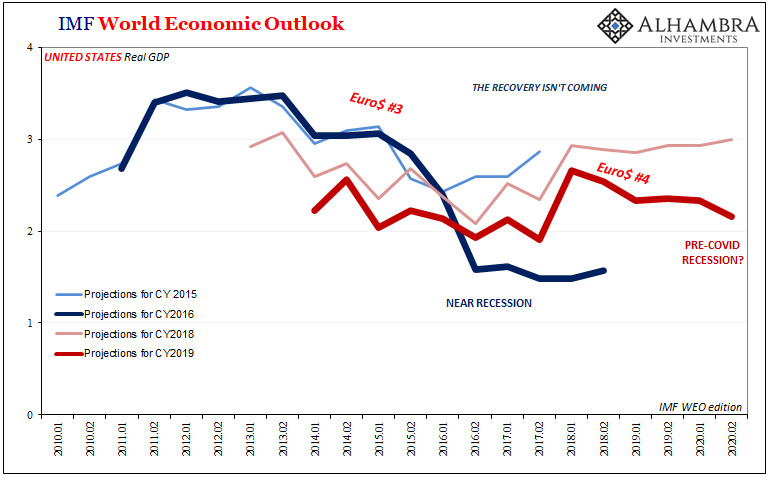

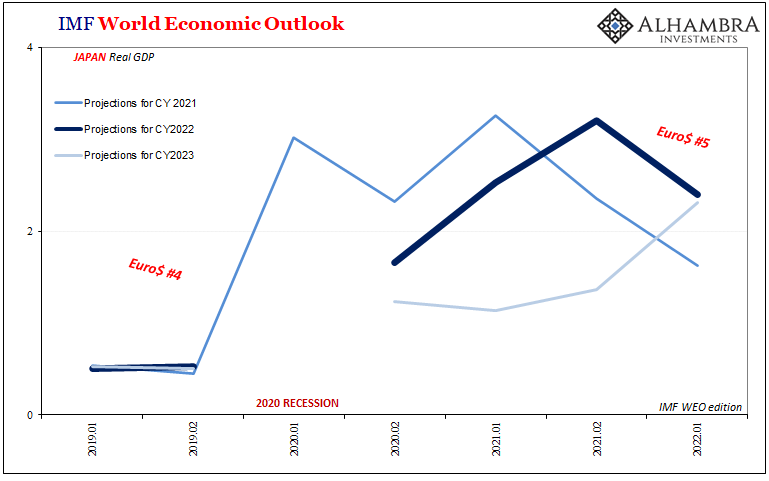

It wouldn’t be Euro$ #5 without perhaps the last of its rituals completed: the mainstream downgrades. Go back in time to each of the prior episodes, markets change, the data inflects, and then only later do surprised, shocked Economists at whichever establishment outpost begin to recalculate their DSGE outputs.

Every time.

