The script has been flipped, so to speak, this time around. Whenever we’d go through one of those regular, alternating downturns worldwide, like the one which began right from the start of 2018, it was services which held up the increasingly troubled manufacturing sector. The variation for the swing, from globally synchronized growth to globally synchronized downturn, was mostly contained in industry at least during its initial phase.

It had been that way in 2015, too. A safety net or margin for downside economic error provided by service providers less easily influenced by the initial macro direction change.

This time around, however, Uncle Sam plus corona combined to decimate then hold back the rebound in services. In the US, Americans binged on goods often at the expense of purchasing their normal rounds of non-manufacturing. This continued along with the negative effects of lockdowns most pronounced on that side of the economic ledger.

And it wasn’t just in America; services globally, by their touch-y, feel-y nature are what’s most exposed to the irrational ire of those all-in on pandemic. You can stay home and buy from Amazon easily through delta, omicron and whatever comes next.

Unless those at the margins have exhausted any surplus cash.

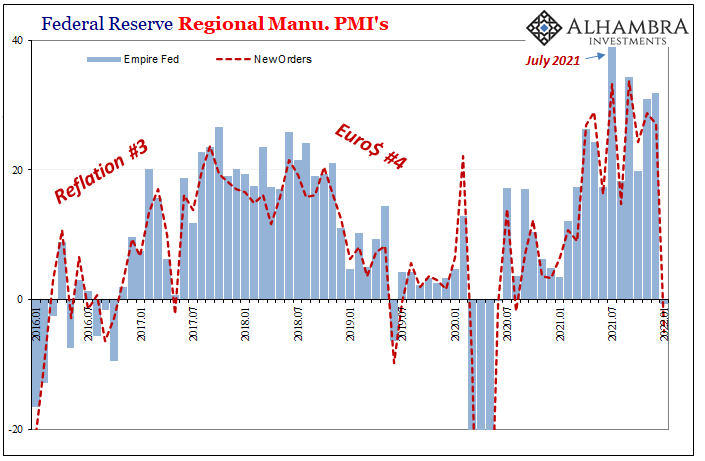

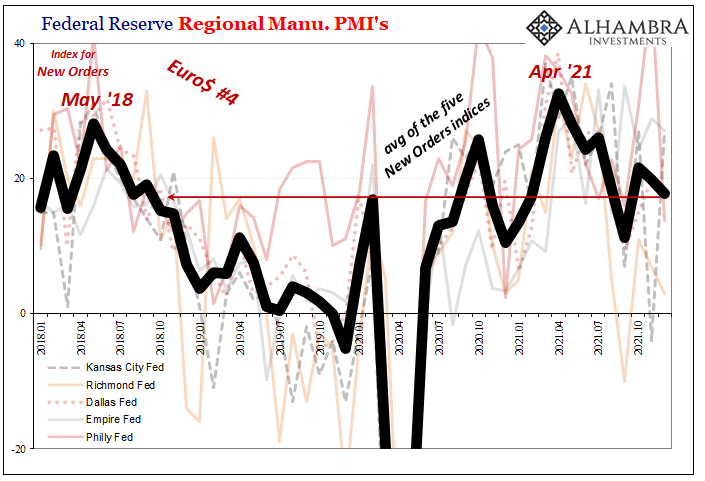

Separating one from the other, though, that’s going to be the trick. Take, for example, the Federal Reserve Bank of New York’s Empire Manufacturing survey. While case counts and hospitalizations were rising in near-vertical ascent during December’s seasonal omicron surge, according to FRBNY’s data on manufacturing everything remained fine.

It wasn’t in January, though. As cases and whichever pandemic number peaked late last month, the headline for the survey collapsed by nearly 33 pts, going from 31.9 all the way down to -0.7 even though the COVID numbers have dropped. This was the first negative number for Empire since August 2020.

More to our more recent point about inventory and the Christmas cycle(s), FRBNY’s Empire New Orders tanked by a similar amount; crashing from 27.1 in omicron-surged December to omicron-abating January’s -5.0 – the worst since May 2020.

Is this merely a delayed consequence to the latest seasonal upswing in disease, even though the government(s) in New York’s response to it has been nothing nearly as draconian as December 2020 and January 2021? Sure, vaccine mandates/corporate vax requirements are causing some problems and a great deal of uncertainty for many, maybe too many.

But what else could be different about the start of 2022 not disease or regulatorily related?

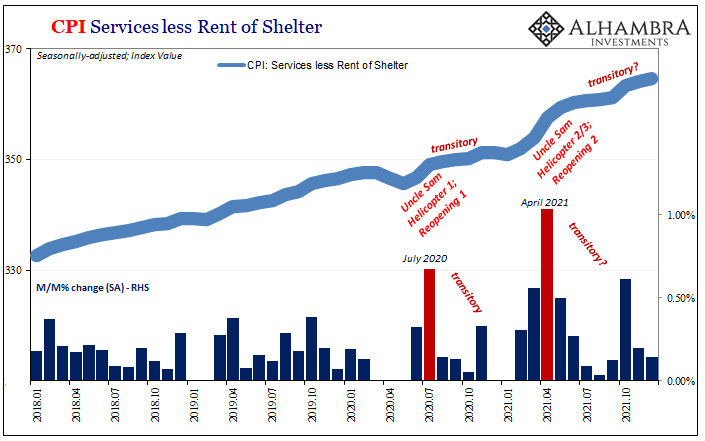

It isn’t just this one manufacturing index. While Empire is first for January, there’ve been other curiously similar indications including, believe it or not, inflation numbers. Last week’s CPI featured an unhealthy dose of what I wrote up top; mainly, the huge difference between services and goods.

