Chinese Communists, like their counterparts everywhere around the world, they do love their metaphors. Speaking virtually at Davos again in 2022 like he had in 2021, the theme was largely the same. A year ago, China’s dictator had warned about the uncertainty of the global recovery, a celebratory party only then getting going around those parts; he got that one spot on, though hardly anyone noticed.

Xi Jinping began his sermon this year with a doozy of a downer. He told his audience of the ultra-rich and connected how in two weeks it will begin China’s Year of the Tiger. The great cat symbolizes “bravery and strength” to the Chinese people who often, Xi said, pair the “leaping tiger” alongside the “soaring dragon” both together symbolizing the one-half of the binary nature of this our globalized economic system.

The momentum of the world either flourishes or declines; the state of the world either progresses or regresses.

We need not guess to which of those options the “spirited dragon and dynamic tiger” might refer. But Xi claimed that this year we all must instead makes sure to “add wings to the tiger.” Huh? What kind of sickly beast is this? It doesn’t sound like the first options he gave.

Basically, the Chinese strongman warned Western leaders not to count their inflationary/recovery chickens before they hatch. As in 2021, Xi in 2022 warns that not all is aligned right for those things – only beginning with China.

As if to emphasize the message, Ning Jizhe, the Chinese National Bureau of Statistics’ current director, admitted to reporters the state of the diseased cat. In Ning’s press conference announcing the latest batch of economic data from the world’s second largest economy, the Big Three (IP, FAI, and ugly retail sales) to go along with Q4 2021 GDP, the typical Communist platitudes which he dispatched with the required emphasis suddenly dissipated in his summary in favor of Xi-like clarity:

At the same time, we must be soberly aware that the current downward pressure on my country’s economy is still relatively large…

You can only spin so much before such context of a wingless and ailing tiger cuts straight through such semantic reflexiveness.