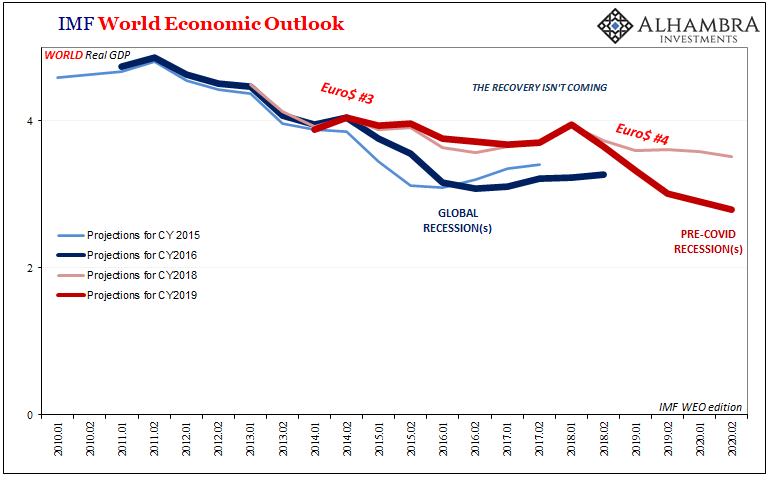

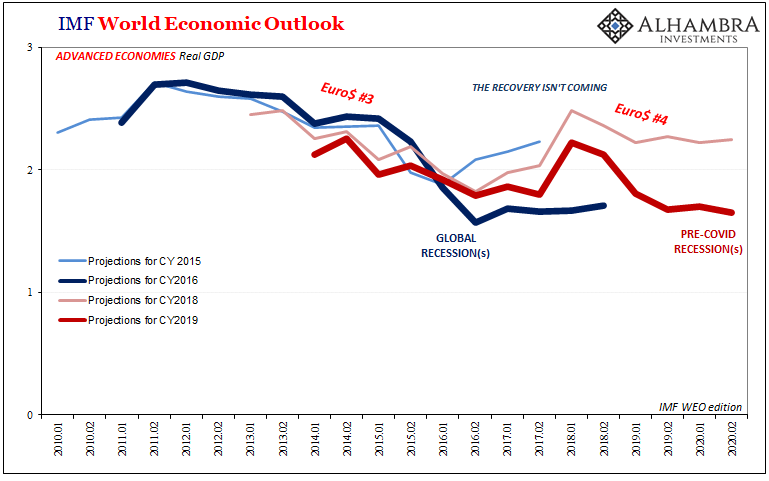

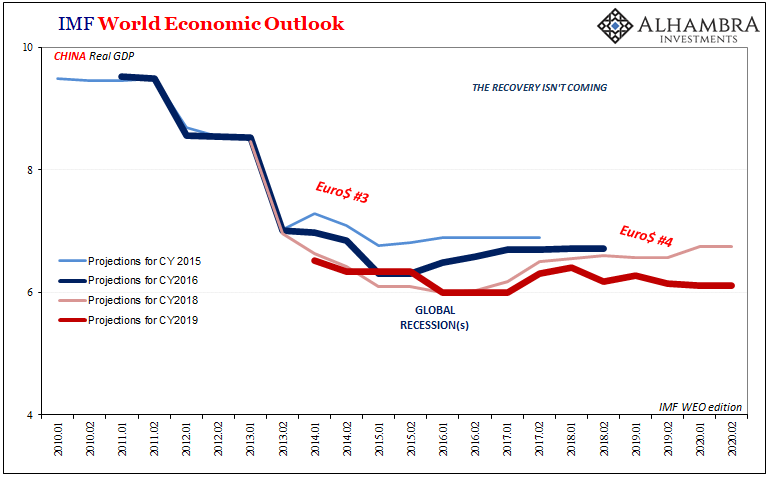

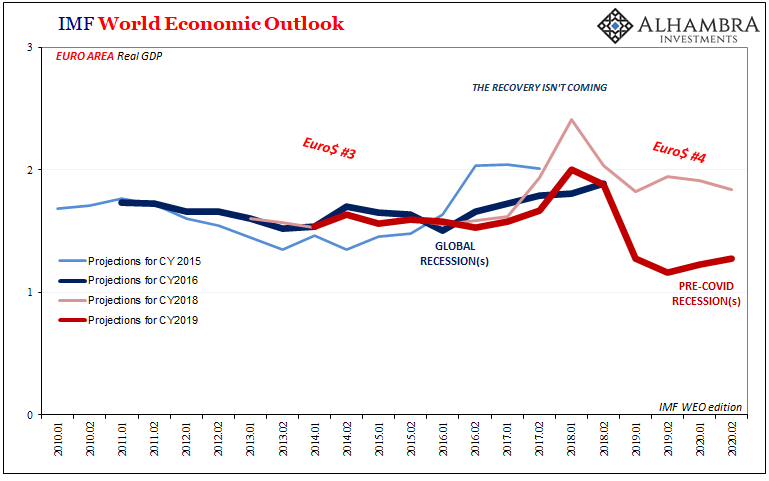

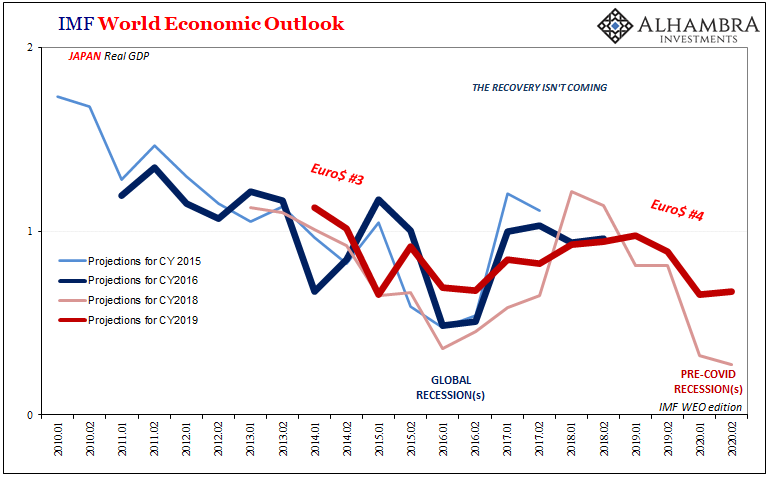

Way back in 2015, it took the IMF’s semi-annual World Economic Outlook (WEO) quite a while to catch on to what was already shaping up to be a nasty third outbreak of eurodollar disease. This was on top of only long after picking up the atrociously permanent aftermath from number two (see: below).