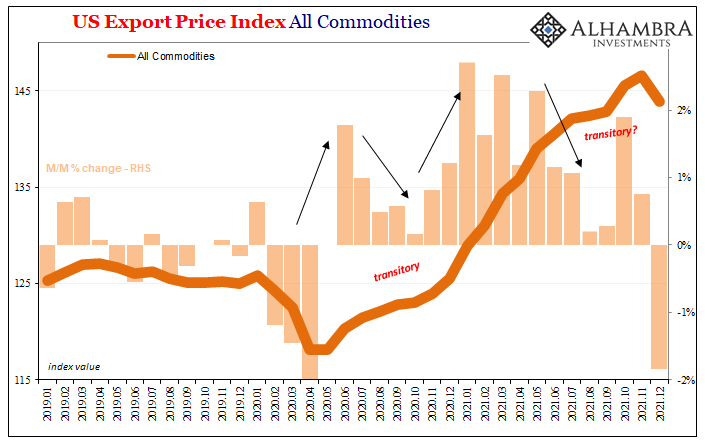

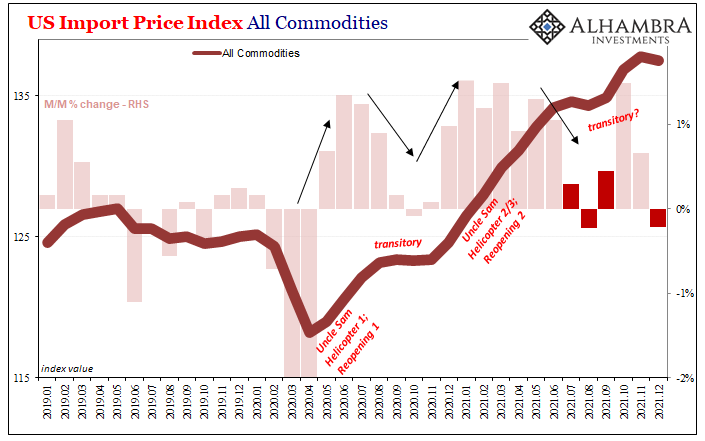

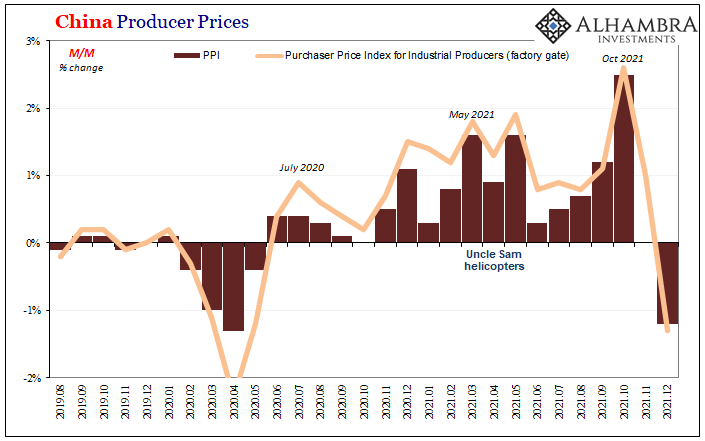

Now to go along with services CPI, BLS also calculates that export like import prices took a step backward in December. Maybe that was a global omicron effect, but in these series we find yet again a defined peak clearly set back in October before this latest troublesome variant ever showed up late in November.

It would match instead the front-loading of Christmas shopping; as would a non-pandemic association within FRBNY’s Empire survey, particularly the stout drop for new orders.

So, if the manufacturing part of the economy begins to suffer a bit, too, a slowdown that doesn’t have to be anything huge – not even to the proportions of a 2018 or 2015 – for the whole thing to tilt the wrong way. Again, services this time aren’t there for support should manufacturing begin to wane (if not already).

As we’ve been writing since delta, if the “growth scare” was nothing more than delta then pretty quickly the global economy goes right back to rebound. But it wasn’t delta; the downside keeps coming. There’s an almost technical analysis aspect to the figures; lower highs and lower lows.

Looking at the trends instead across these series and more, especially in Xi’s backyard, maybe if it is omicron this time it explains some degree of the weakness. It can’t account for all of it in all of these places.

A big contributor in that respect might again be services which still haven’t recovered.

Obviously, none of this is definitive. One Empire survey for one month isn’t going to change anything, or conclusively represent a total regime shift as more than maybe local factors.

But it’s not really just the one month in the one place. Slowly, as variants come and go, it’s the other side which does seem to be beginning to pile up.

Stay In Touch