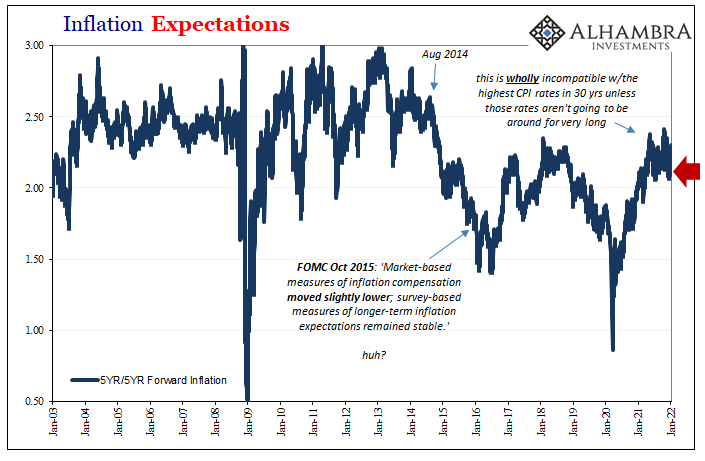

Jay Powell’s Fed is about to do the same thing, and for him for a second time. He just doesn’t learn. The fact that neither inflation breakevens have budged (see: below) along with similar facts of how the TIPS real yields behave leave us with a useful process of elimination which is the same for each of these previous times in history.

Are real yields signaling some profound change? Only if you consider rate hikes profound; merely a non-economic frame of reference (and, to be perfectly clear, what I mean here is all about interpreting these prices, rates, and signals in the context of macro; obviously, there are vastly different considerations when it comes to investing and investments). As far as the real economy, either inflation or growth, not at all.

Neither growth nor inflation, the Fed’s gonna Fed. What’s changed at the start of 2022 is as omicron fears fade fast the path forward for rate hikes has cleared. Chairman Powell himself has said multiple times the pandemic is the only thing which would change his and the FOMC’s collective mind. At least until the real pressures on the real economy reasserts themselves yet again.

Stay In Touch