When the downgrades finally began, I wrote about how initially there’d been hope for “decoupling”:

The situation now is reversed [from 2007-08] in that advanced economies [were], especially the US, supposed to pick up the slack from emerging nations struggling under some apparently unknown strain…Setting aside the obvious consistency in how the “setback” is supposedly “temporary” and yet they don’t want the Fed to raise rates, the failed narrative is much deeper. In other words, the US was supposed to be the grand support for the global economy, but now is not…

Since no one ever bothered to explain just where this massive and global weakness actually came from, it was all just forgotten as if nothing more than a careless driver presumed by its passengers to have plowed over some unseen pothole.

Only, no. The vehicle had actually detoured right (further) off the road. Without having figured out what happened to 2015-16’s global debacle, the world was left imagining 2017’s globally synchronized growth as anything better than unsatisfying reflation could be a realistic possibility.

Instead, Euro$ #4 eventually, and by the release of 2019’s first stab at the WEO once more the downgrades. From April 2019:

The IMF becomes the latest mainstream organization to abandon the recovery. It wasn’t really much of one to begin with, mostly just the hope that an uptick in growth would lead to the long sought, and necessary, completion. Globally synchronized growth in 2017 was supposed to mean a plausible pathway toward it…But it took until 2019 for anyone to admit the possibility something was wrong, let alone actual conditions already very wrong.

All those missed 2018 market warning signs had finally caught up to the IMF, just as they had to Jay Powell by then (at the time merely “pausing” rate hikes which were shortly thereafter converted to full rate cuts).

Mainstream model downgrades like these are simply another item in a long and lengthening list on the wrong side of the ledger pointing to a global economy already tipped in the wrong direction.

