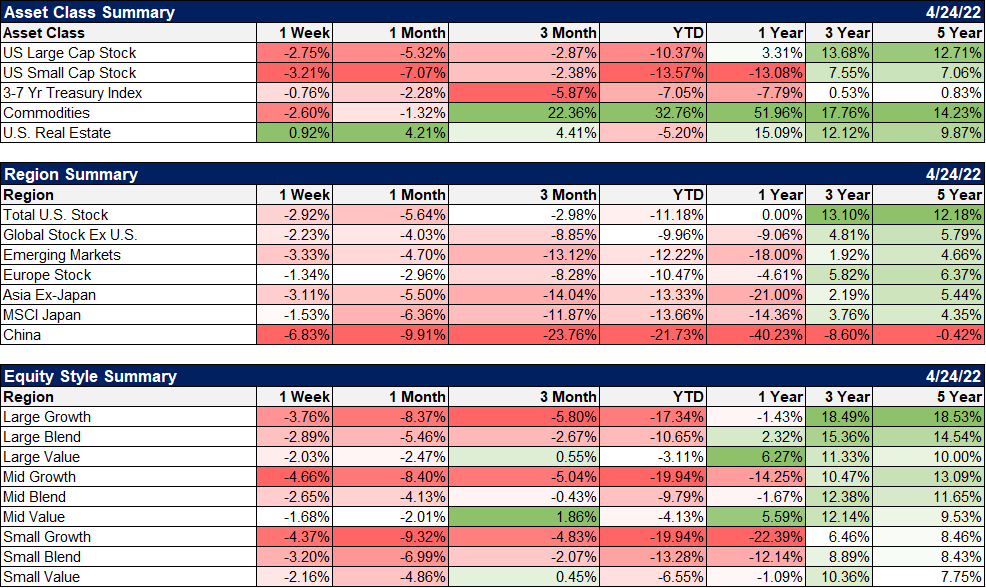

Well, that was an ugly week. Of the six major assets we track, only one was up last week – REITs. Large and small-cap stocks – down. General commodity indexes – down. Gold – down. Bonds – down. The early part of the week was actually pretty calm but Thursday and Friday – especially that close on the low Friday – were just awful. Why? Well, the popular explanation was Fed jawing but I’m not so sure. There were some negative developments that might explain the selling (emphasis on might).

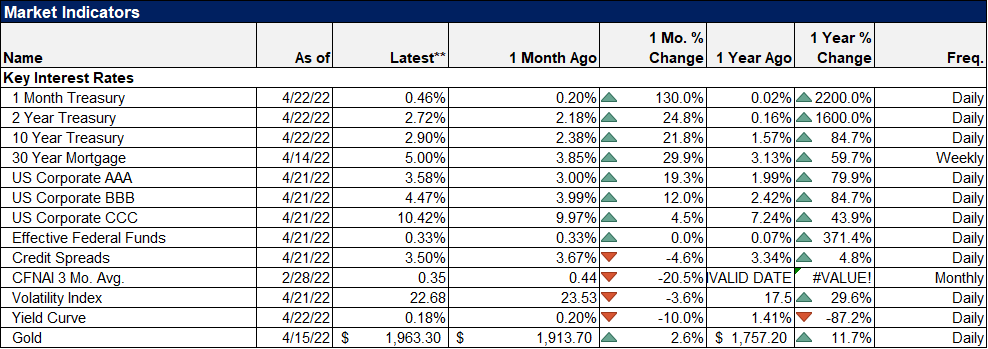

Jerome Powell got the blame for a lot of the selling Thursday and Friday for essentially confirming what the market already knew – the Fed will almost certainly hike by 50 basis points at its next meeting. Personally, I’d put that in the big yawn category. But James Bullard talking about a 75 basis point hike was new and I think probably a more likely culprit if you want to blame Fed talk for this little mini-crash. And apparently, I wasn’t the only one who thought so since Loretta Mester suddenly felt the need for an interview late Friday just to refute it. Stocks rallied as Mester countered Bullard with an “I don’t think so”, but the rally didn’t last and we got that ugly close just about an hour later.

The negative developments were primarily outside the US, namely in China, where the harsh COVID responses continued and Shanghai remains shuttered. Fears are spreading that the shutdown remedy will soon be applied to other cities. The impact on the global supply chain is obviously negative but may not have much immediate impact due to the recent inventory building by US companies. Whether they were built as a precaution or by happenstance, it will reinforce the idea that the proper level of inventory is likely higher than pre-COVID.

Last week I said that if the weakness in China’s economy persists, it will eventually have an impact on the value of the Yuan. Eventually arrived last week with the Yuan trading at 6.56 as I write, down from 6.37 about 10 days ago. That isn’t a huge move and certainly not in comparison to the 7.13 or so it hit in the summer of 2020. But if it’s sustained, it is a directional change and just one more thing with which the global economy must contend. As I said last week as well, the impact on other EM currencies will be interesting and probably of more import.