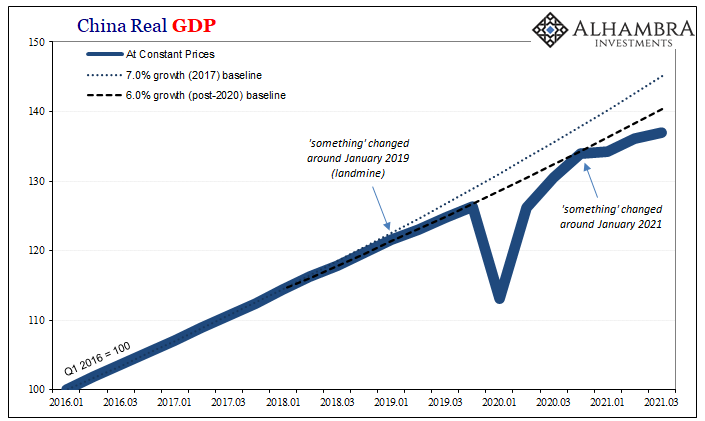

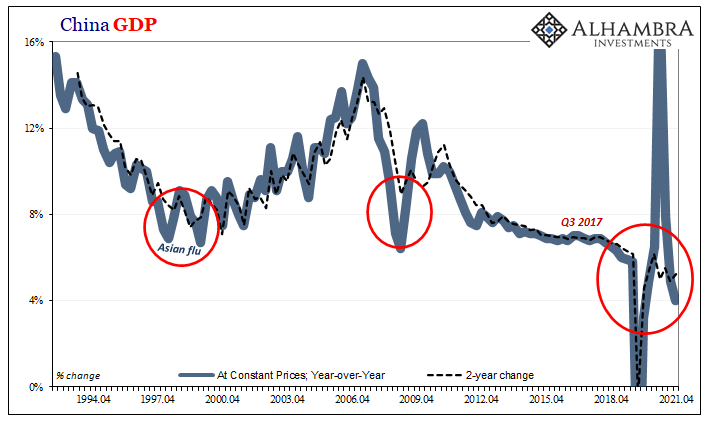

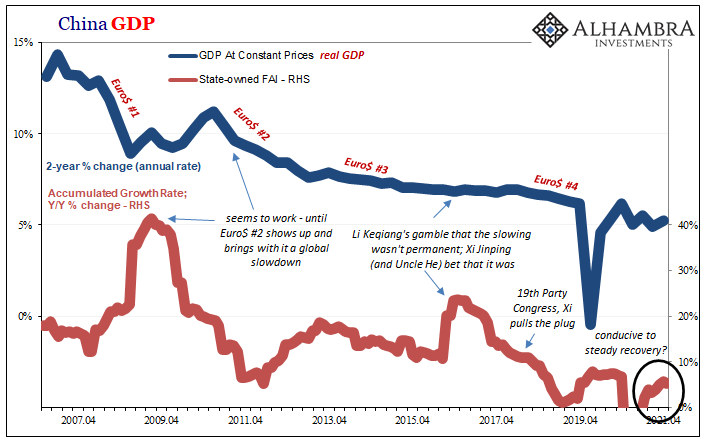

For the fourth quarter data, we can forego need of the 2-year comparisons to make sobering analysis; the annuals are all free from any leftover base effects and do an effective enough job illustrating the struggle. According to Ning’s agency, China’s real GDP gained only 4% year-over-year, the worst rate since the 2020 recession.

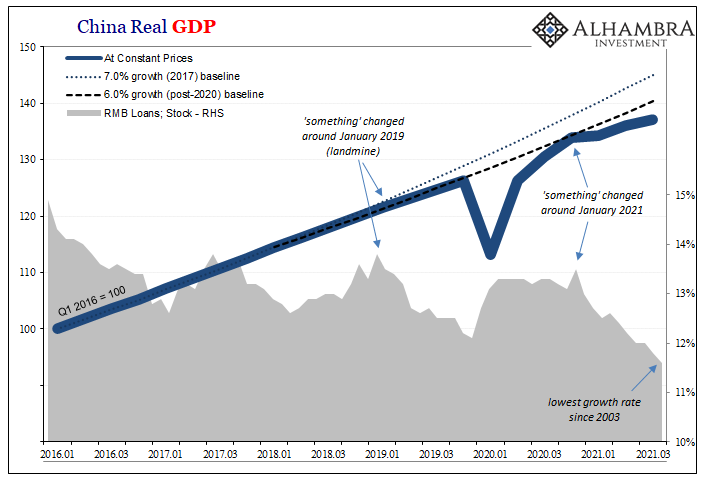

Even on a quarterly basis of a +1.6% when compared to Q3, China didn’t actually end on such a good note. Authorities seeking only to manage the country’s decline, first reduced the RRR rate having recognized the wane of momentum and activity during 2021’s final three months.

And now other rate cuts, too. The Loan Prime Rate (LPR) had already been reduced (by a “whopping” 5 bps, but still) and now, just this week, the PBOC took 10 bps off the MLF rate for some institutions at eligible operations. Just as the rest of the world’s central banks turn ultra-hawkish, Chinese authorities seek instead salve for their cat via the mildest of dovish cases.