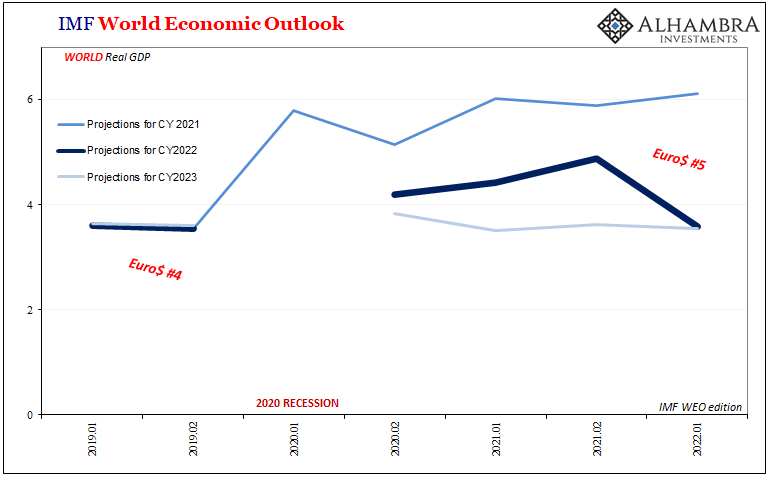

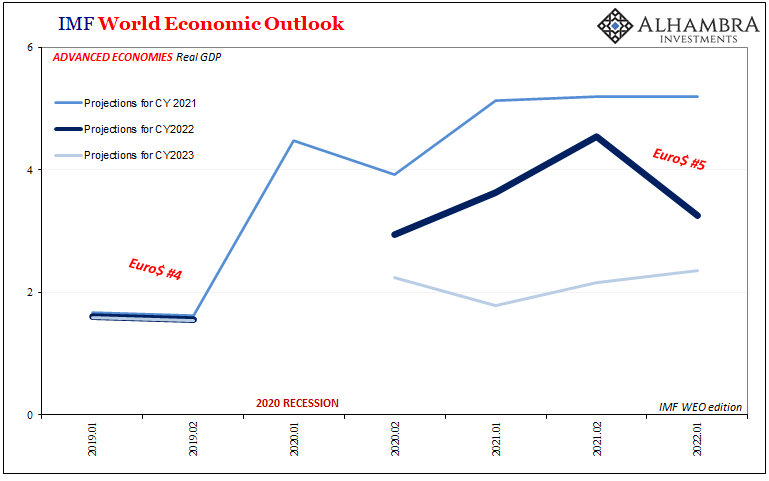

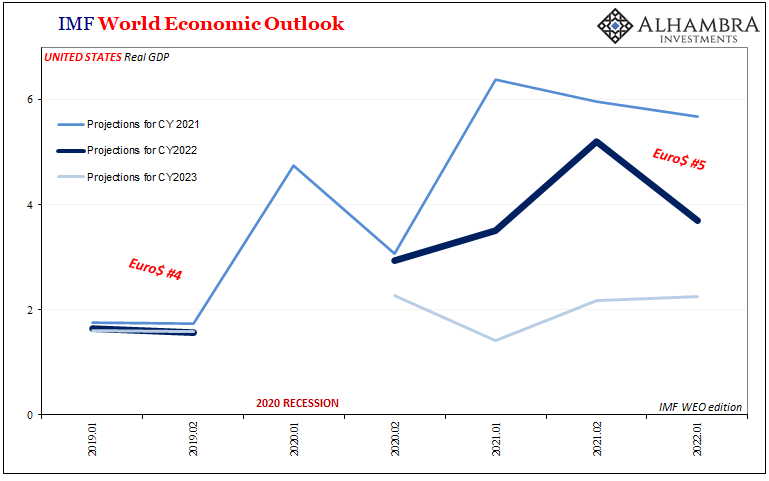

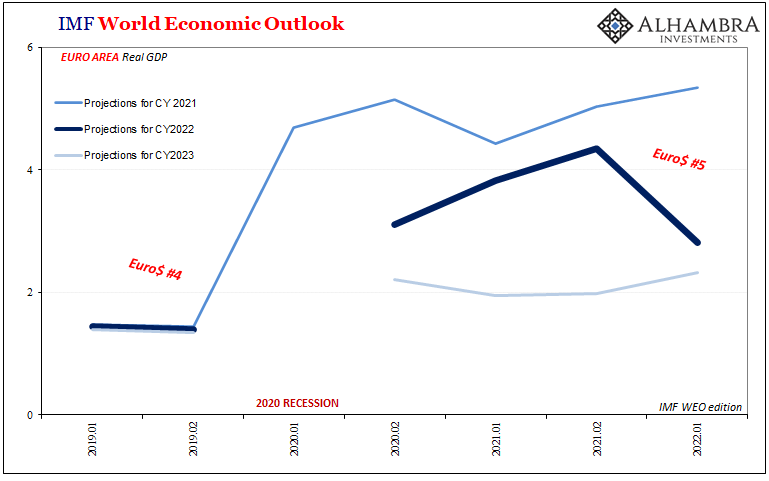

The first of the IMF WEO’s in 2022, published just hours ago, contains, as you already figured out, a plethora of downgrades. Big ones, too.

Reasons given are the standard excuses. Whereas there were trade wars and rate hikes frequently cited back in 2019, today there are future rate hikes and an actual war to dent “sentiment” – the DSGEs have to incorporate “sentiment” because they don’t model money or finance, so still have yet to figure out what happened to growth since August 2007. The problem isn’t the regressions; remember, always garbage in/garbage out.

As it now stands, the IMF calculates CY2022 real GDP growth for the entire worldwide economy should end up around 3.59%. That’s a huge deduction from the last WEO, the second of 2021’s when global GDP for this year was anticipated at 4.89%.

Shedding 130 bps in between last fall and today is a serious move toward pessimism, particularly for these tools which always expect the best and the most. The current 2022 figure is back where it had been a year ago before all the fuss about “red-hot”, overheated inflation and such.

No geographic section was spared: US GDP for 2022 was drastically cut to 3.71% from last 5.20%; for advanced economies overall, including the US, Europe, and Japan, the 2022 figure went from 4.54% down to 3.26%.

All this from a single Fed rate hike? Yeah, not on your life.

The IMF currently figures the economy will accelerate modestly if now in 2023, but the IMF’s methods always calculate a modest acceleration after the initial downgrade. In that 2015 WEO I referenced at the start, real GDP estimates for the world in CY2015 had just been cut to 3.12% from 3.84% the prior year, if only for the models expecting CY2016 to be somewhat better (3.56%).