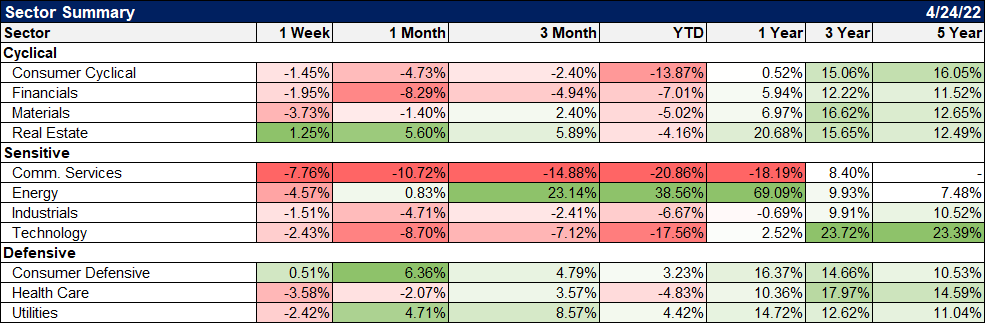

Commodities, one of the crowded trades I wrote about last week, took a pretty big hit as well with the GSCI down 2.6%. That in turn impacted the commodity dollars, Aussie and Canadian. The Brazilian Real is also dependent to a large degree on commodities and it was down a tad too. But the Real is still up considerably for the year (almost 14% YTD) and the commodity weakness is just a correction of a longer-term uptrend at this point. The Canadian and Aussie $s are basically flat on the year.

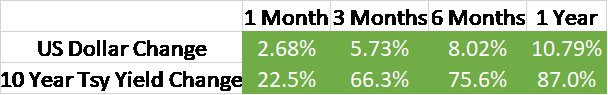

With the drop in commodities and fears about the impact of the China slowdown, the immediate effect should be for inflation and growth expectations to moderate. We didn’t see that in bonds last week but we are starting to see it this morning. The 10/2 curve flattened last week as the rise in the 2-year rate was quicker than the 10-year. While a flatter curve is indicative of slower future growth, the fact that both rates rose shows that the fears about growth are not immediate. Or at least not last week. This morning though both rates are adjusting lower by about 8 basis points. The negativity on bonds, and expectations that rates will keep rising, was another of the consensus trades I pointed out last week and that too seems to be correcting.

For now though, the fears about economic slowing are still focused on next year. That could change if the Fed starts to sound less urgent about rate-hiking but that will likely require a more definitive moderation of inflation expectations. Despite the commodity sell-off last week – that is continuing this morning – we haven’t really seen that yet. Real rates – TIPS yields – have risen but mostly in lockstep with nominal yields, meaning that inflation expectations haven’t really come down much. That may start to change and we’ve already seen gold come down significantly with the rise in TIPS yields.

During the first phase of this correction – or whatever it turns out to be – our portfolios outperformed because we owned commodities/gold and held mostly short-term fixed income. We also focused our equity exposure on value and dividend factors. We have since rebalanced our commodity exposure to take profits and shifted our bond exposure to intermediate. We continue to emphasize the value and dividend factors, although selected accounts did take some profits on the dividend ETFs to rebalance. As I said last week, defensive shares, which the dividend ETF owns, have become more expensive because of their recent outperformance. But we still think the equity portion of your portfolio should remain focused on value and dividend still fits that bill.

In the next phase of this correction, we expect bonds to act in their more traditional role as a hedge to any equity and commodity weakness. We don’t think it is time yet to shift to even longer duration bonds; that would come if recession becomes more imminent.

There was no place to hide last week as basically everything went down. I don’t think that will continue as bonds are poised to rally. How far that rally runs and how helpful it is in offsetting equity weakness will depend on how quickly inflation expectations – and therefore the Fed’s path – moderate.

The rising rate, rising dollar environment continues with the dollar making some multiyear highs right now. A lot of this move in the dollar is about the yen but dollar strength is spreading to the Euro and Yuan now. With commodities starting to weaken – and that isn’t a trend yet – the other EM currencies may be next. That would be a negative development for EM obviously but those markets have had time to prepare and we’re a long way from any kind of crisis.

Rates continued to rise last week but I still think we’re peaking here. Rates are pulling back this morning as fears of the Chinese slowdown spread like their shutdowns. Credit spreads remain well behaved so, for now, this is just a moderation of growth expectations and not a full-blown recession scare.

Markets

As I said above, the only positive major asset on our list last week was real estate. We actually added come global real estate last week in anticipation of a pullback in rates. That is reflective of our view that recession is not imminent if more likely than a few weeks ago. Markets – eurodollar futures and other rates curves – still point to fall of 2023 for the first rate cut. If short rates pull back here – without collapsing – that could start to shift out further. That is, of course, the mythical soft landing and I realize the odds on that are probably pretty long. But that doesn’t mean the market won’t bet on it if it has a chance.

China is just getting shellacked, down another 5% last night on top of the losses in our chart here. Europe, despite some Euro weakness – outperformed as did Japan. That actually might be because of currency weakness as long as it doesn’t turn into a rout.

Value continues to outperform and I see no reason yet for that to change.

On a sector basis, real estate and consumer staples were the only winners last week. Energy was the biggest loser as both crude oil (-4.5%) and natural gas (-8.7%) were down on the week.

Gold is testing $1900 this morning in response to rising real yields. The rest of the indicators here show an economy that is not in imminent danger of recession.

We seem to be entering a new phase of this correction, one driven more by fears of economic weakness than rising rates and Fed policy. That isn’t necessarily bad or more ominous, just different. The assets that protected us in that rising rate phase won’t work in this new falling rate one. Investors should not, however, make big all-or-nothing bets on any particular outcome. Investing is mostly a loser’s game, where the one who makes the fewest mistakes wins the game. So we don’t sell all our commodities or gold and we don’t go all-in on the longest duration bonds. We took some profits on our commodity positions and we shifted our bond duration from shorter than normal to normal – incremental change.

Be humble in your portfolio moves and avoid big mistakes. That’s how you win the market game.

Joe Calhoun

Stay In Touch