Oil has easily, it appears, rebounded after having moved lower in November. It bottomed out that first big day of omicron fear on December 1 (ironically, or not, the same day the eurodollar futures curve inverted). Since a low of just over $65 (WTI), crude’s front futures price is easily back in the $80s thereby threatening to make January’s US CPI into another massacre.

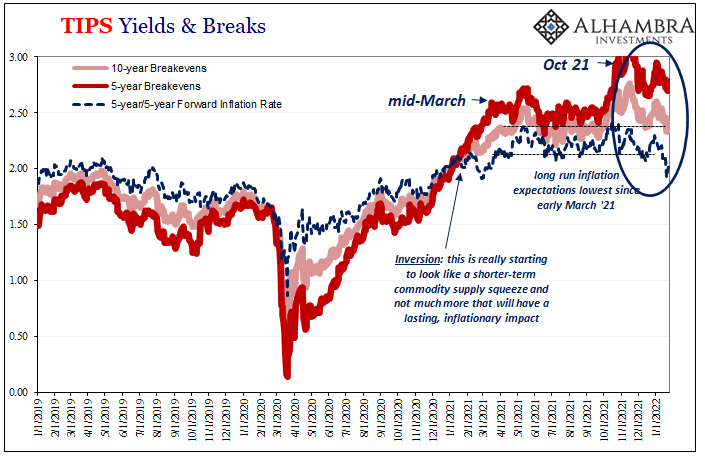

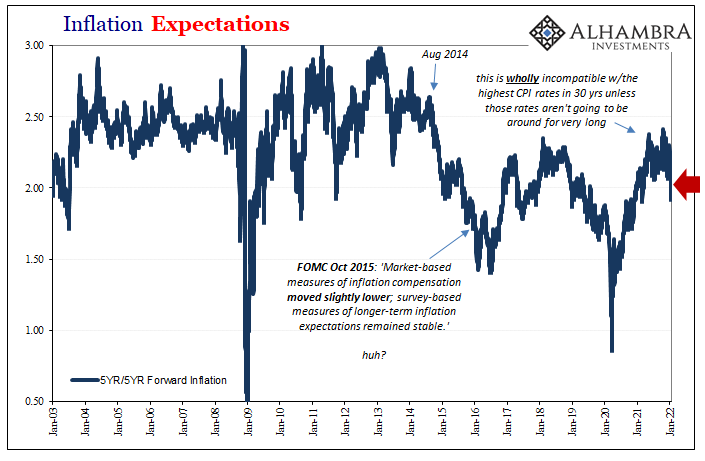

Since much of that BLS inflation index is derived from oil’s impact on gasoline, it would seem reasonable how the TIPS market, which is paid by the average CPI, should have followed WTI. It hasn’t. On the contrary, inflation expectations (breakeven rates) have tumbled back to where they were in October pre-auction (5s) or September (for the 10s).

The longer run 5-year/5-year forward rate, derived from the difference between the 5s TIPS breakeven and the same for the 10s, just recently dropped to its lowest in almost a year (before rebounding only slightly over the past few days).

Why aren’t market-based inflation expectations flooding higher like oil prices have been especially in January?

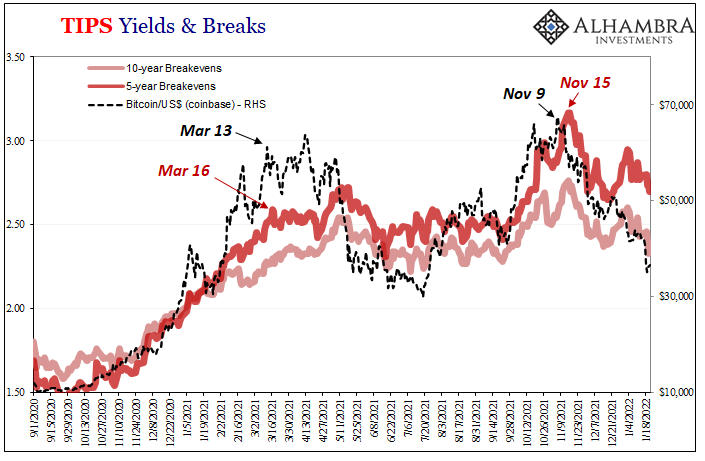

While pondering those possibilities, let’s review another interesting divergence which has developed along the same lines: Bitcoin.

