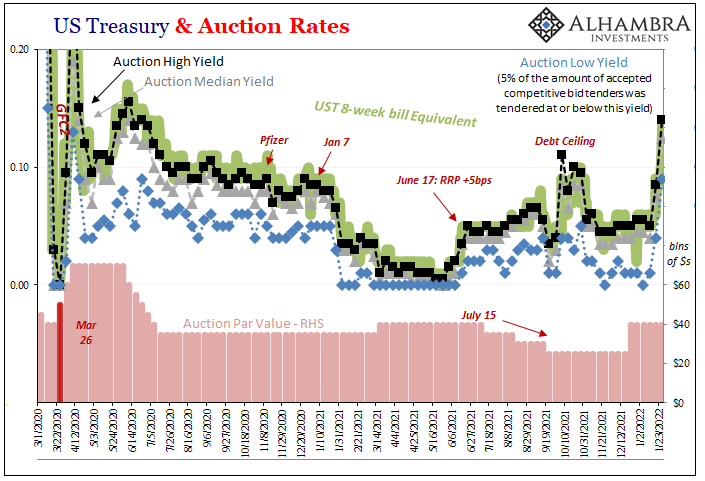

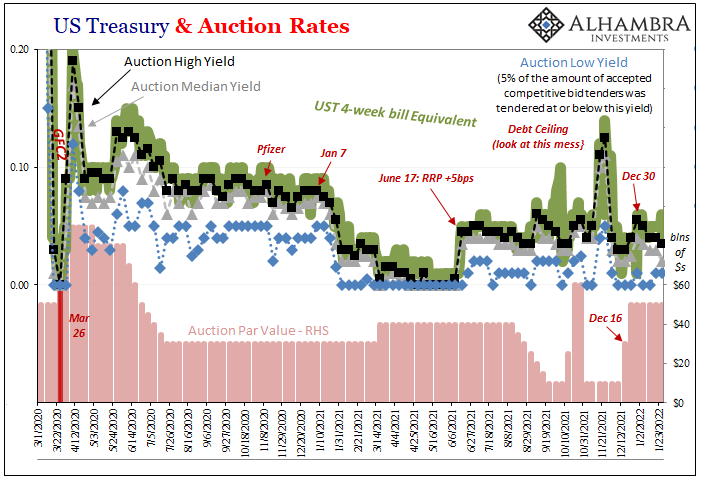

With the first Federal Reserve rate hike widely anticipated (all but confirmed) for the March 15-16 FOMC meeting, this means that every one of the bill tenors with the exception of the 4-week are now inside that window. The 8-week maturity moved into it last week, on January 20, so its equivalent yield is now pricing higher alternative money rates by mid-March.

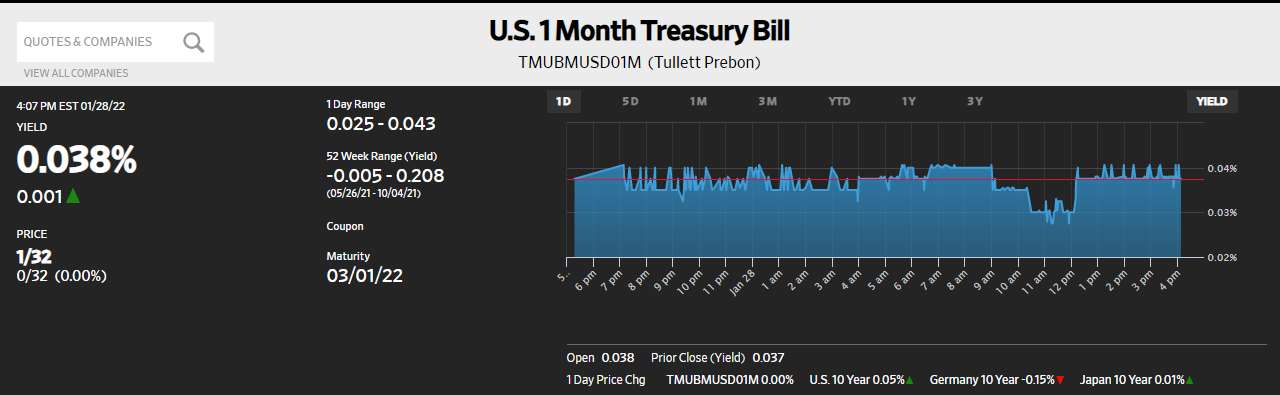

Therefore, we only have the 4-week trading under RRP to give us direct insight into collateral conditions (if the yield on any instrument of any maturity is less than RRP, this is a surefire sign that there is additional demand for T-bills unrelated to investment return considerations). With other bill rates fast on the rise for the upcoming rate hike sequence, there’s just this one for an easy comparable by which to directly measure any scarcity or collateral pressure.