It wasn’t.

The downgrades, like the actual economic trajectory, persist. That’s something else to keep in mind as the world attempts to navigate this progressively confirmed Euro$ #5; both the sliding estimates along with the real decline in the system are almost certainly just beginning.

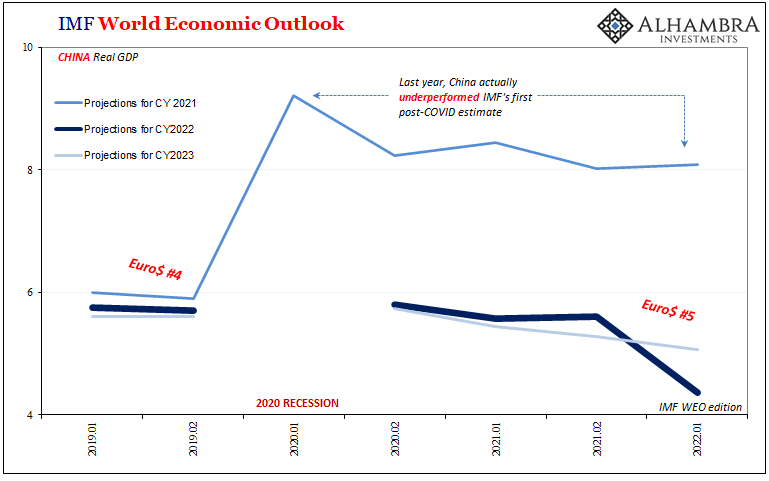

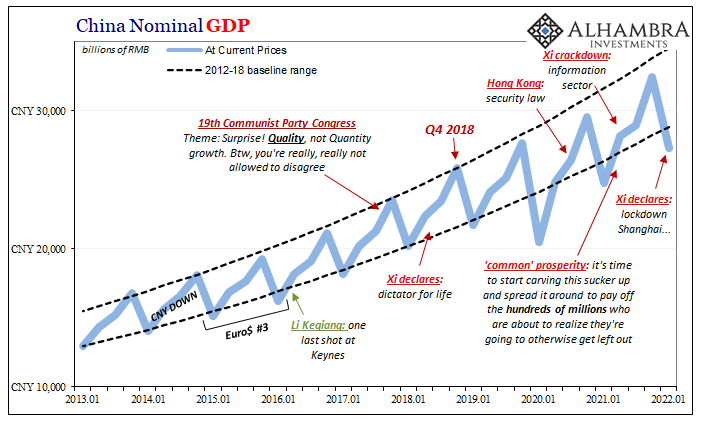

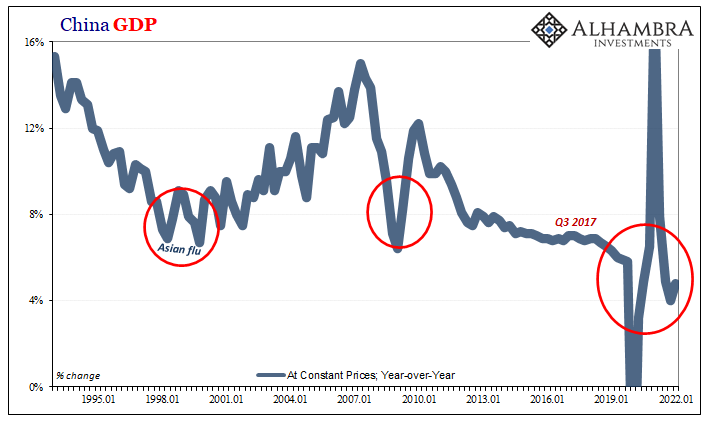

Like 2015, China deserves special attention as both the primary proximate reason for these lowered projections as well as, in every real sense, a primary feedback mechanism surrounding Euro$ #5 and its damaging effects. Bad money (risk aversion) leads to bad economy (and bad politics), which then leads to more bad money (risk aversion confirmed, so more aversion) then still more bad economy.

The IMF’s estimates like any others plainly show the Chinese epicenter. Not only did China’s economy manage to underperform last year, optimism-biased econometrics can’t help but pick up on what’s now an entrenched downward trajectory. Back during the second half of 2020, these were expecting 5.80% real GDP growth in CY2022, now today are looking at just 4.37%.

For China.