My high(er) level view on BTC is relatively simple. The public, by and large, has bought into it along with other cryptocurrencies based on a misunderstanding of the actual monetary situation therefor the true balance of risks.

Economics as a discipline along with the financial media have each done an exceptionally poor job of educating people as to how the monetary system actually works (because neither actually knows). Most have been left to believe wholeheartedly in the money-printer-go-brrrr meme without any pushback anywhere; the claim goes unchallenged and unchecked across the entire landscape.

Since it is merely assumed and accepted as fact, it is understandable if lamentable why people would turn toward BTC (and others) reaching for a store of value (FWIW, I instead believe there’s great distant future value to digital currencies as competing mediums of exchange and not stores of value once, or if, they can demonstrate everyday usefulness in a wide variety of settings from real economy commercial to deep shadow monetary and financial) to shield them from the dollar’s “inevitable” “destruction” as they’ve been repeatedly told.

This was absolutely the case during 2017’s bubble, before the dollar failed to plummet and deflation rather than inflation took over throughout 2018. It appears to have been rebought beginning around September 2020.

At that point, the economy was being reopened from the 2020 lockdowns and recession while the Fed was “printing money” over and above any other QE program in its (sordid) history. Plus, moving closer to the end of 2020, you could hear the whir of Uncle Sam’s helicopters being fired up – as they would move into heavy action to end that particular year and then soar ever higher the first few months of 2021.

Many thought the dollar’s full and complete demise not just inescapable but imminent – especially as it was, right then, falling in exchange value. We’d be lucky to escape with just Great Inflation 2.0, with, many reasoned, risks of Weimar 2.0 rising with every month.

Bitcoin, like short run TIPS breakevens, soared.

But then a funny thing happened to both of those assets. Even as CPI rates accelerated into the back half of last year, as noted above TIPS expectations have dropped despite oil which actually corresponds (loosely, but reasonably close) with the trend in BTC, as well.

Are these markets trying to tell us something about perceived inflation risks for 2022? Not just inflation, economic risks in general.

For one thing, it would seem as if cryptocurrencies aren’t trading specifically on CPI’s and the potential for those coming up, but rather taking cues – at the margins – from other aspects around financial markets. In other words, even as “inflation” certainty reaches a fever-pitch in mainstream commentary, goosed that much more by crude oil of late, for some reason(s) or another it is no longer translating into what should be an easy mark.

Just considering those two market signals, it’s already compelling enough to begin asking serious questions. Sure, it could be another pause such as in the middle of last year when both TIPS breakevens like crypto prices in general backed off for a few months before resuming their upward trend by September.

However, this time there’s a plethora of gathering deflationary warning signs, markets and data, which do cut against the further uptrend in crude oil. And if so, it might be significant how TIPS like BTC (and others) are following those rather than the inflation narrative.

