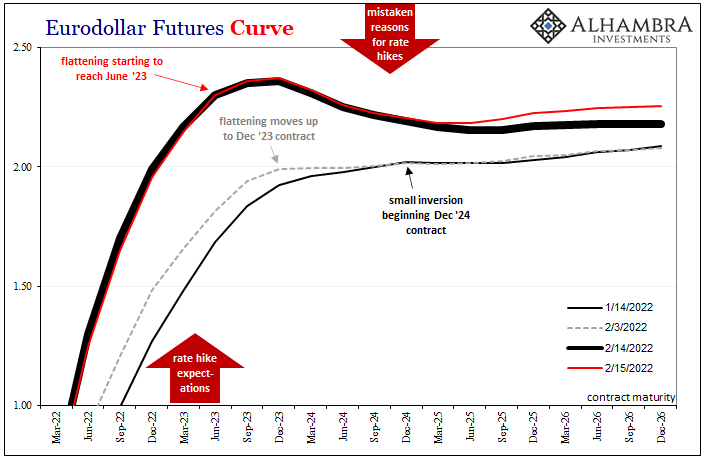

Following up on recent changes to the eurodollar futures curve, the inversion came back (less upside down) by only a couple basis points in trading today, with most of the curve unchanged. There was only modest selling in futures toward the back end, the curve lifting a touch off yesterday’s recent low point.

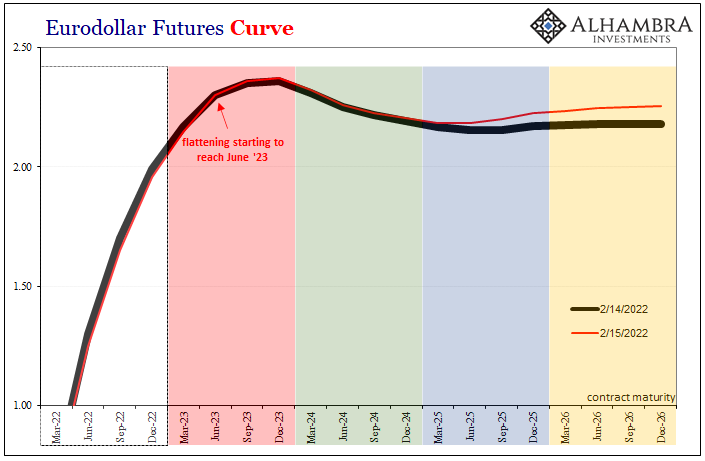

Far more important than that, the inversion or at least flattening has moved way up into the reds. This is significant because reds are supposed to be totally Fed:

The front two “colors” (the whites and the reds) or eurodollar futures packs are – by and of technical necessity – largely bets (hedges) made on where the Fed has said it intends to set its policy targets (these days that’s a range for fed funds, with IOER and RRP rates used to corral fed funds and so highly influence, in theory, these other US$ markets including repo and unsecured eurodollars, therefore LIBOR).

In other words, the immediate front colors, those first two years in contract maturities, are likewise heavily influenced by whatever current Federal Reserve policy predictions…Both cases, pricing the whites and reds, the front parts of the curve, mean pricing “hawkishness.”

Steep(er), upward sloping at the front.

Yes, steep up front but less steep now through most of the reds.

Greens and blues (gold, too) are like the back end of the yield curve, acting independently upon considerations of consequences to the real system and economy than whatever current FOMC regime thinks it might be doing a couple years from now.

Once the reds get sucked into the inversion vortex, that’s big time – the next phase, so to speak.

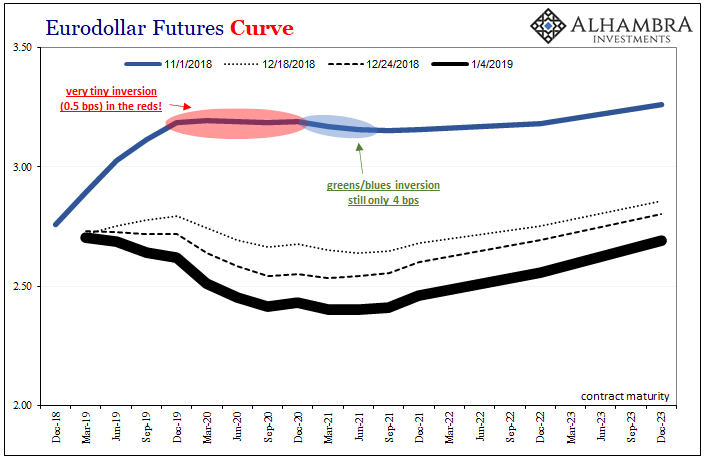

By way of comparison, during the last “cycle”, the reds didn’t get involved in the inversion until around late October 2018; and the full curve didn’t invert in the greens and blues as much as it is right now until mid-December.

Each time period is unique and curve histories aren’t directly comparable, still that’s more than a little unsettling (if you remember December 2018).

What all this means is as simple as it is unpleasant for the inflation/economy-on-fire narrative. This deep, huge, sophisticated, and historically-validated market is increasingly certain there’s real trouble out there, economy and money therefore finance like short-term interest rates.

Remember also, you don’t take the contracts literally. Just because the inversion is deepest at around the December 2023 maturity, this does not mean the market is literally worried about something happening around December 2023. Because of these chromatic considerations and the technical matters driving them, that’s just where this current hedging has become most visible.

In other words, the more the inversion creeps forward (breadth) as well as the bigger it gets (depth) the more that trouble is coming into specific view of the market. The participants there are the monetary system and therefore, as noted yesterday, they’re telling you what they see as probable even if you or I cannot (yet).

The FOMC should be paying close attention, worried fascination over the market’s growing rejection of their predictions and intentions, but that would spoil officials’ ad hoc fly-by-night operations and risk confirming to the public the Fed isn’t a central bank and not in control of much – including the forward trajectory of short-term interest rates.

Stay In Touch