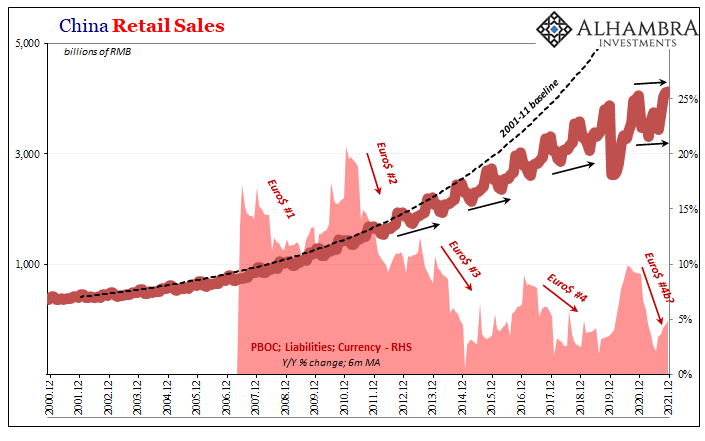

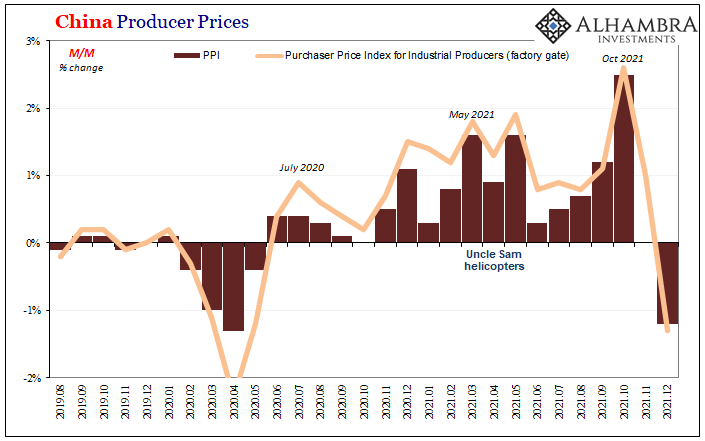

Why? Despite near-constant Western proclamations of a turn higher for China’s mythical “credit impulse” (private measurements derived from a combination of filing cabinet labels and old phone numbers) all throughout the second half of last year – any day now, they kept saying – this is what really happened:

Thus, Xi’s communication using whichever animal set anyone might rather suggest; the decaying tiger in need of a lift just to keep from sinking further toward the abyss.

In other words, to all those central bankers who’ve taken their eyes off the real risks to the global system, be forewarned (it all sounds really familiar, like we’ve all done this before). They won’t heed any of this because their own biases are forever upward and inflationary (see: Stanley Fischer).

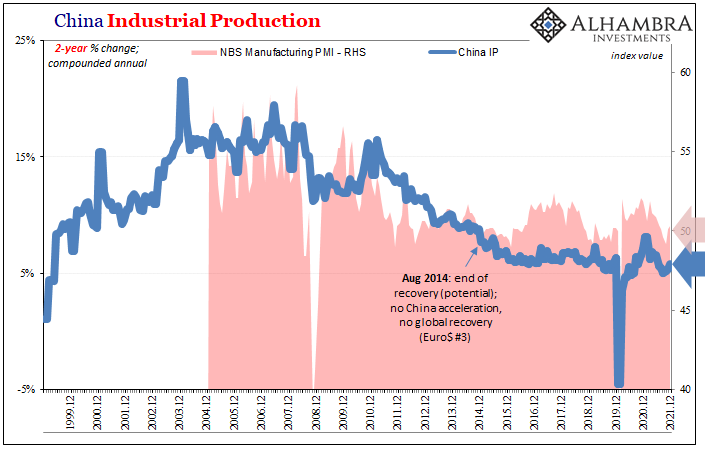

The rest of the Chinese data went along with GDP. An uptick in Industrial Production brought the post-pollution control growth rate to an anemic annual change of 4.3% – which weirdly has been celebrated as a lone bright spot even though the floor for IP had not long ago been placed at around 7%.

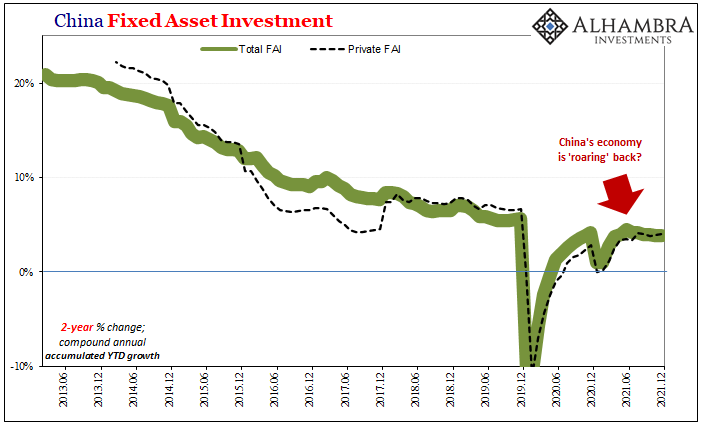

Likewise Fixed Asset Investment (FAI), where the accumulated growth rate for all of 2021 compared to all of 2020 was a stunning 4.9%. Stunning in the sense of having suffered and slowed to a full-year 2.9% in 2020 when compared to 2019, the rebound obviously fell short of even previously slowed speeds.

And in the final few months of last year, the mess and drama of Evergrande only punctuated the downside dangers just now emerging for an economic system which had been heavily influenced, to the upside, by real estate. According to the NBS, for 2021 the accumulated growth rate for all private FAI was 7%, but that was down from an 11% accumulated rate as late as August.