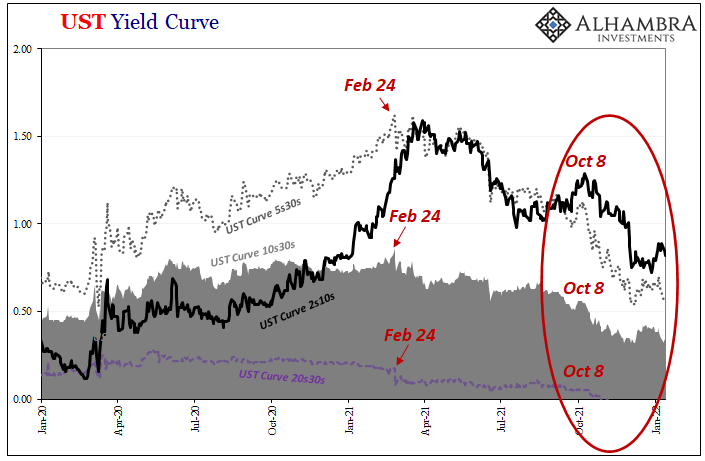

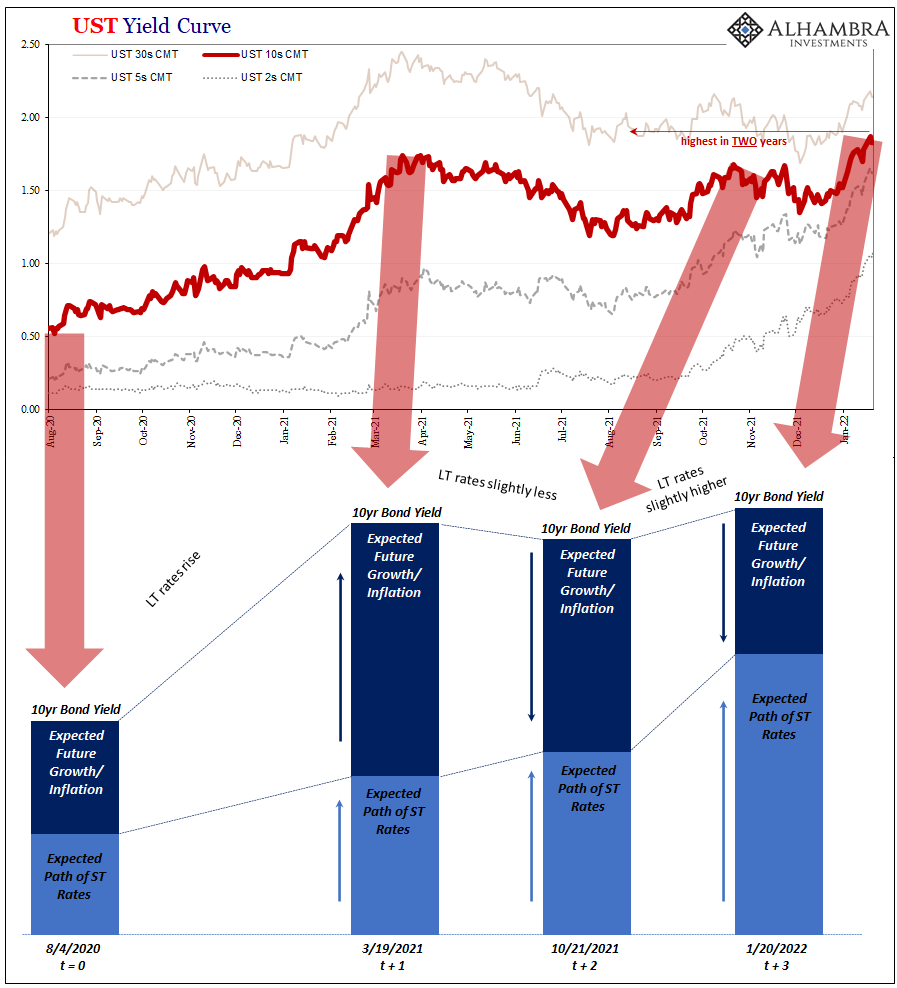

Interesting developments and possibilities, to be sure, though not yet anywhere near conclusive. Definitely worth keeping a close eye on moving forward. After all, according to a more accurate decomposition of the yield curve, real growth and inflation expectations have indeed been dropping since around just before these same potential doubts reached Bitcoin and TIPS (see: the last two on the right below between October and today).

Stay In Touch