I know this gets to be like beating a dead horse. It’s a topic I keep going back to over and over again because, frankly, it absolutely deserves the constant focus. For one thing, you’ll never, ever hear this out of any so-called monetary official despite the fact that history has repeatedly and conclusively established collateral is itself currency and more often than not the scarcity of it the primary pathology of deflationary currency.

In the most recent case of last week’s rate hike, the silence on the subject is literal. At Jay Powell’s press conference, not once was there any mention of T-bills (for any reason). The Chairman only used the word “money” in a single instance, and that was as a broad stand-in for consumer spending power.

Collateral? You know that word’s never going to happen, no one in the mainstream media will ever ask and no policymaker would ever volunteer what’s way outside their grasp. These meetings and releases are spectacles designed (like rituals) only to reinforce the illusion of technocratic control, an effort for which most in the financial press had signed up long ago to contribute.

Maybe a few are wandering outside the ideological box, though?

At least some in the mainstream seem reluctant to follow the Fed off a cliff (again).

— Jeffrey P. Snider (@JeffSnider_AIP) March 23, 2022

Most will anyway because they don't know any better. That's how bad Economics has been at alerting/educating the public.

Don't Fight The Fed? Get out of here.https://t.co/5YBRUMhhmq pic.twitter.com/esLYrqna42

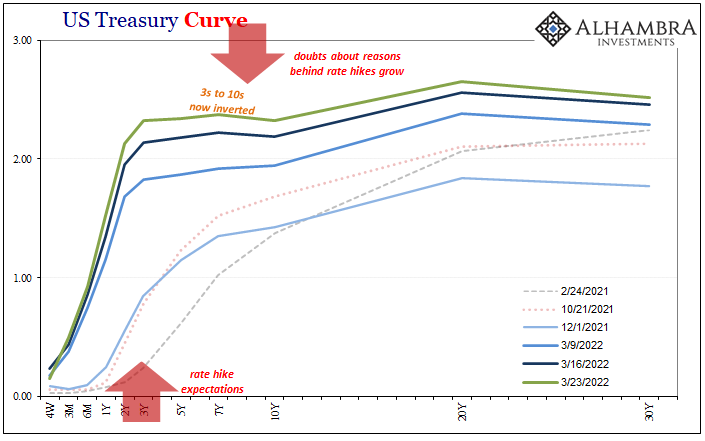

One reason why is due to the fact that so many things are going wrong and going wrong in such obvious and public fashion. It’s easier to ignore front-end T-bills, much more difficult to pretend the yield curve isn’t inverted.

Therefore, why we keep harping on T-bills and collateral is that the one explains much about the other; what can only be severe collateral strains contributing to the deflationary potential upending the yield curve (like eurodollar futures) further down in the belly of the curved beast.

Chairman Powell wasn’t asked a single question about the reverse repo, either, last week, nor did he prepare a comment. In this case, no loss because what the Fed gave us is actually all we need. Here it is spelled out in the usual technical documentation accompanying the FOMC’s written rate hike statement.

Conduct overnight reverse repurchase agreement operations at an offering rate of 0.3 percent and with a per-counterparty limit of $160 billion per day; the per-counterparty limit can be temporarily increased at the discretion of the Chair. [emphasis added]

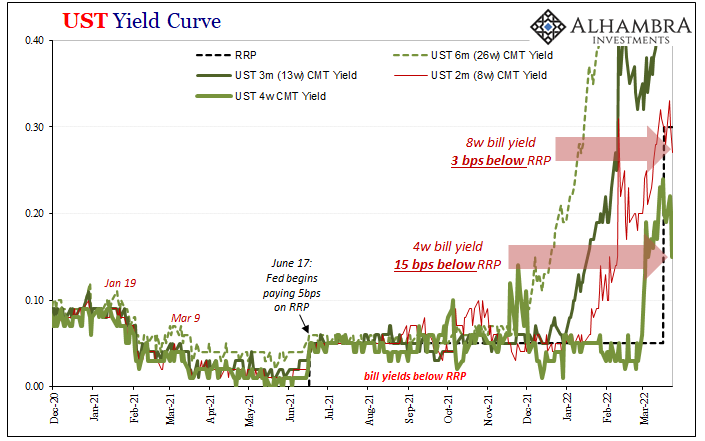

If you can “lend” “cash” to the Federal Reserve on a collateralized basis, the Fed using Treasuries as collateral, and get 30 bps interest in return, who in their right mind would buy a 4-week Treasury bill at such a high price its return is equivalent to half that?

Yes, just 15 bps.

And the 8-week bill is at 27 bps.

I'm sure Powell's right, there's nothing to worry about. It's just another early morning 4w T-bill plunge, now trading almost SEVENTEEN bps below RRP.

— Jeffrey P. Snider (@JeffSnider_AIP) March 23, 2022

[for those who want clarity beyond the well-earned sarcasm, we call this a scramble for collateral and that's not a good sign] pic.twitter.com/XFS1H6xnIX

Both of those come out after another wild day in the shadows of repo and unwinding collateral from yesterday. Today was another one of those plainly obvious scrambles for collateral that continue to bely the notion of either “too much” money or a resilient monetary system more likely to unleash further inflationary perdition than the opposite.

We find these as the telltale signs of degradation, the more extreme version(s) showing up during the worst of the worst; 2008 as well as two Marches ago right in the thick of it:

Over the past several dreadful weeks of liquidations the pattern has largely repeated. During the early morning hours, before regular trading opens, yesterday’s repo transactions are unwound. Under normal and even less-than-ideal conditions these are just rolled over.

Not any more. Collateral calls mean in some cases using gold as a last resort (which gets dumped immediately) and in others the buying of pristine collateral at any price. Gold is slammed while T-bill prices skyrocket, their yields plummet. For those unlucky enough to have neither option in front of them, fire sales of assets including stocks and other risk credits.

Interesting how today’s trading across markets was risk-off even in stocks which, as minor comparison to what’s written about above, were slammed into the regular session open – as if liquidity was sucked out of the global marketplace because it almost certainly had been (counterintuitively confirmed by huge RRP usage).

Since money is inflation, and inflation is money, you’d think the FOMC would be zeroed right in on the subject, particularly given the (carefully constructed) mainstream reputation of policymakers as monetary overlords first and foremost.

But, no. Going back to what Chairman Powell said, and what the committee voted to write in its release, the media makes them out to be near-omniscient demigods they’re instead all just winging it:

The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

It’s not even so much discretionary monetary policy as it is non-money-we-don’t-know-what-else-to-do.

History doesn’t just recommend, it demands, scrapping all those indirect numbers (especially those well-established as faulty, particularly those pertaining to “labor market conditions”) to pay very close attention to curves and bills; the latter not just giving structure but likewise explaining a whole lot that’s useful about the former.

As I always write, listen to bill. Right now, he’s got an awful lot to say.

Stay In Touch