Even the 2023 estimate has been cut, contrary to the standard practice of raising the number one-year further out after such a downgrade (the IMF still, for now, believes 2023 will be a touch better over there than 2022).

In other words, the IMF acknowledges – without acknowledging – China’s bad shape. And if the Chinese are in bad shape, given how much of the world counts on this place to transmit a serious and sustained growth “impulse”, the WEO can’t help but hand out big declines around the rest of the world.

But why?

Over a few thousand symptomatic cases, and ~25k asymptomatic cases out of 26 million. Of a variant w/mildest symptoms yet.

— Jeffrey P. Snider (@JeffSnider_AIP) April 25, 2022

Xi's goal isn't COVID-zero, it is quite clearly DISSENT-zero. https://t.co/Tw3CMCrcSz

Again, the excuses are legion; in addition to Russia and rate hikes, they can (and do) cite consumer prices carving into consumer demand as well as lingering COVID, the last one especially when it comes to trying to explain China’s accelerating problems.

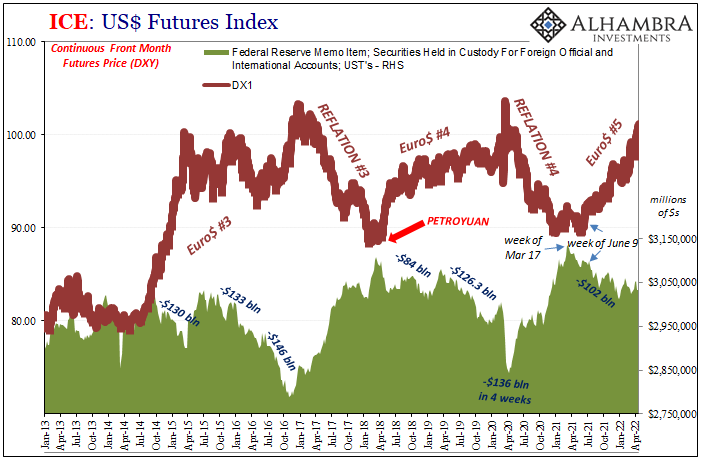

That’s the thing about understanding our number scheme rather than those; Euro$ #5 is, obviously, just the fifth time this same general pattern has repeated. In other words, the world always faces difficulties from going back to time immemorial. Before August 2007, those would rarely lead to such material worldwide economic and financial spasms, through this monetary channel, creating such pronounced and synchronized (given a small amount of time) setbacks.

While it is true overactive governments confronting COVID are as novel as the coronavirus itself, Euro$ #5 was presenting symptoms at the same time most government intrusions were being unwound. Number five has also outlasted them and the corona variants; it, not they, persists.

Even in China, the government’s lack of discretion is, I fully believe, more about the economy than the virus.

Either way, and for whichever set of reasons you might choose to accept, it’s no longer possible to completely ignore and dismiss these symptoms which not coincidentally happen to be perfectly consistent with prior monetary outbreaks.

Unless, of course, you are a member of the Federal Reserve.

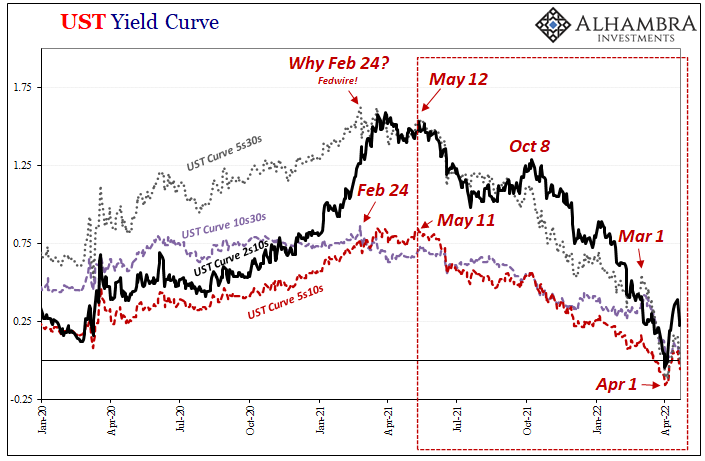

Policymakers finally understanding the real risks and gravity would be – will be? – among the final developments for the first phase of Euro$ #5. As most markets already and currently price, it is widely expected the Fed finally sees reality, stops hiking like in 2016, or, as in 2019, reverses course entirely to go along with even more mainstream downgrades still to come.

Parades typically go on well beyond its opening act.

Stay In Touch