Or, it might at first seem that way given how the 8-week yield has developed since the 20th: the rate went from 6 bps to 9 bps and then to 11 bps this past Wednesday before reaching 14 bps yesterday. Today, though, somewhat out of the blue (not really), the yield dropped down to just 10 bps. That’s a big move for any day when still close to zero, even more curious given that it was the “wrong” way.

At the same time the 8-week yield was driven downward, exactly 9am EST this morning, the 4-week yield developed into another one of those very clear scrambles for collateral we’ve seen time and again. This despite Janet Yellen’s Treasury selling $50 billion weekly (along with $40 billion weekly of the 8-week).

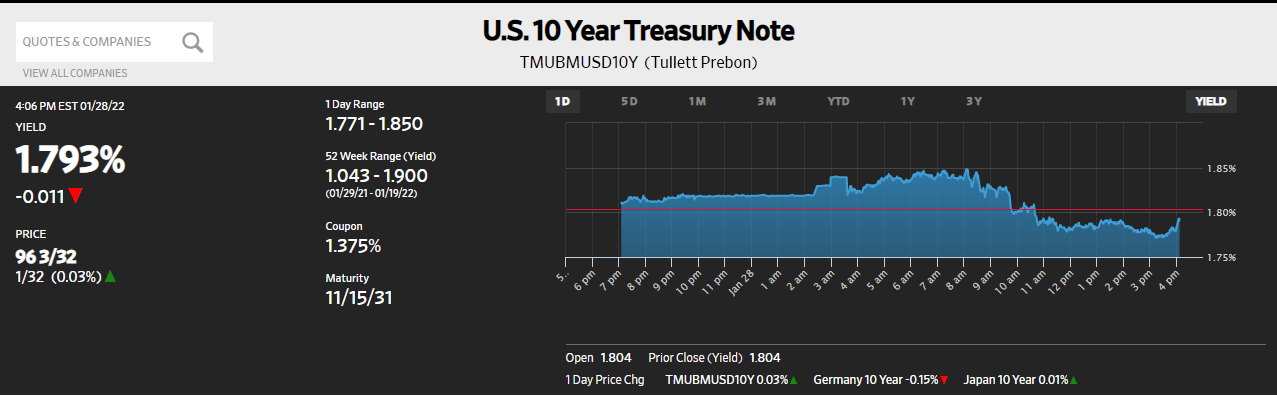

Within minutes of that T-bill scramble, the 10-year Treasury which had been modestly sold throughout Asian and European trading suddenly caught its own “surprising” bid. By around 9:30am, at the US open, the 10s rate had fully reversed and would continue lower throughout today’s session.

Bills and long end, each doing this despite a general, basically ubiquitous consensus of higher alternative money rates in the very near future.

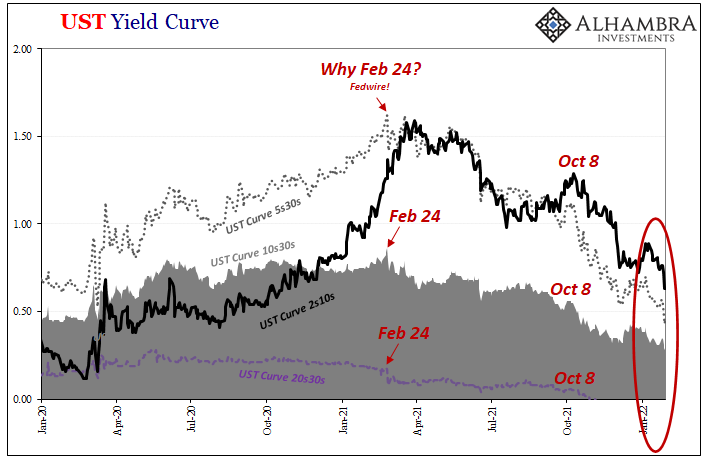

My point being, we can’t forget about collateral and these inside-money deflationary characteristics for why the curve has flattened so much. Though the 8-week isn’t comparable to the RRP anymore, robbing us of our ability to get a clean sense of heightened demand for it, there sure are days or times when it becomes all-too-apparent anyway.

It’s not just the current “growth scare” in economic data like inventory or overseas producer prices which is bothering and flattening yield trades, there’s also the constant threat of this continuously fragile monetary system which was first reminded of this fragility specifically last February 24.

Dealers ran for cover over an otherwise little nothing leaving the system exposed in that same bad way.

In other words, the long end also incorporates the probabilities of something more going wrong in the monetary system (deflationary), potentially creating a larger drag on the real economy than it already has, thereby reducing the potential for inflation even more than the curve has been pricing recently. Prospects for legitimate economic growth suffer much, too, when the collateral part of the monetary system can’t function smoothly.

On an otherwise nondescript Friday.

Stay In Touch