This spurred Ning to tout public FAI as the Keynesian alternative, though at indicated levels nowhere near any of 2020, 2016, 2012, or especially 2009 (charts below).

With the acceleration of the issuance of local government special bonds since the second half of last year, and the accelerated release of investment in the central budget, 102 key projects identified in the “14th Five-Year Plan” have been launched one after another. Increased policy support such as monetary investment is conducive to the steady recovery of fixed asset investment.

“Increased policy support.” Sure, but increased compared to what?

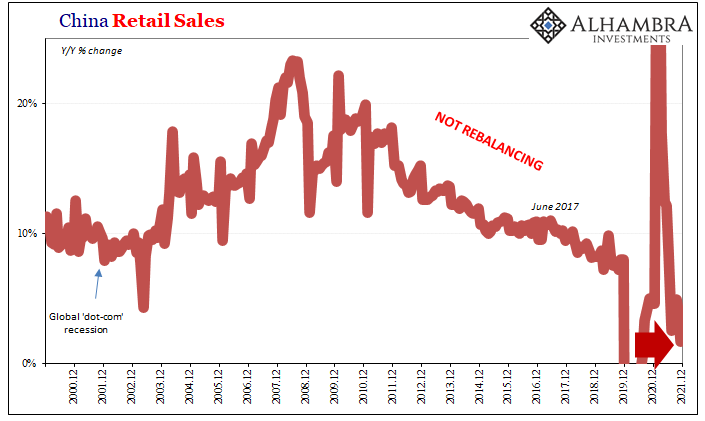

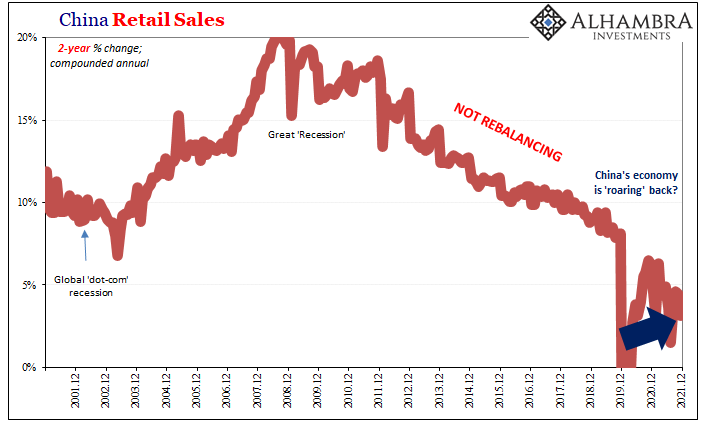

Finally, not much more needs to be said about the state of internal Chinese demand that hasn’t been said repeatedly since 2018. The Retail Sales figures “unexpectedly” dropped in December (and a like basis with November), producing a year-over-year change of not even 2%.

Yes, COVID restrictions and whatnot, but while that might explain this one month below 2% it does not indicate why every month has been substantially less than what used to be the worst of the worst cases (7%).

As usual, the question gets asked, “so what?”

Xi may be right about what’s going on in his own den, yet is doing nothing more than whining to the private jet-set about a situation in which China has no one to blame but those in it. The Developed World, so called, has hit its stride, most say, and if it isn’t benefiting China in the way the Communists there would like, neither Jay Powell nor Christine Largarde is going to lose any sleep nor any taper pace over it.

While doubtlessly true, as we’ve seen countless times, too many times before, the Western narrative always shifts favorably even when undermined by the constant and almost regular undercut of Chinese weakness. Think back only to 2018 (just like 2014), Euro$ #4’s erosion which first registered in places like Germany and Japan – and China.

Xi didn’t use the word “synchronized” (though maybe he did; I have no idea from Google’s translation the actual, specific word Xi chose), yet that was his meaning anyway backed up by every bit of economic history recent as well as the preceding few decades under Deng Xiaoping’s version of Socialism with Chinese Characteristics.

Globalization meaning the global economy is either flourishing, or, forewarned by the tiger’s lethargy, it just isn’t. Any short run differences amount only ever to timing. The problem with globally synchronized growth was never the first two of the slogan’s words.

Stay In Touch